The cost of health care in the United States has continued to grow in recent years. Between 2022 and 2023, overall health spending rose 7.5%, and it is projected to rise another 4.2% in 2025. U.S. spending on hospital care rose 6.4% between 2022 and 2023, and makes up 31% of total health spending. International comparisons show that U.S. spending on inpatient and outpatient care in 2021 was $7,500 per capita, almost triple the average of comparably large and wealthy countries. The U.S. also spent $1,635 per capita on prescription drug costs, compared to an average of $944 per capita in peer countries.

This brief examines market trends contributing to rising health costs and identifies several potential future federal and state policy issues to watch for throughout the rest of the year.

Market Trends to Watch

Healthcare represents nearly one in every five dollars spent in the U.S. economy. Both public and private health spending is driven by market factors, including the prices and utilization of health services. As the year progresses, key drivers of health costs will likely include high-cost drugs and therapeutics, as well as hospital care.

Weight Loss Drugs

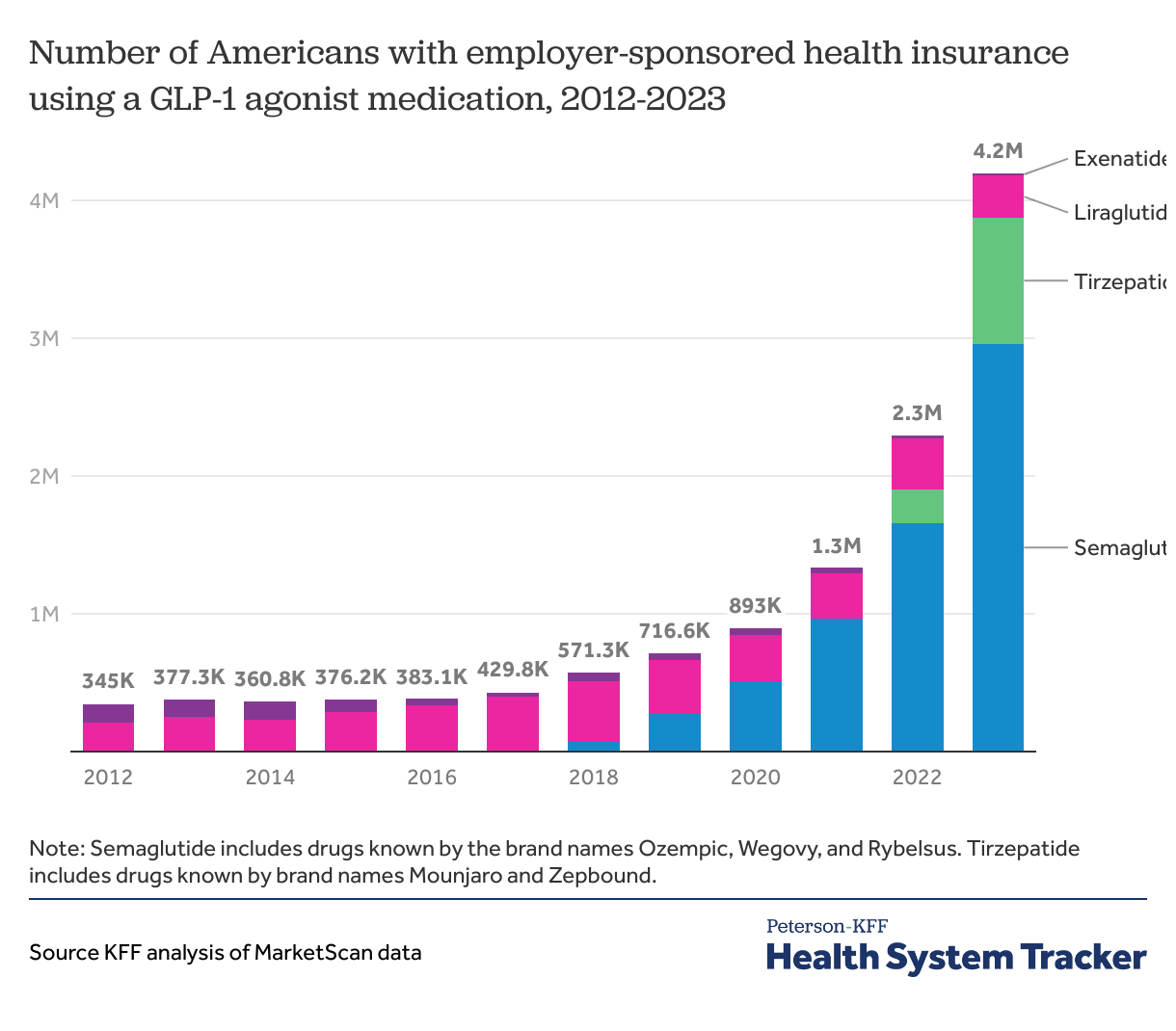

GLP-1 drugs are extremely effective at promoting weight loss, and patients who take them have lower incidence of obesity-associated health problems, such as cardiovascular disease and high A1c. Approximately 12% of Americans say they have taken a GLP-1 agonist, and over 40% of non-elderly adults with private insurance potentially could be medically eligible. However, with list prices of these drugs hovering around $1,000 for a one-month supply in the United States, or around $500 for some brands with a self-pay discount, their increasing use threatens to have a significant upward effect on health costs. Private insurers use various strategies to control the use of these drugs, including prior authorization and quantity limits. CMS has slated certain GLP-1 drugs for Medicare price negotiation. The impact this will have on prices in the private market remains to be seen.

Use of GLP-1 drugs for treating diabetes and obesity has grown rapidly

Other High-Cost Drugs and Gene Therapies

In addition to spending on GLP-1 drugs, spending on other high-cost specialty drugs is expected to continue to increase. Chief among these are biologics (a class of drugs derived from living sources that includes some GLP-1 agonists, as well as other high-cost therapeutics), certain chemotherapies, many treatments for autoimmune diseases, and cell and gene therapies. In 2024, the FDA approved 16 new biologics, including nine cell and gene therapies, with similar numbers expected to be approved in 2025 as well. As increasing numbers of specialty drugs become available, questions about whether or how public programs, insurers, and employers will cover them become more pressing for both policymakers and patients. Another trend to watch is the growing availability of biosimilars, which are the FDA-approved “generic” counterparts to biologics. Biosimilars have the potential to decrease drug prices by introducing competition, which may help to curb increases in overall drug spending as more biosimilars enter the market in the coming years. Preliminary evidence suggests that some insurers may decide to exclude the original reference biologic from their formularies in favor of covering available biosimilars as a cost-saving measure.

Hospital Costs

Hospital spending is also expected to increase overall healthcare costs in 2025. Employment in hospitals increased 4.9% since February 2020, though the American Hospital Association says a workforce shortage has led to increased labor expenses for hospitals. Further, hospital consolidation continues to drive up prices for hospital care.

Federal Policymaking on Health Costs

Health Spending

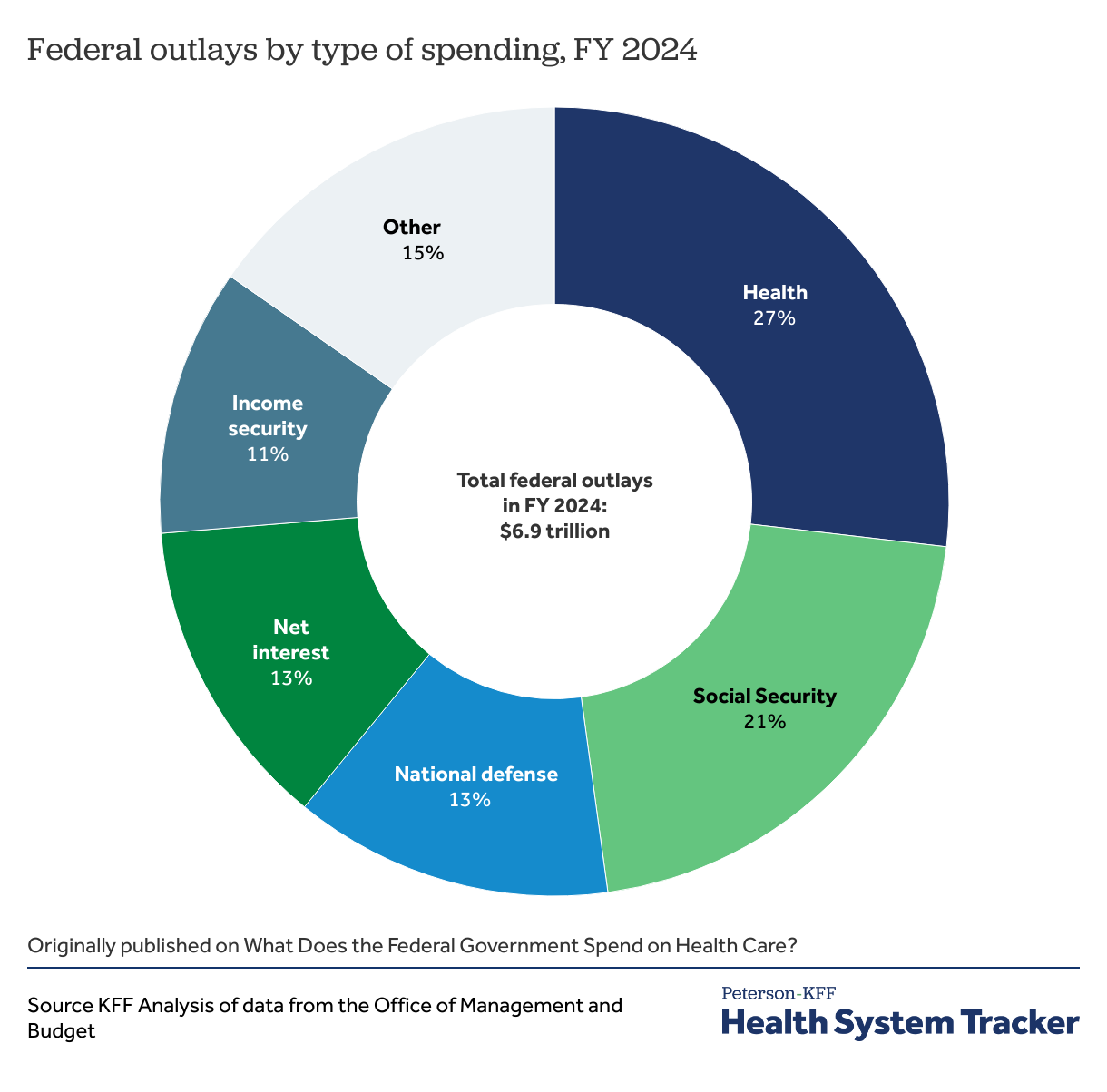

Despite little talk of healthcare on the campaign trail, the first few months of President Trump’s administration have brought numerous policy changes that will have wide implications for health care in the United States and abroad. In addition to making cuts to foreign aid and health research, the Trump administration has also made moves to identify what it describes as “wasteful” and “fraudulent” spending in healthcare, with the goal of decreasing federal spending and reducing the size of the federal workforce. The House of Representatives recently passed a budget resolution that could lead to hundreds of billions of dollars in cuts to federal Medicaid spending, as congressional Republicans look for savings to offset tax cuts. DHHS Secretary Robert F. Kennedy recently implemented a plan to reduce the HHS workforce from around 82,000 to 62,000, following OPM guidance, restructuring the agency with the stated goal of saving $1.8 billion per year. Staff positions have already been cut, as well as over a billion dollars in DHHS grants to states including Texas, Florida, New Jersey, and Michigan.

Federal spending on health plans and services accounted for more than a quarter of net federal outlays in FY 2024

Transparency

Some other health cost policies have bipartisan support, particularly when it comes to increased transparency and price competition. Acknowledging the high cost of healthcare, the Trump administration has taken an interest in increasing price transparency with an executive order requesting “clear, accurate, and actionable healthcare pricing.” The first Trump administration passed price transparency legislation, though several issues remain before consumers can benefit, leading the Trump administration to release an executive order to “ensure hospitals and insurers disclose actual prices, not estimates, and take action to make prices comparable.”

Another potential data transparency policy with bipartisan support is addressing ownership transparency of healthcare facilities, including skilled nursing and elder care facilities.

Site-Neutral Payments

Site-neutral payment proposals, which aim to align the cost of certain services regardless of the setting in which the care is delivered, have the potential for bipartisan support in Congress. Often, the same medical procedure will vary widely in cost based on whether it is provided in a hospital or outpatient facility. This is often due to expensive hospital facility fees, and may be eliminated if Medicare or private insurers switch to a policy of site-neutral payments.

Prescription Drug Prices

Potential bipartisan initiatives may also include attempts to reduce prescription drug prices in 2025. One avenue is through the Inflation Reduction Act and government-negotiated drug prices. A second action may include legislation on the structure and use of pharmacy benefit managers (PBMs). PBMs act as “middlemen” in the relationship between drug manufacturers, insurance companies, and pharmacies, and are primarily responsible for negotiating drug prices and rebates, as well as creating formularies and managing pharmacy networks. The role of PBMs in the provision of healthcare has been blamed for increasing drug prices through trade friction concessions. Additionally, reference pricing, or pricing drugs based on their prices in other countries, has been mentioned as a potential avenue to fight rising prices by President Trump’s nominee to lead CMS, Dr. Mehmet Oz, who stated in his March 2025 confirmation hearing “President Trump has been very clear that he wants me to reduce drug prices, not just for the government payees, but also for beneficiaries. International reference pricing is a way of doing that.”

State Policymaking on Health Costs

Healthcare comprises at least a third of most state budgets. As a result, states are particularly motivated to understand their healthcare markets, uncover sources of spending, and propose solutions that support the health of their specific populations. While federal health policies take shape under the new Trump Administration, some states are also actively pursuing their own reforms to address health costs in 2025.

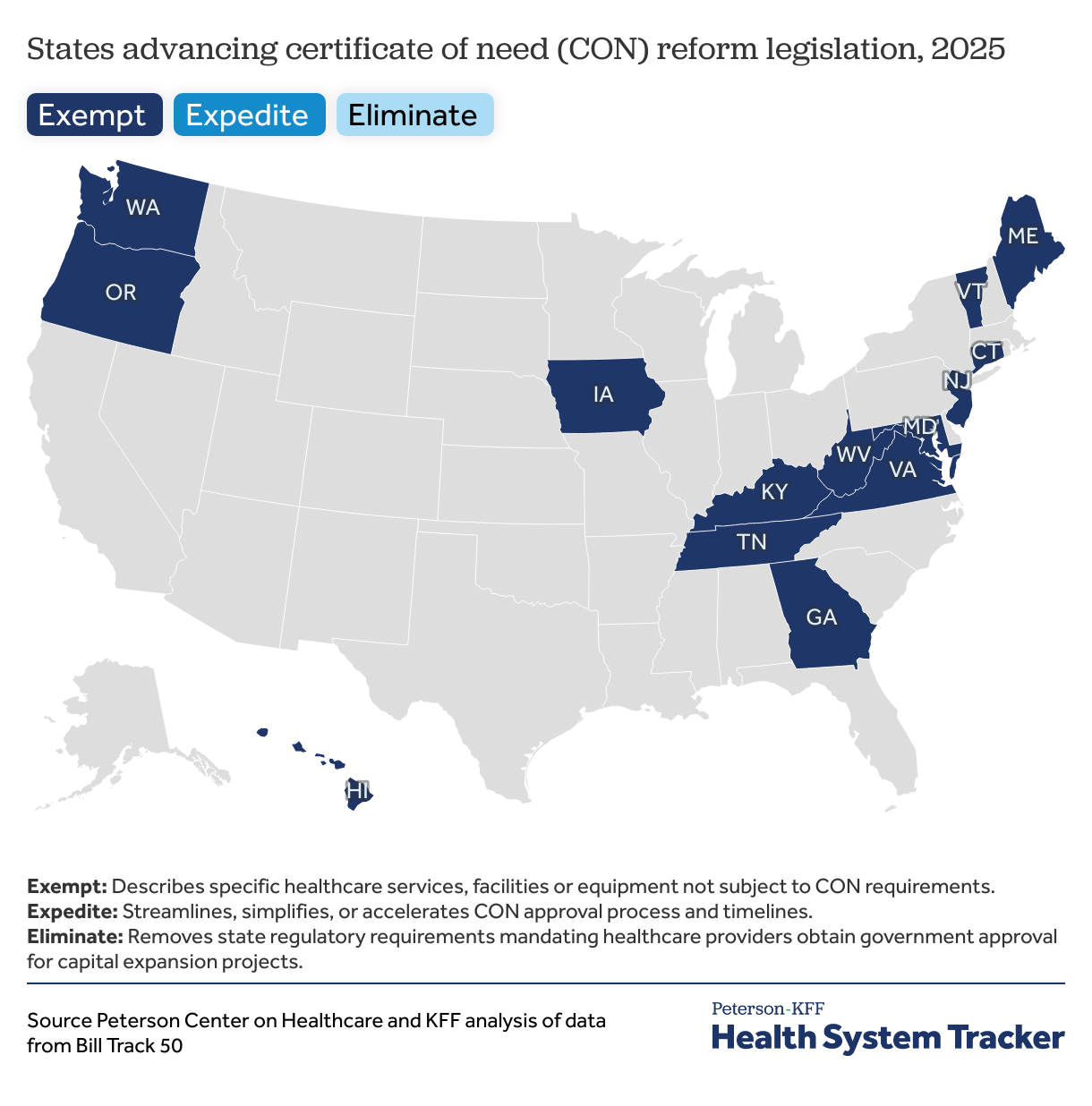

Market Competition

Twenty-three states are working to increase market competition by reforming Certificate of Need (CON) laws. Introduced in the 1970s as a cost control measure, these laws require hospitals to obtain state approval for capital expansion projects like new facilities, services, or major equipment purchases. The approval process was intended to deter unnecessary spending by hospitals pursuing a market advantage by investing in expensive new technologies or state of the art facilities, and passing those costs on to consumers. Some evidence suggests CON laws stifle competition by deterring new entrants and protecting the interests of incumbent hospitals, while evidence of their cost effectiveness is mixed. State legislative activity in early 2025 is in line with trends over the past 5 years to ease CON law restrictions, including exempting services from review, expediting the review process, or repealing it all together.

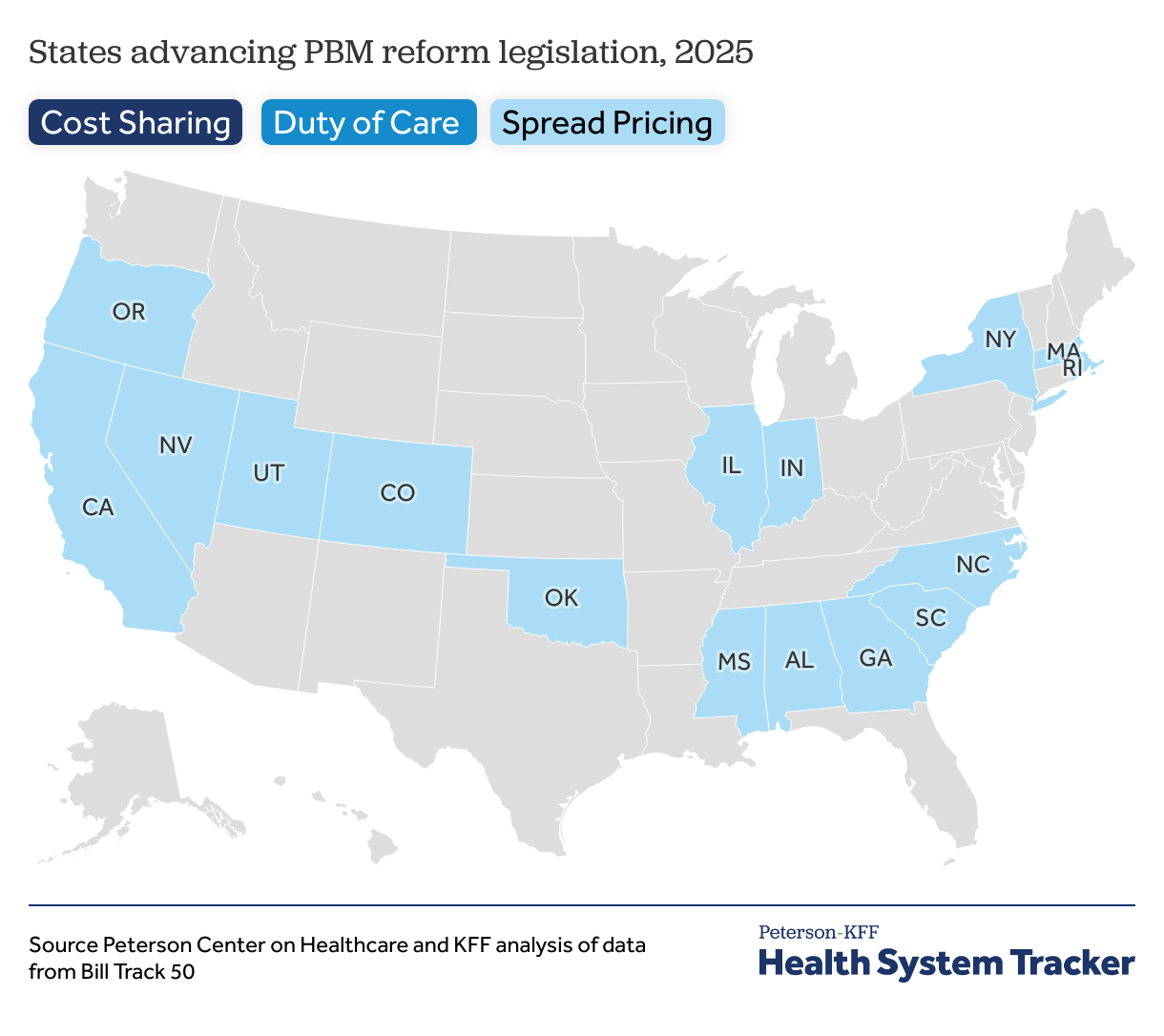

Pharmacy Benefit Managers

States continue to take aim at high drug costs through increased regulation of Pharmacy Benefit Manager (PBM) business practices. While efforts to limit consumer cost sharing has been a top priority for states since 2017, restricting spread pricing has risen as a key issue in 2025. Sixteen states now restrict spread pricing, whereby PBMs profit by charging health plans a different amount than what they paid to the pharmacy for a medication. Twelve states are also advancing legislation to establish a PBM duty of care. This legislation would require PBMs to act in the best financial interest of their clients (i.e., health plans and employers) by prioritizing lower drug costs, disclosing financial and utilization information, and avoiding conflicts of interest. As of 2024, only 2 states have enacted a PBM duty of care.

Health Care Workforce

Since the COVID-19 pandemic, states are increasingly implementing interstate licensure compacts, in which participating states agree to directly recognize or simplify the process for a healthcare provider delivering care across state lines. Streamlining licensure can improve provider mobility, patients’ continuity of care, and patients’ access to a broader network of providers. To date, there are 14 compacts for healthcare workers, including nurses, physicians, social workers, and psychologists. In the first two months of 2025, six states introduced legislation to establish the PA Licensure Compact, the newest compact for healthcare providers, which went into effect in April 2024.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.