Note: This analysis was updated on June 12, 2025, to more accurately characterize the services provided by one of the listed initiating parties.

The No Surprises Act, which was signed into law by President Trump during his first term and took effect in 2022, aims to protect consumers from certain surprise medical bills. Under the No Surprises Act (NSA), privately insured patients who receive out-of-network emergency care, including for air ambulances, or non-emergency care at certain in-network facilities, cannot be charged more than in-network cost-sharing rates for covered services and items.

The law established processes to keep the patient out of the payment negotiations between the provider and the plan in these situations. Once patients pay their in-network cost-sharing amount, providers or insurers may attempt to recoup costs from the other. The amount the plan pays the out-of-network provider or facility is established during an open negotiation period between the two entities. In the event of an unsuccessful negotiation, providers and payers enter an independent dispute resolution (IDR) process in which a designated third-party arbitrator examines eligible evidence from both parties to decide on a final payment rate.

This brief provides an update to a prior KFF brief on the implementation status of the IDR process and a KFF analysis of data on disputes initiated through the federal IDR process, and discusses some of the impacts on providers, payers, and ultimately, consumers. According to data from the Centers for Medicare and Medicaid Services (CMS), a total of 1,265,737 disputes were initiated through the IDR process in 2023 and the first half of 2024, spanning emergency and non-emergency services (excluding air ambulance services). Providers and facilities initiated the vast majority of these disputes (90%) and won 80% of the time. The top ten initiating parties were all affiliated with private equity. In almost all cases where the provider prevailed (99.9%), this resulted in providers receiving the offer they proposed, which was, on average, well above the median in-network rate reported by insurers. While the No Surprises Act is protecting consumers from surprise bills, it is likely not reducing prices and spending.

Background

Implementation of the NSA has been met with a slew of legal and operational hurdles. Provider groups have filed lawsuits for a variety of issues. For example, the median in-network contracted market rate or qualified payment amount (QPA), which is the basis for determining individual cost sharing for covered services and items, has been the subject of litigation as providers have challenged the methodology for determining the amount, its place as a benchmark in the arbitration process, and the weight of that rate in comparison to other factors when determining an outcome. There have also been operational challenges, as providers have disputed a much greater volume than the number CMS anticipated for third-party arbitrators to manage. Providers have largely won in the courts and increasingly in the disputes since the IDR process was implemented, in April 2022, through mid-2024.

In response to court orders vacating certain provisions of the NSA, CMS temporarily halted the processing of disputes, payment determinations, and dispute initiations while developing new guidance and appealing certain court decisions. These legal decisions may obscure how the IDR process will impact out-of-network charges paid by insurance and if those will be passed along to the consumer.

Findings

Over two in five disputes for emergency or non-emergency care at certain facilities resulted in payment determinations

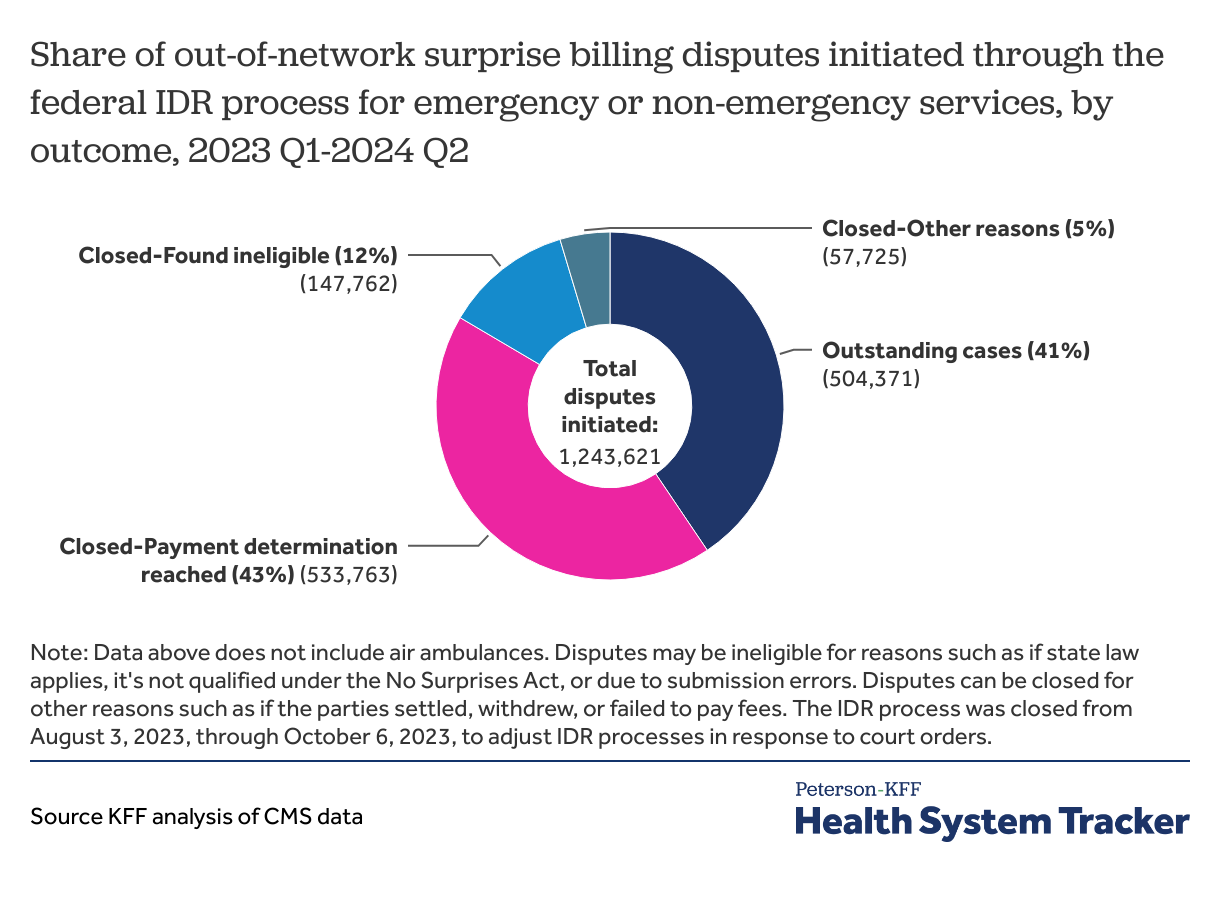

Overall, 1,243,621 surprise billing disputes involving emergency and non-emergency services and items were initiated through the federal IDR process between the first quarter of 2023 and the second quarter of 2024. Using the latest data available (published by CMS in March 2025), we find that over two in five disputes (43%) resulted in payment determinations, much higher than the share in the first year of the IDR process that resulted in payment determinations (13%). Meanwhile, a similar amount (41%) of the disputes are outstanding.

During this period, two in five disputes (41%) were challenged by non-initiating parties for eligibility, and 12% of disputes were closed due to ineligibility or for other reasons. Disputes may be ineligible, for example, if state law applies, if it’s not qualified under the NSA, or due to submission errors. Disputes can be closed for other reasons such as if the parties settled, withdrew, or failed to pay fees.

The share of determinations in which providers prevailed has grown over time

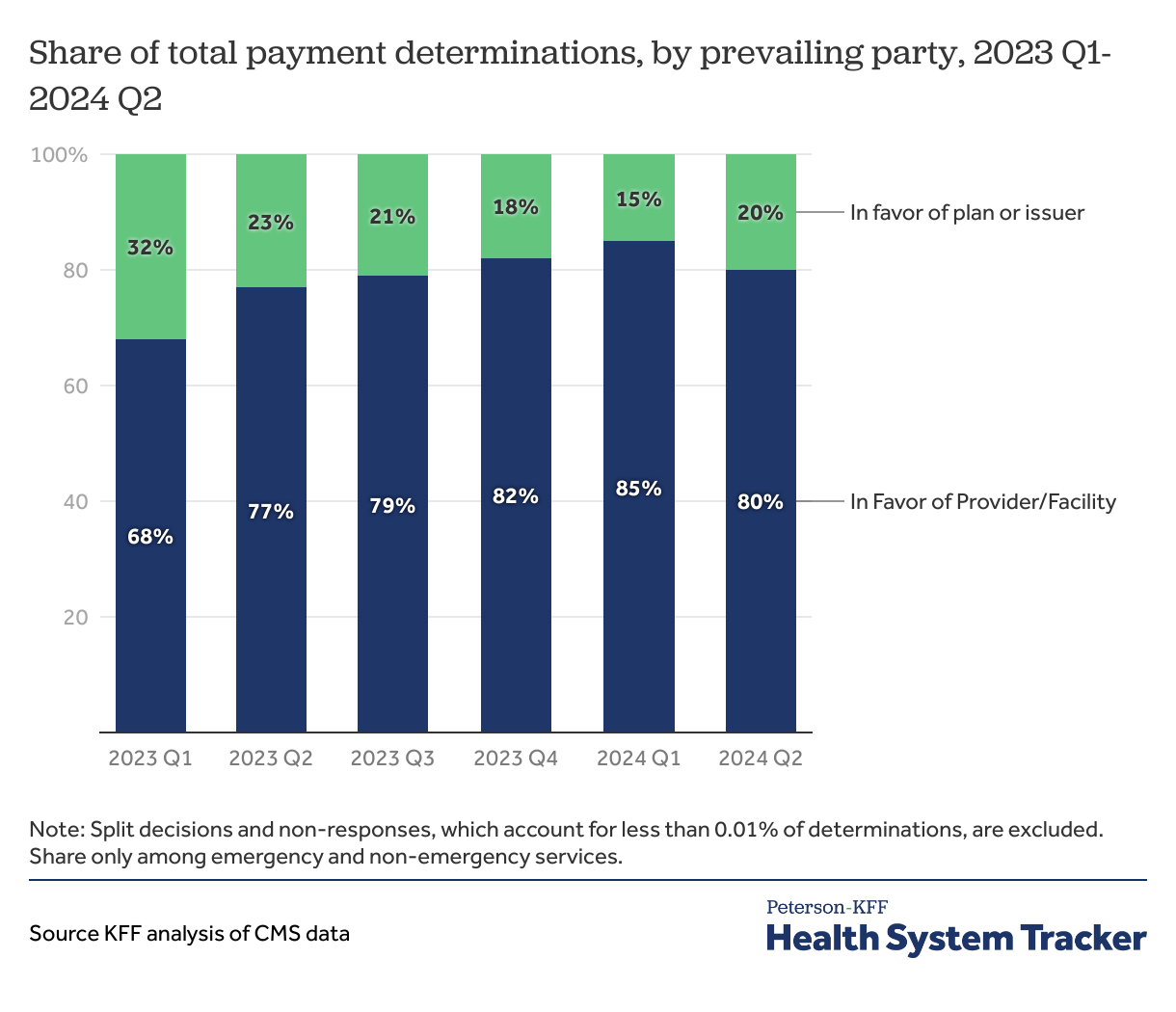

The share of quarterly payment determinations in which providers prevailed grew over the course of 2023. In the first quarter of 2023, providers won 68% of disputes, but by the first quarter of 2024, they prevailed in 85% of disputes.

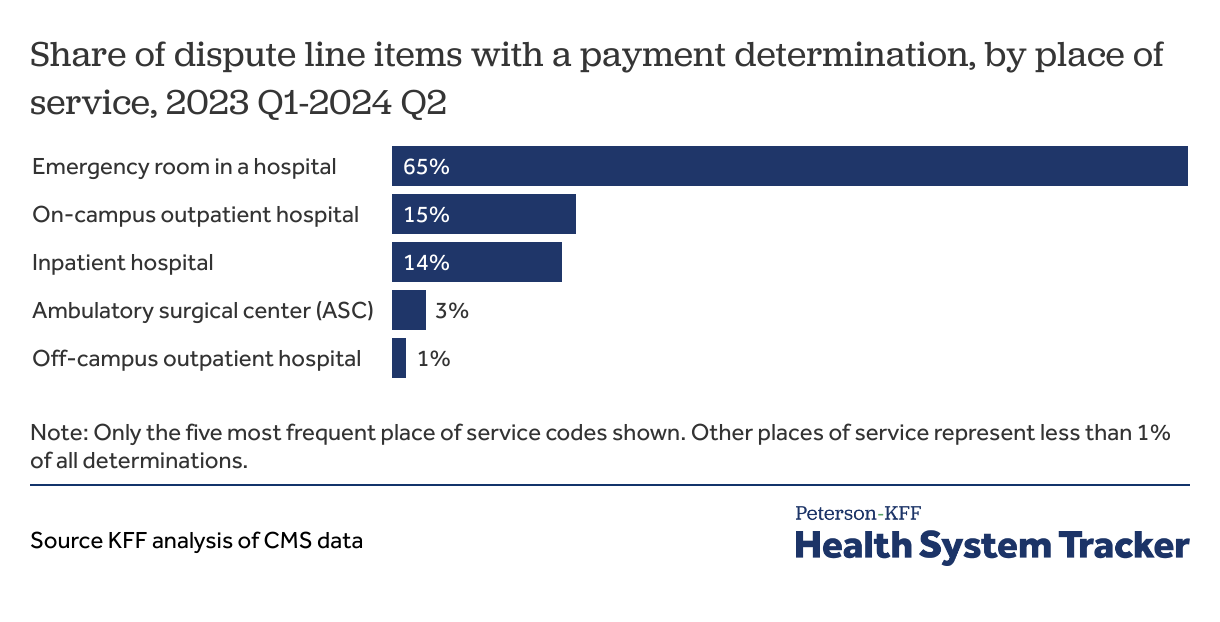

Nearly two in three disputed services were related to care delivered in an emergency room

Nearly two in three disputed services involved care that was furnished in an emergency room. The law protects patients from balance billing if they receive emergency services from an out-of-network provider or out-of-network facility. It is estimated that nearly one in five people (18%) receive at least one out-of-network charge after an emergency room visit from either a provider or the facility.

Under the NSA, a qualifying facility is defined as an in-network hospital, freestanding emergency department, ambulatory surgical center, or certain urgent care centers. For non-emergency services, patients are only covered under the NSA against surprise bills provided at in-network facilities. Other places consumers frequently receive health care services, such as medical offices or birthing centers, are not subject to the law or eligible under the IDR process. In such cases, consumers are not protected from surprise billing.

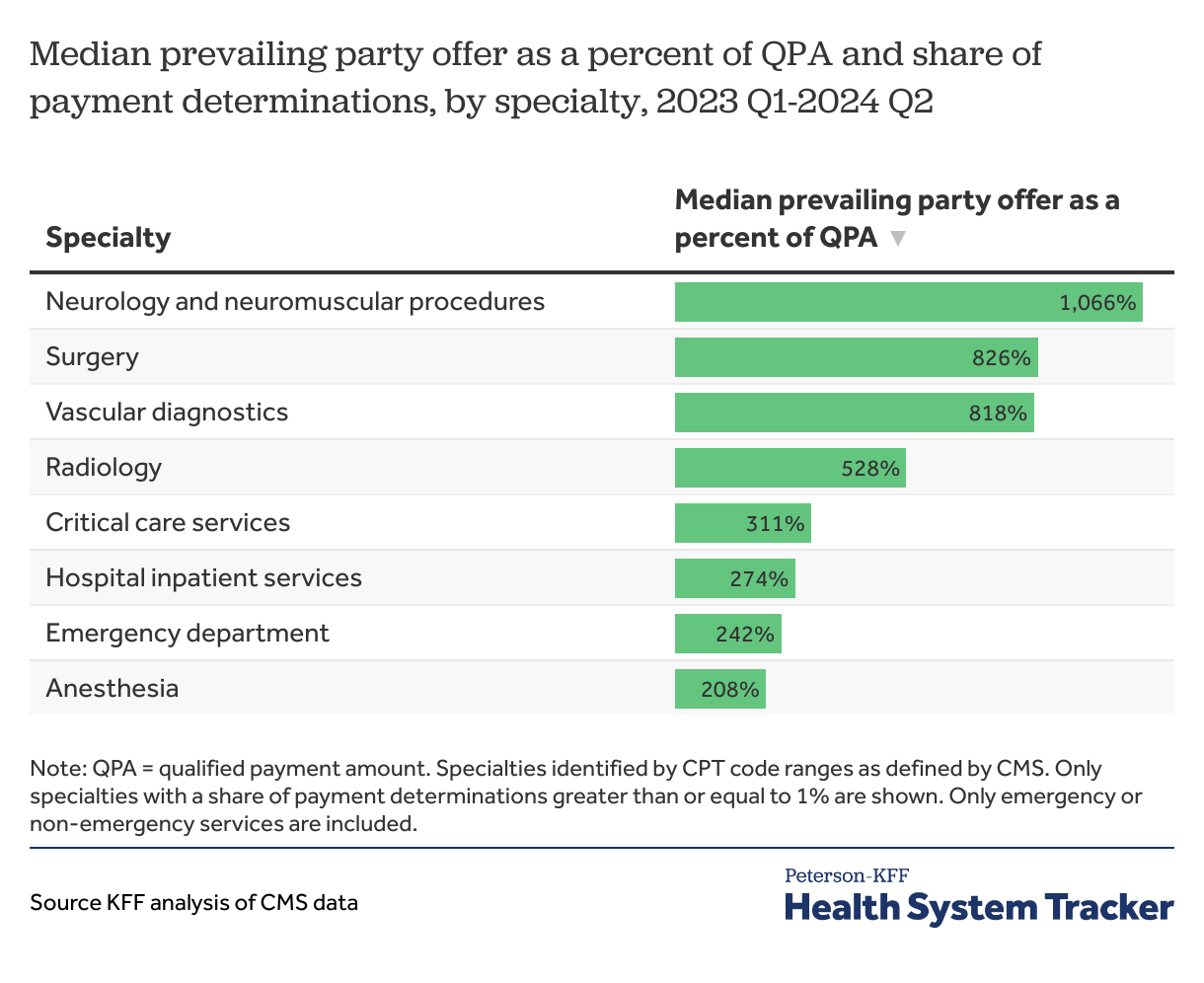

Across all specialties, payment determinations exceeded the median in-network rate

While providers won most disputes across the board, the extent to which the final offer exceeded the QPA varied by specialty. For instance, the median payment determination among disputes involving neurology and neuromuscular procedures was over ten times the QPA through the first half of 2024. Meanwhile, the median payment determination among disputes involving anesthesia services was about two times the QPA.

The QPA has been the subject of scrutiny from the provider community, which argues that the NSA and related rules and regulations concerning the calculation and weight of the QPA in arbitration give an unfair advantage to insurers. In most cases, the district and federal courts have sided with providers and have issued rulings that vastly reduce the weight of the QPA in the arbitration process, while allowing arbitrators to evaluate provider offers as well as other factors for the price of their services and items.

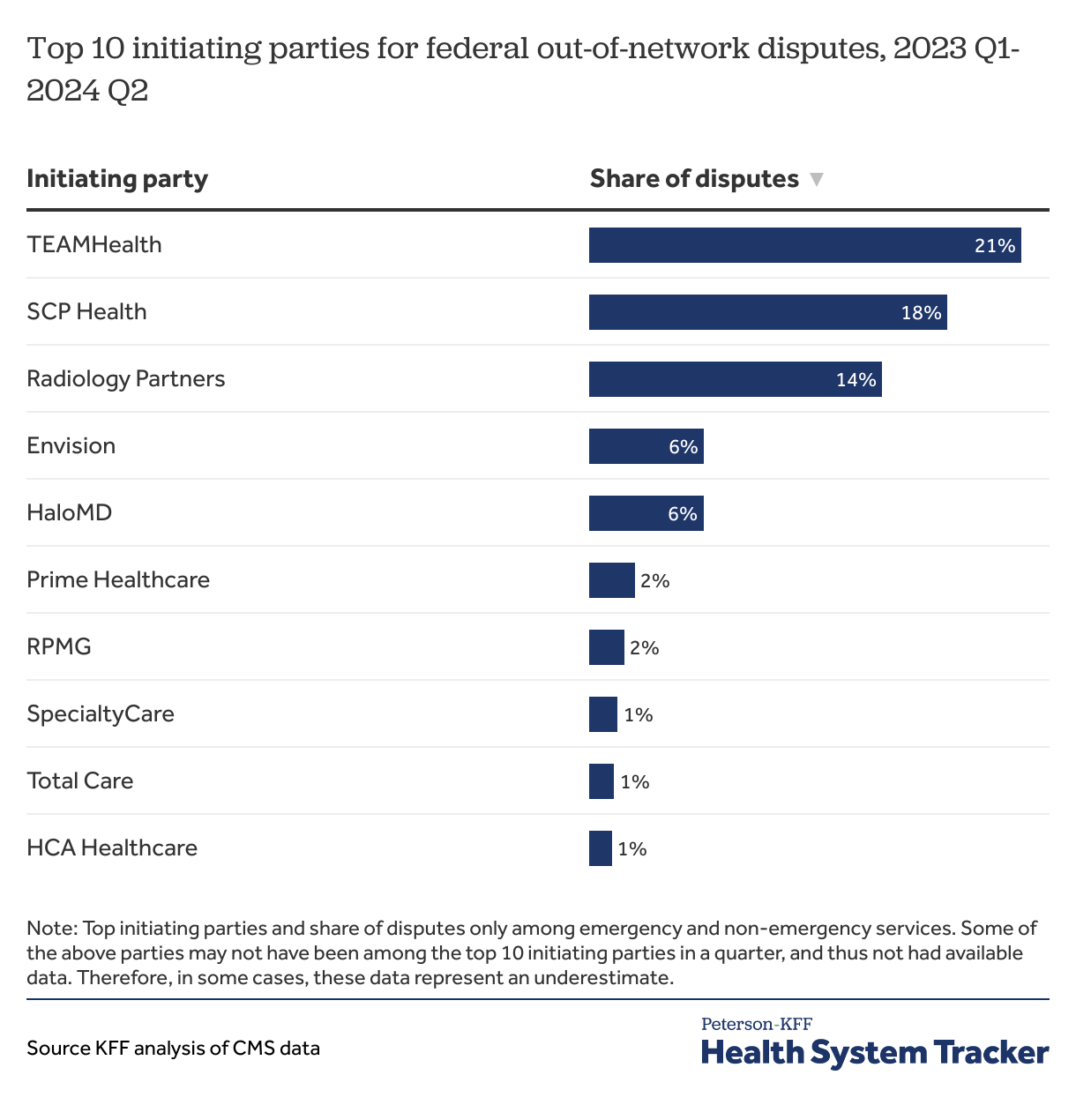

The top 10 initiating parties account for seven in ten initiated disputes

The top 10 dispute-initiating parties are all providers or their billing consultants, and they submitted 72% of the out-of-network payment disputes from 2023-mid-2024. The top three parties accounted for 53% of payment disputes from the beginning of 2023 through mid-2024: TEAMHealth, SCP Health, and Radiology Partners, all of which are backed by private equity firms. Private equity is a form of corporate ownership that often entails relying on loans to acquire a business, taking it private (if not so already), and attempting to increase its value with the goal of selling it at a profit, typically within a short period of time. Private equity in health care has come under intense scrutiny in recent years, with concerns about its role in provider consolidation and high prices. All ten of the top ten initiating parties are affiliated with private equity.

Fewer than 1% of disputes were initiated by insurers, with no single insurer being represented in the top 10 initiating parties. Among non-initiating insurers, the top three in 2023 and half of 2024 were UnitedHealthcare, MultiPlan, and Aetna.

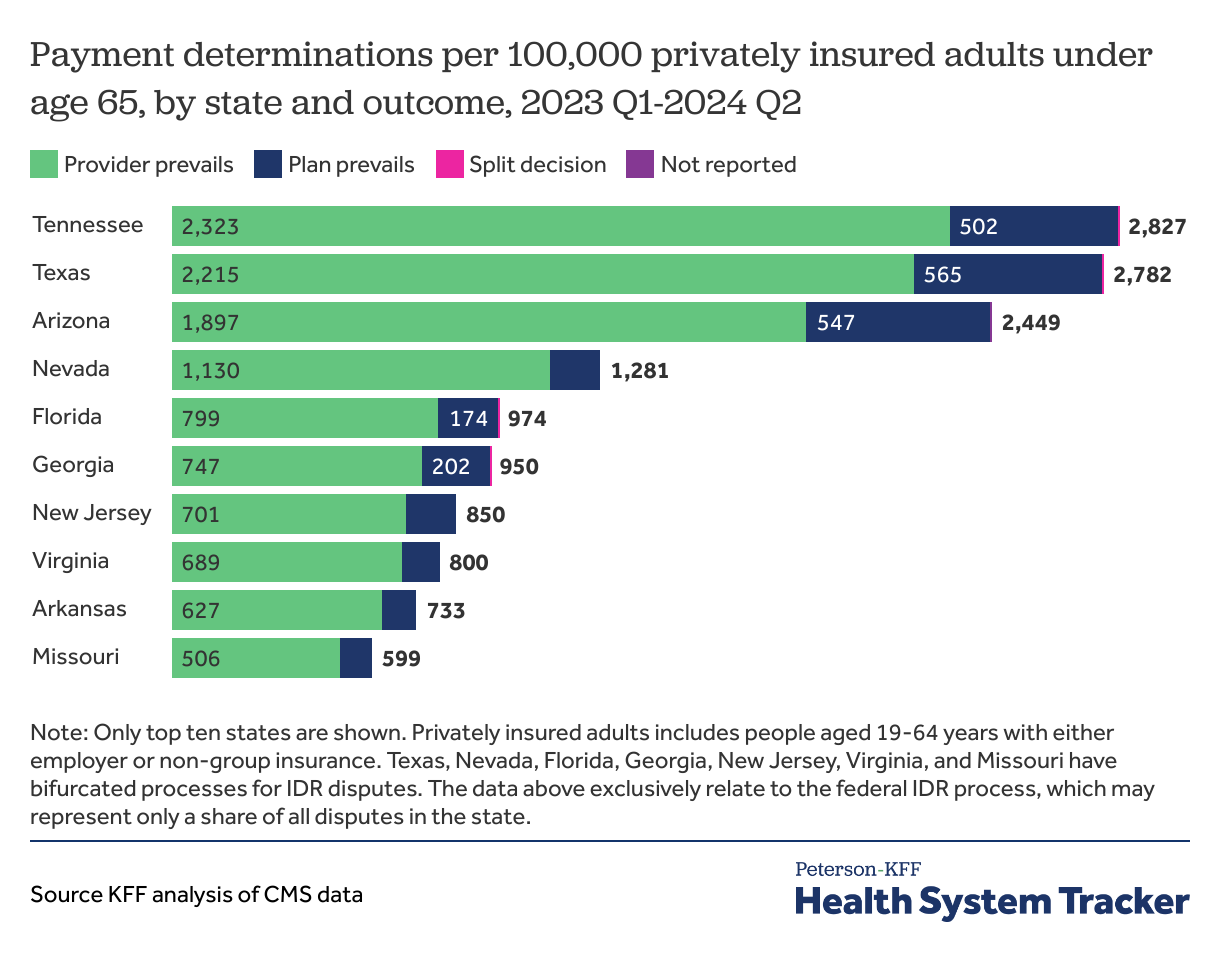

Tennessee, Texas, and Arizona have IDR payment determinations that are at least twice that of other states

Tennessee, Texas, and Arizona have by far the highest rate of payment determinations per 100,000 privately insured adults under age 65 (2,827, 2,782, and 2,449 determinations per capita, respectively).

Tennessee’s rate of payment determinations where the provider prevails is greater than any other state’s rate by nearly 5%. However, Tennessee’s rate of payment determinations where the plan prevails is less than that of Texas or Arizona. Of note, TEAMHealth, a national physician staffing and revenue cycle management entity that initiated the single most disputes from 2023 through mid-2024, is based in Tennessee.

Additionally, Texas is among the 22 states that have specific state laws about resolving payment disputes between providers and insurers under state-regulated insurance plans (including non-group plans and fully-insured employer plans). However, the federal IDR process still applies in these states when the scope of the law is more limited than the NSA, or if the state does not have an established dispute process. Health plans subject to ERISA (including self-insured health plans sponsored by private employers, which covered 63% of workers with employer-sponsored coverage in 2023) generally fall under federal jurisdiction for payment disputes. Texas, as well as some other states with high rates of payment determinations, have bifurcated processes in which jurisdiction of the IDR enforcement is split between state and federal government. The data above represent only federal disputes. In states where there are bifurcated processes, these data may represent only a portion of all disputes.

Implications for Prices and Consumers

Following the passage of the NSA, legal challenges, temporary suspensions, and delays in the IDR process have complicated the implementation. Providers and payers describe confusion over implementation, oversight, and enforcement. Despite these challenges, 2023 and the first half of 2024 saw a high volume of disputes initiated through the IDR process, with providers increasingly winning disputes each quarter.

There is much speculation about the reason for the high win rate among providers. One reason could be how IDR entities weigh the median in-network rate (QPA) submitted by insurers versus other information submitted by providers such as prior contracted rates, which IDR entities are required to consider. Notably, private equity-backed provider groups have historically been able to negotiate for above-average contracted rates, and account for a disproportionate share of initiated disputes. Another reason for these win rates could be that the initial offer from providers may be closer to pre-NSA out-of-network allowed amounts, and IDR entities weigh this heavily.

However, some providers (including Radiology Partners, a top 10 initiating party) have speculated that the QPAs are being artificially deflated by insurers as they include rarely or never-used reimbursement rates in their calculations and are not indicative of the actual rates paid to providers.

The issue of the weight of the QPA in the dispute resolution process, the subsequent litigation, and high provider win rate have contributed to the increased tensions between providers and insurers during contract negotiations. Both providers and insurers state that the payment rate offered to providers to remain in-network is lower than before the NSA, and refusal to accept those rates often leads to contract terminations. While some providers have moved in-network at these lower rates, specialty providers, who account for a greater share of the disputes, are much less willing to accept lower-than-market rate prices to remain in-network.

A high provider win rate provides an incentive for specialty providers and those who can afford it to remain out-of-network, especially given that the final payment amount adjudicated is often equal to the provider’s initial offer. Such providers with access to greater capital can absorb the cost of implementing the IDR process and the delay in final payments, remain out-of-network, and recoup the cost by setting higher prices.

Beyond the various legal challenges to the NSA, recent changes to agencies tasked with overseeing the IDR process and enforcement, including mass layoffs, also call the future of the IDR process into question. Nevertheless, despite ongoing legal issues regarding the NSA and outstanding questions regarding how it will affect costs and access in the future, patients remain protected from some balance billing. However, the downstream effects of the IDR process may impact patients through changes in in-network cost sharing, network breadth, or monthly premiums.

Methods

Data from CMS’s Independent Dispute Resolution reports are used for this analysis. Data are aggregated for emergency and non-emergency services while air ambulance services were excluded. In total, CMS reports 1,243,621 disputes initiated between January 1, 2023, and June 30, 2024, of which 739,250 disputes were closed. These closed disputes include 897,689-line items for emergency and non-emergency services. CMS releases two different line-item-level files quarterly. The first contains service code (CPT or HCPCS), disputing party identity, and dispute outcome. The second includes the service code, the geographic region, dispute party offer information, and dispute outcome information. Dollar amounts are suppressed by CMS for services with fewer than 10-line items in a geographic region and quarter. Given that there is no shared variable across these two files, it is not possible to merge them. CMS also reports Supplemental Tables quarterly, which contain limited information about dispute initiation, such as initiations by state, party, outcome, and service category.

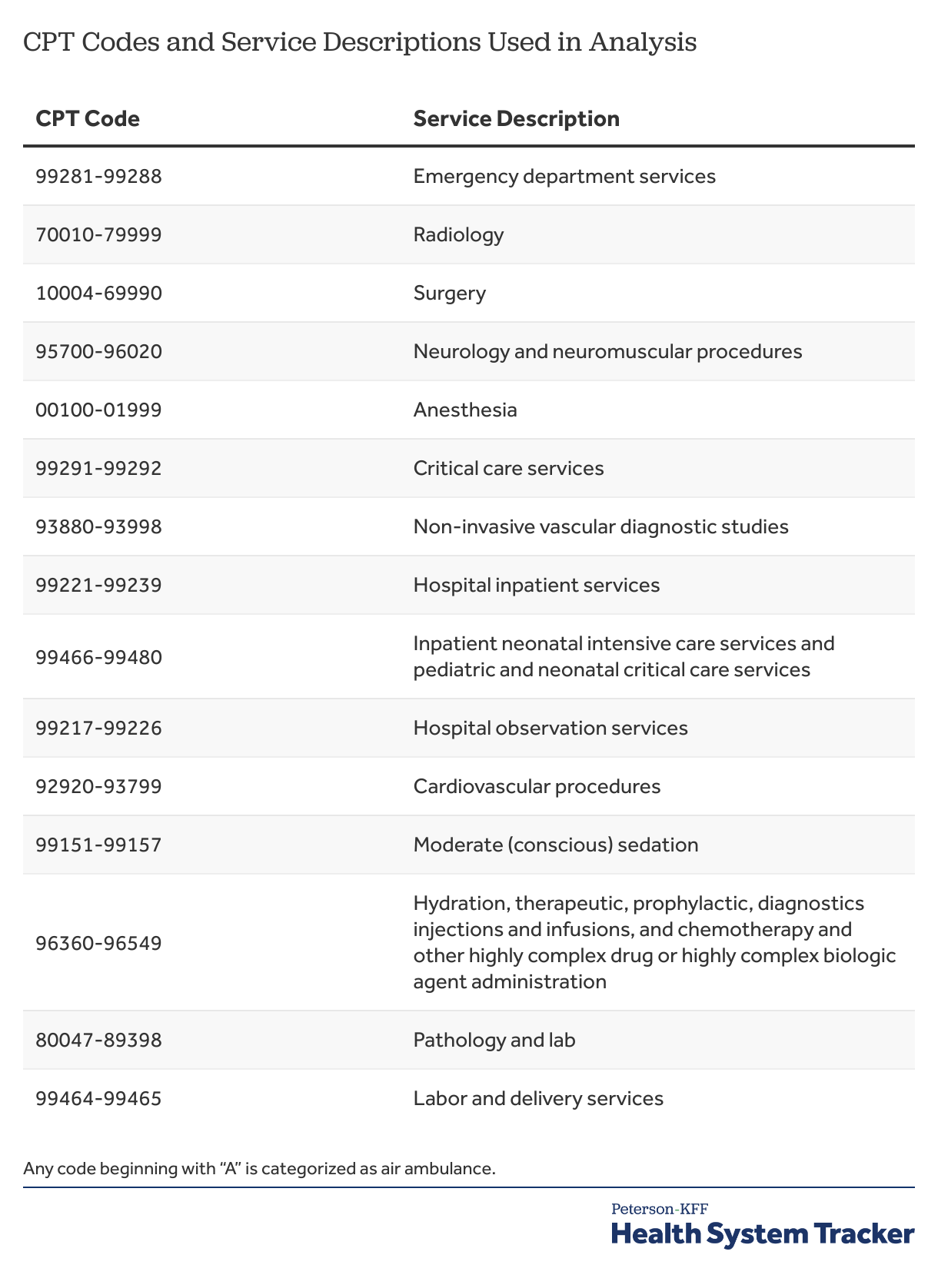

The first chart in this analysis pertains to dispute initiation and the others pertain to closed disputes with a payment determination. When aggregating payment determinations by place of service and state, only the top five entities are shown. The rate of payment determinations by state was calculated using the population ages 19-64 with private insurance in 2023, according to KFF analysis of the American Community Survey. When examining payment determinations by specialty, CPT codes following CMS’s definitions are used to categorize services by the following:

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.