Compared to other private health plans in the U.S., coverage offered by large employers tends to be the most generous and comprehensive. However, even in these relatively generous plans, out-of-pocket spending has risen about twice as fast as workers’ wages in the last decade. Deductibles have risen and become more common, driving this rapid growth in out-of-pocket spending.

Rising deductibles have in turn raised concerns about affordability. Four in ten adults with employer coverage reported having problems affording their medical bills in a recent survey. The burden of increasing cost-sharing may be shifting employees’ priorities, as health costs have overtaken provider choice as the primary reason workers choose their health plan.

This analysis looks at trends in out-of-pocket costs and the demographics and health conditions of people who face these high costs. In particular, we look at people with large employer coverage who had high annual out-of-pocket spending of over $2,000 in one year. The typical deductible for a typical employer plan exceeds $1,500. We analyzed a sample of health benefit claims from the IBM MarketScan Commercial Claims and Encounters Database. The sample was limited to people under the age of 65 who were enrolled in their plan for more than half a year. Out-of-pocket spending in this analysis reflects cost-sharing (coinsurance, co-payments, deductibles) for covered services. Importantly, this does not include balance bills (also known as surprise bills) for non-covered services. Please see our related analysis for more information on surprise bills.

We find that 12% of people with large employer coverage had more than $2,000 in out-of-pocket spending in 2018. High out-of-pocket spending becomes more likely as people age and is more likely for women than for men, as well as for people with certain health conditions including cancers, mental health disorders, and diabetes.

More than 1 in 10 people with large employer coverage have out-of-pocket spending over $2,000

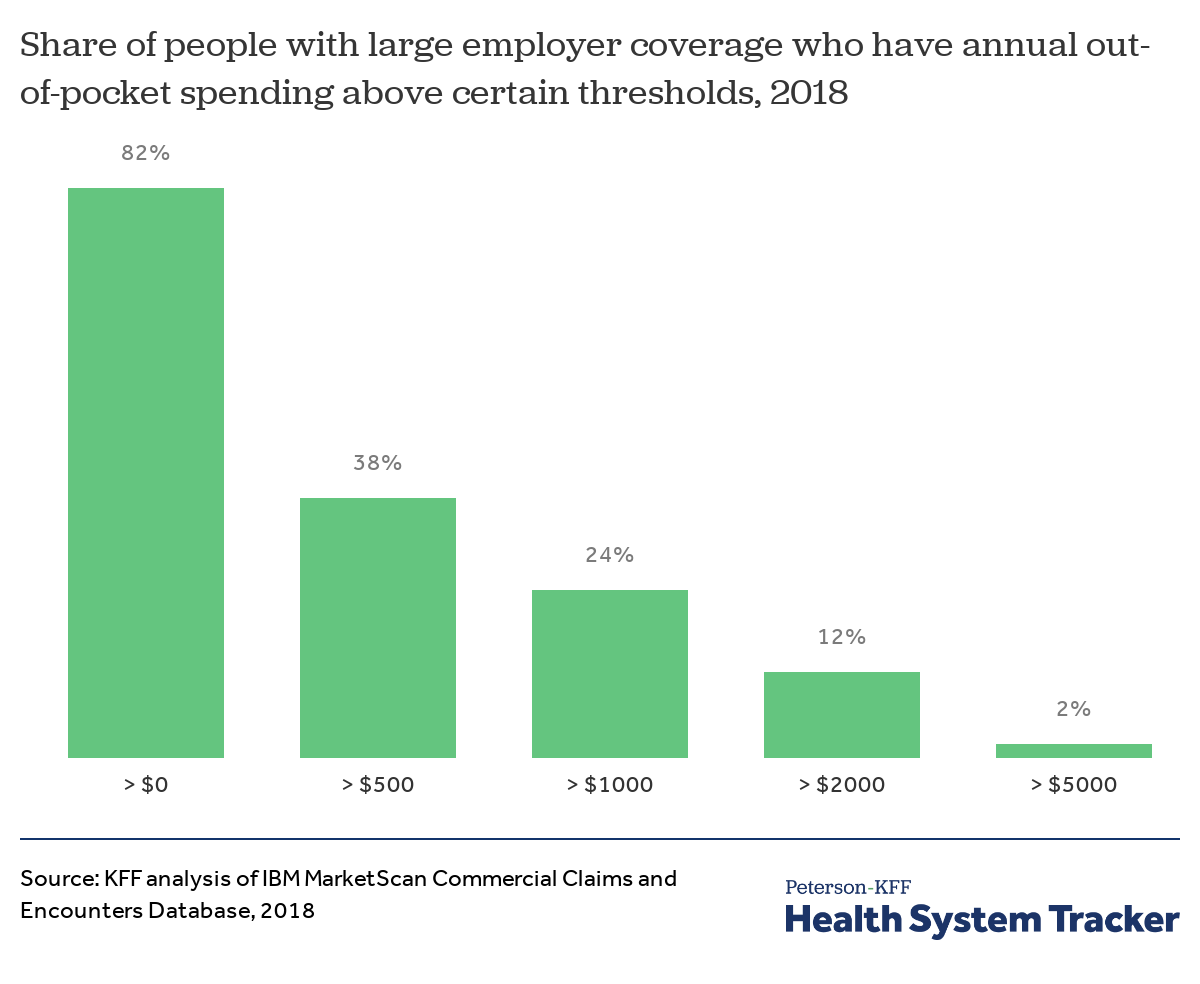

People with large employer health coverage spent an average of $802 out-of-pocket, with deductibles accounting for over half of that spending ($417) in 2018. The vast majority (82%) of people with coverage from a large employer had some amount of out-of-pocket health spending. Roughly one in 10 enrollees (12%) faced more than $2,000 in out-of-pocket spending that year (referred to as “high” out-of-pocket spending in the remainder of this analysis).

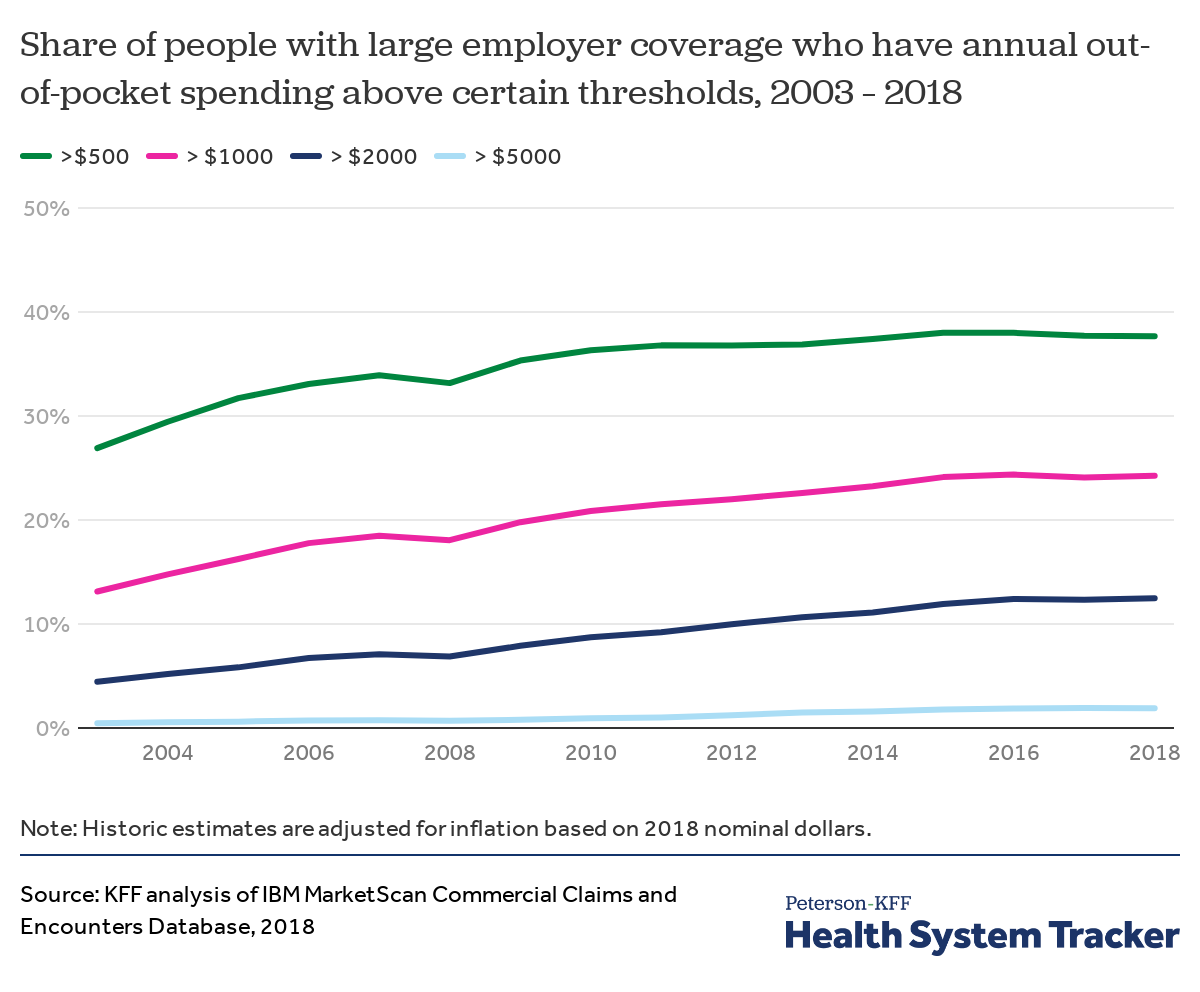

The share of enrollees with high out-of-pocket spending has increased over time

As deductibles have increased and become more common, more enrollees have reached higher thresholds of out-of-pocket spending. Over the last fifteen years (from 2003 to 2018), the share of people with large employer coverage with over $2,000 in annual out-of-pocket spending (in constant 2018 dollars) increased from 4% to 12% of enrollees.

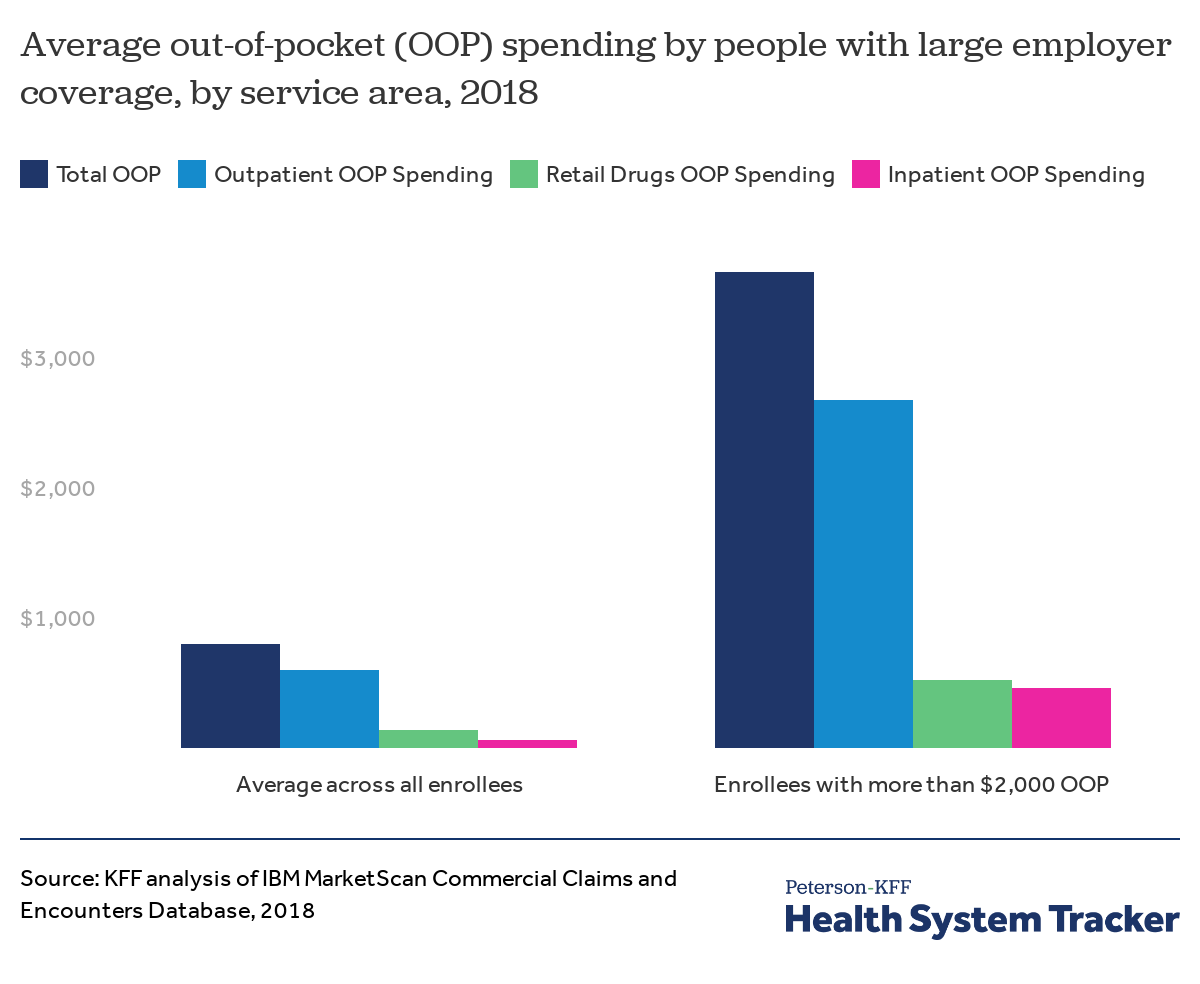

Among people with high out-of-pocket costs, outpatient services represent their largest expenditures

Out-of-pocket spending on outpatient services constitutes the bulk of cost-sharing for both those with high out-of-pocket spending and all enrollees on average. Enrollees with high out-of-pocket spending average $2,673 in outpatient out-of-pocket spending (73% of their average, high out-of-pocket spending), while the average enrollee has $604 in outpatient out-of-pocket spending (75% of average out-of-pocket spending). Even so, those with high out-of-pocket spending see a greater share of their out-of-pocket costs go towards inpatient spending ($467 on average, or 13% of their average, high out-of-pocket spending) than do enrollees on average ($64 on average, or 8% of average out-of-pocket spending).

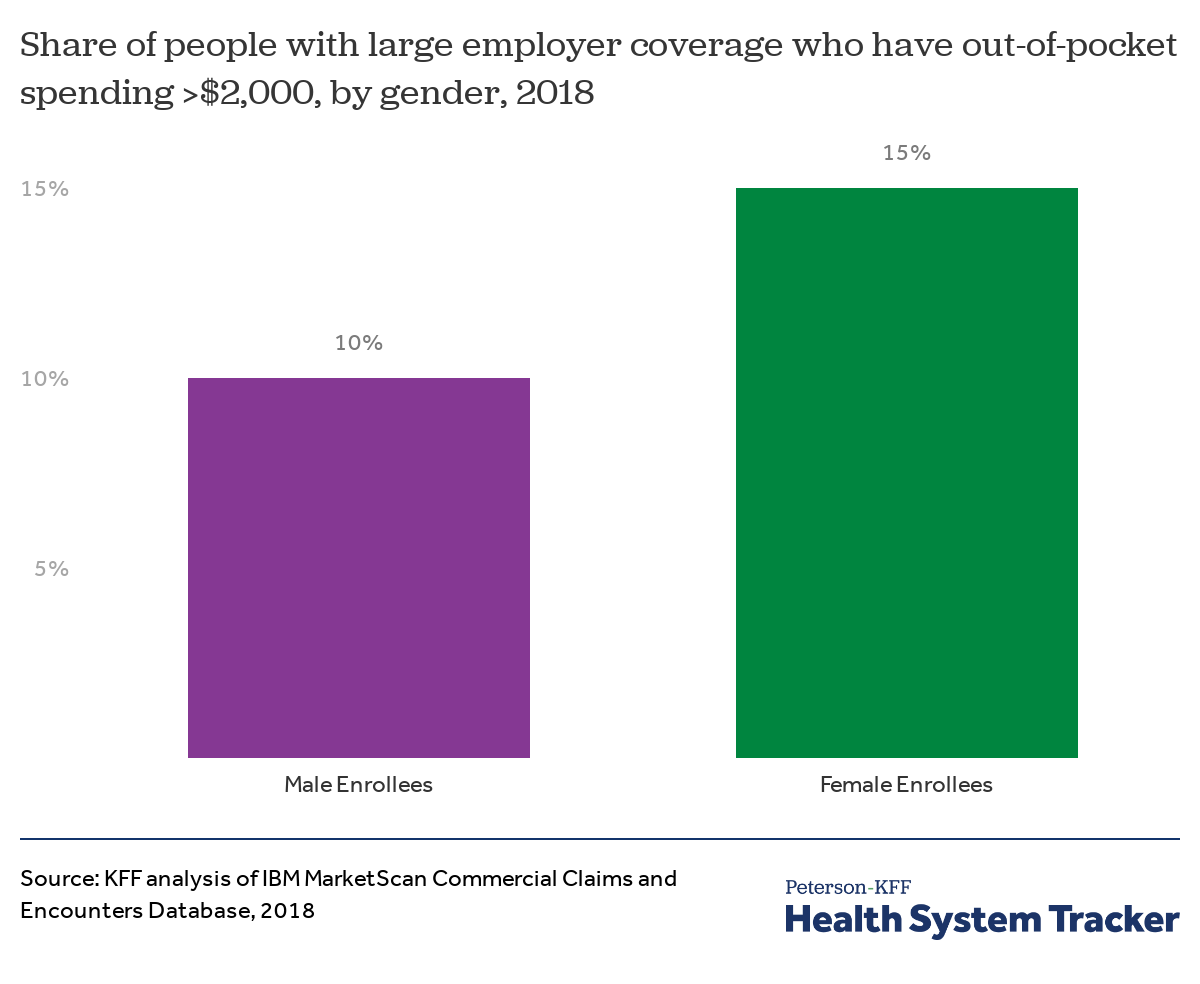

Female enrollees are more likely than male enrollees to have high out-of-pocket costs

Among nonelderly people (including adults and covered children) with health coverage from a large employer, female enrollees are more likely than male enrollees to have over $2,000 in out-of-pocket spending (15% of female enrollees compared to 10% of male enrollees in 2018). Among all enrollees, female enrollees averaged 35% more in out-of-pocket spending than male enrollees ($919 vs $680 in 2018).

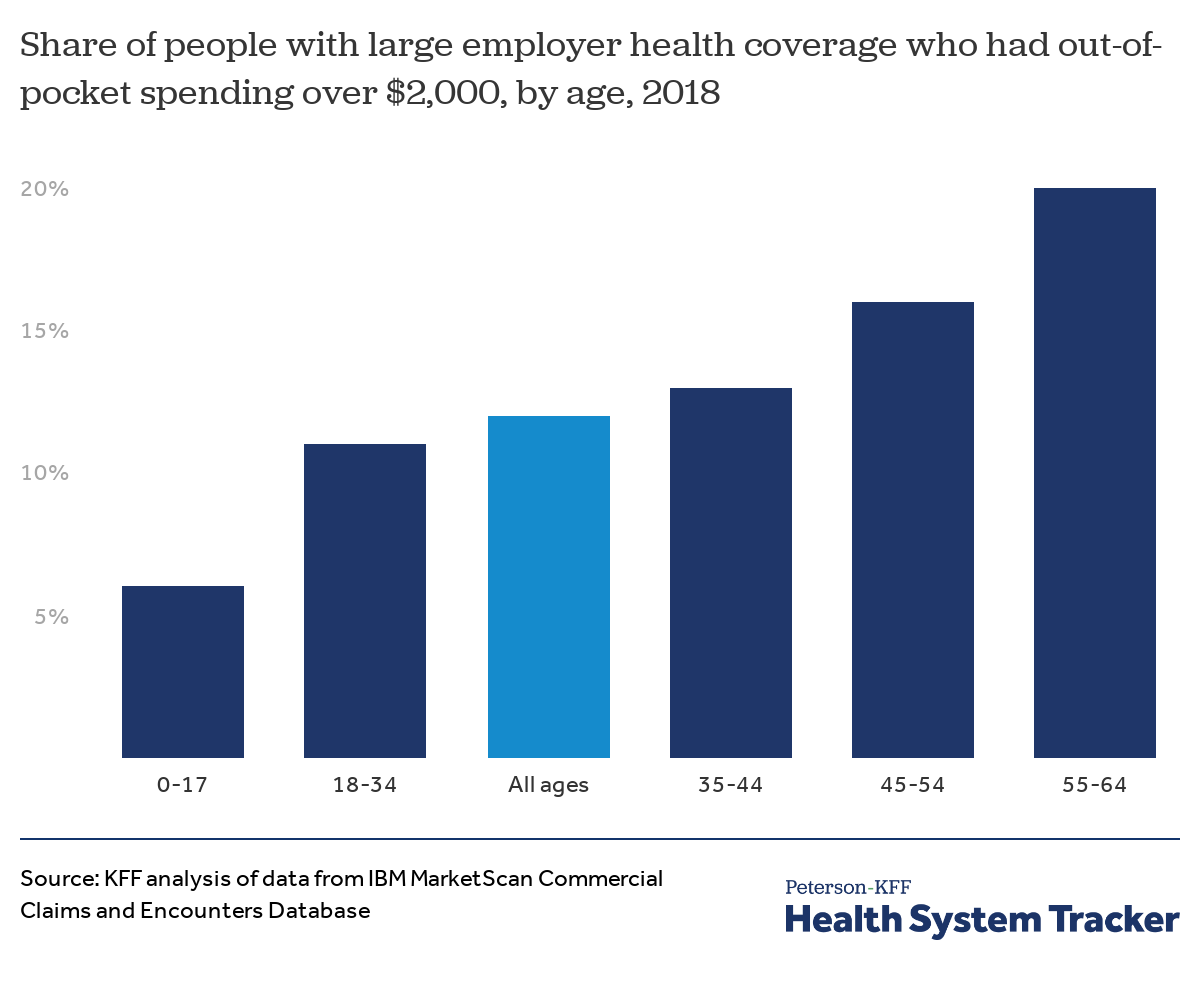

High out-of-pocket spending becomes more likely as enrollees age

People are more likely to have high out-of-pocket spending as they age. Among nonelderly people with large employer coverage, 6% of children (enrollees up to age 17) and 11% of adults ages 18 to 34 had out-of-pocket spending over $2,000 in 2018. This high level of out-of-pocket spending was more common among older enrollees: 13% of enrollees ages 35-44, 16% of those ages 45-54, and 20% of those ages 55-64 had out-of-pocket spending over $2,000 in 2018.

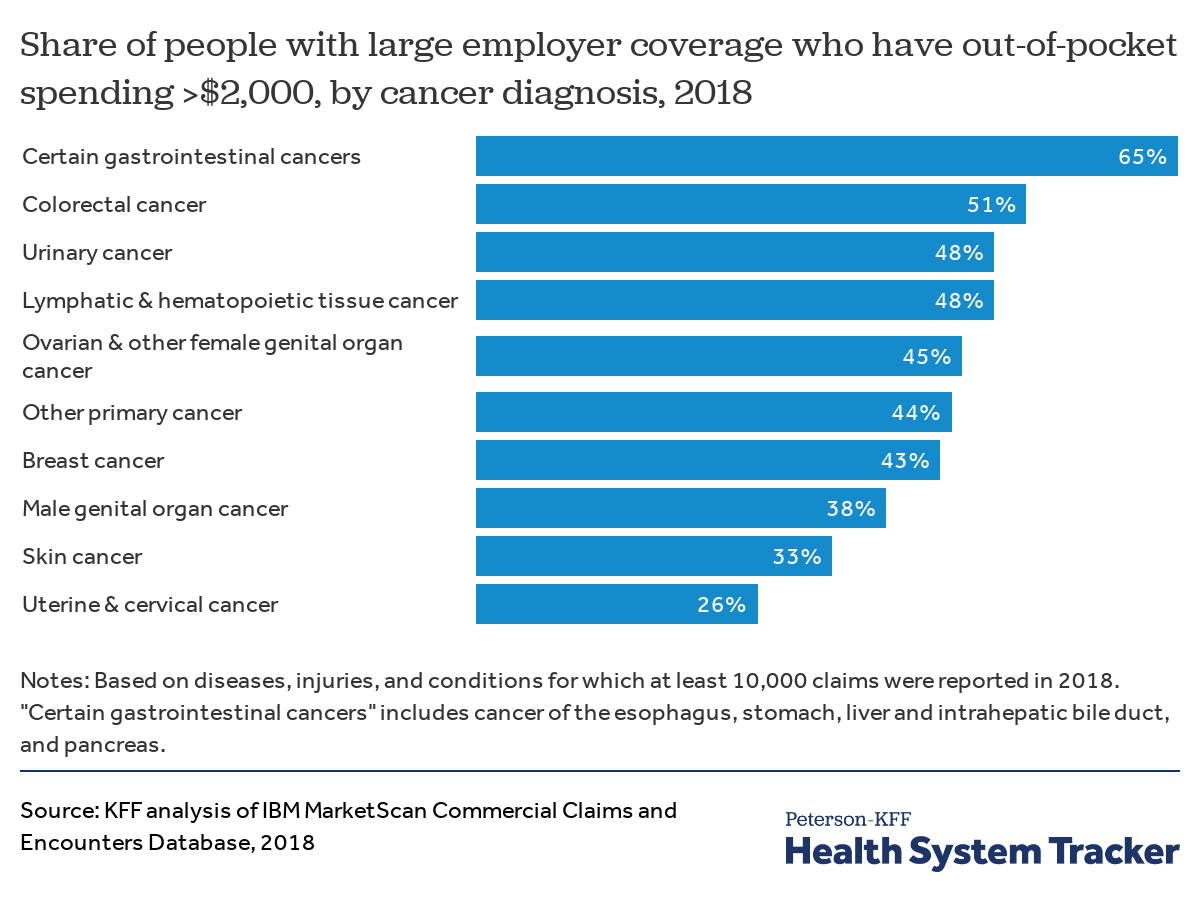

Cancer patients have a higher risk of large out-of-pocket expenses

Although 12% of enrollees in large employer plans have out-of-pocket costs exceeding $2,000, those with certain cancer diagnoses are much more likely to have high costs. In 2018, 65% of enrollees with certain gastrointestinal cancers had high (>$2,000) out-of-pocket spending. One in every two people with colorectal, lymphatic, urinary, or ovarian cancer had out-of-pocket spending in excess of $2,000. Not all of this out-of-pocket spending is for cancer treatment specifically, as many people have other diagnoses (comorbidities) that also contribute to their out-of-pocket liability.

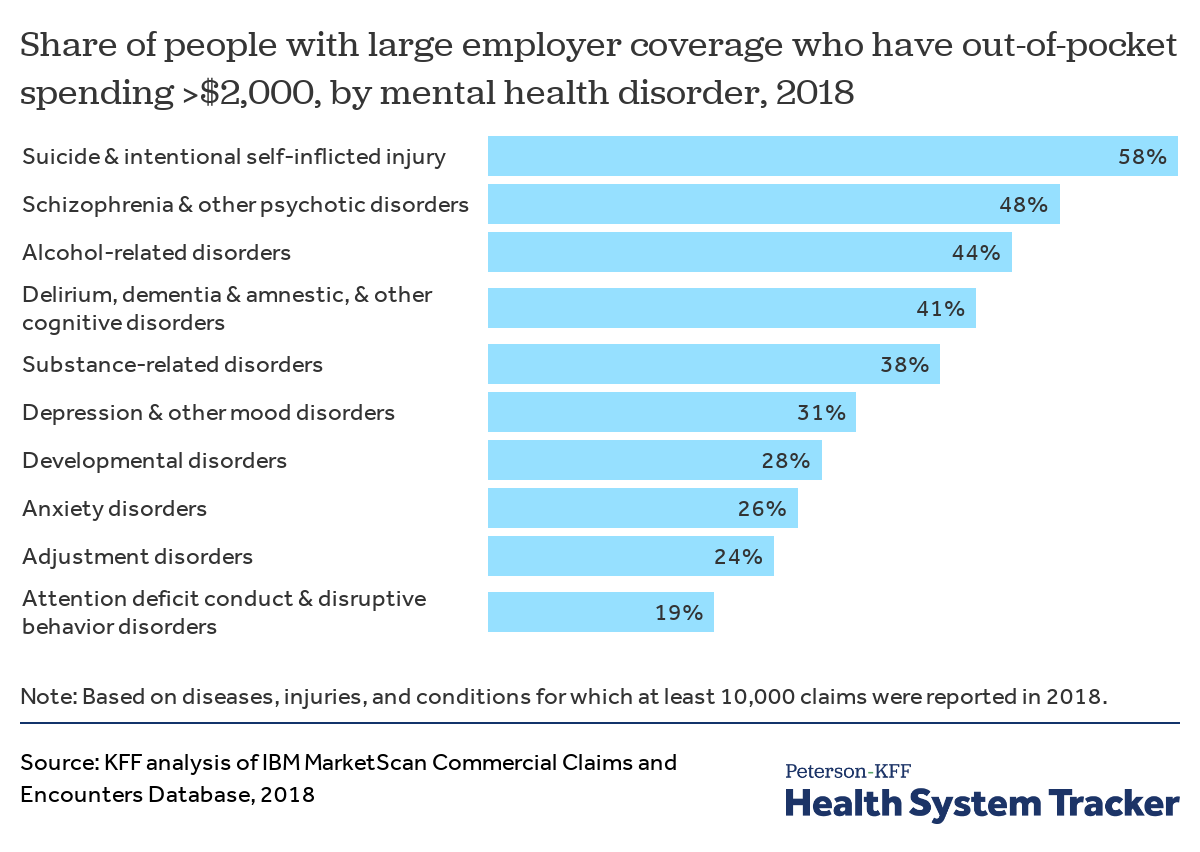

Many people with mental health conditions face high out-of-pocket spending

A quarter of large employer plan enrollees who had mental health diagnoses in 2018 had out-of-pocket spending in excess of $2,000. Notably, out-of-pocket spending exceeded $2,000 for 58% of instances of suicide or intentional, self-inflicted injury.

Average out-of-pocket spending for all enrollees with a mental health related diagnosis ranged from $1,228 for enrollees with attention deficit conduct and disruptive behavior disorders to $2,996 on average for instances of suicide or intentional self-harm.

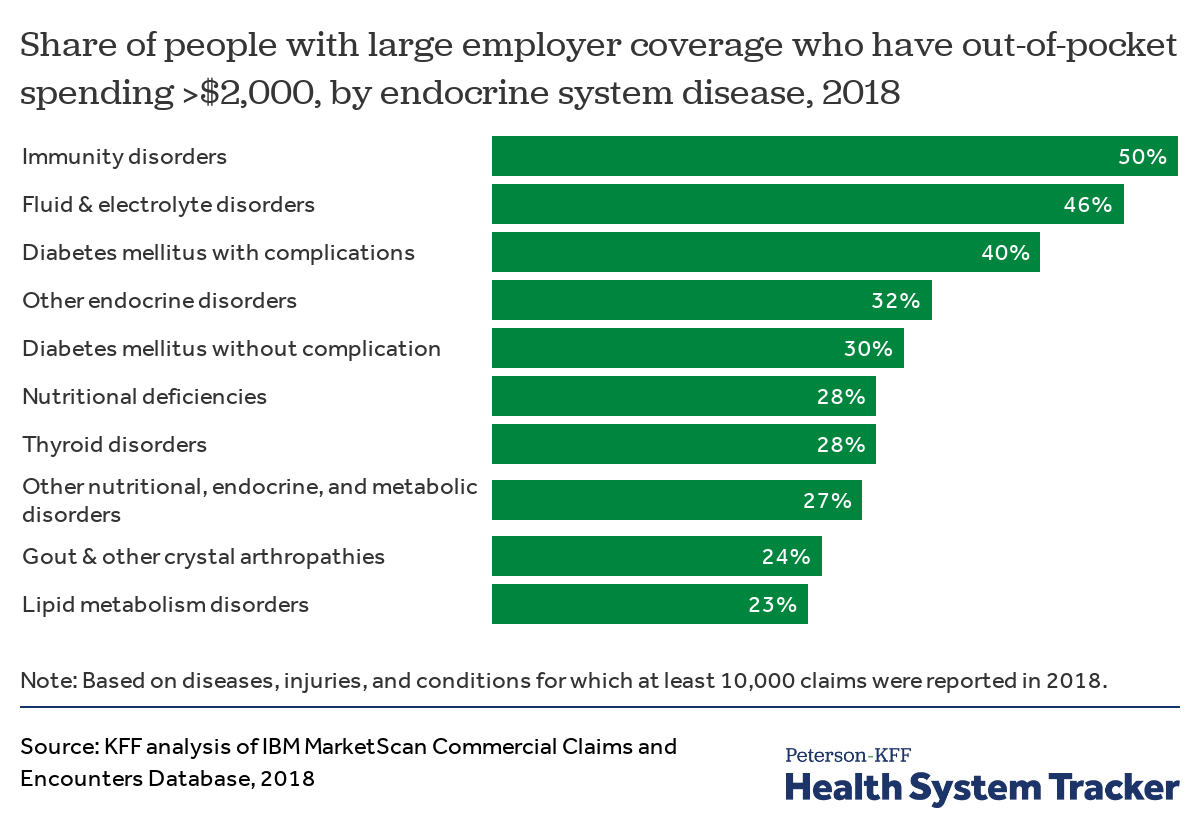

People with diabetes or other endocrine disorders have a higher risk of high out-of-pocket costs

Among enrollees in large employer plans, high out-of-pocket spending is more common for those who have diabetes complications (40% of diagnosed enrollees in 2018 had out-of-pocket costs in excess of $2,000, compared to 12% of all enrollees). Even diabetes patients without complications are substantially more at risk of high out-of-pocket costs (30% of diagnosed enrollees had out-of-pocket costs in excess of $2,000 in 2018).

Average out-of-pocket spending for all enrollees with an endocrine system disease ranged from $1,373 for enrollees with lipid metabolism disorders to $2,570 for enrollees with immunity disorders.

Methods and Definitions

We analyzed a sample of medical claims obtained from the 2018 IBM Health Analytics MarketScan Commercial Claims and Encounters Database, which contains claims information provided by large employer plans. We only included claims for people under the age of 65, as people over the age of 65 are typically on covered by Medicare. This analysis used claims for almost 18 million people representing about 22% of the 82 million people in the large group market in 2018. Weights were applied to match counts in the Current Population Survey for enrollees at firms of 1,000 or more workers by sex, age and state. Weights were trimmed at eight times the interquartile range.

The advantage of using claims information to look at out-of-pocket spending is that we can look beyond plan provisions and focus on actual payment liabilities incurred by enrollees. A limitation of these data is that they reflect cost sharing incurred under the benefit plan and do not include balance-billing payments that beneficiaries may make directly to health care providers.

Inpatient claims were aggregated by admission and outpatient claims were aggregated by the day (‘outpatient days’). Each claim on the inpatient and outpatient services files has a variable (‘ntwkprov’) that indicates whether or not the provider or facility providing the service was in the health plan’s network.

ICD-9 or ICD-10 diagnosis codes were used to classify 283 distinct illness and conditions. Disease classification are based on whether an enrollee received at least one primary diagnoses for any outpatient event or principal diagnosis for any inpatient admission at any point in 2018. We used the disease definitions developed by the Healthcare Cost and Utilization Project (HCUP). The distinct illnesses and conditions reported here were limited to those for which at least 10,000 episodes occurred in 2018.

Unless stated otherwise, all dollar values are reported in 2018 nominal dollars.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.