Note: This brief was updated on March 21, 2023 to reflect new federal guidance issued on March 17, 2023.

The No Surprises Act prohibits most surprise bills starting in 2022. About 1 in 5 emergency room visits and 16% of in-network hospitalizations for non-emergency care included surprise bills from out-of-network providers. The law prohibits doctors, hospitals, and other covered providers from billing patients more than the in-network cost sharing amount for protected services, which include: emergency services, post-stabilization services, non-emergency services at in-network facilities, and air ambulance services. The protections cover people with private insurance (including employer-based coverage, non-group plans, and grandfathered plans). The patient’s cost sharing amount for out-of-network services and items covered under the law is required to be no more than the in-network cost sharing.

To determine the plan payment to the out-of-network provider or facility, the No Surprises Act established an independent dispute resolution (IDR) process. The IDR process takes patients out of the disputes between the out-of-network provider’s asked price and plan payment for surprise bills. Instead, a third-party baseball-style arbitration process determines the plan payment amount.

In this explainer, we describe when federal or state IDR process applies, the federal IDR process timelines, recent data from federal IDR disputes, and implications for providers, payers, and patients.

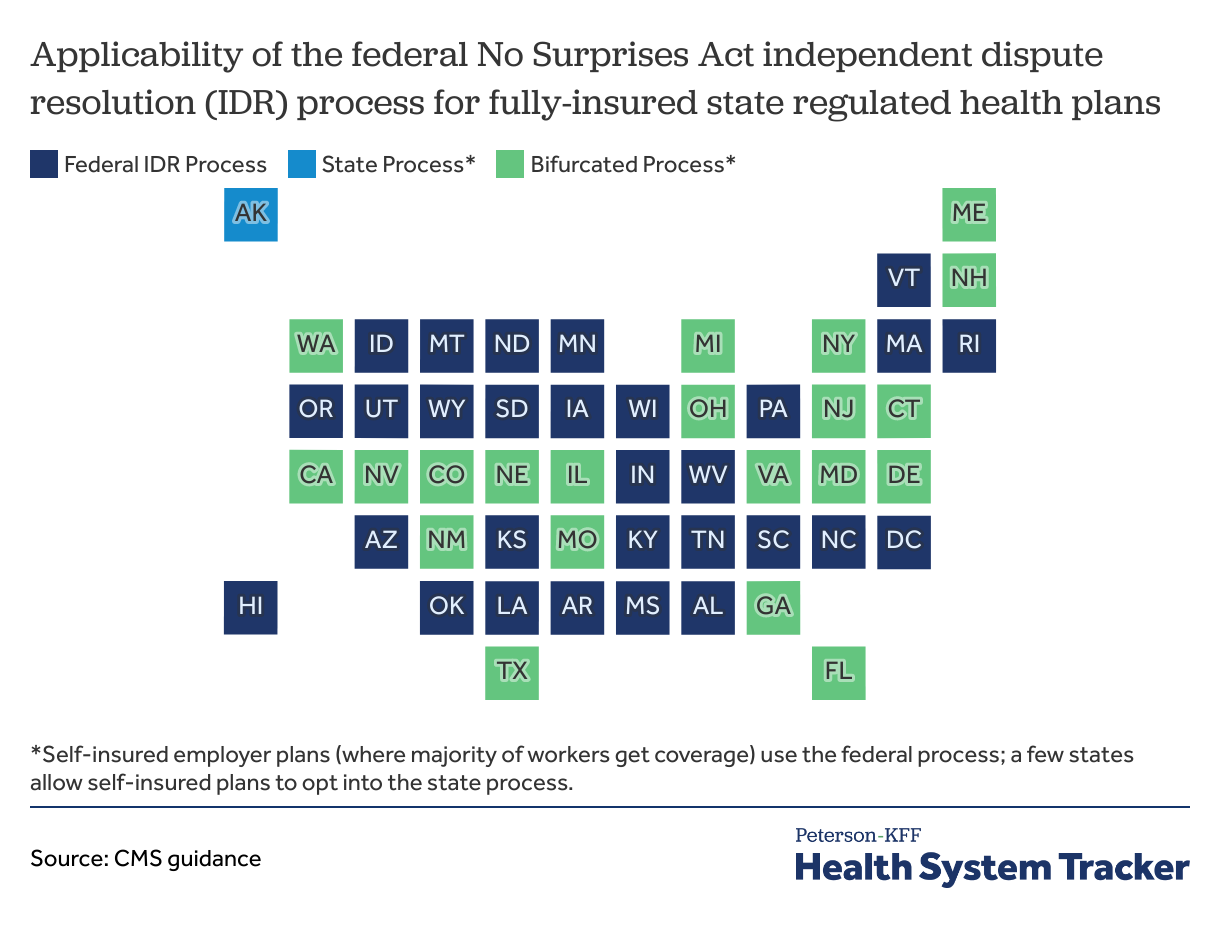

The federal dispute resolution process applies in a majority of cases

The federal IDR process will apply for all self-insured group plans (which represent 65% of workers with employer-based coverage in 2021). In states that do not have any surprise billing protections, the federal IDR process will also apply for fully-insured plans. A state process will apply for fully-insured plans in 22 states where the state has some surprise billing protections. In 21 of those 22 states, the state’s law covers only a portion of the federal surprise billing protections. In these “bifurcated process” states, the federal process will apply where the surprise bill is not covered under state law. Some states permit self-funded employer plans to opt into the state’s process.

Read more from

Surprise Bills

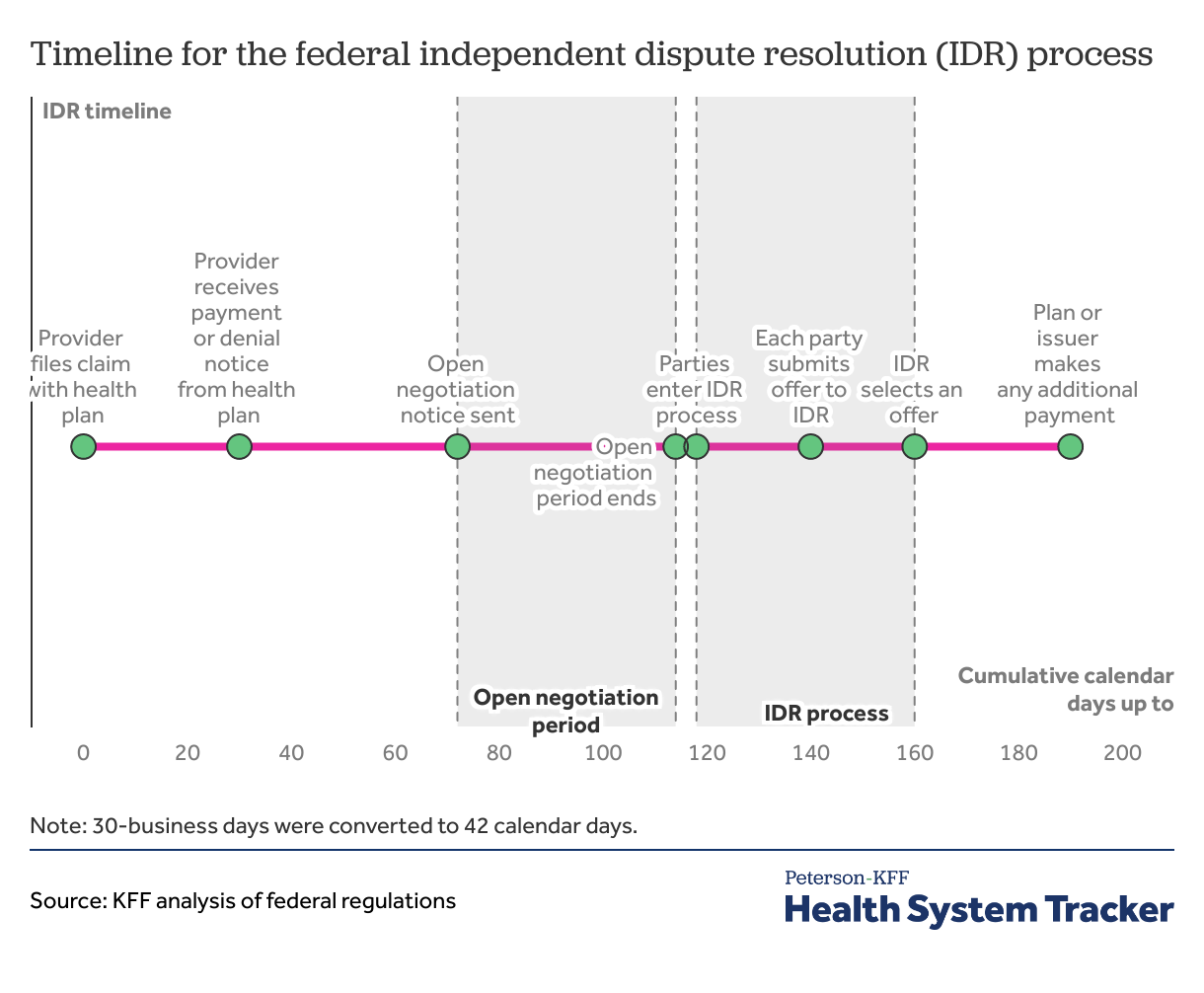

For disputes submitted to the federal IDR, the process from provider claim filing to payment determination can take 6-months

After the provider files a claim, the plan generally has 30 days to make an initial determination on whether and how to cover a claim. Once a claim is filed, by day 30, the health plan must decide whether it will pay, deny, or adjust the claim. There are rules permitting extensions in certain circumstances, for example, if the plan determines the claim is incomplete, the plan could ask for additional information. On the date the health plan processes the surprise bill claim, it calculates the applicable in-network cost sharing amount based on the qualified payment amount (QPA)—which is the median in-network contracted rate by the health plan issuer in the same insurance market and region for the item or service. The plan informs the out-of-network provider of the patient’s responsibility and issues an explanation of benefits (EOB) to the patient showing the applicable in-network cost sharing that the patient owes the provider.

Open negotiation period must be exhausted before initiating a federal IDR process. After the plan determination, the plan or provider initiate open negotiation on the payment. Parties must exhaust 30 business days (or about 42 calendar days) of open negotiations before entering the federal IDR process. If the parties do not reach an agreement after open negotiation, either party can initiate the federal IDR process within 4 business days following the end of open negotiations.

Federal independent dispute resolution entities select one of the offers submitted. Parties have 10 business days to select a certified IDR entity and submit offers of payment. IDR entities are third-party organizations that are certified by the federal government to arbitrate the payment amount between plans and providers. The selected IDR entity picks one of the two offers within 30 business days of offer submissions. In selecting the offer, the IDR entity considers the QPA and additional supporting materials. Additional supporting materials can include provider’s or facility’s quality, market share, and complexity of population served. The IDR entity is not allowed to consider typical provider charges or public payers’ payment rates. From IDR entity selection to the IDR entity selecting an offer can take up to about 62 calendar days. Once the IDR selects one of the offers submitted by the plan or the provider, the health plan has 30 calendar days to make any additional payments. From the claim determination to any additional payment being made can take over 6 months.

Ongoing litigation of the No Surprises Act may change the course of IDR implementation

Provider groups have challenged the No Surprises Act and the implementation of the law in multiple lawsuits. A lawsuit brought by the Texas Medical Association resulted in the United States District Court for the Eastern District of Texas setting aside parts of the initial No Surprises Act implementing regulations, including the requirement that IDR entities presume that the QPA amount is the appropriate rate for the claim, absent additional information. Another requirement, that the certified IDR entity select the offer closest to the QPA unless additional credible information indicates otherwise, was also vacated. In response to this court ruling, the Biden Administration issued a final rule in August 2022 requiring the IDR entities to consider the QPA first and then consider other submitted justifications in addition to the QPA in selecting an offer. On February 6, 2023, the U.S. District Court for the Eastern District of Texas again ruled in favor of the Texas Medical Association in another challenge to the IDR regulations and ruled the August 2022 final rule unlawfully favors the QPA. In response to this ruling, federal regulators initially asked IDR entities to hold payment determinations. On February 24, 2023, federal regulators asked IDR entities to resume payment determinations for disputes involving items or services furnished before October 25, 2022, and to continue holding payment determinations for those furnished on or after October 25, 2022, until further guidance. On March 17, 2023, federal regulators posted updated guidance in response to the February 6, 2023 decision, and resumed IDR payment determinations for all disputes. Other challenges are pending and will determine the future of the No Surprises Act implementation.

Challenges to the dispute’s eligibility under the No Surprises Act can further delay IDR payment determination

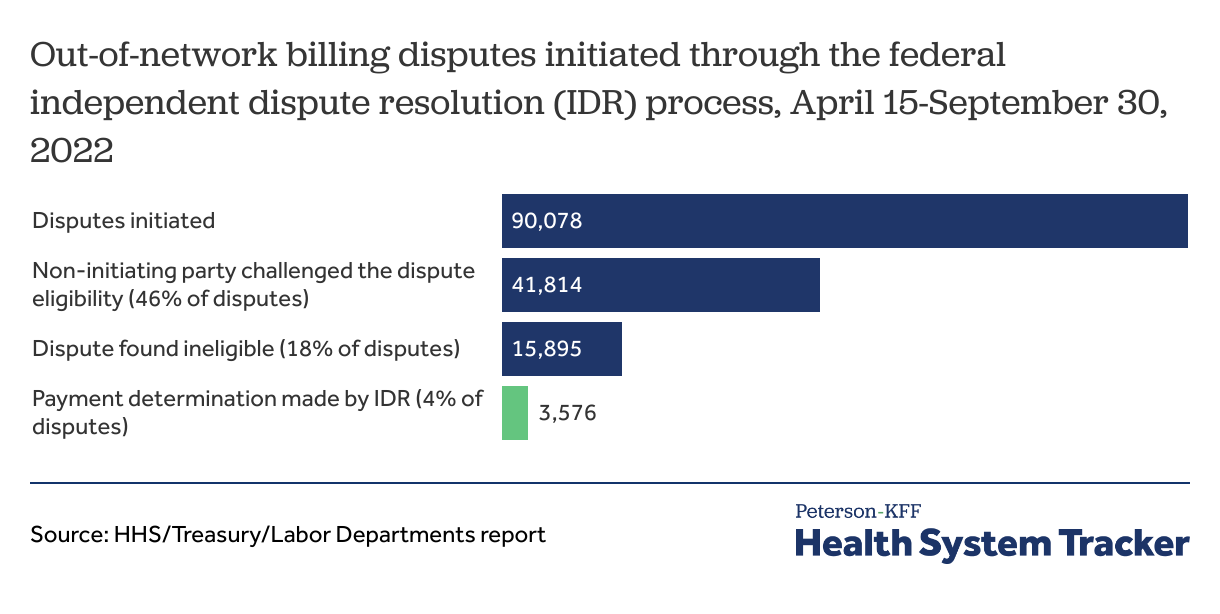

According to the Centers for Medicare and Medicaid Services (CMS), which is responsible for implementing the law, 90,000 disputes were initiated through the federal IDR process from April to September of 2022. Disputes initiated in this period exceeded CMS’ initial estimate of less than 20,000 for the entire year. Similar disputes between the same provider and plan are required to be batched and so we do not know how many out-of-network items or services were disputed through the federal IDR process.

Half of disputes submitted (46%) were challenged by the other party and 18% were found ineligible for the federal IDR process. The non-initiating party can challenge the dispute’s eligibility for the federal IDR process. The dispute can be found ineligible if state jurisdiction applies, incomplete or incorrect information is submitted, submission does not comply with requirements, or the open negotiation period has not been exhausted.

Of the disputes initiated in the April to September 2022 period, less than 4% were issued payment determinations. Most of the disputes initiated were awaiting eligibility or payment determination.

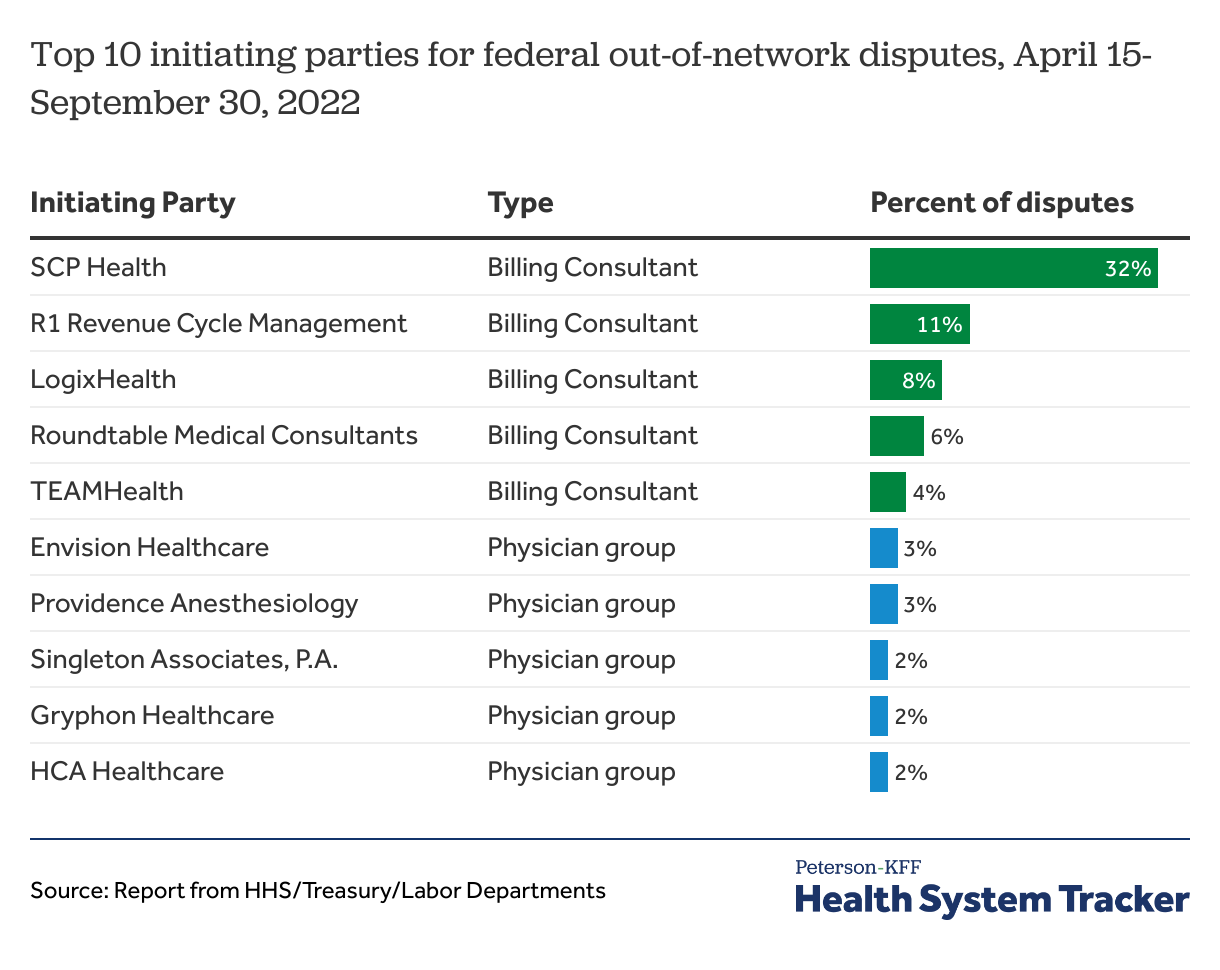

Nearly all federal IDR disputes are initiated by providers

The top 10 dispute initiating parties submitted 73% of the out-of-network payment disputes. The top 5 of them are billing consulting companies initiating disputes on behalf of provider groups and account for nearly two-thirds of the disputes (61%). Five physician provider groups accounted for 12% of the disputes. Less than 1% of disputes were initiated by health plans. Less than 1% of disputes were initiated by health plans.

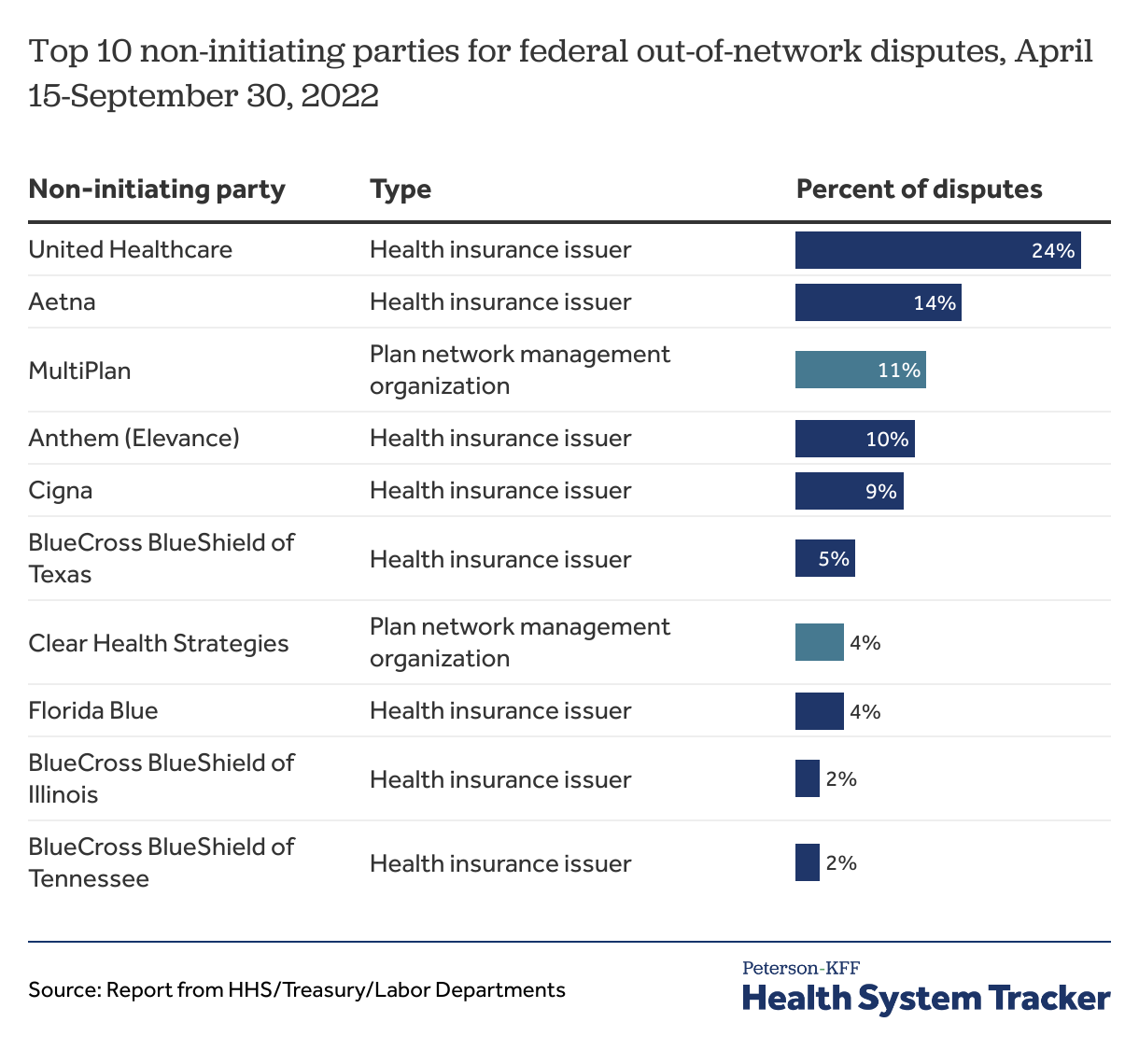

Most of the disputes were initiated against 8 health insurers and 2 entities that help plans with their networks

Over 8 in 10 disputes (85%) were initiated against 10 entities. Of these, 8 are health insurers with 70% of the disputes and the others (Clear Health Strategies and Multiplan) are entities that help insurers with their provider networks.

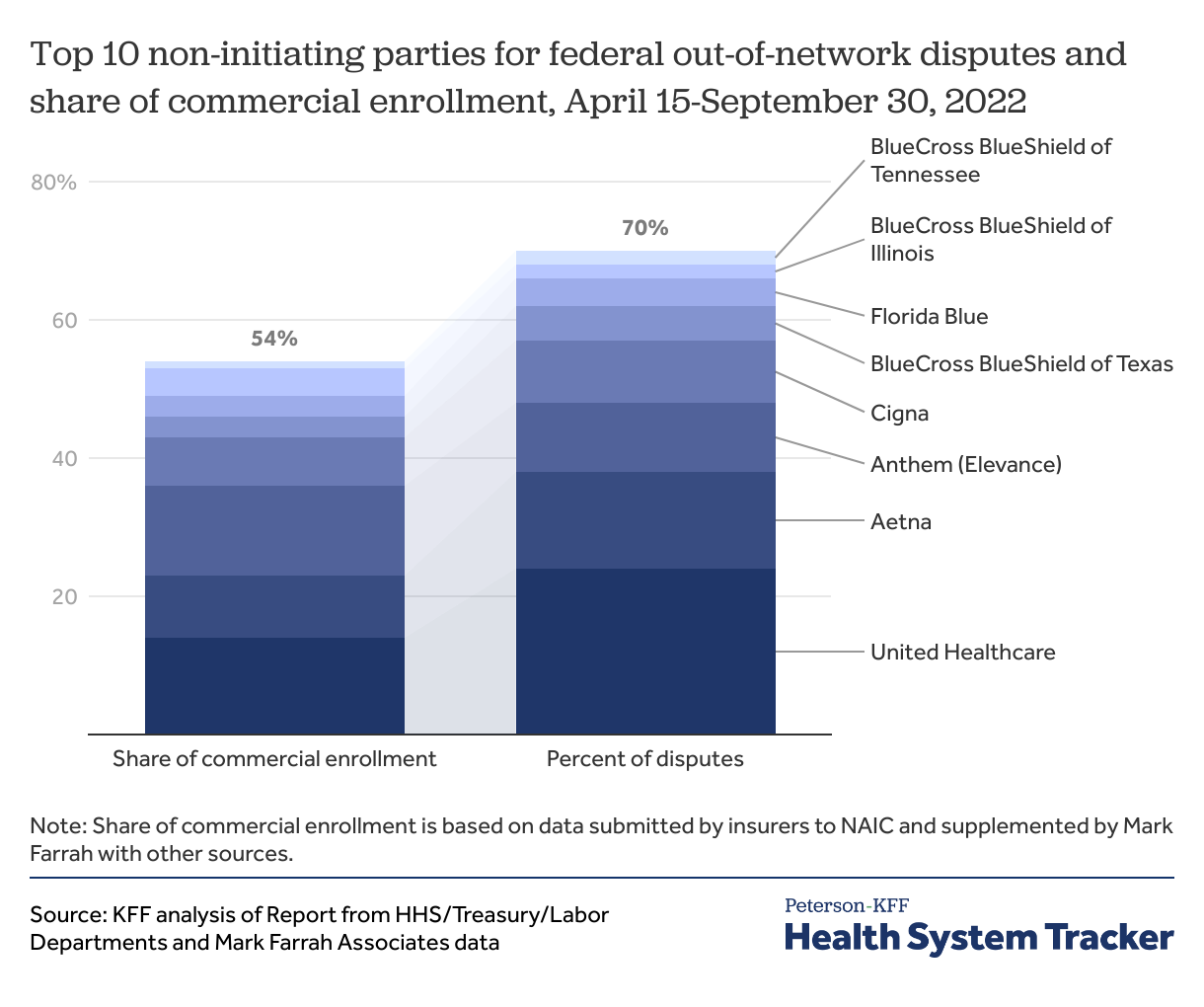

Share of disputes initiated against some health insurers was higher than their market share

Implications of the IDR process for plans, providers, and patients

The IDR process incentivizes good faith plan and provider offers. The federal IDR process is established as a last resort in case all other plan-provider negotiations fail. If the parties choose to use the federal IDR process, then the process incentivizes both parties to make reasonable offers, as one of the two offers will be selected. Unless the providers and plans can justify their offer payment amount, very high or very low offers would likely result in the other party’s offer being picked.

The losing party (whose offer is not selected by the IDR) is responsible for the IDR fees. The IDR process in theory leaves room for the plan to make an initial payment to the provider that is far below the QPA, and let the process play out to benefit the plan’s own cash flow, and in-turn create cash flow issues for the provider. Offsetting that potential, though, are the baseball arbitration rules of the IDR process, which specify that the IDR must select either the plan’s or the provider’s offer, and the losing party must pay the IDR fee. The IDR fees in 2023 can range from $350 to $700 for single determinations and from $475 to $938 for batched determinations. This may incentivize the plans to avoid lowballing their offer amount and the providers to avoid asking for high payment rates without strong justification. Otherwise, the outlier party risks getting stuck with the other party’s offer and the IDR fee.

Providers not participating in any plan networks could face longer timelines for reimbursement. The time from plan initial claim determination to IDR decision and plan payment could take over 6 months. Providers with many out-of-network claims could face cashflow issues while waiting to resolve payment disputes.

Patients generally should not be affected by the IDR process, so long as the plan or provider did not make a billing mistake. The out-of-network provider is permitted to bill the patient only the applicable in-network cost sharing amount for surprise out-of-network bills, regardless of the IDR entity’s determination. Once the patient pays their cost-sharing amount, the patient has no further responsibility. If there are billing mistakes, a patient may not notice them or know how to address them.

Health plans and providers can be issued penalties for not correctly covering surprise medical bills or sending incorrect bills to patients. For plans who incorrectly process claims, they can be charged up to $100 per day per affected beneficiary under federal law. State regulators may have additional authority and enforcement tools they can use to address billing problems. On the provider side, the penalty for incorrect billing is up to $10,000 per violation. That is, if a provider sends 200 incorrect bills, the provider could be penalized $2,000,000.

Discussion

The No Surprises Act independent dispute resolution process generally encourages plans and providers to resolve payment disputes outside of the IDR arbitration process, while at the same time protecting patients, though early experience shows the number of arbitrated disputes has been higher than expected. The federal independent dispute resolution process has the potential to put downward pressure on prices, particularly among providers charging extremely high prices. The Congressional Budget Office (CBO) had estimated a premium decrease of between 0.5% and 1% as a result of the No Surprises Act. Thus far, health plans are generally not estimating an impact of this law on 2023 premiums.

With the IDR payment determination guidelines for out-of-network services being challenged in the courts, the impact of the law on premiums remains uncertain. The federal agencies’ modification to how the IDR entity selects the offer due to these lawsuits may weaken the downward cost pressures.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.