Most adults (92%) have health insurance, and the majority (85% of adults) also report their health as at least good. While half of the population has little or no out-of-pocket medical spending, they may have a sick, uninsured, or underinsured family member, leading to medical bills putting a strain on household budgets. KFF polling finds that many Americans overall report that they think the cost of healthcare is too high, and that they are worried about unexpected medical bills and prescription drug costs.

This chart collection explores trends in how cost affect access to healthcare in the U.S. using National Health Interview Survey (NHIS) data through 2023. In addition to the financial barriers to healthcare reported here, another analysis examines several non-financial barriers to accessing healthcare.

In this analysis, the share of adults who reported delaying or going without healthcare due to cost is based on NHIS questions asking about delayed or missed medical care, mental health care, and dental care as well as delayed, missed, or rationed prescription medications due to cost. While some people reported going without multiple types of care, others say that they only delayed or did not get one type of care.

While most adults are insured and in good health, many report barriers to accessing medical care

In 2023, more than 1 in 4 adults (28%) reported delaying or not getting some form of healthcare due to cost. Uninsured adults, adults in worse health (reported as fair or poor health status), and Black and Hispanic adults are much more likely than others to delay or go without healthcare due to cost.

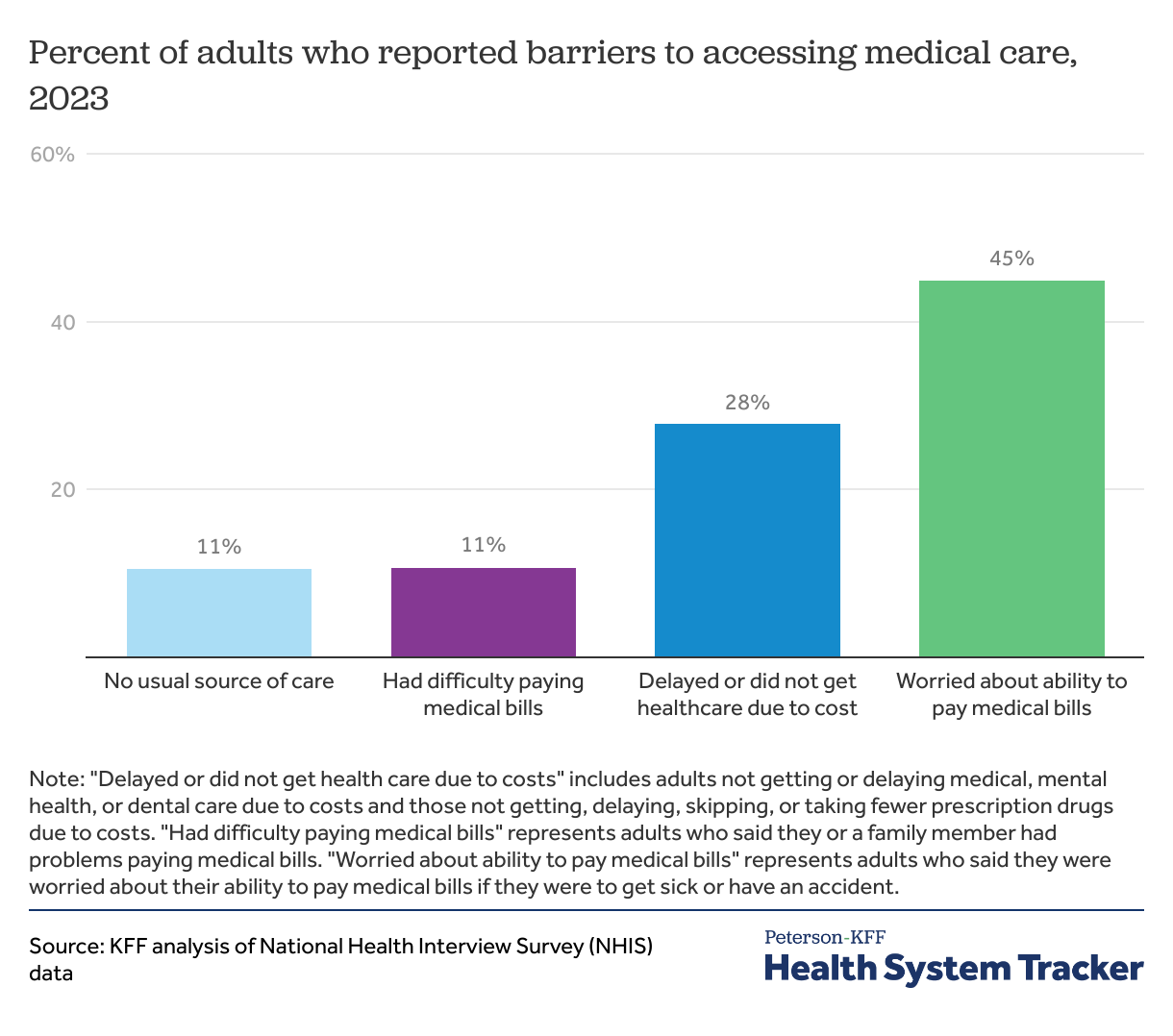

While similar shares of adults reported not having a usual source of medical care (11%) or that they or a family member had difficulty paying medical bills (11%), almost half (45%) of adults reported that they worried about their ability to pay medical bills if they were to get sick or have an accident.

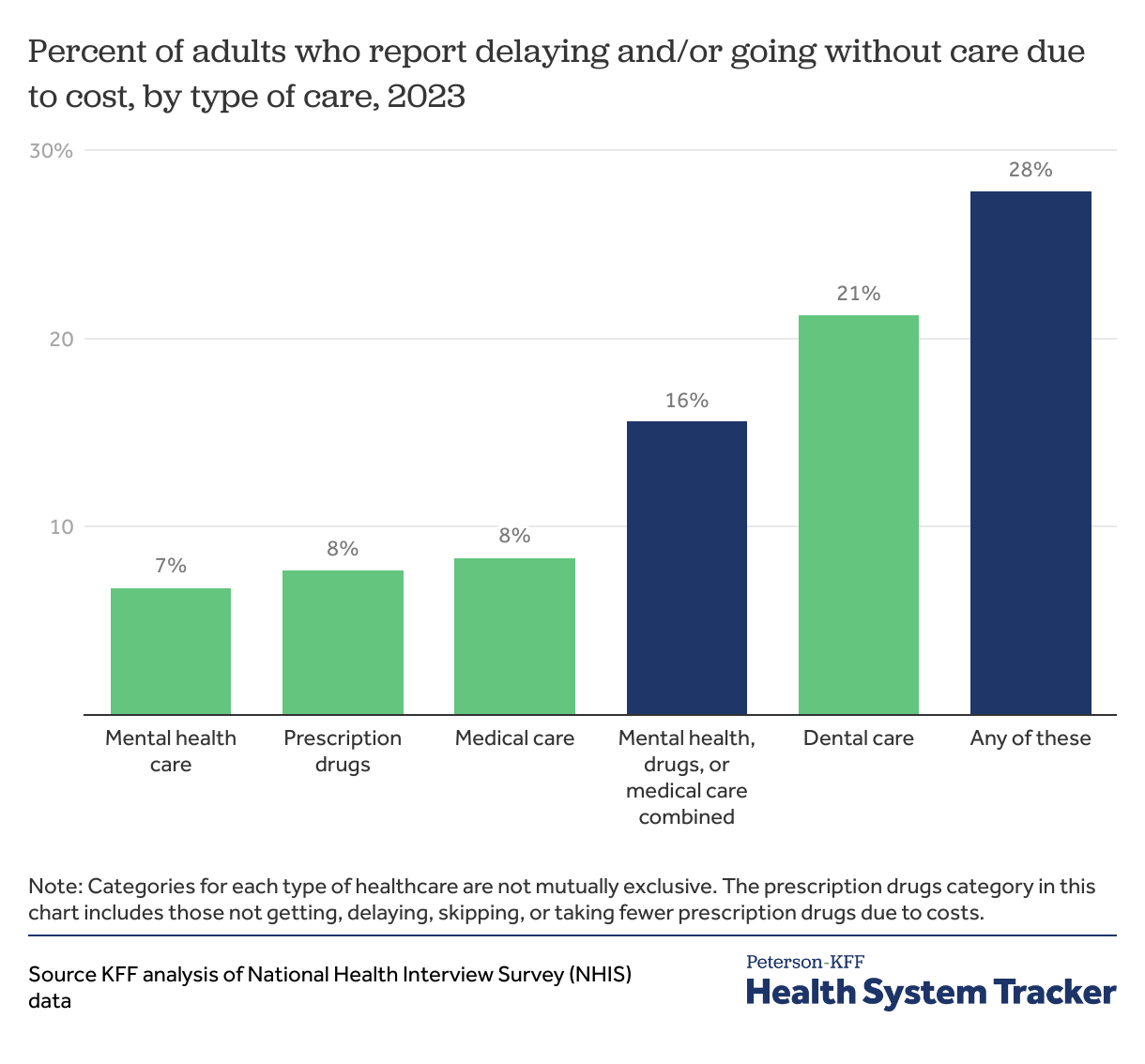

Including dental care, over 1 in 4 adults delayed, rationed, or did not get some form of care due to cost

In 2023, more than 1 in 4 adults (28%) reported delaying or going without either medical care, prescription drugs, mental health care, or dental care due to cost. A smaller share of adults (16%) reported delaying or forgoing either medical care, prescription drugs, or mental health care due to cost.

While a similar share of adults reported delaying or going without mental health care (7%); delaying, rationing, or going without prescription drugs (8%); or delaying or going without medical care (8%) due to cost, a much larger share reported delaying or forgoing dental care (21%) due to cost.

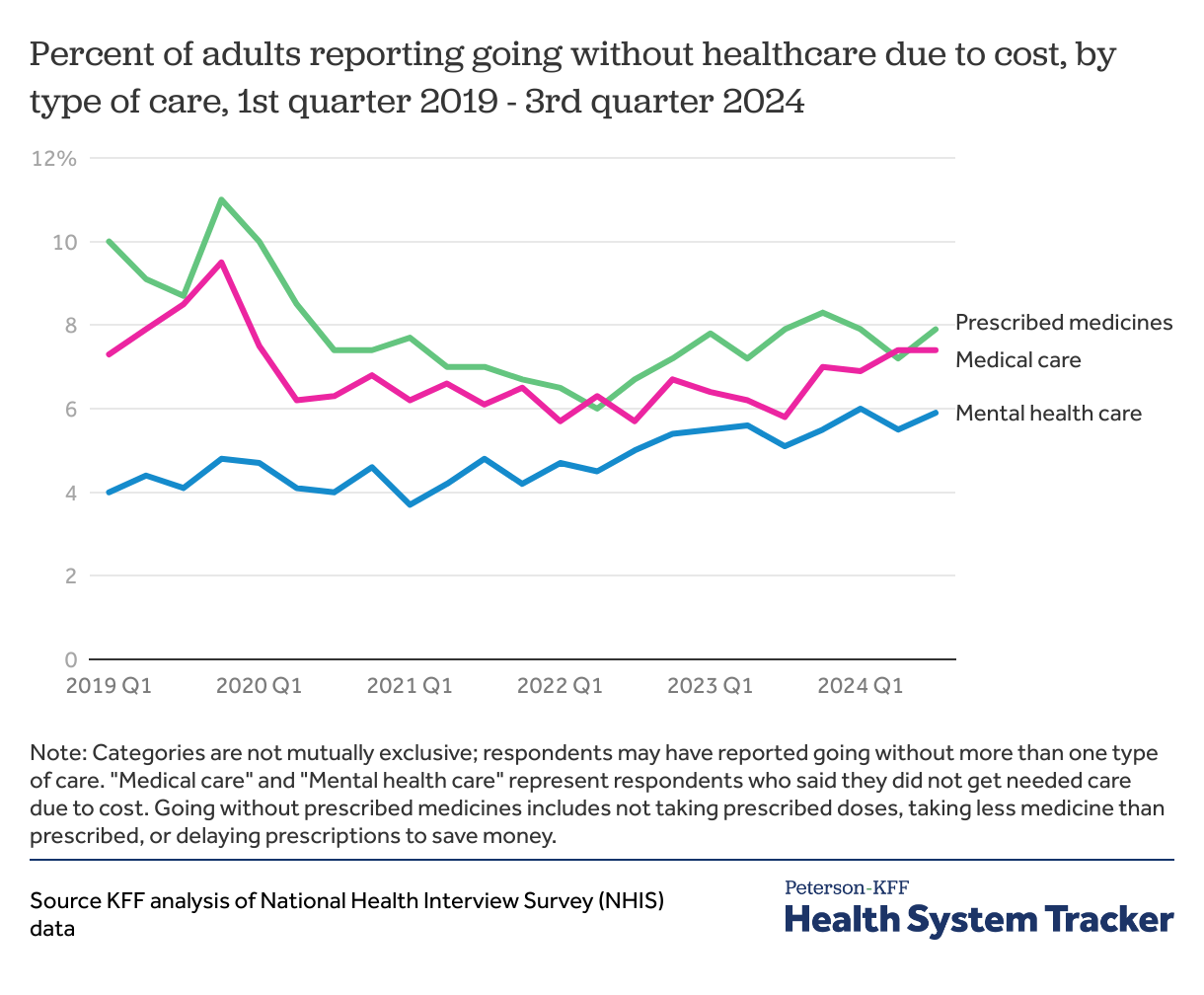

The share of adults forgoing medical or mental health care slightly increased in 2024

The share of adults reporting that they did not get medical care or did not take medicine as prescribed due to cost has increased slightly since 2020 after dropping during the COVID-19 pandemic. The decline was at least in part because of people forgoing care due to COVID-19, and thus not skipping it due to cost but due to other reasons. The share of adults going without mental health care because of cost has continued to increase over the past five years.

In the third quarter of 2024, a similar share of adults reported not taking medicine as prescribed (8%), not getting needed medical care (7%), or not getting needed mental health care (6%) due to cost. Note that respondents may answer yes or no to any of these questions so they should not be totaled.

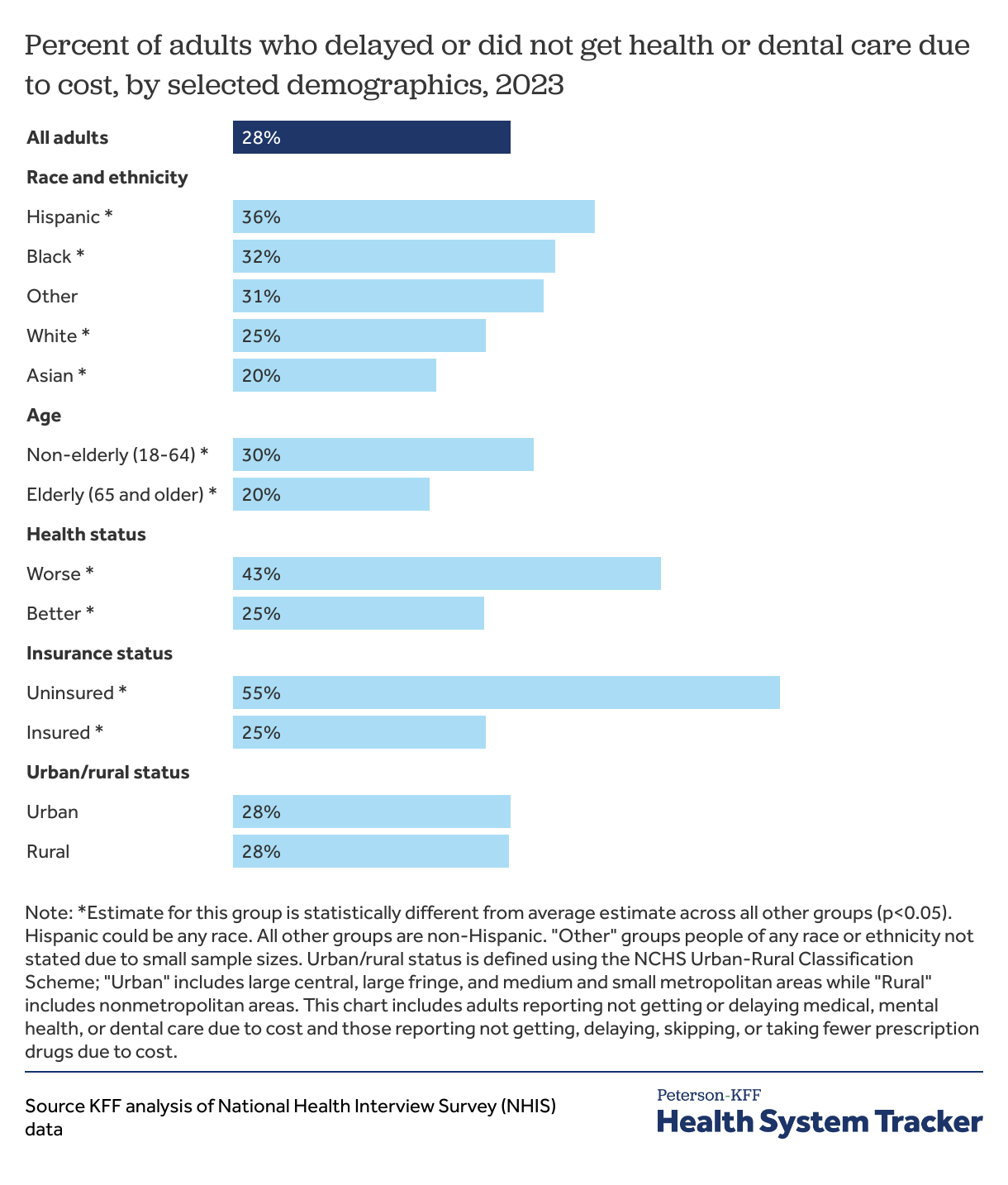

Hispanic adults, non-elderly adults, adults in worse health, and uninsured adults are more likely to delay or forgo care due to cost

Adults who are uninsured at any point in the year reported delaying or forgoing care due to cost more than twice as often compared to those who are insured (55% versus 25%). These estimates include adults who reported delaying or not getting medical, mental health, and dental care due to cost as well as those who reported delaying, not getting, skipping, or taking fewer doses of prescription drugs due to cost.

Beyond insurance status, race, age, and baseline health all impact peoples’ ability to afford healthcare. For example, Hispanic adults had higher rates of facing cost barriers to accessing care than all other people (36%). Estimates for Asian people were the lowest among all race and ethnic groups for delaying or forgoing health or dental due to cost (20%).

Non-elderly adults (aged 18-64) are more likely to report delaying or not getting some form of care due to cost than elderly adults (aged 65 and older) (30% versus 20%). Elderly adults generally receive health insurance coverage through Medicare, which tends to pay lower prices and experience slower price growth than private insurance.

Adults in worse health are nearly twice as likely to report delaying or forgoing some form of care due to cost compared to adults in better health (43% versus 25%).

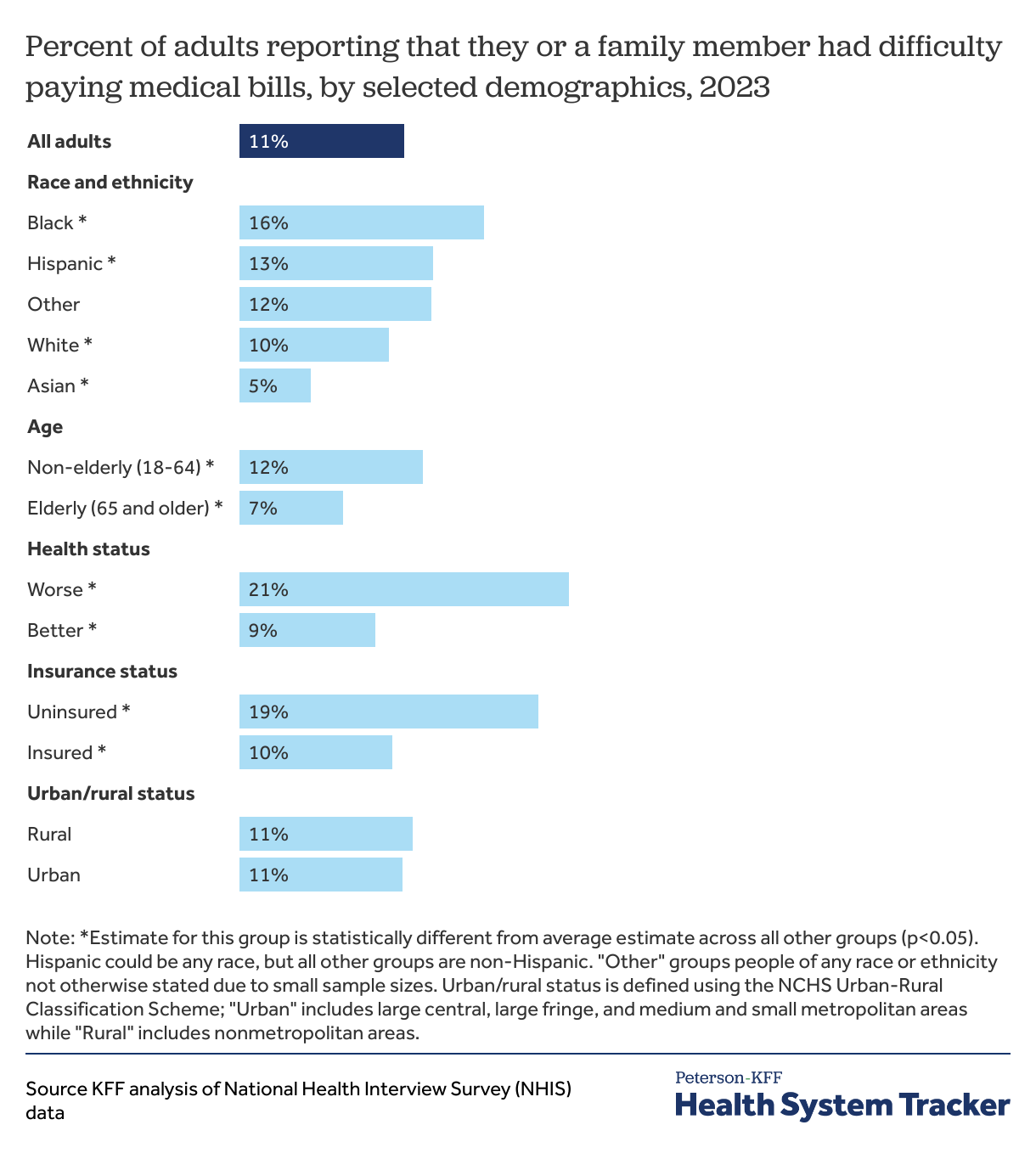

Uninsured adults and adults who are in worse health are twice as likely to report that they or a family member had difficulty paying medical bills

Some people miss or delay care they cannot afford, while some people still receive the care and go into medical debt, and others experience both types of challenges associated with high medical costs.

Among adults, 1 in 9 (11%) stated that they or a family member had difficulty paying medical bills. However, about 1 in 5 uninsured adults (19%) said they or a family member had difficulty paying medical bills. Insured adults reported difficulty paying medical bills at a lower rate. Even then, 10% of insured adults reported having difficulty paying medical bills for themselves or a family member.

Black Americans had a higher share of adults in families reporting difficulty paying medical bills compared to all other race and ethnic groups (16%). Non-elderly adults are also more likely to report difficulty paying medical bills than elderly adults (12% versus 7%). Adults with worse health report they or a family member had difficulty paying medical bills at over twice the rate of adults with better health (21% versus 9%).

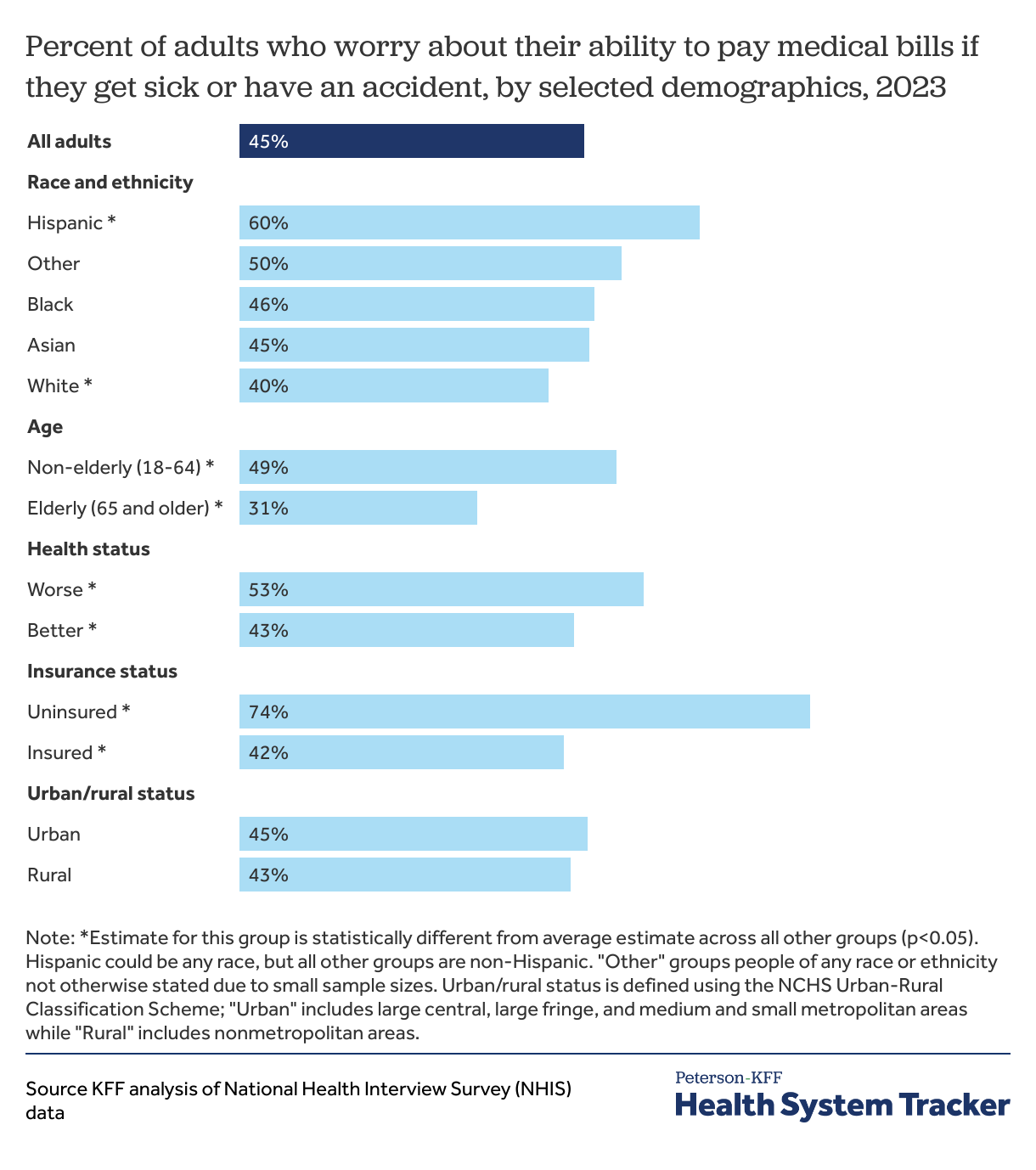

Nearly half of adults worry about their ability to pay medical bills if they get sick or have an accident

About half of adults (45%) report being worried about their ability to pay medical bills if they get sick or have an accident. About three in four uninsured adults (74%) report being worried about being able to pay medical bills in case of an illness or accident. Even a large share of insured adults (42%) report being worried about their ability to pay medical bills. Non-elderly adults are more likely to worry about being able to pay medical bills compared to elderly adults (49% versus 31%), as are adults in worse health compared to adults in better health (53% versus 43%).

Out of all race and ethnic groups, Hispanic adults were the most likely to report being worried about being able to pay medical bills in case of an illness or accident (60%), while White adults were the least likely to do so (40%).

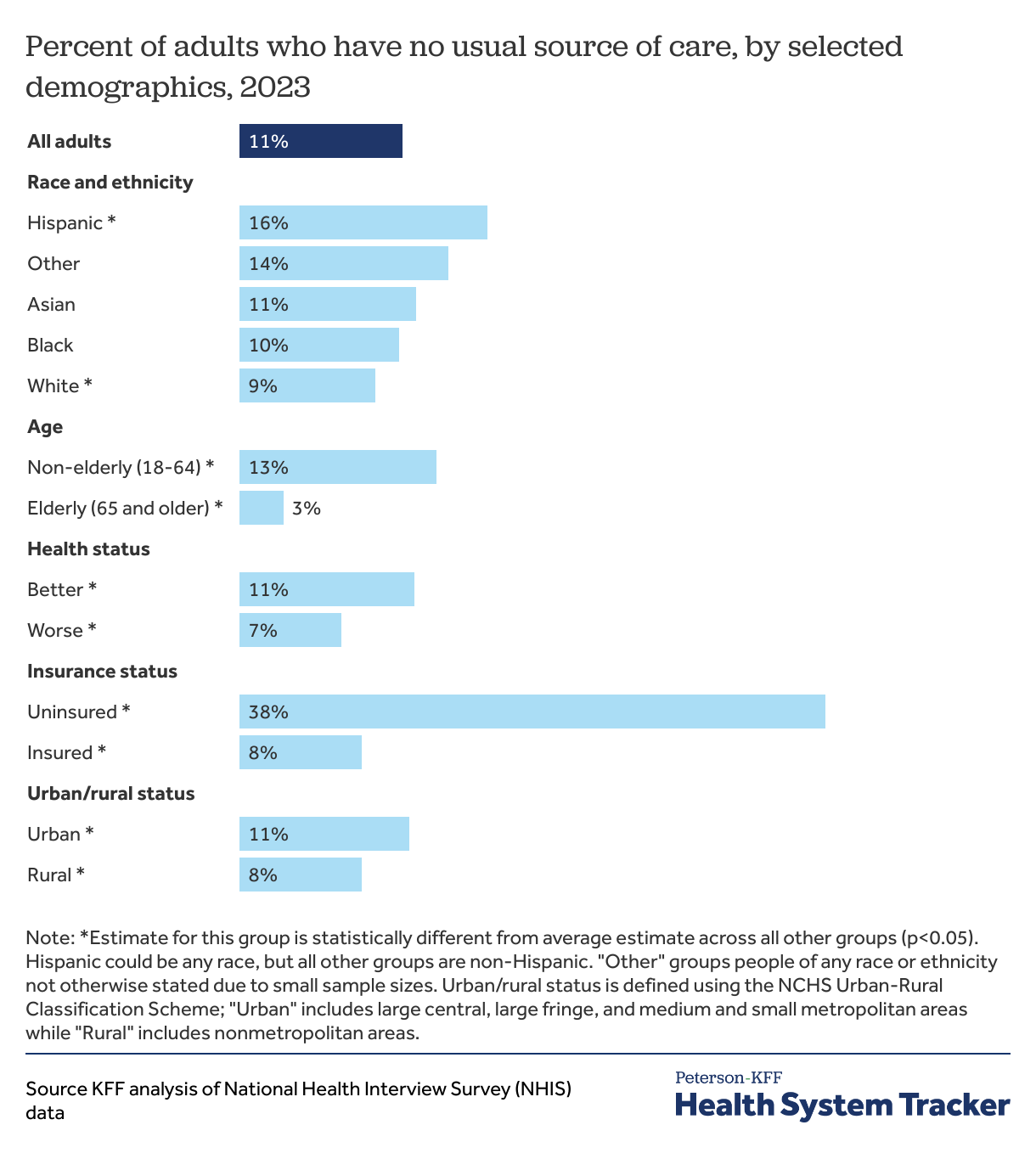

Over 1 in 3 uninsured adults report not having a usual source of care

Having a usual source of care allows people to easily connect into the healthcare system, both for preventive services, and when they are ill. Uninsured adults are nearly five times as likely as insured adults to have no usual source of care (38% versus 8%). Though the share of adults without a usual source of care is similar across most race and ethnic groups, Hispanic adults (16%) are more likely than others to report not having a usual source of care. Non-elderly adults are more than four times as likely as elderly adults—who tend to be in worse health and have higher healthcare utilization—to have no usual source of care (13% versus 3%).

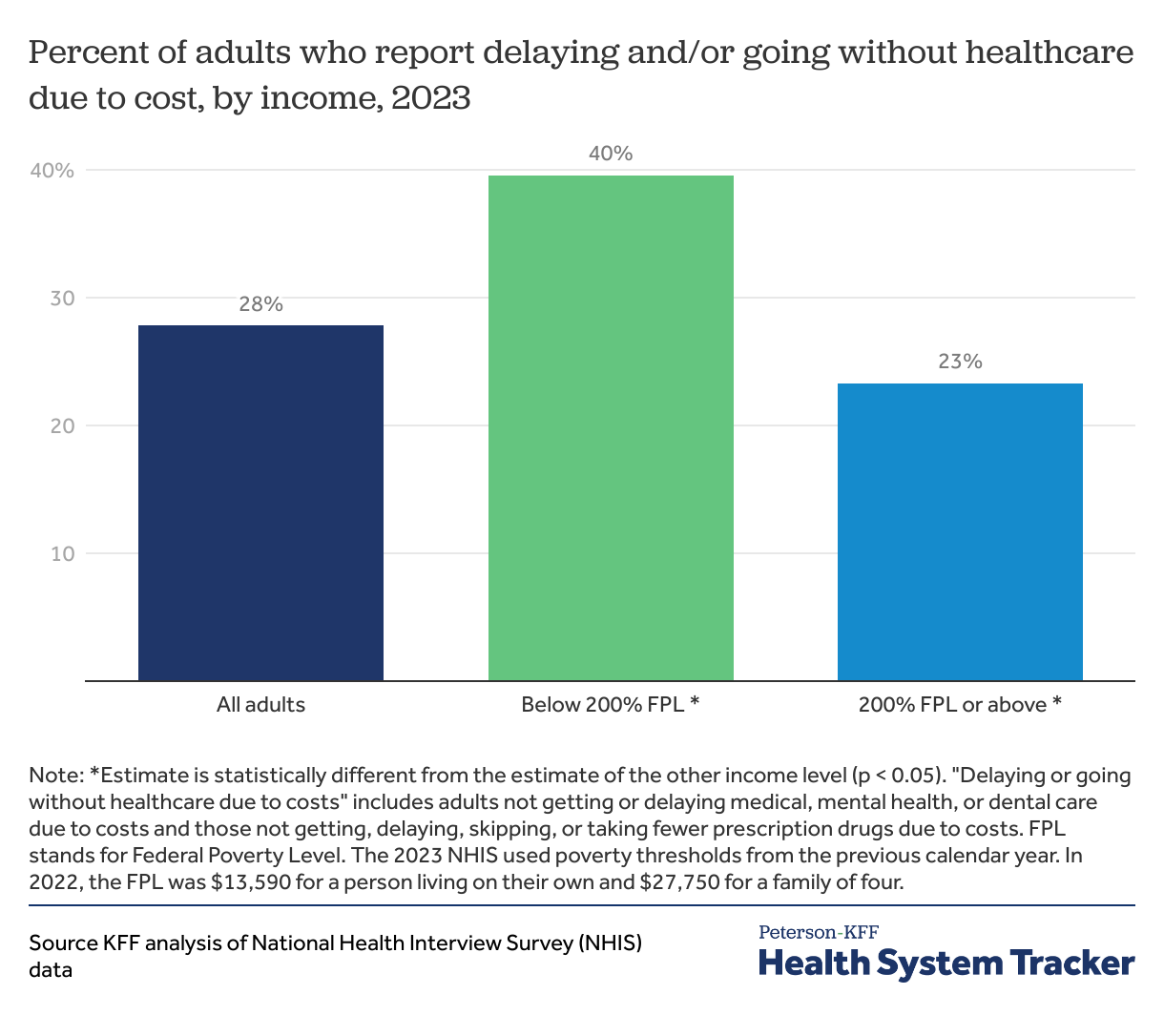

Adults with incomes below 200% of the poverty level are nearly twice as likely to go without healthcare due to cost

Adults with incomes below 200% federal poverty level (FPL) are nearly twice as likely to delay or go without healthcare due to cost than those with incomes above 200% FPL (40% versus 23%). Additionally, among people with employer-sponsored insurance, those with lower incomes spend a larger share of their incomes on insurance premiums and cost-sharing.

Uninsured adults and those in worse health report higher rates of not getting care due to cost

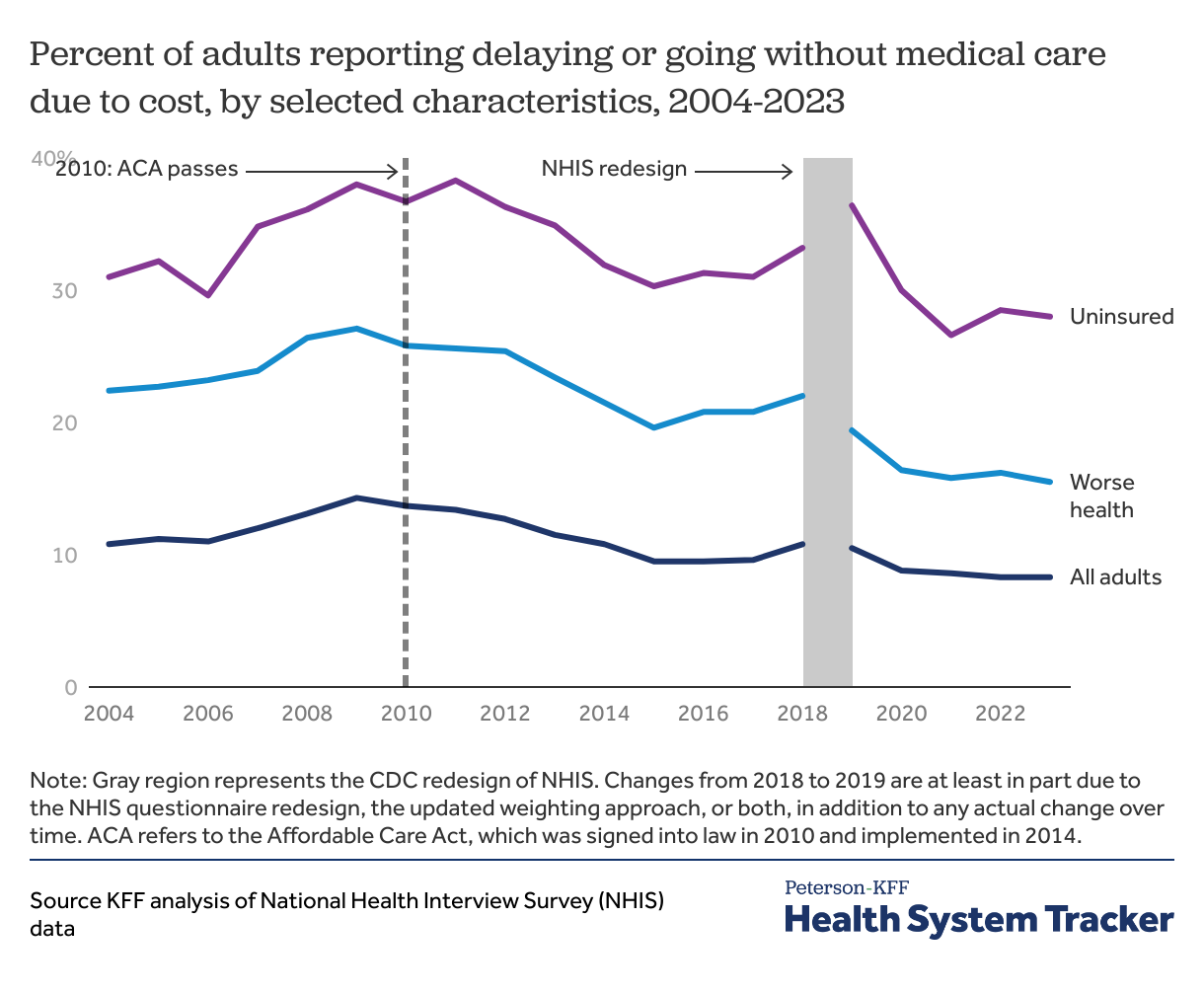

From 2004 to 2009, there was an increase in the share of all adults, those in worse health, and those who were uninsured who reported delaying or going without medical care due to cost. However, between 2010 (when the Affordable Care Act (ACA) was signed into law) and 2015 (the year after the expansion of Medicaid and opening of ACA Marketplaces), there was a decline in the share of adults who report delaying or going without medical care because of cost.

Despite improvements, many people continue to face access barriers due to the cost of care. In 2023, 28% of uninsured adults reported delaying or not getting medical care due to cost, compared to 7% of insured adults.

Starting with the 2019 NHIS, the U.S. Centers for Disease Control and Prevention (CDC) redesigned the questionnaire and updated the sampling weights methodology. As a result, changes in estimates from 2018 to 2019 cannot be attributed to actual change over time alone. The shaded gray region in the chart above indicates the break in the survey. The trend from 2018 to 2019 in the percent of adults delaying or forgoing medical care is likely at least partly due to changes to NHIS questionnaire and sampling weights, rather than actual changes in access to care alone.

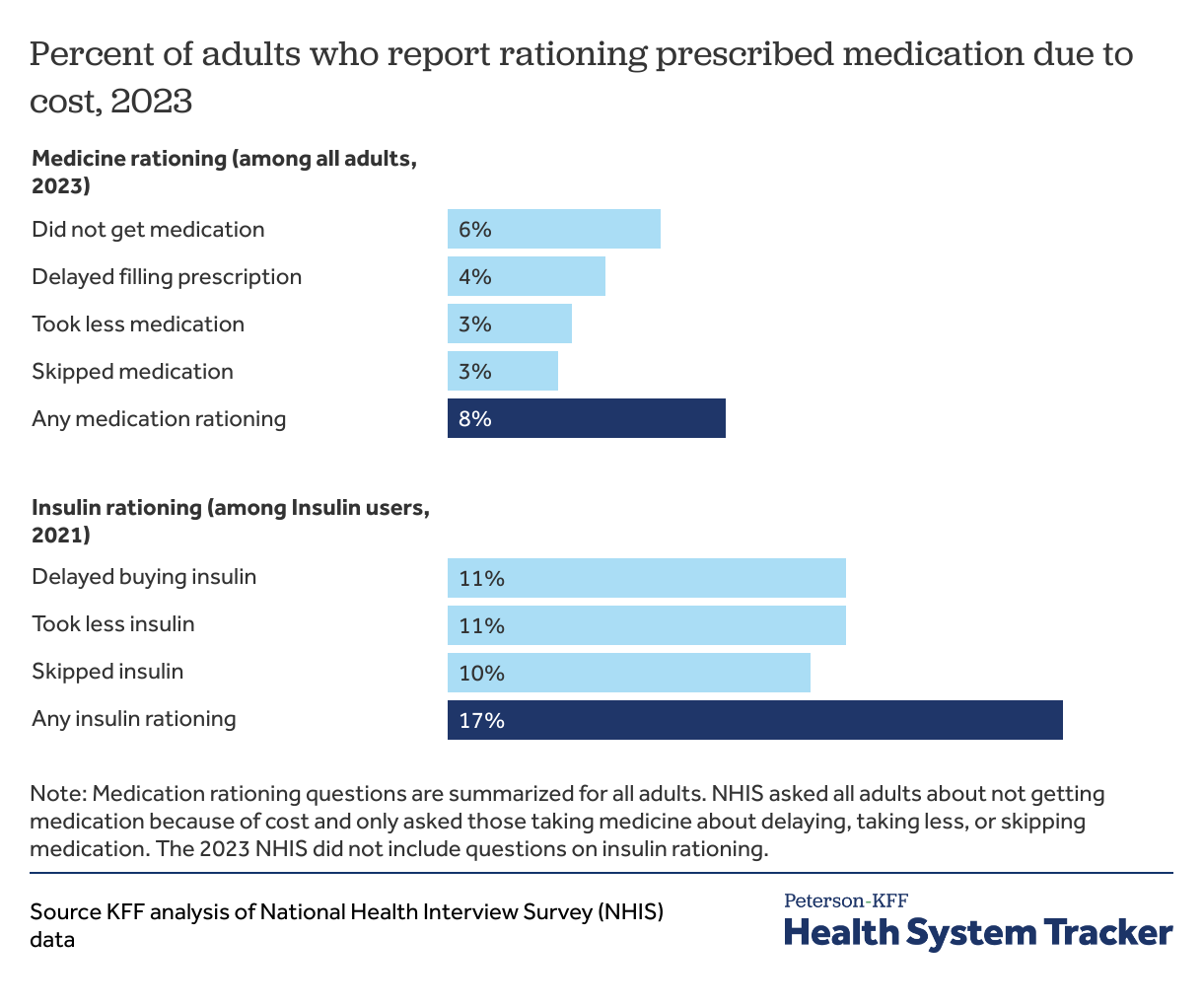

1 in 6 insulin users rationed insulin due to cost in 2021

In 2021, 1 in 6 insulin users (17%) reported either delaying buying insulin, skipping an insulin dose, or taking less insulin than needed due to cost. Among all adults, 8% reported rationing prescribed medication due to cost and 6% did not get needed prescription medication to save money. The most recent NHIS (2023) did not ask respondents whether they rationed insulin due to cost.

In 2022, several measures to address medication costs for Medicare beneficiaries were signed into law as part of the Inflation Reduction Act. These provisions include a $35 monthly cap on the out-of-pocket cost of insulin for Medicare beneficiaries and federal price negotiations for certain medications covered by Medicare.

Problems with health insurance can pose a barrier to accessing healthcare

Across diverse economic backgrounds, Americans worry about the high cost of healthcare. Recent KFF polling further finds that among all adults, 74% worry about being able to afford unexpected medical bills for not just themselves but for their family as well, which even includes 62% of adults who are regularly able to afford their monthly bills along with savings. Most adults who have difficulty affording bills also report being worried about affording monthly premiums (60%), and their prescription drugs (65%). While most adults in the U.S. have health insurance and uninsured adults are more likely than others to delay or forgo healthcare due to cost, people with health insurance can still face cost barriers to care. Cost-sharing can place financial burdens on enrollees, contribute to debt, and render care unaffordable. For example, more than 40% of U.S. households do not have enough assets to pay a typical private plan deductible.

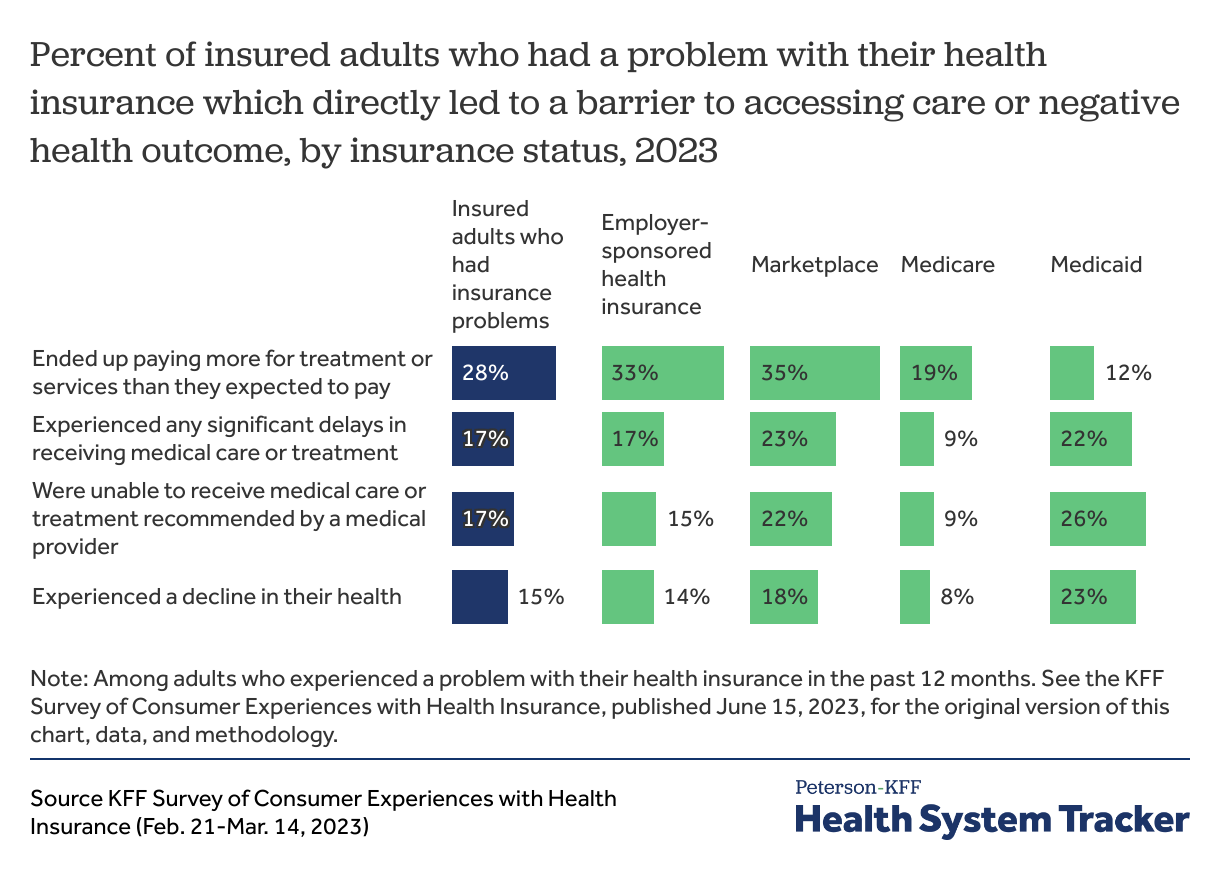

According to the 2023 KFF Survey of Consumer Experiences with Health Insurance, similar shares of insured adults who had a problem with their health insurance reported either significant delays receiving medical care or treatment (17%) or not receiving medical care recommended by their provider (17%) as a result of their insurance problems. A larger share reported paying more for treatment or services than they expected to pay (28%) due to their insurance problems. Almost 1 in 6 (15%) insured adults with insurance problems also said those problems caused a decline in their health.

In addition to several non-financial issues, like pre-authorization and network coverage, problems with health insurance include cost-related barriers to care, such as: insurers paying less than expected for medical bills, insurers not paying for care a patient thought they covered, and insurers not covering a prescription drug or requiring a high copay for a prescribed drug.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.