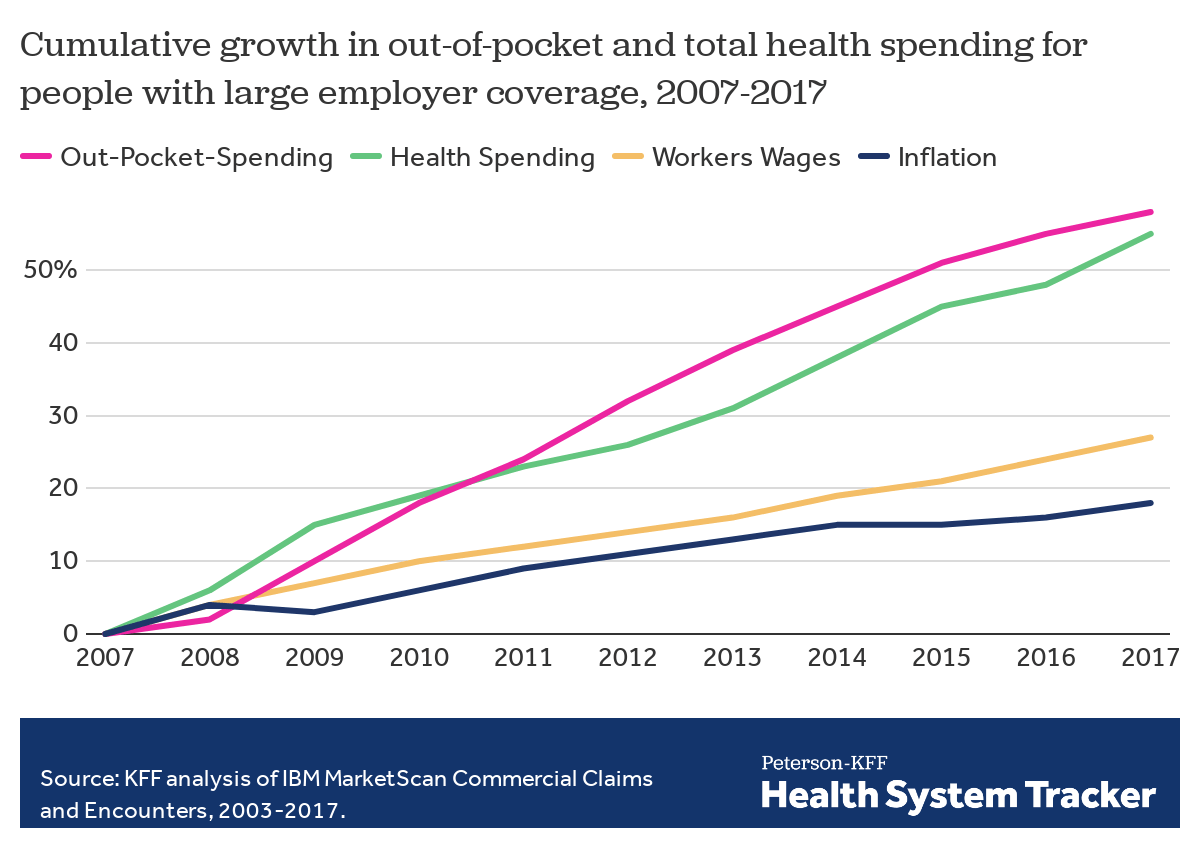

As health costs rise, enrollees in large employer plans face higher health spending both through rising premium contributions and increased cost-sharing when they use services. On average, health spending by families with large employer health plans has increased two times faster than workers’ wages over the last decade. This increase has been driven in part by rising deductibles, which are an increasingly prominent feature of many employer plans.

This brief examines trends in employee spending on premiums, deductibles, copayments, and coinsurance over time. We analyzed a sample of health benefit claims from the IBM MarketScan Commercial Claims and Encounters as well as the Kaiser Family Foundation’s Employer Health Benefits Survey.

Total family health spending

Family health spending includes both premiums and the cost-sharing charged when an enrollee uses services. Cost-sharing, or out-of-pocket spending, takes the form of deductibles, copayments and coinsurance, and can vary widely based on an enrollee’s plan and utilization. To look at both premiums and cost-sharing payments together, we added the average family premium for a family of four for those with employer coverage to the average cost-sharing for a worker, spouse and two children. This provides a fuller picture of the impact of healthcare on a household’s budget.

For most of those with employer coverage, the cost of the premium is split between the employer and employee. Looking only at the health spending for which workers are responsible (their families’ premium contributions and cost-sharing payments), the average family spent $4,706 on premiums and $3,020 on cost-sharing, for a combined cost of $7,726 in 2018. This represents an 18% increase in the health costs borne by employees and their families from five years earlier ($6,571 in 2013), outpacing the 8% increase in inflation and a 12% increase in workers’ wages over the same period.

Total health spending by and on behalf of a family of four with employer coverage tops $22,000, on average

As a result of increases in both premiums and out-of-pocket spending, average combined health spending by families and their employers has grown over time. Over the last decade, health costs incurred by families covered by large employers – including premium contributions and out-of-pocket spending on health services – has increased 67% from $4,617 to $7,726. Over the same decade, average health costs paid on behalf of workers by large employers in the form of premium contributions for family coverage increased 51% from $10,008 to $15,159.

Read more from

Employer-based coverage affordability

On average, employees of large firms contribute about a third of the total cost of covering themselves and their families (34%), with employers picking up the reminder. In 2018, workers contributed about 20% of the total cost through their families’ premium contributions and an additional 13% in the form of cost-sharing. A decade ago the typical family covered 32% of the total cost of their coverage.

On average, families cover about a third of total health spending, including their premium contribution and out-of-pocket costs

In comparison to cost-sharing, premium contributions are less visible to families and more consistent, usually coming in the form of regular payroll deductions, rather than a payment when a family member needs services. Over the last decade (from 2008 to 2018), the average premium for families with large employer health coverage has increased 55%, and average cost-sharing for a family increased 70%.

Looking specifically at the total cost for the family, both through higher average premium contributions and higher average cost-sharing, families contribute 67% more to their health benefits than they did a decade ago, while employers contribute 51% more in premium contributions. Meanwhile, wages have increased 26%.

Both employer and employee spending on healthcare has increased faster than workers’ wages

Cost-sharing in large employer plans

One way to measure the generosity of health insurance is actuarial value: the percentage of the total average cost for covered benefits that a plan pays. Generally, a higher actuarial value indicates a health plan is shouldering more of the cost of care. On average, employer plans cover 85% of enrollees’ in-network expenses in 2017, leaving plan enrollees to cover the remainder in cost-sharing. Since 2003, employer plans have covered between 85% and 86% of enrollee costs.

On average, large employer health plans are paying a greater share of prescriptions drug costs than a decade ago

While the actuarial value of large employer plans has remained relatively consistent in recent years, there have been changes in the share of specific services covered by insurance. On average, plans cover almost 10 percentage points more of the cost of prescription drugs than they did ten years ago and a relatively lower share of outpatient visits. With many new high-cost drugs available, some enrollees may hit their out-of-pocket maximum on prescription drug spending, meaning the health plan picks up a larger share of the cost. One important limitation of the MarketScan database is that it contains the retail cost for prescription drugs and does not include information about the value of rebates that may be received. Some prescriptions may be accompanied by substantial rebates (e.g., insulin), while prescriptions for some other drugs, such as sole-source drugs, may not result in any rebates.

Out-of-pocket costs continue to grow faster than workers’ wages.

While plans continue to cover a significant share of enrollees’ health costs, out-of-pocket spending for enrollees continues to rise. Over the last ten years, average enrollee out-of-pocket spending has grown 58%, more than double the increase in workers’ wages during the same period. As health spending absorbs a greater portion of household budgets, there are questions about the long-term affordability of some employer plans. Out-of-pocket spending averaged $779 in 2017 compared to $493 in 2007.

Health spending nears $6,000 per person, among people with large employer coverage

General annual deductibles are the amount enrollees must pay out-of-pocket before most services are covered by a health plan. Plans are required to cover some services, such as preventative care, before the deductible and in some cases plans elect not to apply the deductible to services, such as prescription drugs or physician office visits. After enrollees have met their deductibles, most must also pay a copayment (a specified dollar amount) and/or coinsurance (a percentage of the cost of the care they use) at the point of healthcare service.

Over time, there has been a significant increase in both the share of workers with a general annual deductible and the average deductible for those who have one. Analysis of claims data allows us to look beyond changes in the plan designs and focus on the out-of-pocket liability that plan enrollees are incurring.

Deductibles now account for over half of enrollee cost-sharing payments

Deductibles accounted for 26% of cost sharing payments in 2007, rising to more than half in 2017. Conversely, copayments accounted for 46% of cost sharing payments in 2007, falling to 19% in 2017. The increase in coinsurance and deductibles may reflect the strong growth in plans that qualify a person to establish a health savings account; these plans by definition require a deductible and are more likely to have coinsurance than copayments for physician services. Unlike copays that build up over time, deductibles are required before the plan covers benefits, making patients more sensitive to the actual price of healthcare and potentially causing affordability challenges. Differences in the types of cost-sharing have impacts on how families budget for health costs through the year; on average spending on deductibles is highest at the beginning of the year and subsides after many of those with several healthcare visits a year hit their deductible for the year.

Deductible payments have grown more than ten times faster than inflation over the last decade

From 2007 to 2017, average spending toward deductibles and coinsurance among people with large employer coverage rose while the average spending in the form of copayments fell. From 2007 to 2017, average per person spending on deductibles rose 205% to $397, while average spending on copays fell by 35%, to $148. This reflects a trend of health insurance providers relying less on copayments, and more on deductibles and coinsurance. The decrease in average copay spending is driven by an increasing percentage of enrollees who have no copay spending all year (23% in 2007 compared to 44% in 2017).

On average, people with large employer coverage now spend almost $800 per year out-of-pocket

While average spending on copays is decreasing, the out-of-pocket cost an enrollee faces is still increasing. For example, while only 44% of general office visits have cost-sharing in the form of a copay in 2017, (compared to 70% in 2007), the average copay amount has increased from $21 dollars in 2007 to $27 dollars in 2017. Even when adjusting for inflation the average copay cost of an office visit is higher than it was ten years ago.

Discussion

The growth in out-of-pocket costs continues to outpace increases in workers’ wages, and while many employer plans cover a significant portion of health costs, the payments made by enrollees have increased significantly over the last decade. The average family in a large employer plan now faces over $3,000 in out-of-pocket costs per year and nearly $5,000 in premium contributions. Families with large employer coverage pay more than a third of the total cost of care in the form of premiums and out-of-pocket costs, averaging over $22,000 annually.

When considering the affordability of healthcare, it is important to put it in context with the relatively low increases in workers’ wages. Unlike premium contributions which impact most enrolled households, cost-sharing affects those with higher utilization of medical services more drastically. While average payments towards deductibles are still relatively low, they have increased considerably in the context of total household budgets. To people with employer coverage, deductibles are the most visible element of an insurance plan and can create financial hardships when a large expense must be met at once. Although health insurance continues to pay a large share of the cost of covered benefits, patients in large employer plans are paying more of their medical expenses out-of-pocket and contributions to their families’ premiums have increased.

Methods

We analyzed a sample of medical claims obtained from the 2003 – 2017 IBM MarketScan Commercial Claims and Encounters Database (MarketScan), which is a database with claims information provided by large employer plans. We only included claims for people under the age of 65 and people who were enrolled in a plan for more than half a year. Weights were applied to match counts in the Current Population Survey for enrollees at firms of a thousand or more by sex, age, state and whether the enrollee was a policy holder or dependent. Weights were trimmed at 8 times the interquartile range. This analysis used claims for almost 17 million people representing about 19% of the 86 million people in the large group market.

In the analysis of total health spending, out-of-pocket spending reflects the average spending of one worker, one spouse and two dependent children. Out-of-pocket spending excludes drug rebates, balance billing payments or health spending not covered by the plan. We estimated cost-sharing in 2018 by inflating 2018 spending by 4.5%, the increase in family health insurance premiums in 2018.

The employer and employee premium contributions are collected in the 2018 KFF Employer Health Benefits Survey and the 2005-2017 Kaiser/HRET Survey of Employer-Sponsored Health Benefits. The Employer Health Benefit Survey is a national probability survey of private and non-federal public employers with 3 or more employees. Contributions represent premiums or premium equivalents in the case of self-funded plans for a family of four. For more information see the Employer Health Benefit Survey. Dollars are not adjusted for inflation.

Another way in which employers contribute to the total cost is through account contributions such as to a Health Reimbursement Arrangement or a Health Savings Account. Assuming employers spend all the money they commit to an HRA each year, adding this spending increases the share contributed by employers by about a percentage point.

Actuarial values (AV) are calculated for in-network services. To confirm the robustness of our reported estimates we calculated AV for a combined in-network and out of network services (excluding any balancing billing). Including out-of-network spending, AVs are about one percentage point less and follow the same trend.

Average copay for an office visits refers to CPT codes 99201 to 99205 and 99211 to 99215. Visits with a total cost below $5 or in the 99.5 percentile were excluded.

Information on workers’ wages are from the Bureau of Labor Statistics’ Occupational Employment Statistics. Wages reflect average hourly earnings of production and nonsupervisory employees, total private, seasonally adjusted (April to April). Inflation is calculated using the Bureau of Labor Statistics Consumer Price Index, U.S. City Average of Annual Inflation.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.