Telehealth visits—patient-provider visits delivered virtually—have been a feature of some physician practices for several years, but the COVID-19 pandemic and the accompanying social distancing protocols catalyzed a shift toward remote care. Telehealth services can be delivered in various formats, including through specialized vendors, as a supplement to in-person care delivered by a patient’s physician, or by a provider at a remote location when a patient is at a medical facility. Before the pandemic, most employer health plans provided at least some coverage for services delivered through telehealth but very few enrollees used these services.

Background

Social distancing to reduce the spread of COVID-19 led many health providers to deliver more services remotely. Governments and payers sought to maintain access to care during this period by removing regulatory barriers and reforming payment policies. For example, Medicare suspended restrictions on which telehealth services it covered, the geographic location of the beneficiary and whether the visit had to originate in a health care facility. Many states expanded telehealth access by allowing or increasing payment for telehealth services under state health programs, changing or suspending licensing rules, and allowing providers to prescribe based on virtual visits. Additionally, many employers and private plans reduced or eliminated cost-sharing for telehealth services and increased reimbursements for telehealth providers. In order to expand their offerings, some employers contracted with a specialized telehealth provider. Some states and payers started paying for telehealth services on parity with in-person care.

This brief assesses telehealth use from March 2019 through August 2021 using data from Cosmos, a HIPAA-defined Limited Data Set of more than 126 million patients from over 156 Epic organizations, including 889 hospitals and 19,420 clinics across all 50 states. In particular, this brief examines the share of outpatient visits taking place through telehealth.

Findings

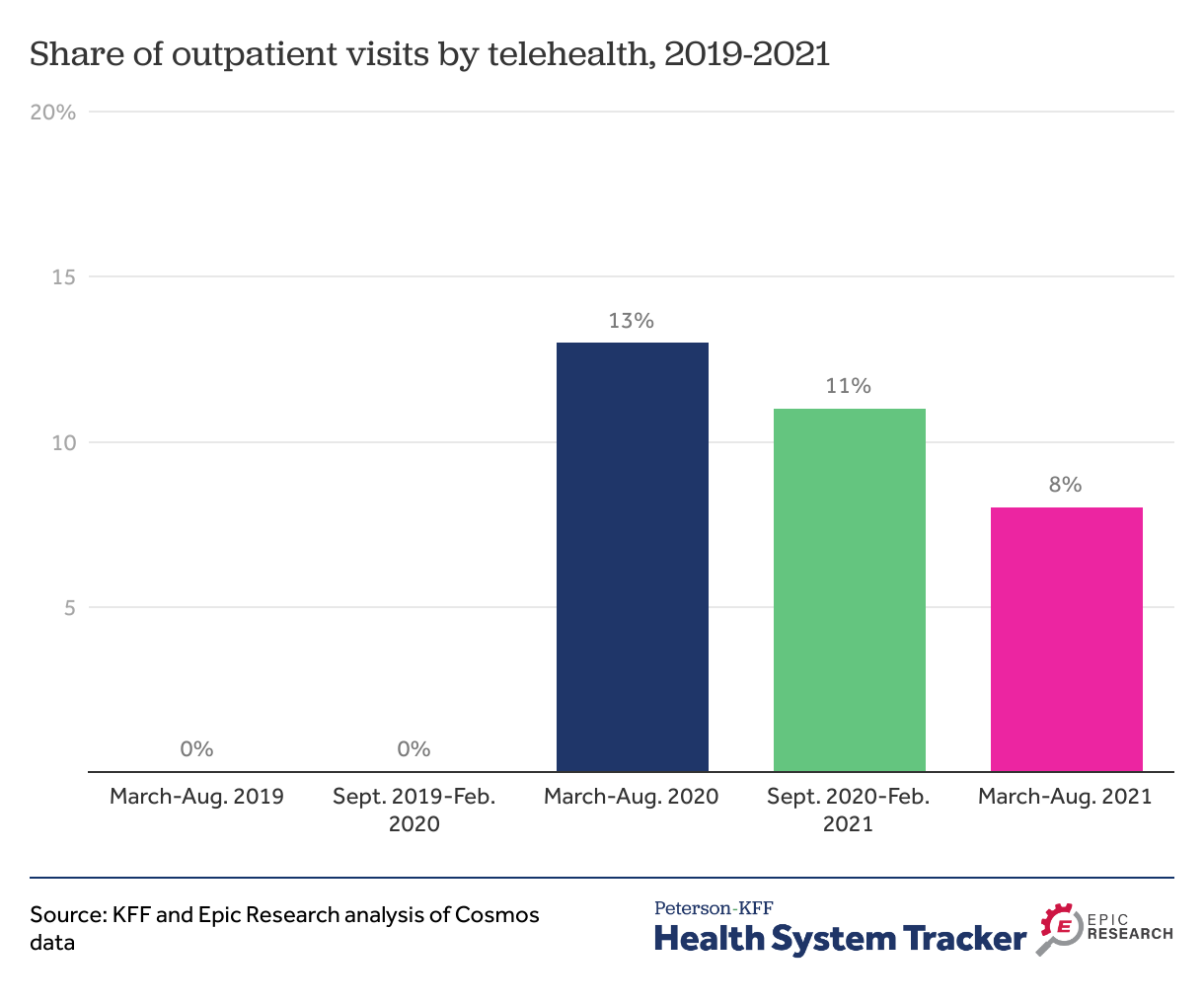

Outpatient visits by telehealth have declined since the early months of the pandemic

Prior to the onset of the pandemic in the United States, telehealth use was a negligible share (rounding to 0%) of outpatient visits. Many enrollees have had increased access to telehealth services over the last two years. During this period, telehealth use soared from less than 1% of outpatient visits before the pandemic to 13% of outpatient visits in the first 6 months of the COVID-19 pandemic. This rate declined to 11% during the next 6-month period, and then to 8% a year into the pandemic (March-August, 2021).

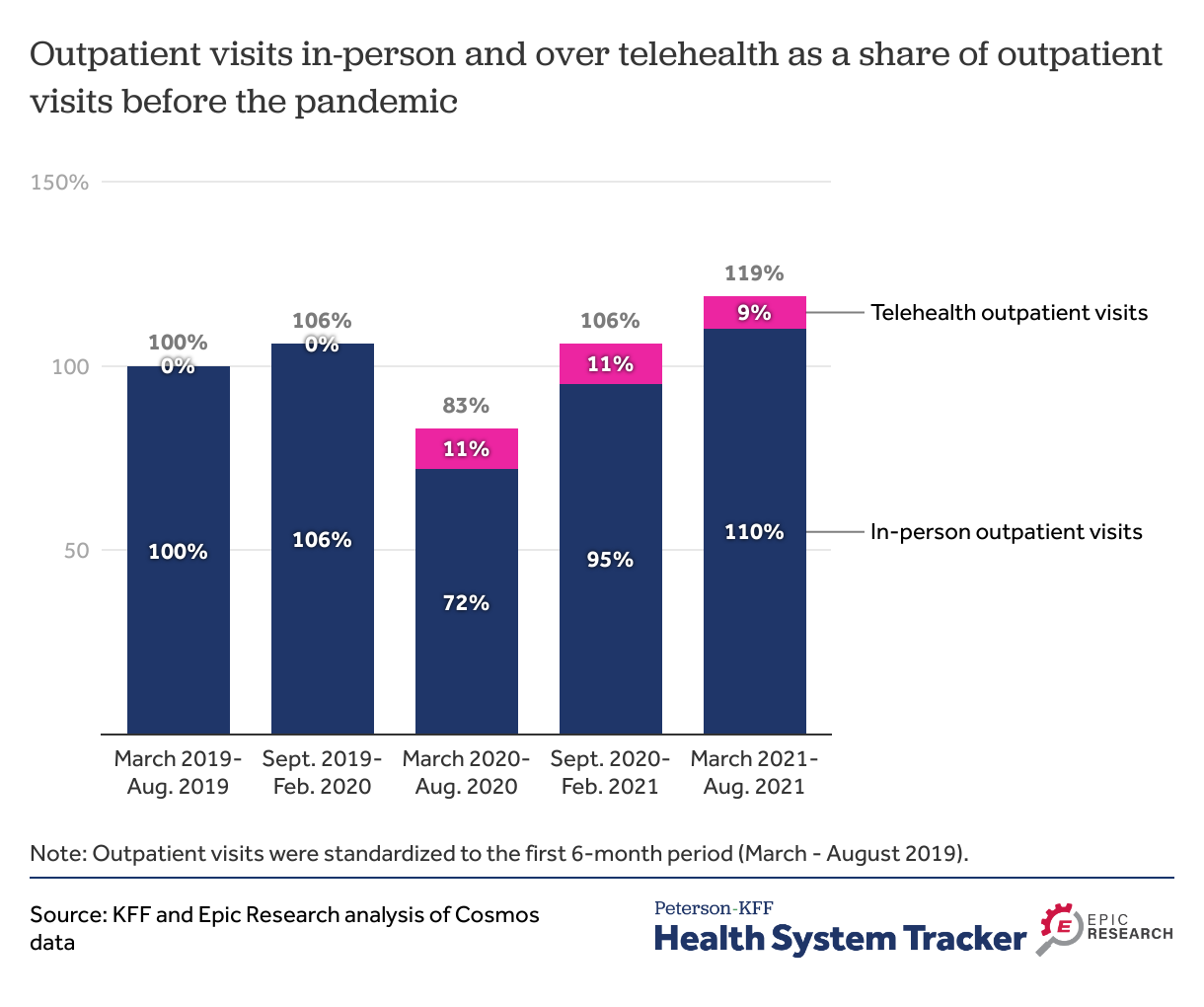

The total number of outpatient visits has returned to pre-pandemic levels, but telehealth visits remain elevated

In-person outpatient visits in the first 6-months of the pandemic (March-August 2020) declined to 72% of outpatient visits a year earlier (March-August 2019). During this period, telehealth helped fill the gap, but in total there were only 83% as many outpatient visits between March and August 2020 as during the same period a year earlier. After an initial decrease in visits, utilization has now surpassed pre-pandemic levels; In-person outpatient visits have exceeded the 6-months immediately preceding the pandemic (106% in September 2019-February 2020 vs. 110% in March-August 2021), but with an additional boost from telehealth visits, the total number of outpatient visits between March-August 2021 was 19% higher than the number of visits before the pandemic in March-August of 2019.

With increased use of in-person care in the most recent months of the pandemic, the share of outpatient visits delivered through telehealth has decreased. The number of outpatient visits delivered over telehealth have declined since the first 6-months of the pandemic. The share of outpatient visits delivered via telehealth is about 60% of what it was during the first six months of the pandemic (13% vs. 8%).

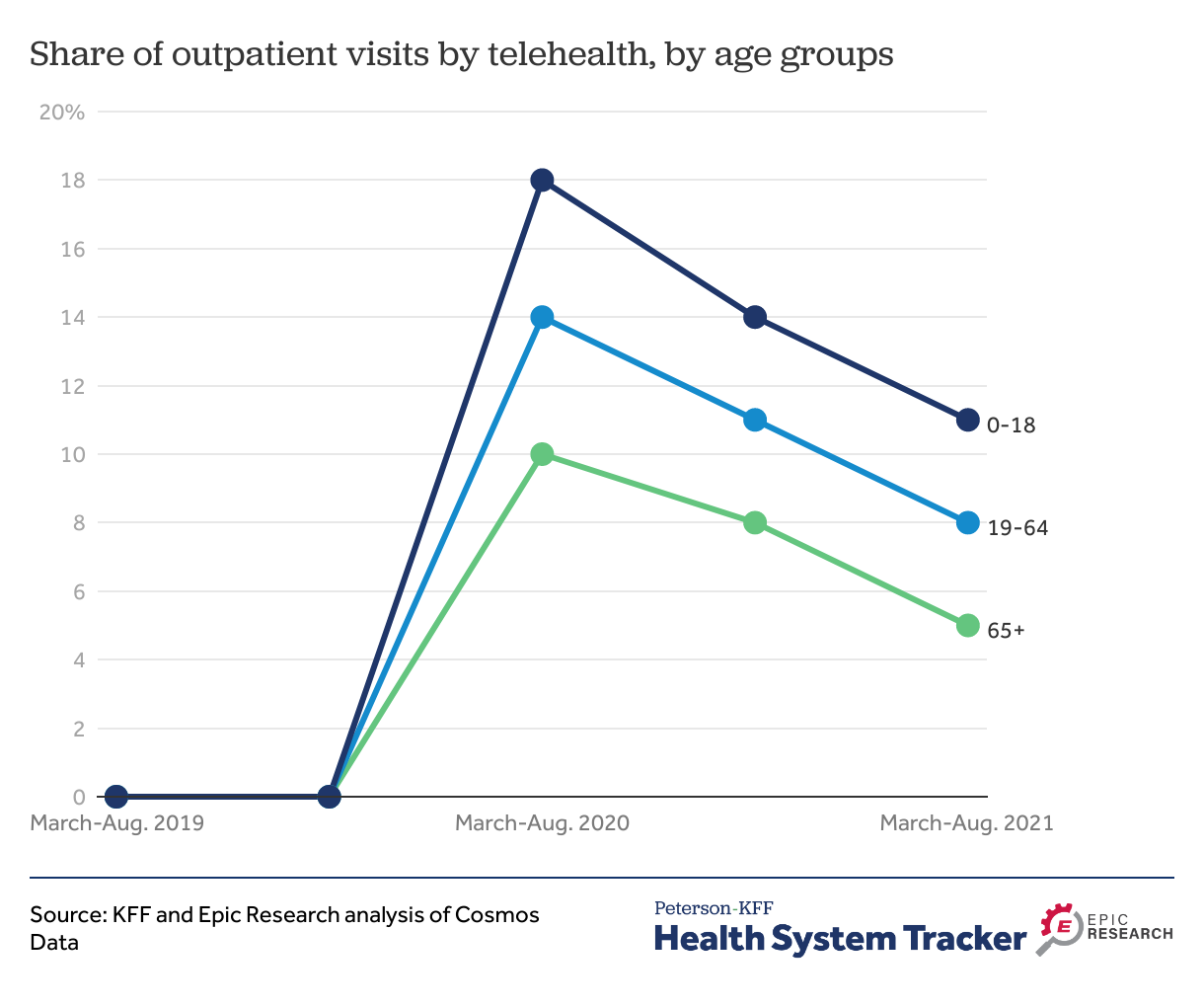

Non-elderly had higher telehealth uptake and have continued using telehealth at higher rates than elderly

Telehealth is often discussed as a potential way to improve access to care for older adults, who may be less mobile or have many time-consuming appointments. However, this group has had lower retention of telehealth since the pandemic peak than younger people. At the beginning of the pandemic, children and non-elderly adults (ages 19-64) accessed care by telehealth for 18% and 14% of outpatient visits, respectively. Elderly adults (ages 65 and older) used telehealth for only 10% of outpatient visits. As the pandemic has continued, elderly adults have continued to have used telehealth for outpatient visits less than children and non-elderly adults. The share of outpatient visits delivered through telehealth among children and non-elderly during March-August 2021 was 11% and 8%, respectively, whereas the share of outpatient visits by telehealth among elderly adults declined from 10% in 2020 to 5% in 2021. These patterns may reflect differences in enrollees’ comfort with the technology, internet access, and the types of services used.

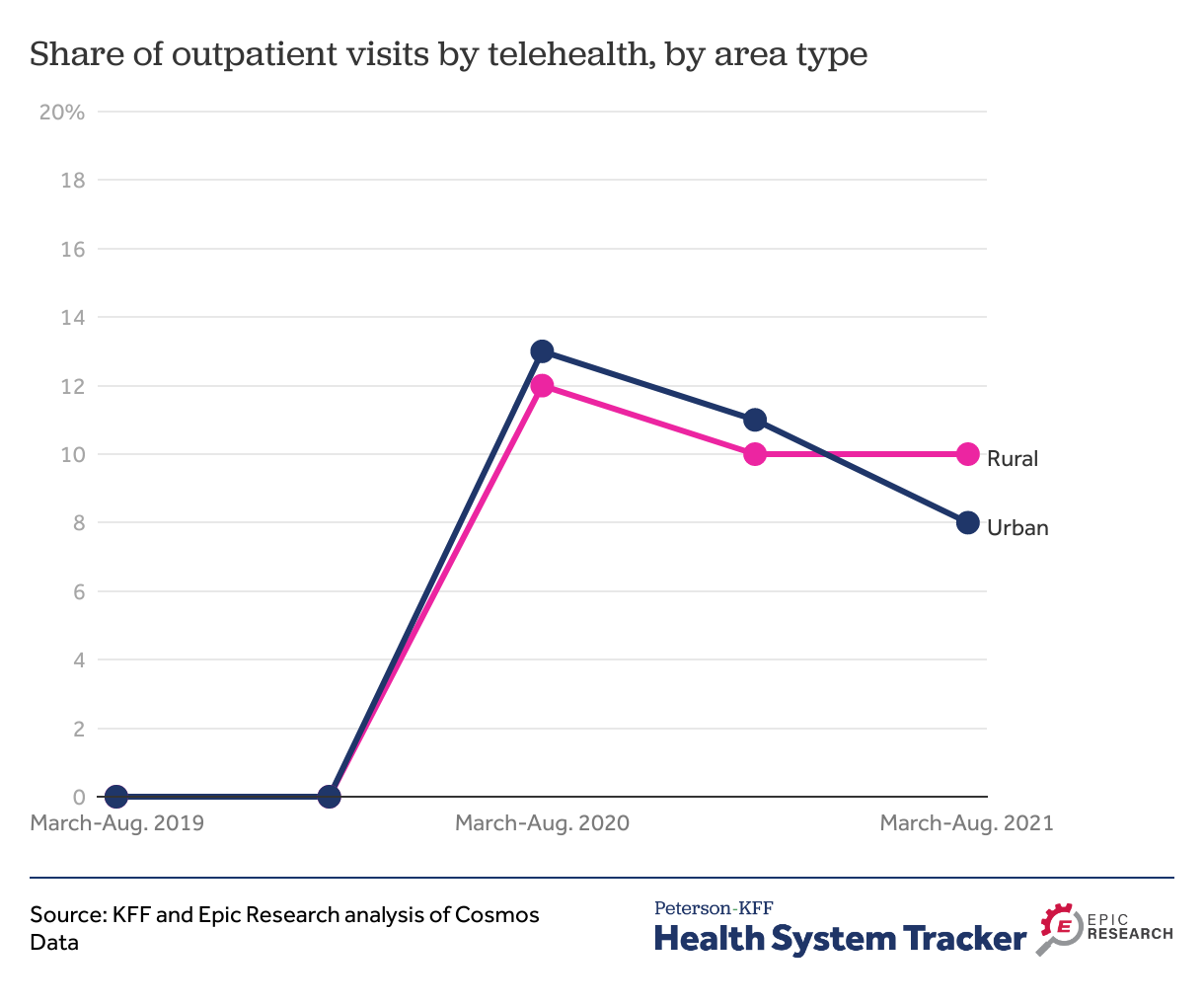

Patients in rural and urban areas used telehealth at similar rates

Many consider virtual care as an alternative in areas which have physician shortages. However, urban and rural residents had similar share of telehealth outpatient visits in the first six months of the pandemic (13% vs. 12%). By the spring and summer of 2021, telehealth visits in both urban and rural areas had declined to 8% and 10% of visits respectively.

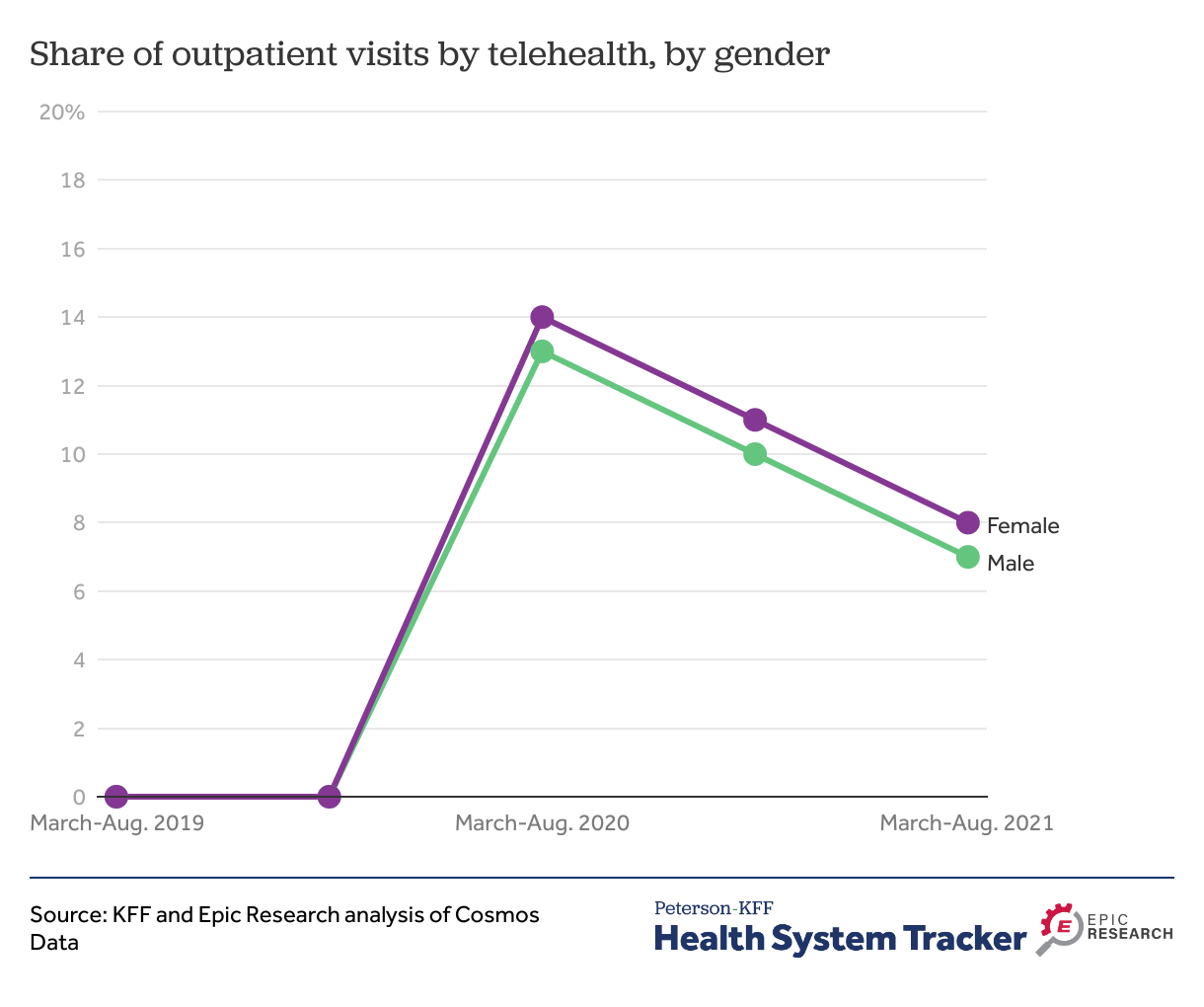

Men and women used outpatient visits by telehealth at similar rates

Men and women were using telehealth at approximately the same rate – 8% of women’s outpatient visits were conducted via telehealth in March-August of 2021 vs. 7% of men’s visits.

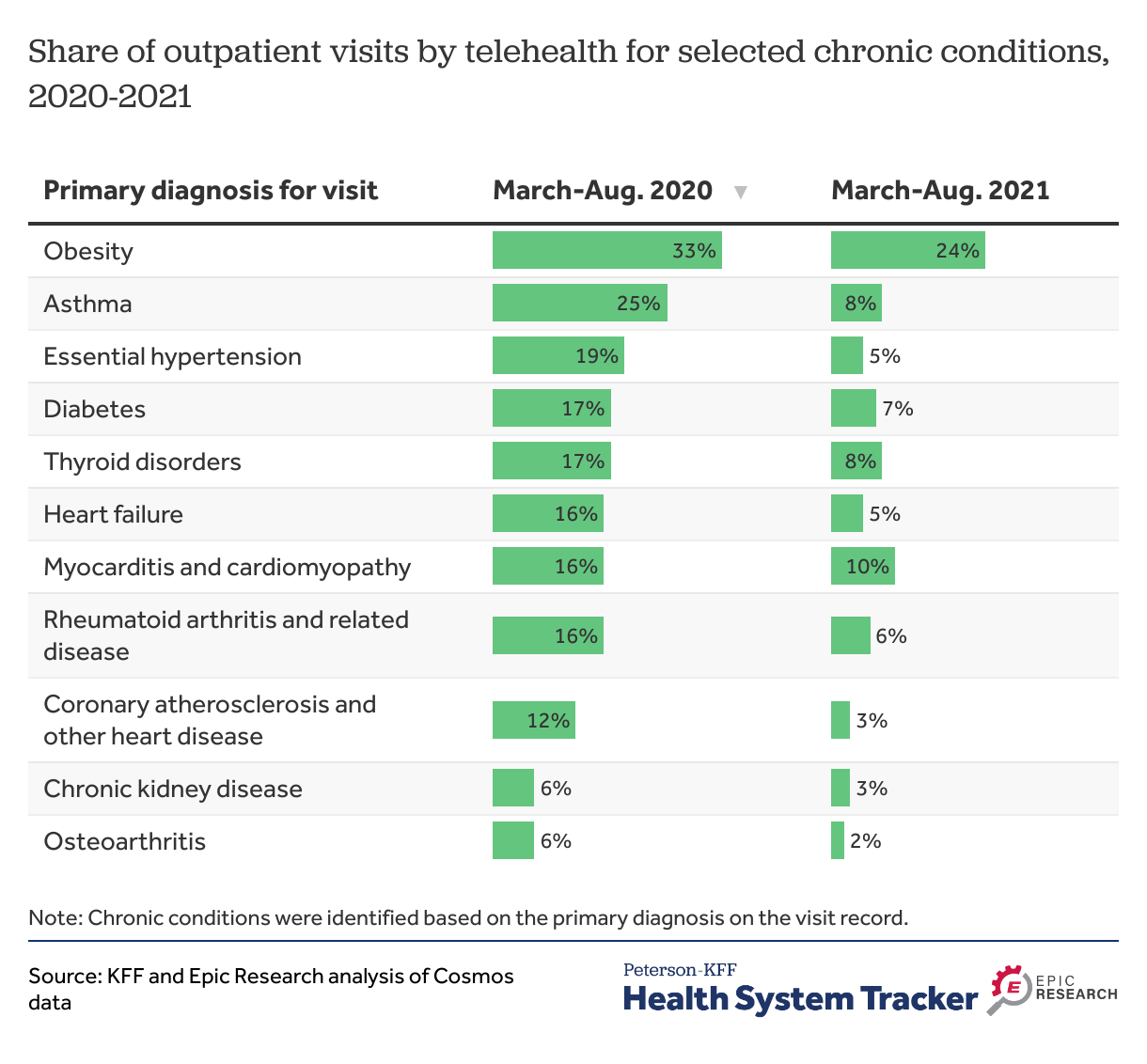

Telehealth use for chronic condition management has decreased over the pandemic but remains elevated over pre-pandemic levels

The growth of telehealth may allow persons with chronic conditions more availability to services to manage their conditions. Some have proposed increased use of telehealth for care management, such as helping patients monitor their disease and adherence to treatments remotely. In the first 6-months of the pandemic (March-August 2020), more than 1 in 6 outpatient visits for visits which had a primary diagnosis of obesity, asthma, hypertension, diabetes, or thyroid disorders were delivered through telehealth. In the year after (March-August 2021), the share of outpatient visits by telehealth for a chronic condition primary diagnosis has declined substantially. For example, the share of outpatient visits delivered through telehealth for asthma declined from 25% in March-August 2020 to 8% a year later (March-August 2021).

Impact of increased telehealth use on access, cost, quality, and outcomes

Access. Telehealth has played a large role in addressing health needs during the COVID-19 pandemic, particularly when in-person services were delayed or postponed to avoid potential spread of COVID-19 at health sites. Governments, payers, and employers acted to make telehealth more accessible through changes in payment, coverage, and licensing policies. Providers also increasingly adopted telehealth as the extent of pandemic disruptions became apparent. These factors combined to significantly increase telehealth access and use among publicly and privately insured people. While before the pandemic telehealth was a negligible share of outpatient visits, services delivered remotely now account for 8% of outpatient visits.

Costs. How telehealth use affects health spending remains to be seen. On one hand, if payment for telehealth services is lower than for in-person visits, then the overall cost of care could decrease. However, telehealth may not reduce spending if it leads to increased utilization or requires in-person visits in addition to the telehealth visit, even if telehealth is available at lower prices. One study found a higher likelihood of follow-up visits for acute respiratory infections after some types of telehealth visits compared to in-person visits. That is, unless telehealth is a replacement for in-person visits rather than a supplement or duplicative, it is unlikely to reduce overall health spending. Telehealth may further impact costs of health services if improved case management of complex conditions reduces utilization of high-cost services, such as emergency room visits.

Quality and Outcomes. Questions also remain as to which conditions and services can be provided at equal or better quality over telehealth compared to in-person. As during the COVID-19 pandemic, telehealth visits could potentially reduce spread of infections at health sites. On the other hand, patients may not be able to get additional preventive services that would have occurred at an in-person visit.

Telehealth regulatory landscape beyond the pandemic

Going forward, it’s not clear what role telehealth will play, and for what types of health services. So far, telehealth use has been the highest for mental health and substance use services. Services delivered over telehealth may improve access for people with certain conditions–older people with chronic care management needs, rural residents without robust access to providers, people who need lower intensity health services, and for services that do not need in-person evaluations. Though older people and rural residents are less likely to have internet access at home, which may hinder access.

Private and public payers’ telehealth coverage and licensing policies will unquestionably also affect telehealth use in the future. Some payers and employers have signaled continued coverage of more telehealth services beyond the pandemic.

Private payers. During the winter and spring of 2021, almost half of employers with 50 or more employees said telehealth would be ‘very important’ in providing access in the future compared to only 4% who said that telehealth would be unimportant. Private payers expanded coverage of telehealth services during the pandemic. Some private plans even paid for telehealth services in parity with in-person services and waived out-of-pocket cost sharing telehealth services for a period of time. Though some of these policies may have already expired and it’s unclear to what extent private payers’ policies on telehealth will continue beyond the pandemic.

Federal policies. Early in the COVID-19 pandemic, CMS temporarily expanded coverage and payment for telehealth services beyond rural areas. CMS has announced that Medicare will continue covering this approved list of telehealth services beyond the Public Health Emergency through the end of 2023. Medicare is considering whether it will permanently cover certain telehealth services after 2023. Additionally, implementing the Consolidated Appropriations Act of 2021 (CAA), Medicare has permanently removed geographic restrictions for mental health and substance use services delivered over telehealth from a patient’s home. For mental health and substance use services, Medicare will also cover audio-only visits permanently in the future.

State policies. State regulators have authority over Medicaid coverage of telehealth services as well as providers’ licensure requirements to practice and prescribe during a telehealth consultation. Many states expanded coverage of telehealth services for Medicaid during the pandemic, including for mental health and substance use services. However, more recently, some states are moving in the opposite direction and reinstating licensing rules that limit telehealth use and providers’ ability to prescribe medications without an in-person visit.

Regulatory and coverage policies in addition to clinical guidelines and recommendations will determine telehealth use in the future.

METHODS

This analysis was done using Epic Cosmos data. Estimates in this report are based on this population and not weighted to be nationally representative. The analysis used data on outpatient visits for 94 Epic Cosmos contributors from March 1, 2019 through August 31, 2021 and was analyzed in 6-month periods. Organizations were then excluded if they had go-lives or mergers during the study period, had multiple weeks of missing data, or showed discrepancies. Overall, 41 million outpatient visits during the time period were included. An outpatient visit represents either an in-person or telehealth visit. Visits on the same day, irrespective of modality, are counted separately. Chronic conditions were identified based on the primary final billing ICD-10 diagnosis code listed on the outpatient visit. Primary diagnosis codes were grouped based on the Agency for Healthcare Research and Quality (AHRQ) Clinical Classifications Software Refined (CCSR) grouping.

Justin Lo is with Epic Research. Krutika Amin, Matthew Rae, and Cynthia Cox are with KFF.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.