The high and growing cost of emergency department visits is important to consumers and policymakers alike, with recent policy changes including the No Surprises Act aiming to curb emergency department costs. A recent KFF analysis found that average out-of-pocket costs for an emergency visit exceed some household’s liquid assets, putting them at risk for medical debt from a single trip to the emergency department.

The cost of an emergency department visit usually includes a facility fee, or overhead charge, in addition to professional charges by physicians or advanced practice providers. For a given patient, a facility fee is a charge for being seen at an emergency department, and it comes in addition to the costs for specific services the patient receives. Regardless of other services provided, which are billed separately, the facility fee can be thought of as the cost for walking in the door. For emergency departments, facility fees help ensure a revenue stream to stay open and be able to provide mandated services to the public 24 hours per day, 7 days per week. For example, facility fees can cover the cost of nursing staff, maintenance of diagnostic and therapeutic technology, building costs, and administrative overhead costs. However, these charges are variable and usually not made publicly available.

To examine the role of facility fees in rising emergency department costs, we use data from the Merative MarketScan Commercial Database, which captures claims from privately insured individuals with large employer health plans. We compare growth in facility fees to growth in professional fees for evaluation and management services delivered in emergency departments from 2004-2021, including how facility fees are billed and what they cost.

We find that, on average, from 2004 to 2021, facility fees grew at a rate (531%) that was 4 times the rate of growth in professional fees (132%) for emergency department evaluation and management services. While facility fees are being billed at higher complexity over time, we find that the average cost of facility fees at all levels is rising faster than the cost of professional fees. The rapid overall growth in emergency department evaluation and management costs (relative to other outpatient settings including urgent care and physician offices) appears to be driven primarily by rapidly rising facility fees.

Facility fees grew at a rate 4 times the rate for professional fees for emergency dept evaluation and management services from 2004-2021 Share on XUnderstanding facility and professional fees

After an emergency department visit, both the physician (or other advanced practice provider) and the facility separately bill for services provided during the visit. Both use a Current Procedural Terminology (CPT) “evaluation and management” code. Evaluation and management claims are charges for the overall service provided and do not relate to specific procedures, tests, or treatments.

While professional fees are dictated by nationally standardized criteria, facility fees do not have comparable standardized criteria. The Centers for Medicare and Medicaid Services (CMS), which administers Medicare, instructs individual hospitals to create internal guidelines that “reasonably relate the intensity of hospital resources to the different levels of effort represented by the codes.” Private insurers have their own guidelines and processes for determining if facility fees are appropriately billed.

Evaluation and management charges represent nearly half of emergency department visit spending. The other half of emergency department spending is for itemized services, such as radiology or laboratory charges. These itemized additional services are similarly divided into other professional bills or facility bills for specific services rendered.

In this analysis, we focus on the professional and facility fees associated with evaluation and management services, and do not include other professional and facility bills associated with itemized additional services. Although these itemized additional services represent a significant share of overall emergency department spending, they depend on the needs of a given patient, and some patients receive few or none of these additional services.

Meanwhile, all patients coming to the emergency department have evaluation and management charges, including professional fees and facility fees. Focusing on the cost of these evaluation and management fees also allows us to compare growth in emergency department costs to similar services in other outpatient settings (physician offices and urgent care centers).

Emergency department evaluation and management cost growth is primarily driven by rising facility fees

We look at the average cost of an evaluation and management claim in the emergency department by professional versus facility fee. Emergency visits generally have at least one facility fee and at least one professional fee. A previous KFF analysis found that the average emergency department visit cost $2,453, about half of which ($1,134) is for evaluation and management (including professional and facility fees).

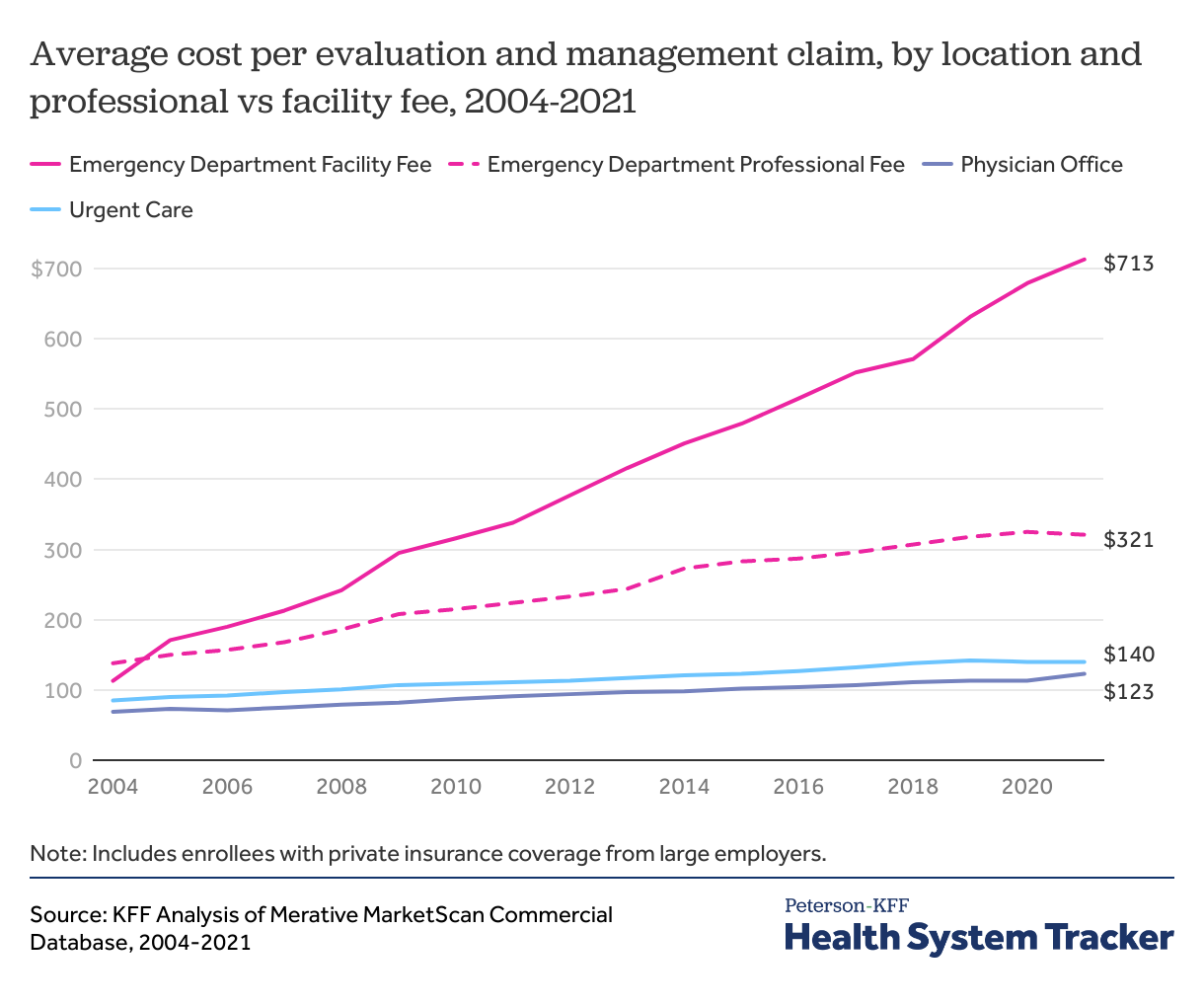

In the emergency department, we find the average facility fee claim is both more expensive and rising at a faster rate than professional fee claims for evaluation and management services. Emergency department professional fees increased from $138 in 2004 to $321 by 2021, growing 132% during this time. Meanwhile, the average cost of evaluation and management claims in other outpatient settings grew much more slowly, increasing 78% in physician offices and 65% in urgent care centers during this time period. Facility fees are very uncommon in other outpatient settings, so we do not break out evaluation and management into professional and facility claims for physician offices or urgent care centers.

While emergency department professional fees grew at a faster rate than both physician office and urgent care evaluation and management fees, they were far outpaced by facility fee growth. Emergency department facility fees increased 531% from 2004 to 2021 (from $113 in 2004 to $713 in 2021) and 112% in the past decade (from $337 in 2012 to $713 in 2021). Facility and professional fees were comparable in 2004, but by 2021 the average facility evaluation and management claim was more than twice as expensive as the average professional evaluation and management claim.

Facility and professional fees are billed at higher levels over time

As in other outpatient settings, emergency evaluation and management claims are billed at five complexity levels using CPT codes 99281-99285, depending on visit complexity. Professional evaluation and management fees in the emergency department are assigned a complexity level based on guidelines from the AMA, which were historically based on a review of the physician’s history, physical exam, and medical decision making. In 2023, this process now only takes into account medical decision making in the emergency department.

Facility fees are coded as level 1-5 based on the resources required to care for the patient, but unlike professional fees, there is not a nationally accepted standard for assigning levels. While visits result in both a professional fee and a facility fee, the level of each claim are not required to match and often differ.

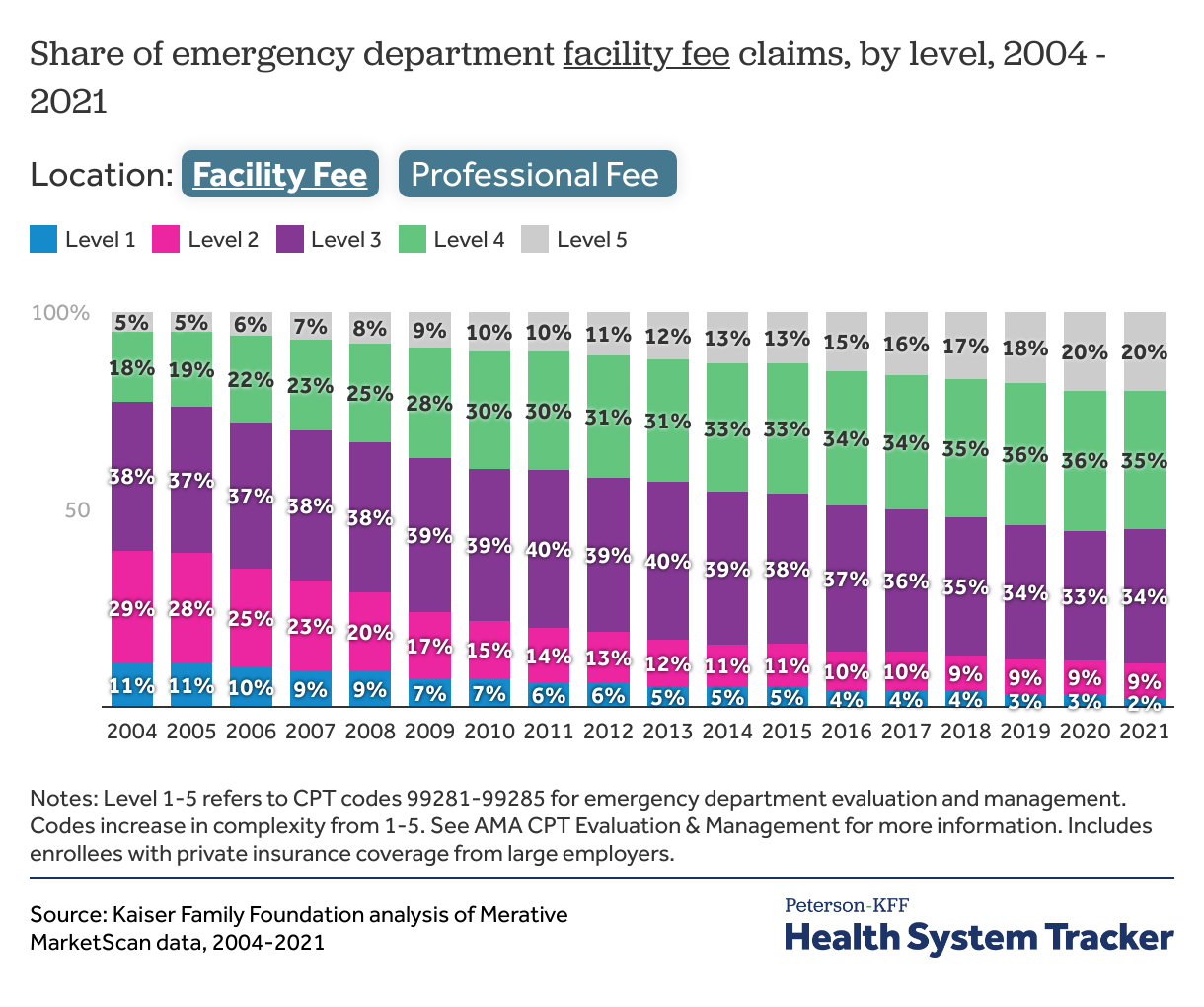

In a separate analysis, we show how coding for emergency evaluation and management claims have increased in complexity over time. Here, we further divide these evaluation and management charges into facility and professional fees and find that this trend toward higher complexity billing can be seen for both professional and facility fees, though the trend is more pronounced for professional fees.

From 2004 to 2021, the share of level 5 facility fee claims increased from 5% to 20%, while the share of level 4 claims almost doubled from 18% to 35%. On the professional side, level 5 claims increased from 10% to 34% of all claims. Meanwhile, moderate level 3 claims went from nearly half (48%) to a quarter (25%) of all claims.

At each level of complexity, the cost of facility fees has grown faster than professional fees

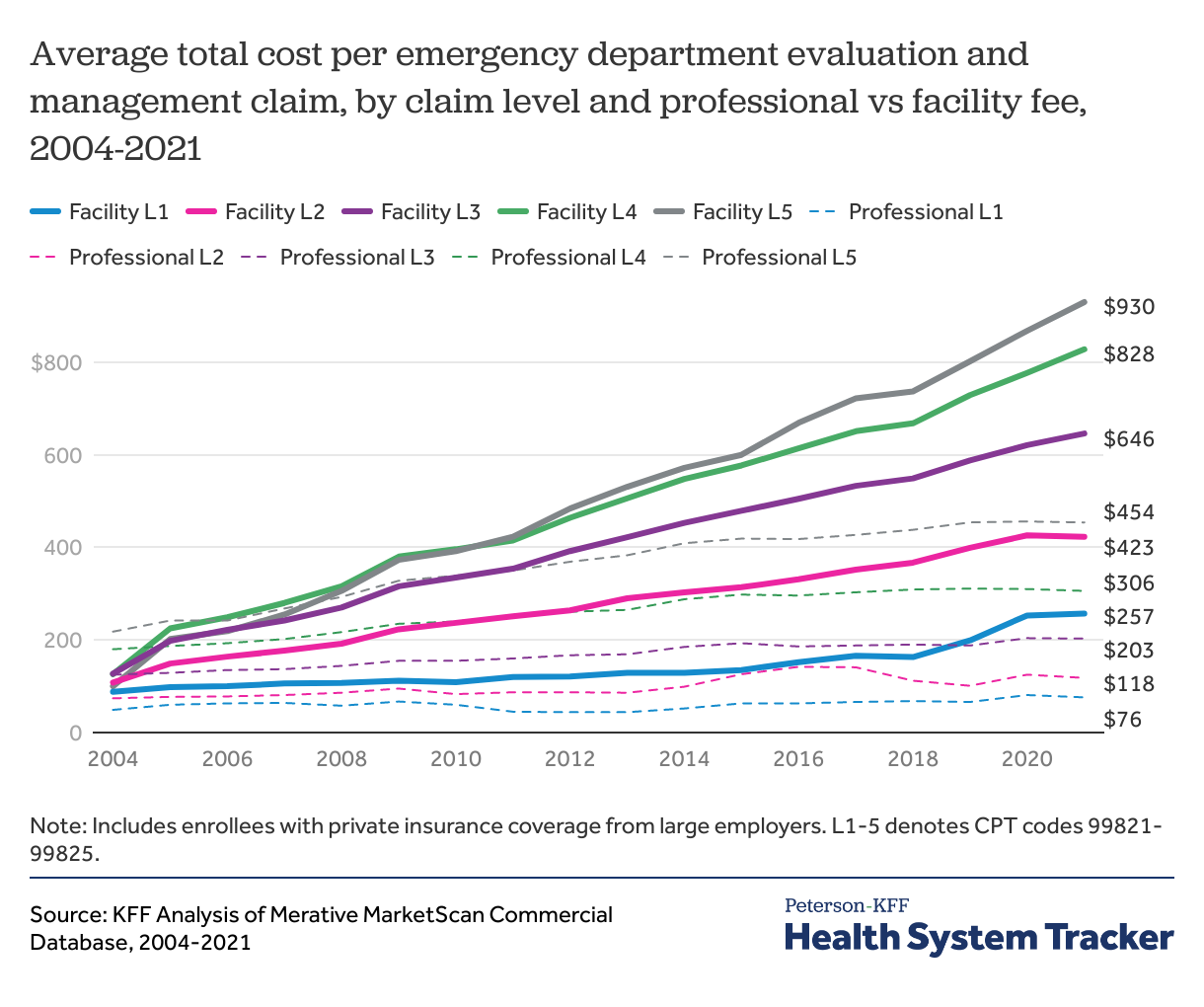

From 2004-2021, the cost of facility fees at each level has increased faster than professional fees at any level, and higher complexity level facility fees have grown the fastest. Level 5 facility fees increased over 9 times the rate of growth for professional fees during this time (from $100 on average in 2004 to $930 on average in 2021), while level 1 facility fees nearly tripled from $88 to $257, on average. Meanwhile, level 5 professional fees doubled from $218, on average, in 2004 to $454, on average, in 2021. Level 1 professional fees had the most modest growth, increasing 55% from $49, on average, to $76, on average.

Even within levels of complexity, there is significant variation in facility fee cost

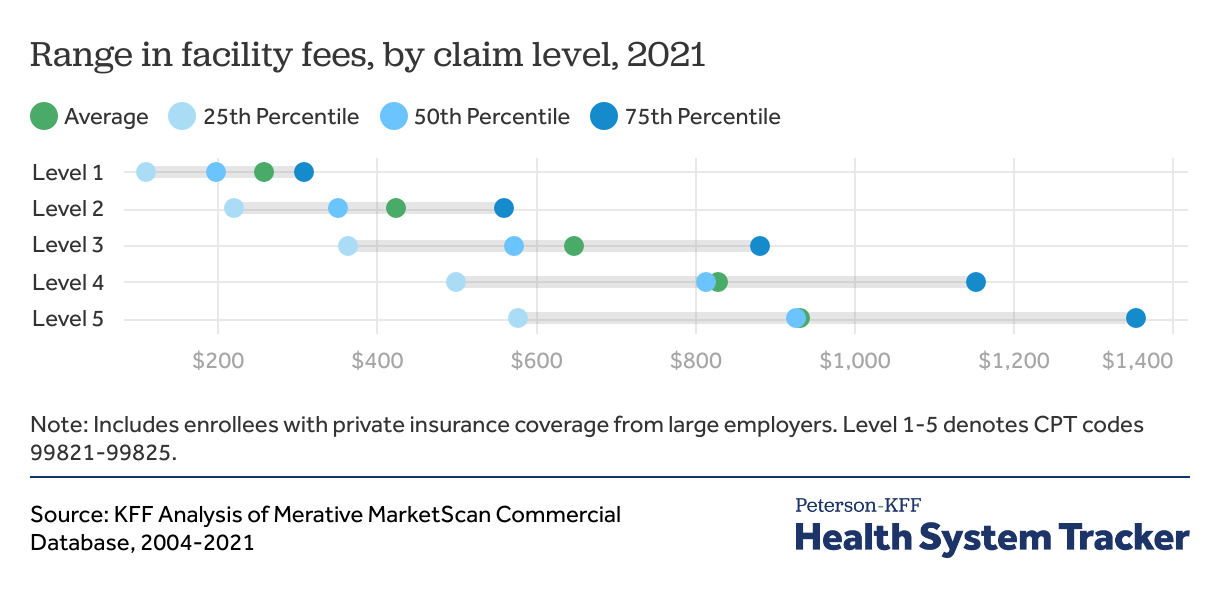

On average, facility fees increase in cost by level. However, within each level, there is a wide range in claim costs. For example in 2021, while level 5 facility fees were, on average, $102 more expensive than level 4 facility fees, the top quarter of level 5 fees was more than twice as expensive as the bottom quarter ($1,352 versus $576). There is substantial overlap between the costs of facility fees at all levels.

Discussion

In this analysis, we find that the average cost of emergency evaluation and management services is increasing faster than in other outpatient settings. The disproportionately fast rate of growth in emergency department claims relative to other outpatient settings is primarily due to high and rising facility fees, as opposed to professional fees.

We also find significant variation in facility fee costs, with fees for the most complex visits costing almost four times the average cost of fees for the least complex visits in 2021. Even within the same level, fees ranged widely, showing that facility fees are a variable and unpredictable component of emergency department bills that may impact out-of-pocket costs for consumers with deductibles or coinsurance for emergency visits.

Emergency facility fees are increasingly billed at higher levels over time, which contributes to their rising average cost. However, we find comparable trends in professional fees, so this trend alone does not explain the rising cost of facility fees relative to professional fees. We also find that at all levels of visit complexity, the cost of facility fees is increasing faster than professional fees.

The rapid growth in emergency department costs may reflect a variety of factors, including increasing intensity of services required to care for patients in the emergency setting, the growing scope of emergency medicine, and higher costs of more expensive technology. However, we find that facility fees are rising out-of-proportion to other costs, including the cost of emergency physician services, suggesting that service intensity is not the only contributor. Increasing provider consolidation and market power may be contributing to increasing prices of facility fees, as seen across a variety of health care settings.

Facility fees provide overhead revenue for hospitals to meet regulatory standards, including federal requirements for emergency departments to remain open 24/7 and provide necessary triage and stabilization to all comers regardless of ability to pay. Some states require emergency departments to notify patients that they will be charged a facility fee. However, even in light of recent price transparency regulation, only a third of hospitals currently report facility fee prices. Lack of standardization and transparency creates opportunities for consumers to be hit with surprisingly high emergency bills that may be difficult to negotiate and contribute to increasingly unaffordable emergency care.

Methods

This analysis is based on data from the Merative MarketScan Commercial Database, which contains claims information provided by a sample of large employer plans. This analysis used claims from about 17% of the 85 million people in large group market plans (employers with a thousand or more workers) from 2004-2021. To make MarketScan data representative of large group plans, weights were applied to match counts in the Current Population Survey for enrollees at firms of a thousand or more workers by sex, age and state. Cost is the sum of the amount paid by the insurer and the amount paid by the enrollee for each claim. Claims were included if they were below the 99.5th percentile of all claim cost. The MarketScan database includes only claims covered by the enrollees’ plan and does not include any balance billing directly from providers to enrollees.

Evaluation and management claims were included and classified by location if their place of service was in the emergency department, physician office, or urgent care. We included claims that were classified as both professional and facility charges, if they were associated with evaluation and management procedure codes. Evaluation and management claims in the emergency department included CPT codes 99281-99285, which are specific to the emergency department. In offices and urgent care centers, we included 99211-99215 CPT codes for established patient visits and 99201-99205 CPT codes for new patient visits.

This analysis has some limitations. First, we calculated the total cost per evaluation and management claim, though evaluation and management is often only one component of a visit. Visits in any outpatient setting may include other charges, including medications, laboratory studies, or imaging, so evaluation and management claims do not reflect the total cost of an outpatient visit. Secondly, the IBM MarketScan database includes only claims incurred under the enrollees’ plan and do not include balance billing to enrollees which may have occurred during the study period. Lastly, we include only privately insured, non-elderly adults, so these trends may not be representative of emergency department costs for other populations.