The Affordable Care Act (ACA) enhanced premium tax credits expired on January 1st, 2026, causing premium payments to increase significantly for many Americans enrolled in ACA exchange plans. The Congressional Budget Office (CBO) projected that a permanent extension of the enhanced tax credits would increase the number of people with health insurance by 3.8 million in 2035. Without the extension, the CBO anticipated insurers on the individual market would raise rates with the expectation that some healthier people would drop coverage rather than pay a significantly higher monthly amount. The total number of people who have enrolled in the ACA Marketplaces and paid for at minimum one month of coverage won’t be available until the summer of 2026.

To keep the same plan as last year, KFF estimates that enrollees’ contributions to their premium payments will increase by an average of 114%, net of premium tax credits. According to a recent KFF poll, most Marketplace enrollees are expected to maintain some form of health insurance coverage in spite of rising premiums payments and, so far, available data suggests that signups remain strong. However, 70% of respondents stated that, if premium payments for their current coverage doubled, they would likely look for a different Marketplace plan with a lower premium and higher out-of-pocket expenses. Enrollees could generally find a less expensive premium by switching to a lower metal tier plan with a higher deductible. This brief explains the tradeoffs that exist when individuals switch between silver and bronze plans.

Background on ACA Premium Tax Credits

In 2025, 93% of Marketplace enrollees received some form of premium tax credit subsidizing their coverage. Among enrollees who receive advance premium tax credits (APTCs), the average monthly gross premium (the total premium including both the enrollee portion and federal subsidy) was $619, but the average subsidized enrollee paid only $74/month after APTCs.

In 2026, the average monthly gross premium for a benchmark (second-lowest cost) silver plan is $625, and the average gross monthly premium for an individual’s lowest-cost bronze plan option is $456.

With the enhanced tax credits in place, Marketplace enrollees making between 100%-150% of the federal poverty level were eligible for a fully subsidized benchmark silver plan. Prior to the availability of the enhanced APTCs, enrollees making just above the poverty level were expected to contribute about 2% of their household income towards a benchmark plan. As the enhanced premium tax credits have expired, those in this income bracket again will again pay around 2% of their income for coverage.

Background on ACA Metal Tiers

Health plans available for sale in the ACA Marketplace are tiered by actuarial value – also called “metal levels” – or the average amount of expected expenses that the plan will cover for a typical enrollee. Gold plans have high premiums but cover health costs with low out-of-pocket payments from the enrollee. Silver plans are the most common with approximately 70% actuarial value (the typical amount of medical expenses annually paid by the plan), then bronze with around 60% AV. Although bronze plans would generally cover a smaller portion of total health expenses, as high deductible health plans, they additionally offer tax advantages through health savings accounts.

In 2025, about 56% of Marketplace enrollees chose a silver plan. Bronze is the second most common plan choice, with 30% of Marketplace enrollees choosing a bronze plan.

Under the enhanced premium tax credits, people who earned under 150% of the federal poverty level could qualify for zero-premium silver plans. When taken as an APTC, the subsidy is applied to the premium at the time of payment, reducing the monthly out-of-pocket expenditure for premiums. In the absence of enhanced APTCs, these people may still qualify for zero-premium bronze plans. However, switching to a bronze plan comes with tradeoffs, particularly when it comes to cost sharing.

Some proposals by lawmakers to extend the enhanced tax credits have included a minimum premium payment provision, where individuals must make a set nominal payment per month (such as $5) to receive the tax credit, regardless of plan metal level. These provisions aim to reduce improper enrollments, though whether they will be included in any proposal that receives a vote in Congress remains uncertain.

Cost Sharing

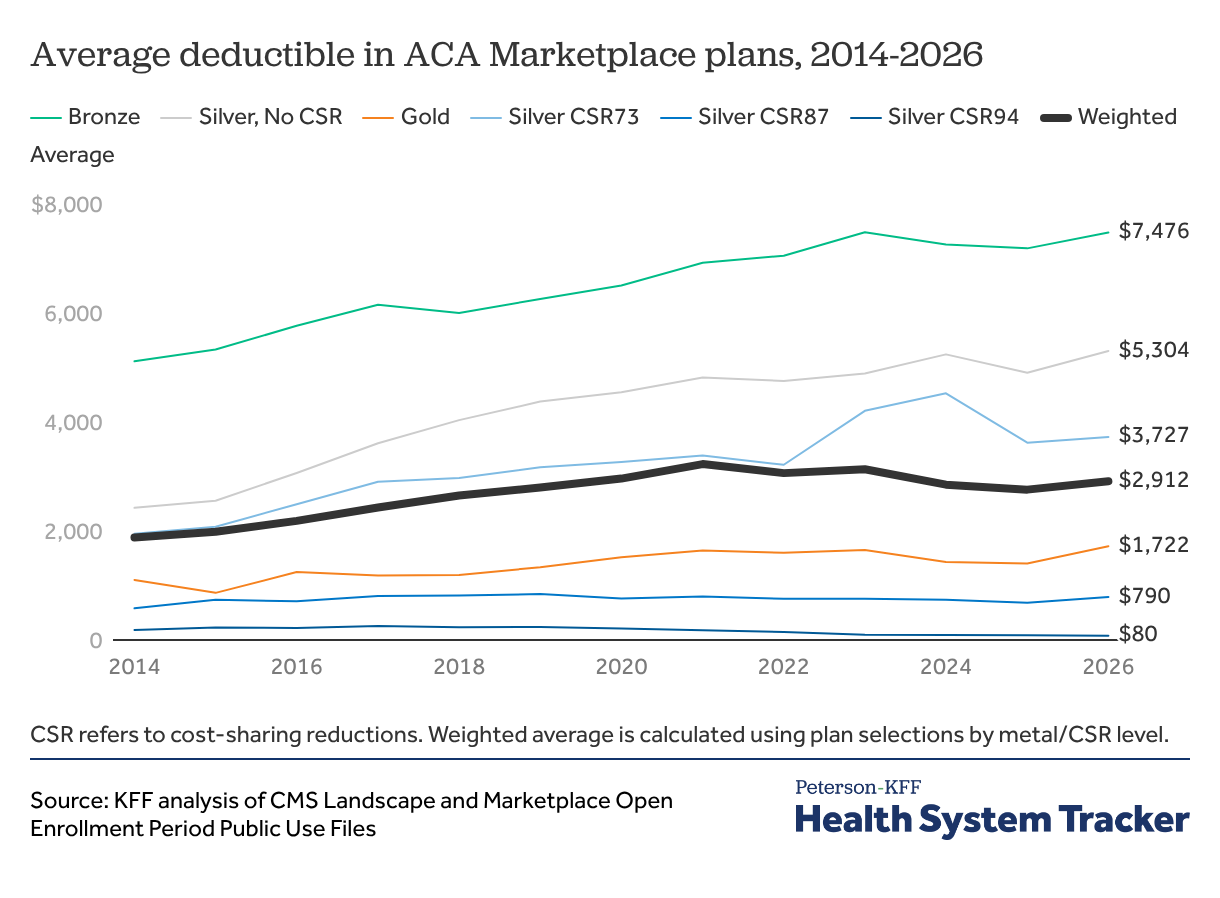

In 2026, the average deductible is $5,304 for a silver plan and $7,186 for a bronze plan. However, cost-sharing reductions (CSRs) decrease the amount of cost sharing (deductibles and copays/coinsurance) individuals must pay when they use care. Enrollees with an income below 250% FPL can receive some level of CSR when they purchase a silver plan, increasing the actuarial value to a level comparable with or better than higher metal levels. Bronze plans are not eligible for CSR. In 2025, 53% of Marketplace enrollees received some form of CSR subsidizing their coverage

The average benchmark silver plan deductible in 2026 is reduced from $5,304 to $80 for those with incomes below 150% of the federal poverty level, $790 for those with incomes between 150% and 200% of poverty, and $3,727 for those with incomes between 200% and 250%.

Plan Switching

If an individual keeps their plan from 2025, they can expect the amount they pay each month in premiums net of tax credits to increase by 114%. Most individuals (56%) were enrolled in a silver plan in 2025.

However, if an individual switches from a CSR-eligible silver plan to a bronze plan, they may pay a lower or even a $0 premium. However, the loss of CSR and the higher cost-sharing associated with a bronze plan may leave them worse off financially, depending on care utilization. Enrollees are not allowed to switch plans during the plan year without a special enrollment period, which means enrollees in bronze plans who need more care than expected mid-year cannot then enroll in silver plan to reduce their out-of-pocket expenditure.

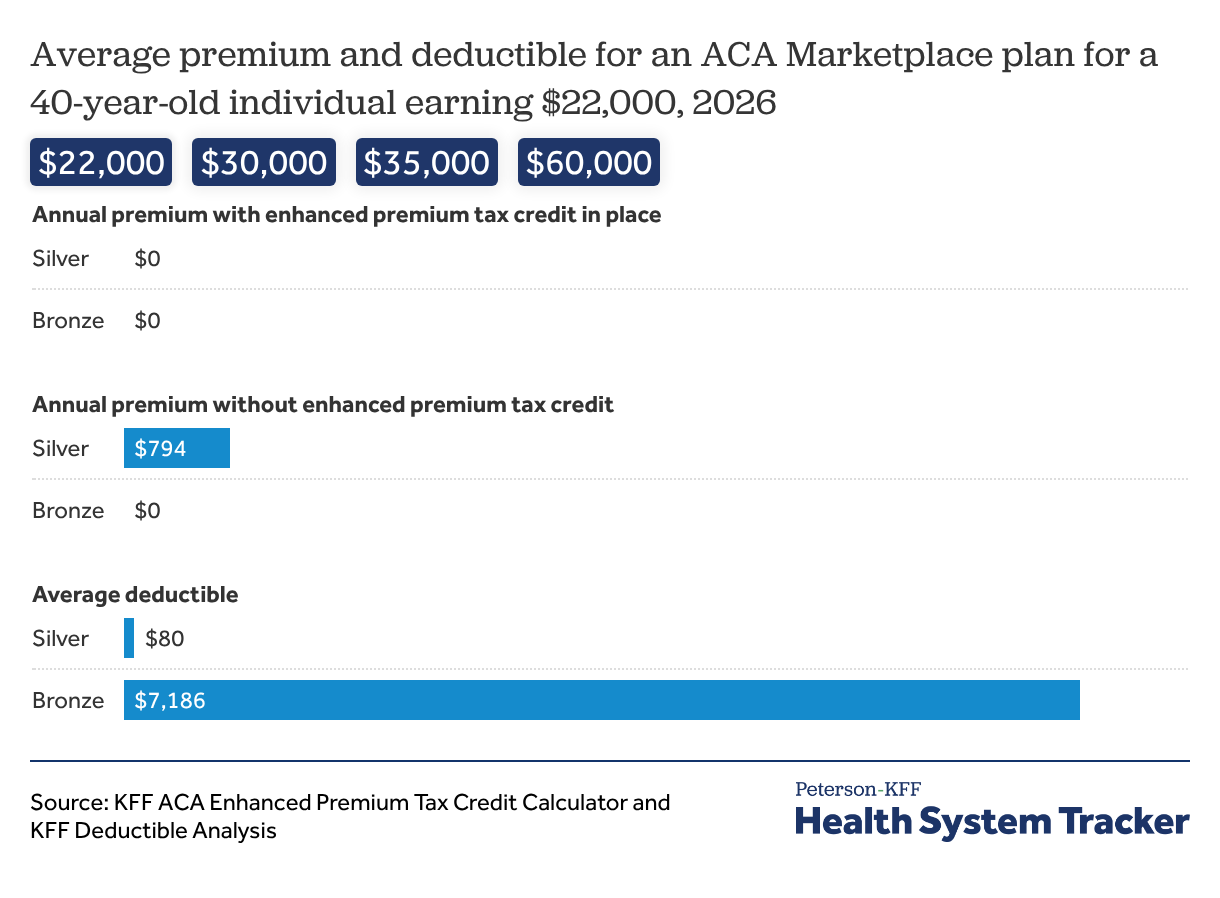

For example, a 40-year-old individual who earns $22,000 per year (141% of the federal poverty level) would have qualified for a $0 premium silver plan under the enhanced tax credits in 2025. Additionally, based on their income, this person would qualify for CSRs with a silver plan, reducing their 2025 annual deductible to an average of $80. Without the enhanced APTC in 2026, however, their annual premium cost would be $794 for a silver plan, though they will still be eligible for CSRs for their deductible and other cost sharing. A person in this situation may see that their premium cost for a bronze plan would still be $0 annually and choose to switch. However, a bronze plan is not eligible for CSRs, and the average deductible for a bronze plan in 2026 is $7,476. The cost for most hospital stays – including for routine cases such as pregnancy and delivery – typically well exceeds this number, which would mean an individual would need to pay their entire deductible in these scenarios. If this individual ends up with more than $874 in health costs annually (the average annual silver premium plus the $80 average silver plan deductible with CSR for 2026), they may be better off with a silver plan, even with monthly premium payments. While some people with chronic conditions know they will have substantial health expenses, many people cannot anticipate their health needs in advance.

Individuals who earn more than 150% but less than 250% of the federal poverty level were required to contribute towards their premium for a silver plan under the enhanced tax credits, but face a significantly higher premium after their expiration. These individuals may also be forced to consider switching to a low- or no-premium bronze plan, sacrificing CSR eligibility and facing a significantly higher deductible.

Of adults who qualified for a free silver plan with enhanced premium tax credits, almost all (98%) would still qualify for a free bronze plan without enhanced premium tax credits. Among these enrollees, over a quarter are in Florida or Texas. States that have not expanded Medicaid generally have higher proportions of individuals that may gain coverage through free bronze plans, since low-income enrollees making up to 138% of poverty are not eligible for Medicaid. Nationwide, enrollees making between 100%-150% of poverty accounted for 45% of all ACA Marketplace enrollees.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.