In late 2020, Congress passed and President Trump signed the No Surprises Act establishing new federal protections for consumers from surprise medical bills. The law became effective in 2022. A significant component of the law was to hold consumers harmless for surprise, out-of-network medical bills by creating a process where the medical provider and health plan would negotiate a payment for the service provided or end up in an independent dispute resolution (IDR) process.

About 1 in 8 disputes in the first year of the No Surprises Act arbitration process resulted in payment determinations

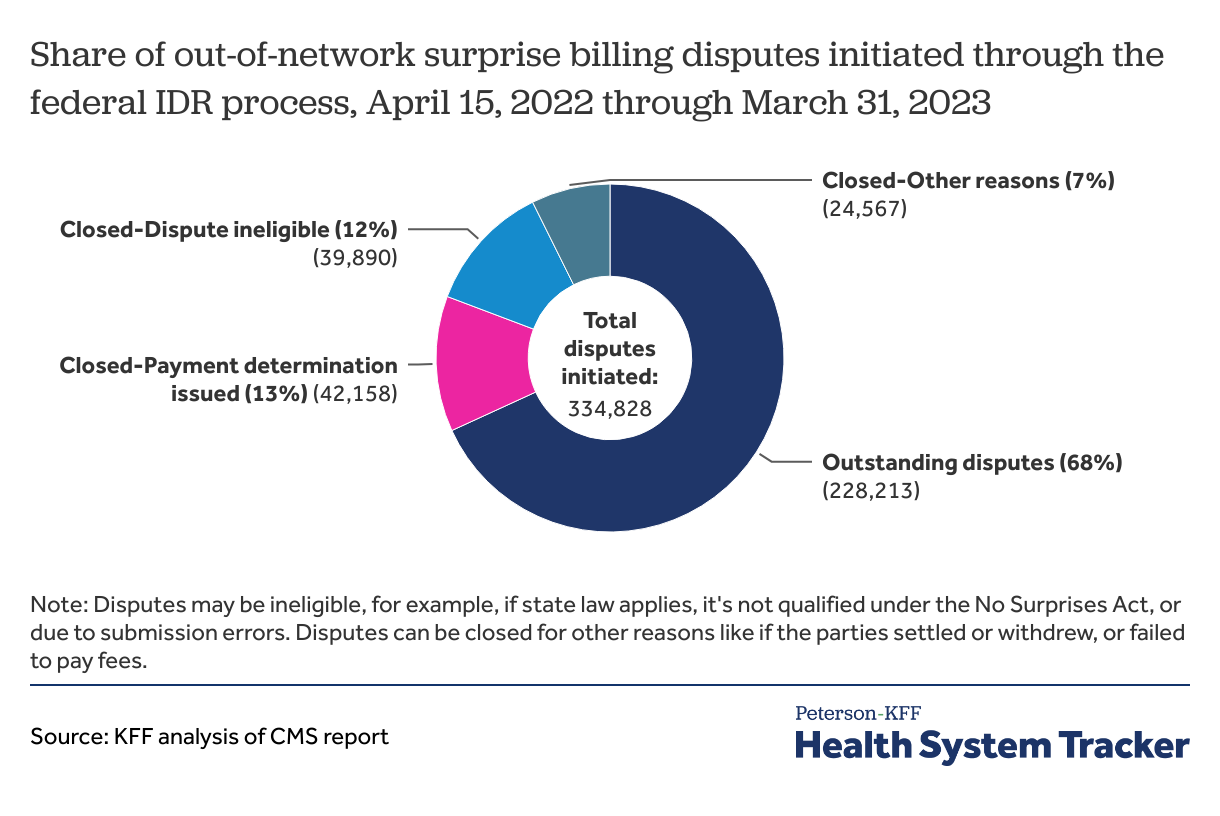

Over 300,000 surprise billing disputes were initiated through the federal IDR process starting in April 2022 through March 2023. Disputes in the first year far exceeded CMS’s initial estimate of less than 18,000 for the year.

About 1 in 8 (13%) disputes during the first year of the IDR process received payment determinations. Another 19% of disputes were closed due to ineligibility or for other reasons. Disputes may be ineligible, for example, if state law applies, it’s not qualified under the No Surprises Act, or due to submission errors. Disputes can be closed for other reasons like if the parties settled or withdrew, or failed to pay fees. Nearly 7 in 10 disputes (68%) remained outstanding.

About 7 in 10 payment determinations were in favor of the providers’ asking price and the remaining were in favor of the health plans’ payment offer. (Based on an earlier government report, nearly all of the dispute initiators are providers.) Even though most payment determinations through the federal IDR arbitration process have been in favor of providers, most of the lawsuits against the No Surprises Act are also being brought by providers.

The federal government recently proposed several changes with the goal of making the IDR process more efficient and increasing early communication between the parties.

Recent court decisions throw out parts of No Surprises Act regulations, other court challenges are pending

Provider groups have sued regarding the No Surprises Act and its implementation in several lawsuits. District court rulings have set aside the requirement that IDR entities presume the Qualifying Payment Amount (QPA), defined as the median in-network rate in the region for the item or service, is the appropriate payment rate absent additional information. A district court decision also vacated certain provisions related to the QPA calculation methodology, and the federal government intends to appeal this decision. In the meantime, federal agencies announced that they do not plan to enforce court-required changes to the QPA methodology until May 2024. A district court ruling also vacated the administrative fee increases established in guidance. In response, the federal government has issued a proposed rule to set administrative fees through formal notice and comment rulemaking. Other lawsuits, including challenges to specific IDR payment decisions, are pending.

As a result of the court decisions, the IDR process has been halted several times. The federal government announced on August 25, 2023 that it had once again put the federal dispute process on hold in response to a Texas district court ruling striking down part of the law’s regulations about the methodology insurers use to calculate a qualifying payment. Payment determination processing for disputes submitted on or prior to August 3 was resumed on September 21, 2023. On October 6, 2023, the federal IDR portal was reopened for submission of some new disputes. Submission and processing of batched disputes and submissions for air ambulance disputes remain suspended pending further guidance.

In the midst of the legal disputes over the dispute resolution process for payment rates, patients are still held harmless for surprise, out-of-network bills.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.