This chart collection explores how health spending is expected to grow in coming years, based on National Health Expenditure (NHE) projections from federal actuaries. A related chart collection explores how U.S. health spending has changed over time using historical data, and an interactive tool allows users to explore health spending changes over time.

Per capita health spending growth is expected to slow slightly in 2025

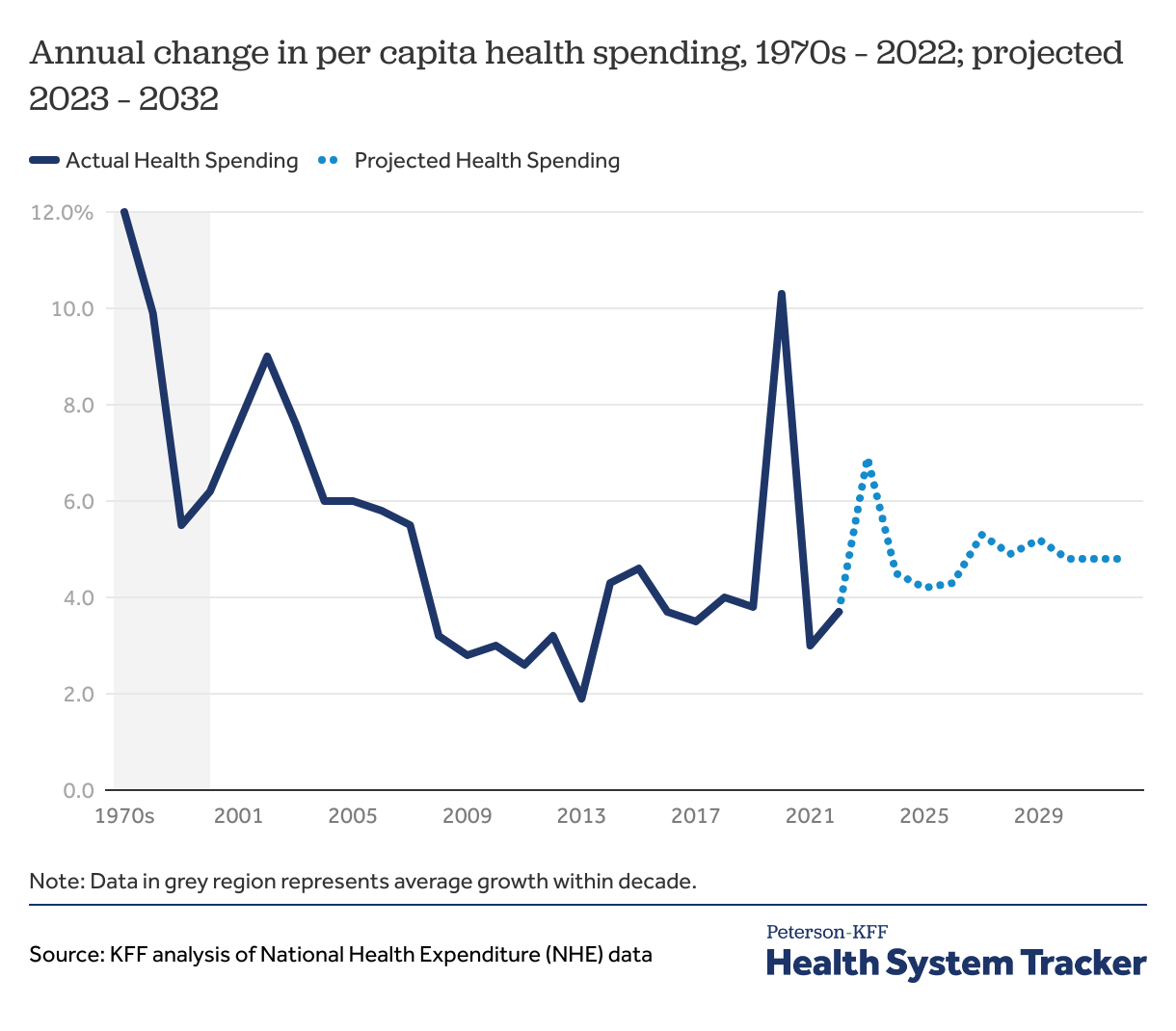

Each year, actuaries from the Centers for Medicare and Medicaid Services (CMS) project future spending on health. In 2024, per capita health spending growth is estimated to have slowed to 4.5%. Growth is expected to slow further in 2025 and 2026 to 4.2% and 4.3%, respectively.

From 2027-2032, per capita spending growth is projected to moderate at an average annual rate of 5.0%. During this period, national health spending is expected to outpace GDP, partly due to the growth in medical prices. However, the Inflation Reduction Act’s (IRA) Medicare drug price reforms, which begin to take effect in 2026, are expected to put downward pressure on growth during this period.

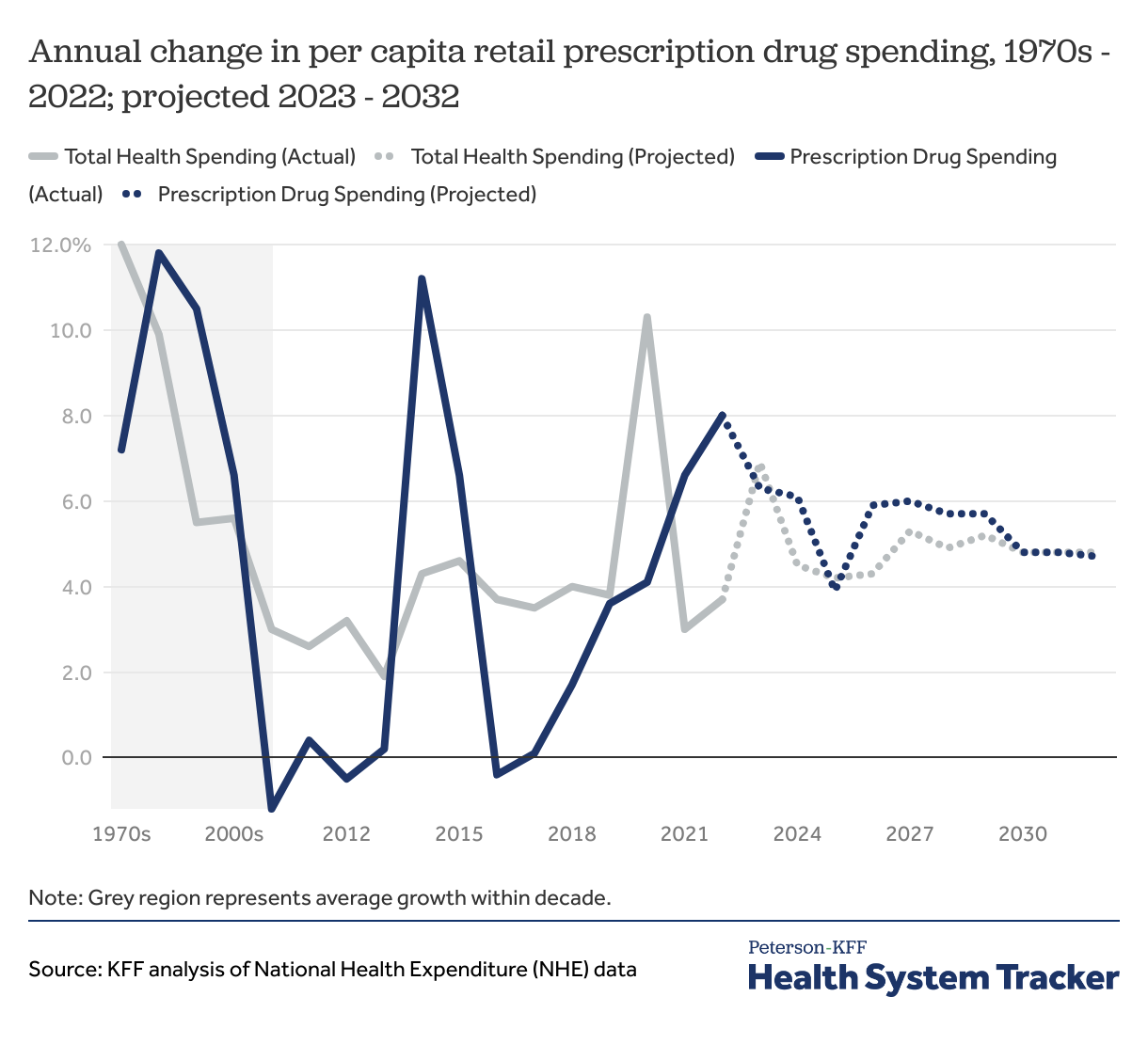

Per capita prescription drug spending growth is projected to average 5% annually starting in 2026

Starting in 2026, per capita retail prescription drug spending growth is expected to average 5.4% through 2032 as the IRA’s negotiated drug prices begin to take effect. These negotiated drug prices are expected to place downward pressure on Medicare and out-of-pocket spending. However, there is considerable uncertainty in projected prescription drug spending due to the potential introduction of new drugs, especially for diabetes, cancer, and autoimmune diseases.

Retail prescription drugs do not include drugs that are physician-administered in hospitals, physician offices, outpatient centers, long term care facilities, and at home. Trends in physician-administered drug spending may differ from trends in spending on retail prescription drugs.

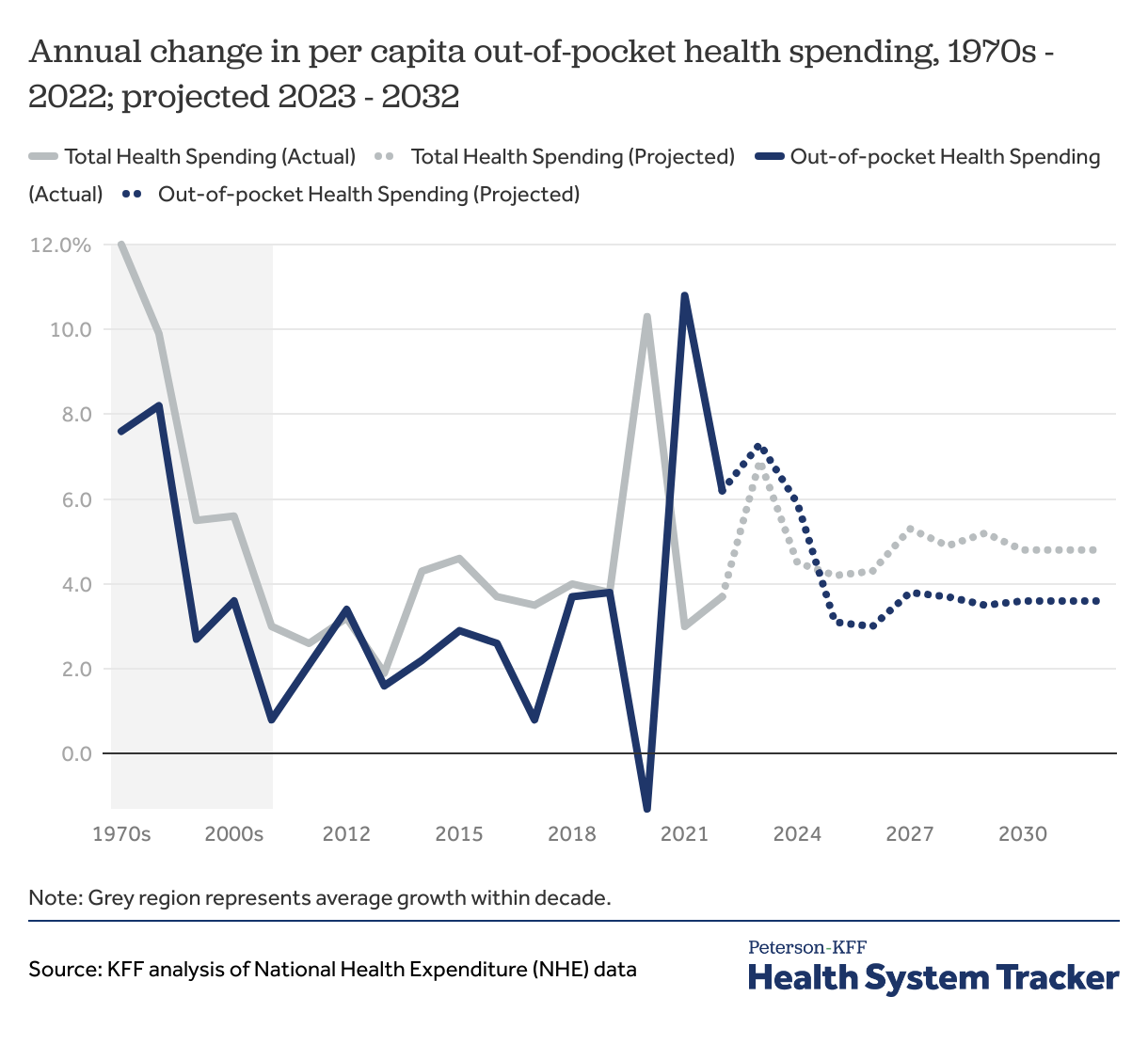

Per capita out-of-pocket spending growth is expected to fall to lower levels beginning in 2025

After somewhat volatile growth during the early 2020s, CMS actuaries expect per capita out-of-pocket spending growth to average 3.5% from 2025 to 2032. The IRA’s Medicare prescription drug benefit changes, such as the elimination of the 5% coinsurance component for catastrophic coverage and the start of the $2,000 Part D out-of-pocket spending cap for Medicare beneficiaries, are expected to put downward pressure on average out-of-pocket spending.

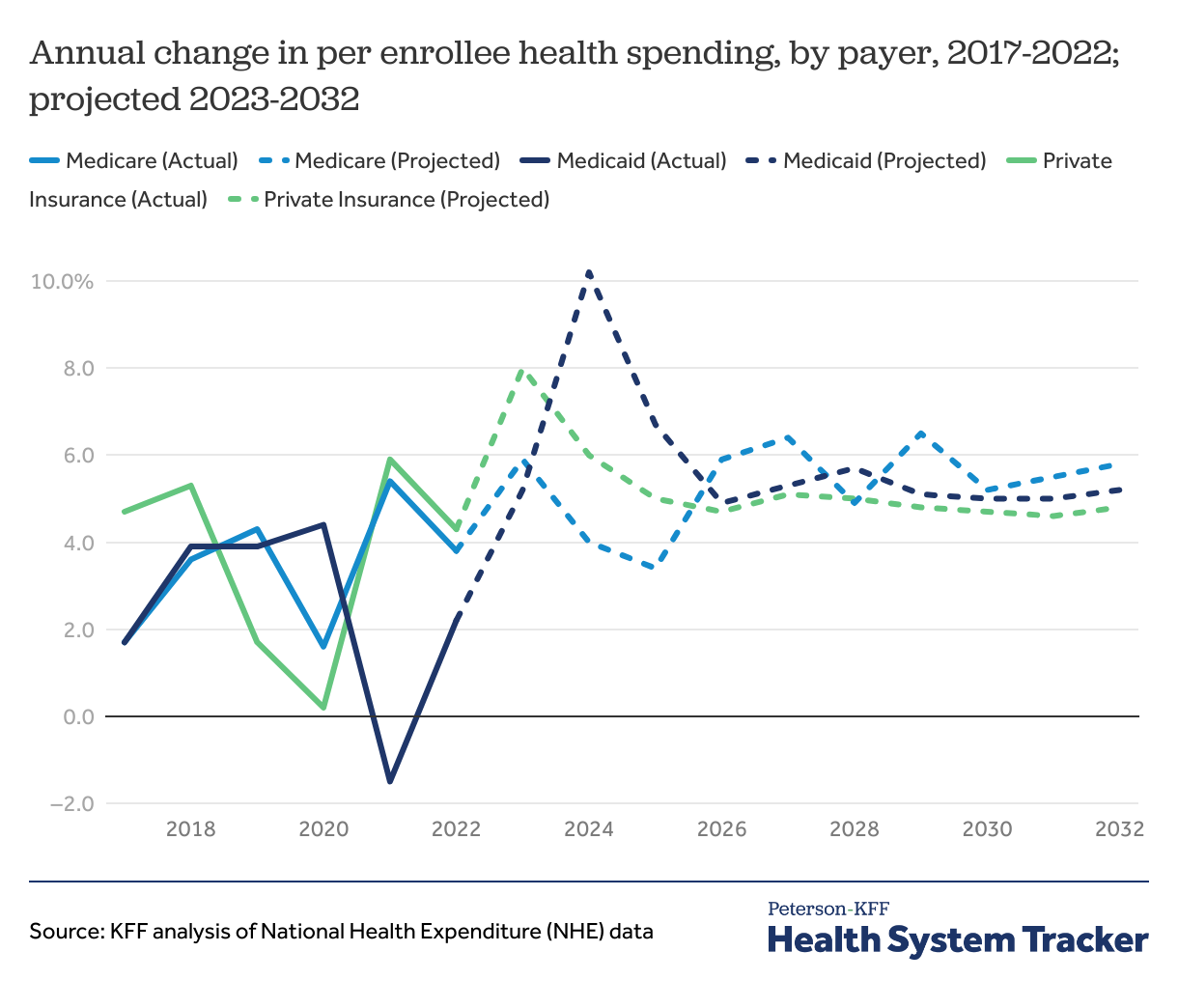

Across all payers, per enrollee spending is expected to moderate after 2025

Growth in per enrollee Medicare spending is expected to slow, beginning in 2025. From 2025-2032, per enrollee growth is expected to range between 4.9% and 6.5%.

CMS actuaries project that per enrollee Medicaid spending will grow by 10.2% in 2024, the highest rate in over 30 years. With Medicaid unwinding, younger and healthier Medicaid enrollees are more likely to be disenrolled, leading to higher per enrollee Medicaid spending. From 2025-2032, per enrollee Medicaid health spending is estimated to average 5.4%.

In the private insurance market, per enrollee spending growth is expected to decelerate in 2025 and 2026 to an average of 4.9% annually. From 2027-2032, per enrollee private insurance spending growth is expected to stay between 4.6% and 5.1%.

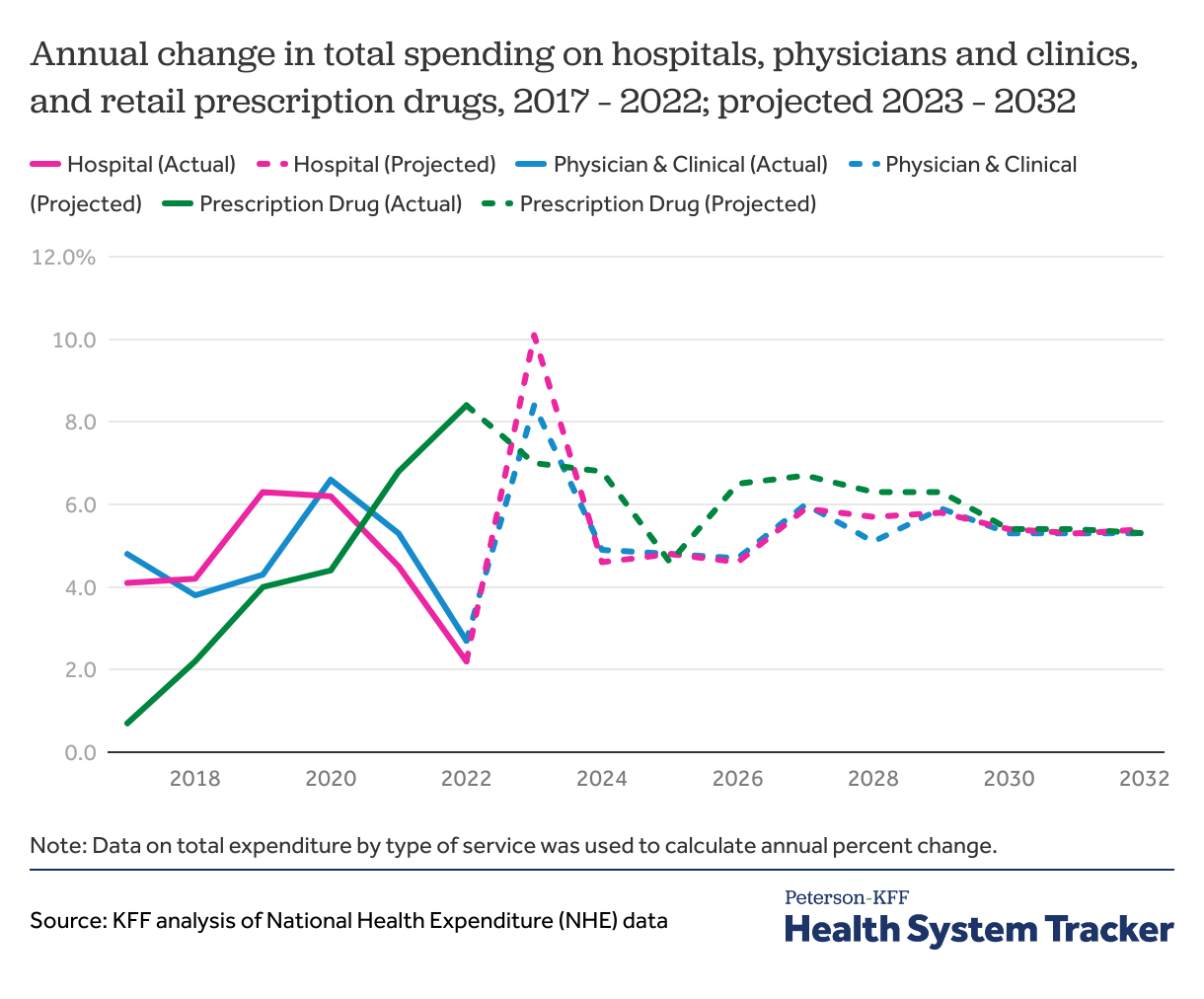

Growth in spending on hospitals and physician services is projected to remain stable in 2025

In 2024, hospital spending is estimated to have slowed to 4.6%. Growth in total hospital spending is expected to remain stable in 2025 and 2026. However, hospital spending is expected to grow at a slightly higher level of 5.6% per year on average from 2027-2032.

After rapidly increasing over the last few years, the annual change in total spending on physician and clinics is expected to decline before moderating at a slightly higher level. In 2025 and 2026, the annual change in total physician and clinic spending is estimated to be 4.9% and 4.8%, respectively. From 2027-2032, physician and clinical services growth is expected to moderate at an average annual rate of 5.5%.

Total prescription drug spending growth is expected to slow to a rate of 4.6% in 2025. From 2026-2032, growth is expected to increase to an average annual rate of 5.5%.

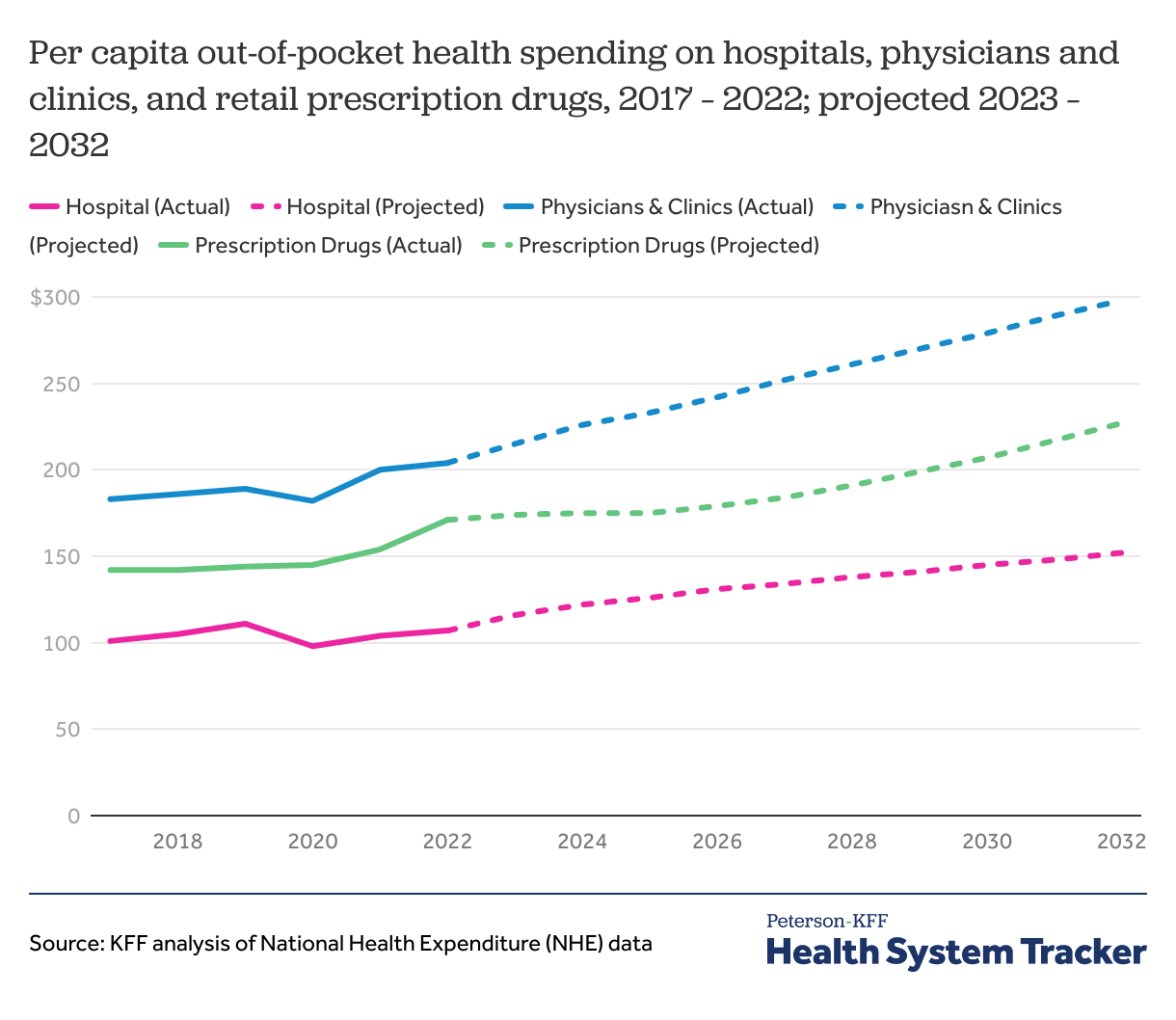

Across all services, out-of-pocket spending per capita is expected to continue increasing

Per capita out-of-pocket spending is expected to increase across all services through 2032. Out-of-pocket hospital services spending per capita is projected to increase at an average rate of 2.9% per year, reaching a high of $152 out-of-pocket per capita by 2032 – a 24.6% increase from 2024.

Out-of-pocket physician and clinical services spending per capita is expected to increase at an average rate of 3.5% annually during the same period. In 2024, physician and clinical service out-of-pocket spending is estimated to be $226 per capita but is expected to increase to $298 by 2032.

CMS expects out-of-pocket prescription drug spending per capita to increase at an average rate of 3.3% per capita from 2024-2032. Prescription drug out-of-pocket spending is projected to be $227 per capita in 2032, up from $175 in 2024.

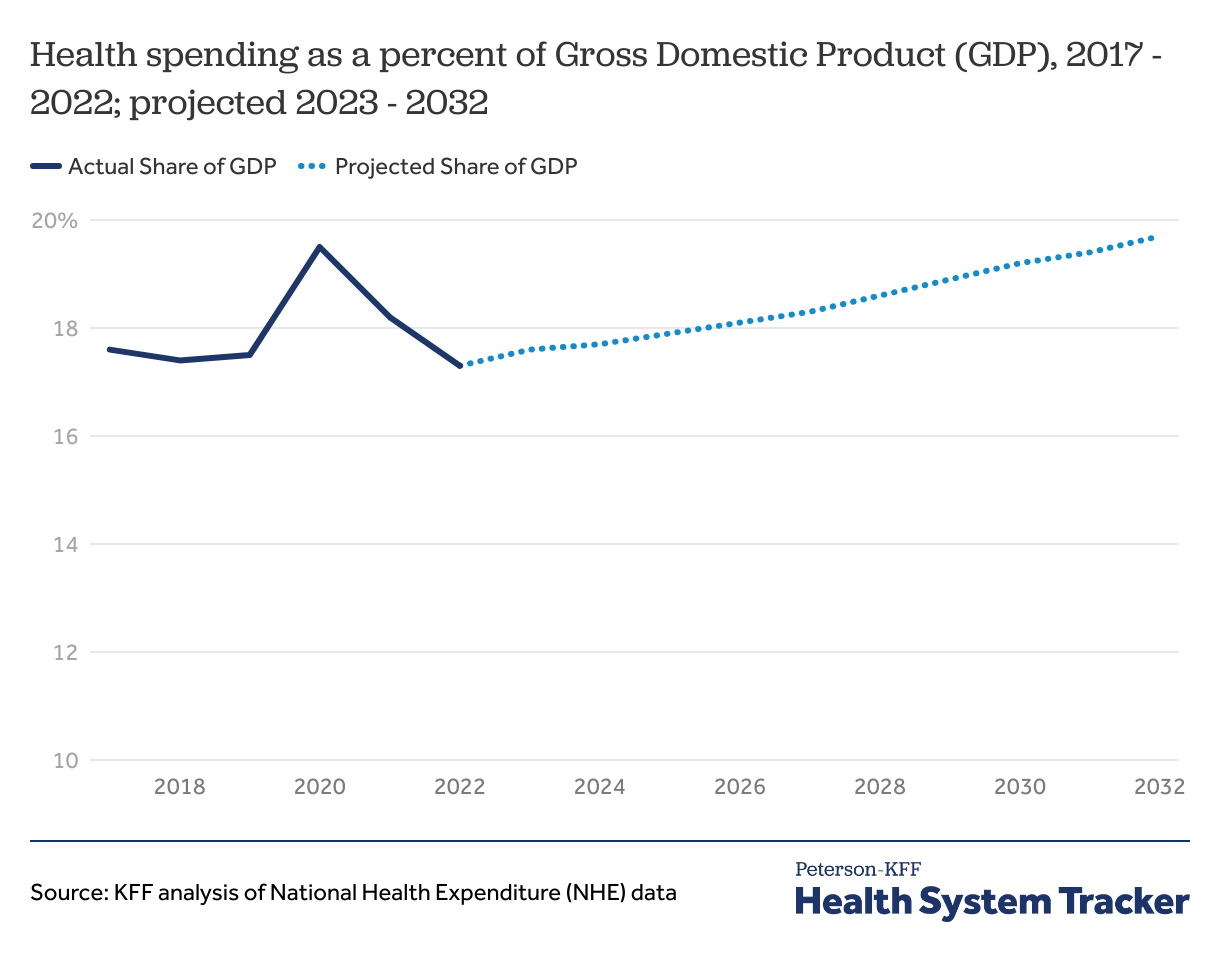

Health spending is projected to account for nearly one-fifth of the U.S. economy by 2032

Health spending is estimated to have grown slightly quicker than the economy in 2025 and increase to 17.9%. Health spending growth is expected to outpace growth in the overall economy and eventually hit 19.7% of GDP by 2032.

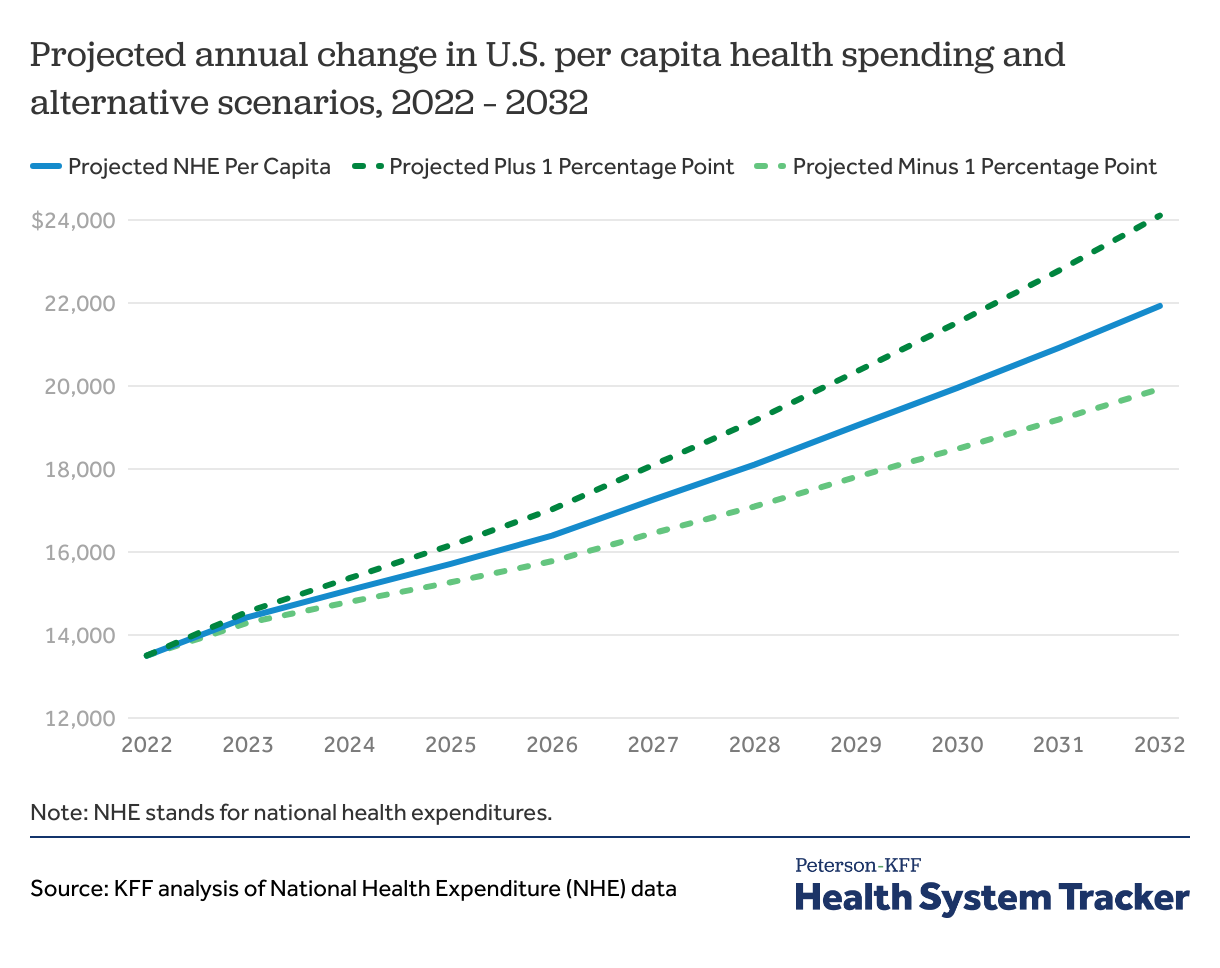

Projecting health spending grows in difficultly due to workforce shortages and inflation

The COVID-19 pandemic and its long-term effects on health spending have made projections even more difficult than in normal years, and even small differences in growth rates can add up to large spending differences over time. Volatile economic conditions, such as changing health employment and periods of inflation, can also impact the cost of health services.

Per capita health expenditures are projected to grow from $14,423 in 2023 to $21,927 in 2032, which is an average annual growth rate of 5.0%. If growth rates end up being 1 percentage point lower each year over that same period, per capita spending would be about $2,000 lower than expected in 2032. If growth rates end up being 1 percentage point higher each year, spending would rise to $24,108 per person in 2032.

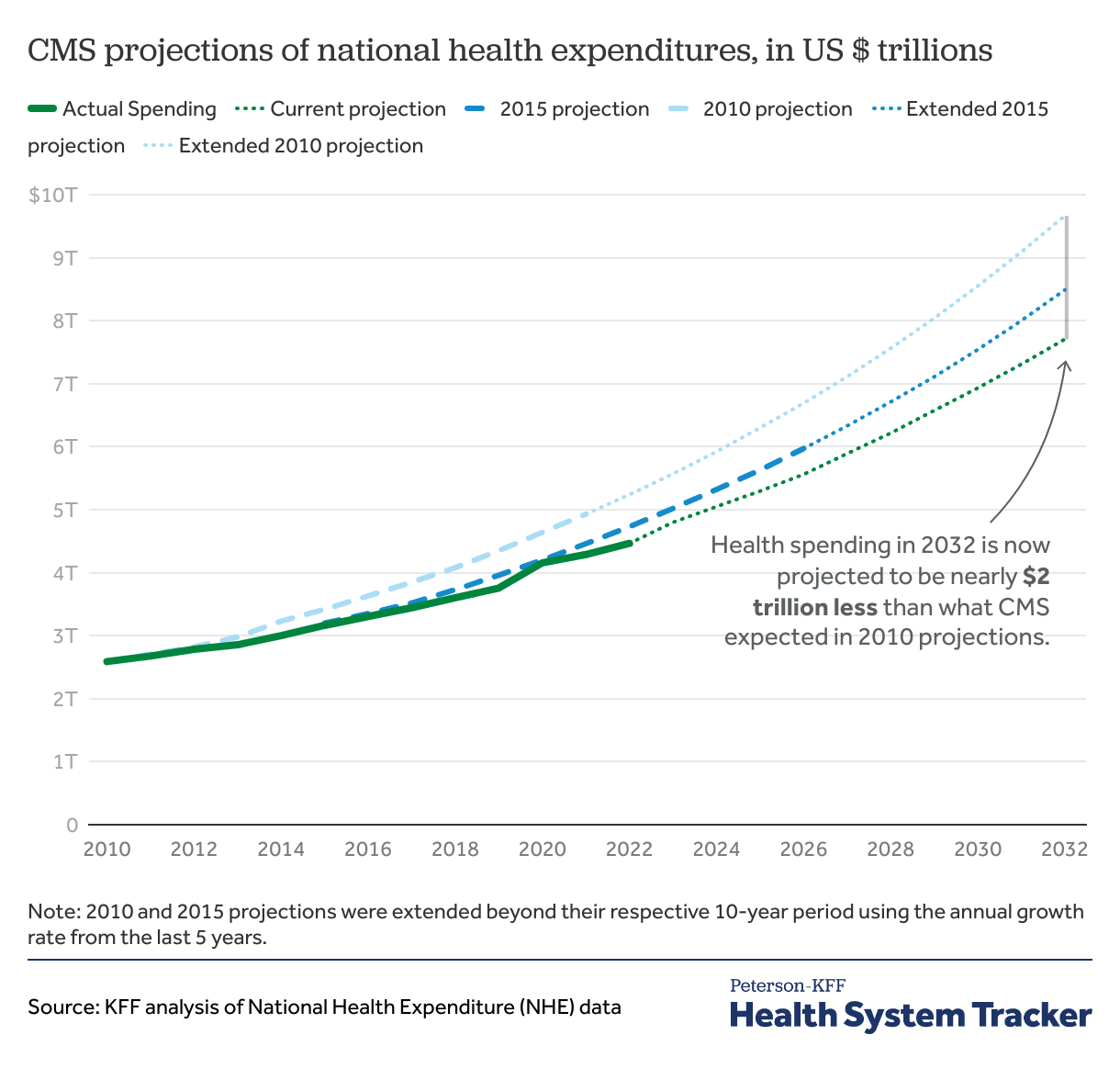

Health spending projections for 2030 are now over 20% below what CMS expected a decade ago

In 2015, health spending was projected to reach $5.6 trillion by 2025. However, latest projections now estimate health spending to be $5.3 trillion in 2025. The difference in these estimations is partially due to a slowdown in health expenditure growth at the end of the 2010s.

CMS actuaries’ estimates of total health expenditures from 2010 and 2015 projections extended out through 2032 indicate that health spending is now expected to be nearly $2.0 trillion less than what CMS had expected in 2010 projections and $780 billion less than 2015 projections.