As of January 1, under federal rules issued by the Trump Administration, hospitals are required to publish the price of health services by payer. The federal rule aims to improve price competition by requiring hospitals to publicly list the hospital gross charge, discounted rate, and payer-specific negotiated rates for all available health services and items.

These prices must be made publicly available in a “machine-readable file” on the hospital’s website to support third-party collection and use of price data to inform research, purchasing tools, and policymaking. The rule also aims to help patients shop for lower-priced care, and to that end requires hospitals to provide a consumer-friendly online tool with prices for 300 common services. (To help patients estimate out-of-pocket costs, a separate rule requires health plans to provide enrollees with online tools that would allow patients to compare prices with out-of-pocket cost information for covered services; this rule will be implemented 2022-2024).

In this brief, we focus on the recently effective hospital price transparency rule to assess hospital compliance and examine how payer-negotiated rates vary. First, we describe the requirements in the rule. Then, we show how prices can vary for the same service (an MRI of the lower spine) across select hospitals that provide payer-specific negotiated rates. Finally, we describe the major challenges with the implementation of the price transparency rule. These challenges have been identified through our analysis of the websites of two of the largest hospitals in each state and the District of Columbia.

Federal hospital price transparency rule

The Affordable Care Act (ACA) requires hospitals to publish and update a list of “standard charges” for services and items available at the hospital with an established charge. The recent hospital price transparency rule defines standard charge as “the regular rate established by the hospital for an item or service provided to a specific group of paying patients” and includes the following: 1) gross charge; 2) payer-specific negotiated charge; 3) de-identified minimum negotiated charge 4) de-identified maximum negotiated charge; and 5) discounted cash price. Under the rule, hospitals must publicly post these five charges for at least 300 common services and items on their website, accessible through a consumer-friendly tool. The information must include descriptions of the health service or item, along with a common billing code. The Centers for Medicare & Medicaid Services (CMS) has specified 70 shoppable services that must be made available across all hospitals, and hospitals can choose the remainder. The rule specifies that the information must be displayed prominently and be accessible without requiring patients to submit personally identifiable information. Price information must be searchable by service description, common billing code, and payer. The tool must specify the location at which the shoppable service is provided, and whether the rates apply to an inpatient setting, outpatient setting, or both.

The rule also requires that such price information be published in a “machine-readable file” for all services and items provided by the hospital. Like the consumer tool, the machine-readable file must be displayed prominently and accessible online without barriers, including without cost or requirement to provide personally identifying information. Such files theoretically could be aggregated into a database of prices for services to facilitate comparisons across hospitals, payers, and location. This information is intended to be most directly useful for employers, providers, and developers for consumer-friendly price transparency tools or for shared decision-making during the point of care, according to a CMS release.

Because the same payer (insurer) may negotiate different prices under different specific plans, the rule requires that each of those rates is clearly presented with the name of the third-party payer and plan with which it is associated. For example, an insurer offering a private plan, Medicare Advantage plan, and Medicaid managed care plan must separately list the negotiated for those distinct plans. Prices must be made available for all services and items, including drugs administered in the hospital, though the prices do not reflect discounts or rebates.

Hospitals that do not comply with the transparency rules will be required to submit a corrective action plan to CMS and correct failures within the designated timeline in the plan. If hospitals do not comply with the requirements of the corrective action plan, they may be fined up to a modest $300 per day per hospital until they comply. CMS has the authority to monitor hospital compliance by auditing hospitals’ websites and evaluating and reviewing complaints of noncompliance made by individuals or entities.

Price variation within hospitals

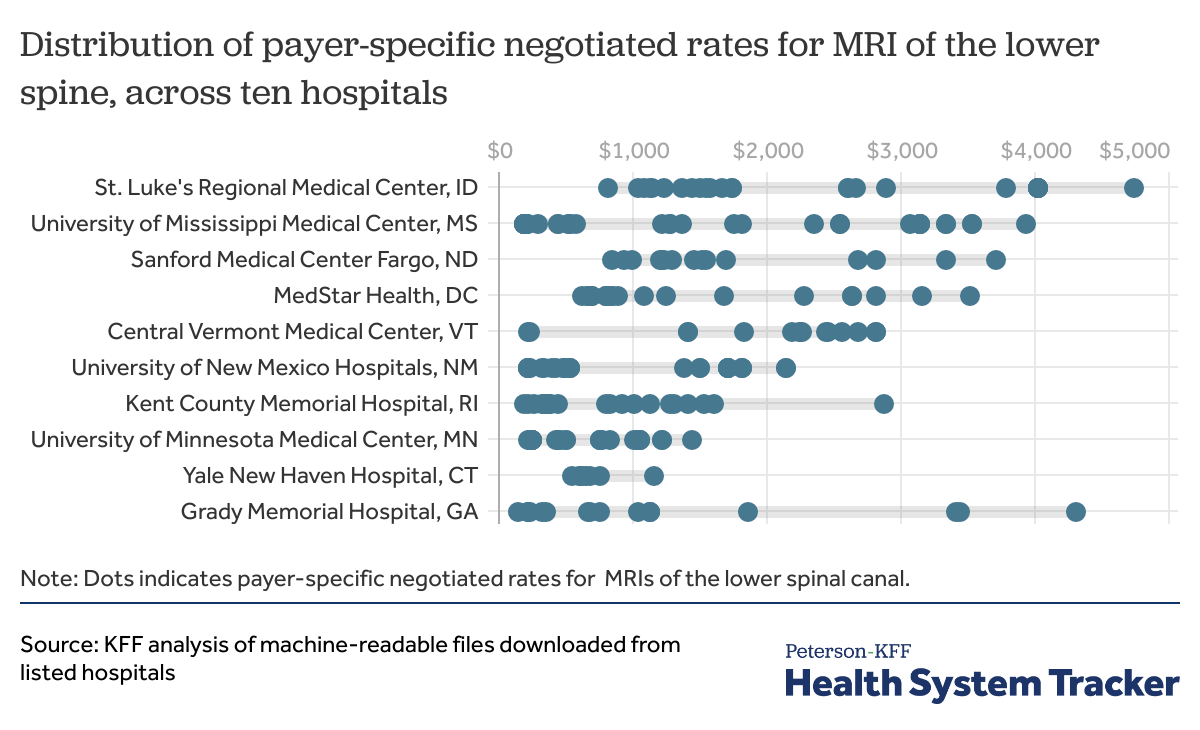

Many studies show that prices for health services in the U.S. vary significantly nationally, across private and public insurance markets, and even within cities. The newly available price data published by hospitals also illustrate how much prices for the same service vary within a hospital. The chart below shows the range of payer-specific negotiated rates for an MRI of the lower spinal canal at ten selected hospitals that provided this data, downloaded from those websites between January and March of 2021. (These hospitals are some of the few we identified that provided multiple payer-negotiated rates for a lower spinal MRI.) For context, our analysis of claims data finds that the price of an MRI of the lower spine paid by large employer health plans averages $861 nationally in 2018, with average prices ranging from $400 to $1,100 across major metropolitan areas.

Depending on who is paying, the price for the same health service in the same hospital varies widely

Within a few hospital in our sample, prices vary by the specific payer and its market segment, with Medicare Advantage and Medicaid managed care plans generally paying lower rates than commercial plans (though the data provided by most hospitals does not clearly indicate in which market a payer is operating). For instance, at University of New Mexico Hospitals, for an MRI of the lower spine, the range of negotiated rates varied between $486 – $1821 in the private insurance market; from $221 – $331 for Medicare Advantage plans; and from $350 – $485 for Medicaid managed care plans.

Hospital compliance with the price transparency rule

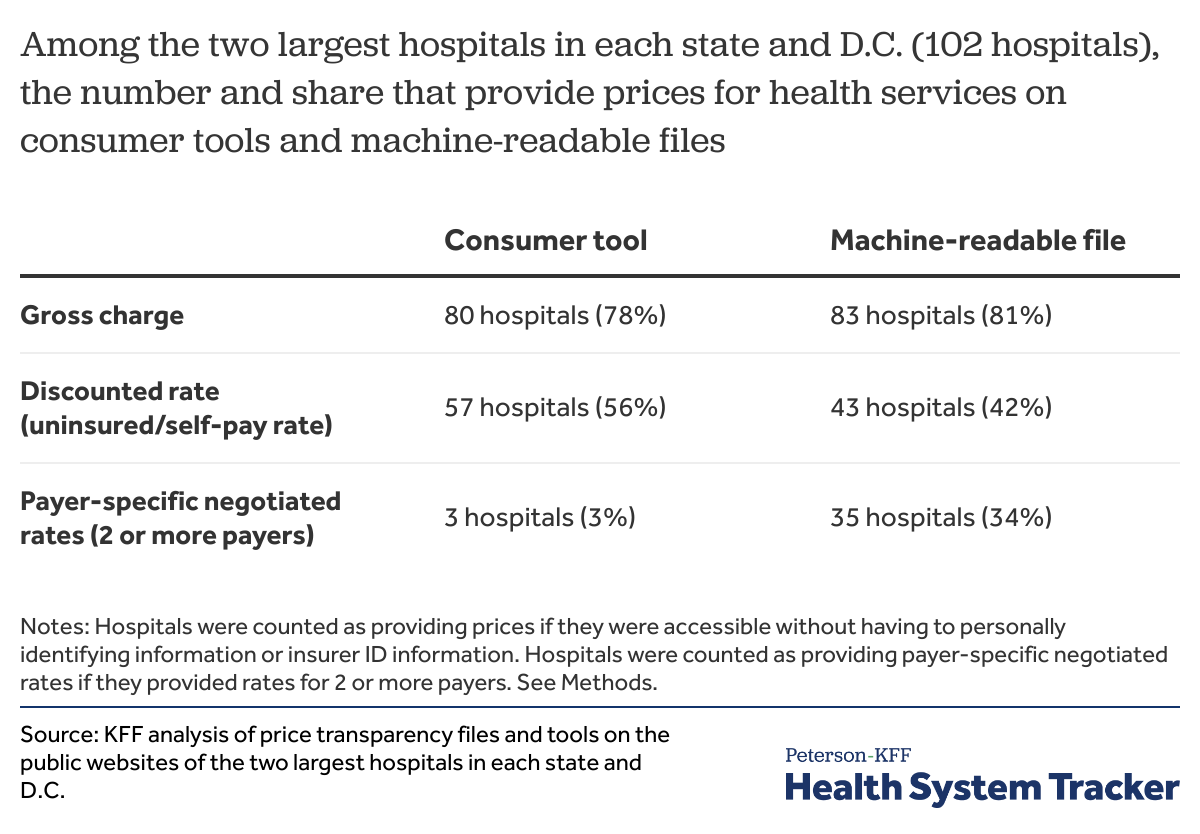

In this analysis, we examined the websites of the two largest hospitals in each state to find the share of hospitals that provided gross charges, payer-specific negotiated rates, and discounted self-pay rates on both a consumer-friendly tool and a machine-readable file (see Methods).

The gross charge refers to the undiscounted charge a hospital applies to a given health service or item. Payer-specific negotiated rates are the prices that hospitals and payers have negotiated for a given service; these prices may vary across a payer’s different plan types. The discounted rate is the price a hospital sets for uninsured or self-pay patients.

Few hospitals provide the public with payer-negotiated rates

While most of the hospitals we searched provided some price information (such as the gross charge), many hospitals did not provide the public with payer-specific negotiated rates for their services. Only three of the hospitals in our sample provided payer-specific negotiated rates on their consumer tools without requiring a patient to provide personally identifying information (including their insurance membership details). Meanwhile, while 35 of the hospitals we examined provided payer-negotiated rates on a machine-readable file, it is unclear whether all participating insurers were included in these files. Also, in some machine-readable files, hospitals provided payer names but did not include actual negotiated rates from those payers. In some cases, payer names were provided, but the associated plan name or market was not listed.

About 3 out of 4 hospitals in our analysis provided gross charges for services to the public. While most people do not pay the gross charge, these rates can serve as a baseline for negotiating rates with payers. They also can be a reference point for the cost of care for individuals without insurance. For example, a hospital may provide a flat 30% discount off the gross charge for an uninsured individual and bill accordingly. Fifty-six percent of hospitals provided a rate for discounted care on their consumer tools, and only 42% did so on their machine-readable files.

Challenges in comparing prices for common services across hospitals

An important goal of price transparency in health care is to reduce the cost of care by increasing price competition. The rule aims to improve competition in two ways: one, by giving patients the option of shopping for lower-priced care, and two, by revealing to health plans and hospitals the rates their competitors have set for the same services.

The data provided by hospitals, where they comply with the rule, may allow for comparisons of prices within a given hospital. For example, using this data, health plans can identify the prices paid by other payers and potentially use that information to negotiate lower rates. However, among the few hospitals in this analysis that do provide payer-negotiated rates, the markets in which the payer operates is not always clear. And, due to a lack of standardization, comparing prices across hospitals is problematic. For reasons outlined below, consumers, payers, employers, researchers, and others attempting to compare prices for services across hospitals should use caution.

Price estimates do not always allow for an apples-to-apples comparison. We found that the price of a service from one provider might not be comparable to the price of the same service from another provider, even when presented by billing code.

- It is not always clear whether the estimated price includes the professional fee. In our analysis, while some hospitals included both facility and professional fees (e.g., for physician services) in their estimate, others opted to just include the facility fee in their total price estimate. While the rule requires that hospitals list the price and name of the main service and all related ancillary services and professional fees, in some cases, it was not clear what was included in the price estimate. Ancillary services were rarely listed.

- Few hospitals distinguished the price difference between inpatient and outpatient care. Most consumer tools did not list the difference in price based on whether the service was received inpatient or outpatient, though a minority of machine-readable files did provide different rates for these two settings.

- Hospitals vary in how they measure “price”, ranging from presenting estimates, averages, or single established rates. Though the “standard rate” is thought to be a hospital’s gross charge, we found that many hospitals used different terminology that would indicate a different sort of measurement of price altogether. For example, commonly used labels instead of “gross charge” included “average charge”, “median charge”, or “estimate”. In one case, a hospital only provided “Medicare Advantage median” in their machine-readable file. The reimbursement for Medicare Advantage plans is often much lower than for private plans, and therefore these price estimates could be misleading for the public.

Price estimates are different between the consumer tool and the machine-readable file. Price estimates for the same service, as identified by unique billing code and service descriptions, often differed between a hospital’s tool and their machine-readable file. This discrepancy was noted in several hospitals, pointing to inconsistencies in hospital pricing policies.

Price estimates may change over a short period of time. Patients attempting to shop for health services may find that the prices change over a short period of time, and as a result, could face unexpectedly high bills. During the month we collected price estimates, we sometimes found that the estimate for a service on the consumer tool changed over a short period of time. Many hospitals provided a disclaimer stating that the price was subject to change and was simply an “estimate” of the total cost.

The price information provided in machine-readable files was not complete. Hospitals are required to post gross charges, discounted rates, and payer-negotiated rates for all the services and items they provide, but finding comprehensive files including all services across all payers and rates was uncommon. For instance, one hospital that had a large and seemingly comprehensive file of prices for services by payer did not have prices for the three common “shoppable” services we examined. Another hospital only provided payer-negotiated rates for Medicare Advantage plans. Other files did not identify services by common billing codes or commonly used descriptions, which made finding a service and its price difficult.

Price information can be hard to access or comprehend. While many hospital websites contained pages with information explaining the cost of care and price transparency initiatives, accessing the customer-friendly tools and machine-readable files was not always straightforward or easy. A recent Wall Street Journal investigation found that some hospitals have added code that prevents the machine-readable files from appearing in online searches. While many machine-readable files can still be accessed directly through hospital websites, they could be hard to locate on those websites, or require multiple clicks and scrolling through pages. For instance, in this analysis we found that while some hospital websites had specific “price transparency” pages with downloadable files, others required consumers to search through “billing and insurance” pages and sub-pages to find the files.

Most hospital website’s consumer tools that we examined generally required patients to input personally-identifying information. (The majority of the hospitals in our analysis used the tool called MyChart, powered by Epic Systems Corporation.) Such tools required patients to know complex medical terminology or billing codes to search for prices. It is unlikely that most patients would use these tools as they exist.

Discussion

Unlike most industries, the prices for services in health care are notoriously hard to pinpoint and vary drastically given a variety of factors. The new price transparency rule is intended to help lift the veil on the full range of those prices for consumers, insurers, employers, and researchers. As intended by the rule, payer-specific negotiated rates in the machine-readable files could help insurers, employers, providers, tool developers, and other third-party actors to identify lower-priced providers and inform plan network decisions.

However, in practice, price transparency data is neither consistently available nor reliable. Most hospitals do not fully comply with the rule. Those that do comply and provide payer-specific negotiated rates vary in what prices they show, how they define price (e.g. does it include both facility and professional fees?), and whether they provide payer-specific negotiated rates for all their participating payers. For example, it is not always clear in which market an insurer operates, and this can drastically affect the price of a given service. The lack of standardization in both the definition of “price” as well as the format of machine-readable files across hospitals makes it impossible to reliably compare prices across hospitals. We found significant inconsistencies in how the files are formatted, the level of detail in payer names and markets, which billing codes are used, and what the measurement of price is. Anyone attempting to make comparisons across hospitals using these data should therefore exercise caution.

For price transparency data to be useful in making comparisons across hospitals, data in the files would need to follow a set template, such that all hospitals use consistent file formats, billing codes, service descriptions, and insurer and market naming formats. The results from implementation thus far demonstrate a wide range in interpretation and compliance with the hospital rule and may suggest similar challenges with implementation of the insurer-focused rule in 2022 if standardization is not enforced.

Methods

We searched the websites of 102 different non-governmental adult hospitals for 50 states plus the District of Columbia to collect the machine-readable file and the consumer-friendly tool data cited in this brief. The top two largest hospitals were defined as those with the greatest number of hospital beds, using data from the 2018 American Healthcare Association Annual Survey of Hospitals. These 102 hospitals represent 12.5% of total non-governmental hospitals beds in the U.S. In some states, these hospitals comprise a much greater share of total hospitals beds in that state. Some hospitals in the sample belong to larger health systems.

We systematically examined hospital websites between January and March, 2021. In each hospital website, we searched through their billing and financial pages for sub-pages on price transparency or standard hospital charges. Many hospital websites had pages on price transparency in accordance with CMS rules on price transparency. Then, when available, the machine-readable files (generally in comma separated value or XLS formats) were downloaded. Similarly, for websites that had price estimator tools we collected the available gross charges, discounted rates, and negotiated rates data as available.

For websites that did not have downloadable files, or for websites in which downloadable files did not contain any price information, we examined the remainder of the billing and financial information webpages and other related pages to identify price information, though this rarely resulted in additional data. When this did not yield results, the hospital was coded as not having the given price information. While some hospitals indicated that price information could be requested through phone, email, or request forms, we did not contact hospitals for this information because the rule requires public posting of this information. The same procedure was followed for price information derived from the consumer-friendly tool.

In the files and the consumer-friendly tool, we identified the services primarily by standard code, though occasionally descriptive information was used. We used CPT 72148 to capture “MRI scan of lower spinal canal (w/out contrast)”, and collected the associated gross charge, discounted rate, and negotiated rate, as available. When different rates were available in inpatient and outpatient settings, both were catalogued.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.