The federal requirement that private health plans cover COVID-19 tests ordered or administered by a clinician at no out-of-pocket charge to consumers will end with the public health emergency (PHE) on May 11, 2023. During the PHE, private insurers were also required to reimburse for up to 8 at-home rapid tests per member per month starting January 15, 2022; this requirement will also end with the PHE. A temporary Medicaid coverage option adopted by 18 states and U.S. territories has given people without insurance access to COVID-19 testing services, including at-home tests, without cost-sharing; as this program ends with the PHE, they no longer have guarantees of free testing. More information on changes to test coverage resulting from the end of the PHE can be found here.

Though the vast majority of people with private health coverage will continue to have coverage for COVID-19 tests ordered or administered by a clinician, those tests may soon be subject to cost sharing (deductibles, copayments, and coinsurance), quantity limits, and prior authorization requirements. And, while some health plans may voluntarily continue to cover at-home tests, plans won’t be required by federal law to do so. Therefore, people with health insurance may face the full cost of tests, if those individuals are within their deductible, subject to quantity limits, denied coverage through prior authorization, or purchase an at-home test that is not covered through their insurance. People without health insurance will face the full cost of COVID-19 tests if performed in the typical clinical setting. Testing may still be available through free or community clinics, provided they continue past the end of the PHE.

In this analysis, we use various data sources to look at prices for COVID-19 tests performed in an outpatient clinical setting and at home. We examine commercial health plan payments for outpatient COVID-19 tests among people with large employer-based health coverage claims using 2021 Merative MarketScan data. We also look at self-pay cash prices (which would apply to uninsured people) for COVID-19 tests in the hospital price transparency data aggregated by Turquoise Health. Lastly, we review prices for rapid at-home COVID-19 tests available online from a sample of retailers. We do not look at the prices paid by Medicare or Medicaid programs using claims or hospital price transparency data.

We find that the median price of a COVID-19 test in an outpatient clinical setting was $45 in 2021 among people with large employer-based health coverage, though prices varied widely. Among hospitals disclosing price transparency data, the median discounted hospital-based self-pay rate was $51 for a COVID-19 antigen test (CPT 87426) and $91 for a PCR test (CPT 87635). We find that recent prices for at-home rapid COVID-19 tests average about $11 per test.

In outpatient clinical settings, COVID-19 test prices vary significantly

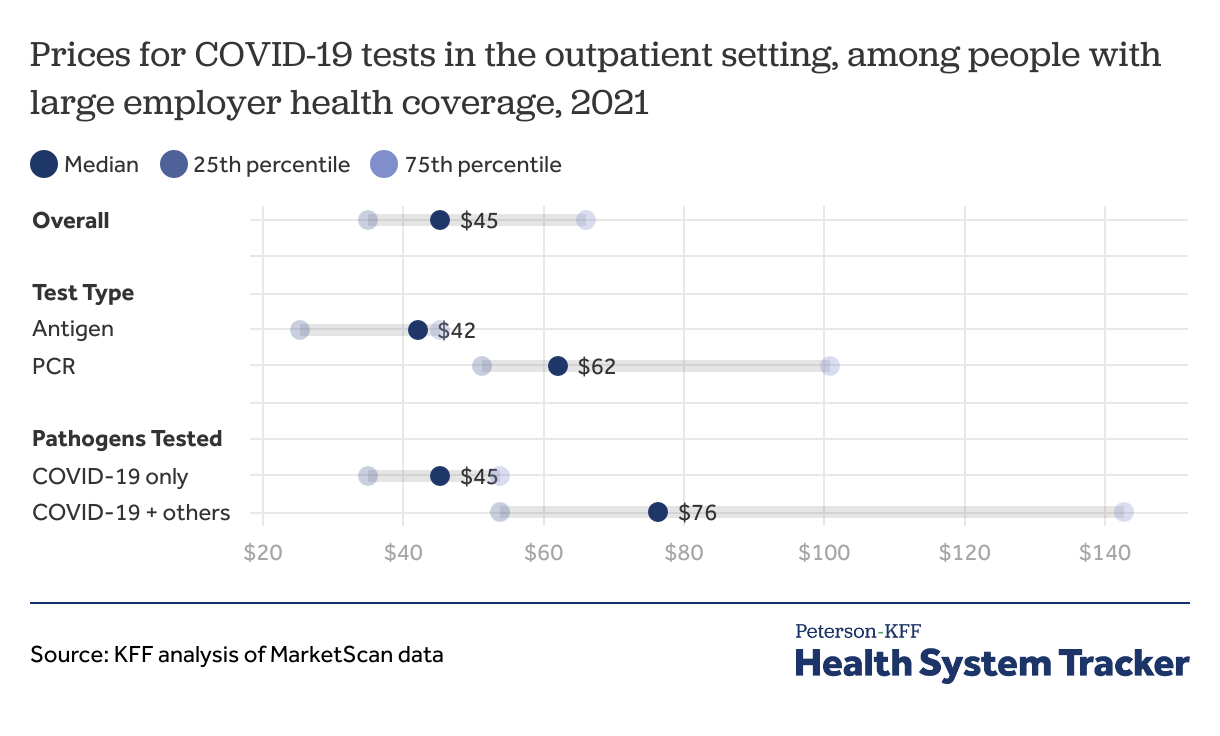

We reviewed variation in large employer health plan prices for COVID-19 tests (antigen or PCR) reported in 2021 MarketScan outpatient data. These were for the test itself in outpatient facility and professional claims and do not include any other cost associated with the test, such as the cost of a physician visit or a specimen collection fee. (In terms of visit costs, our earlier analysis found that the typical commercial health plan payment for a physician visit is $93 in-person and $94 by telehealth.)

Across all types of COVID-19 tests in the outpatient clinical setting, the median price was $45 in 2021 among people with large employer-based private health plans. Half of the prices fell between $35 and $66.

Factors that affected the price include the test type (antigen vs. PCR) as well as whether additional respiratory pathogens (e.g., influenza) were included as part of a test panel. However, prices also varied within various types of diagnostic tests. Generally, antigen testing was cheaper than PCR testing, with a median price of $42 for antigen testing compared to $62 for PCR testing. In this sample of large employer health plan enrollees, antigen tests comprised 60% of all COVID-19 tests ordered in 2021. When COVID-19 was part of a respiratory panel, the median price was $76 (testing for all pathogens combined) compared to $45 just for COVID.

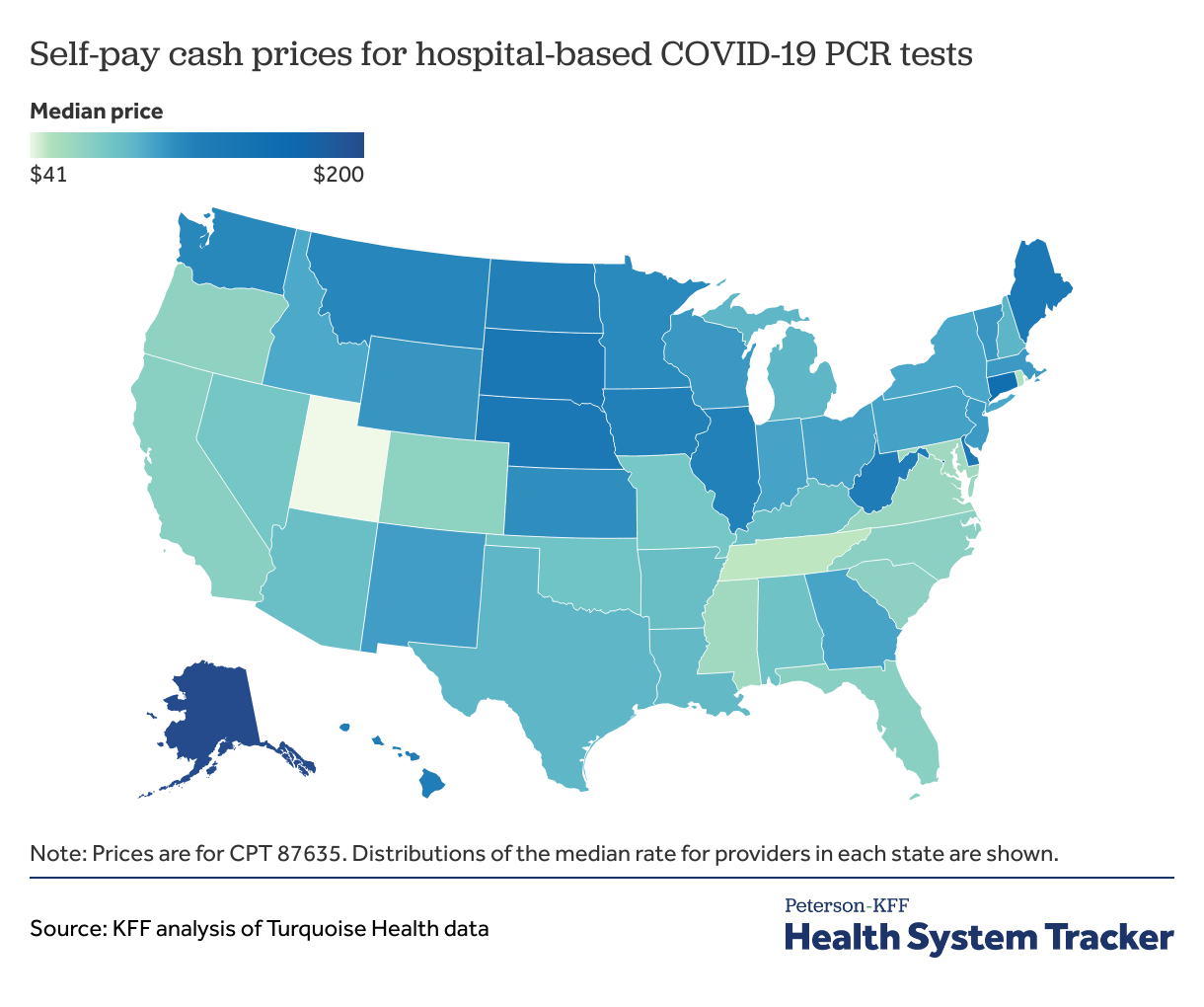

In hospital price transparency data, median self-pay rates for COVID-19 PCR tests vary widely by state

We also examined self-pay cash prices among hospitals whose hospital price transparency data were aggregated by Turquoise Health. These data are posted to comply with Centers for Medicare and Medicaid Services (CMS) price transparency requirements, and include reporting of cash prices, commercial negotiated rates, and list prices. Although not directly comparable to the large employer-based health plan prices, which are for tests conducted in the outpatient clinical settings, the self-pay rates give us an idea of what costs uninsured patients may be exposed to if receiving COVID-19 testing at a hospital or hospital-related outpatient setting. The median self-pay rate was $51 for a COVID-19 antigen test (CPT 87426) and $91 for a PCR test (CPT 87635).

Hospitals’ median self-pay rates varied by state. COVID-19 PCR testing was the most expensive in Alaska, with the median self-pay rate at $200, and least expensive in Utah, with the median self-pay rate at $41. Self-pay rates were not calculated by state for antigen tests since some states had very few hospitals reporting.

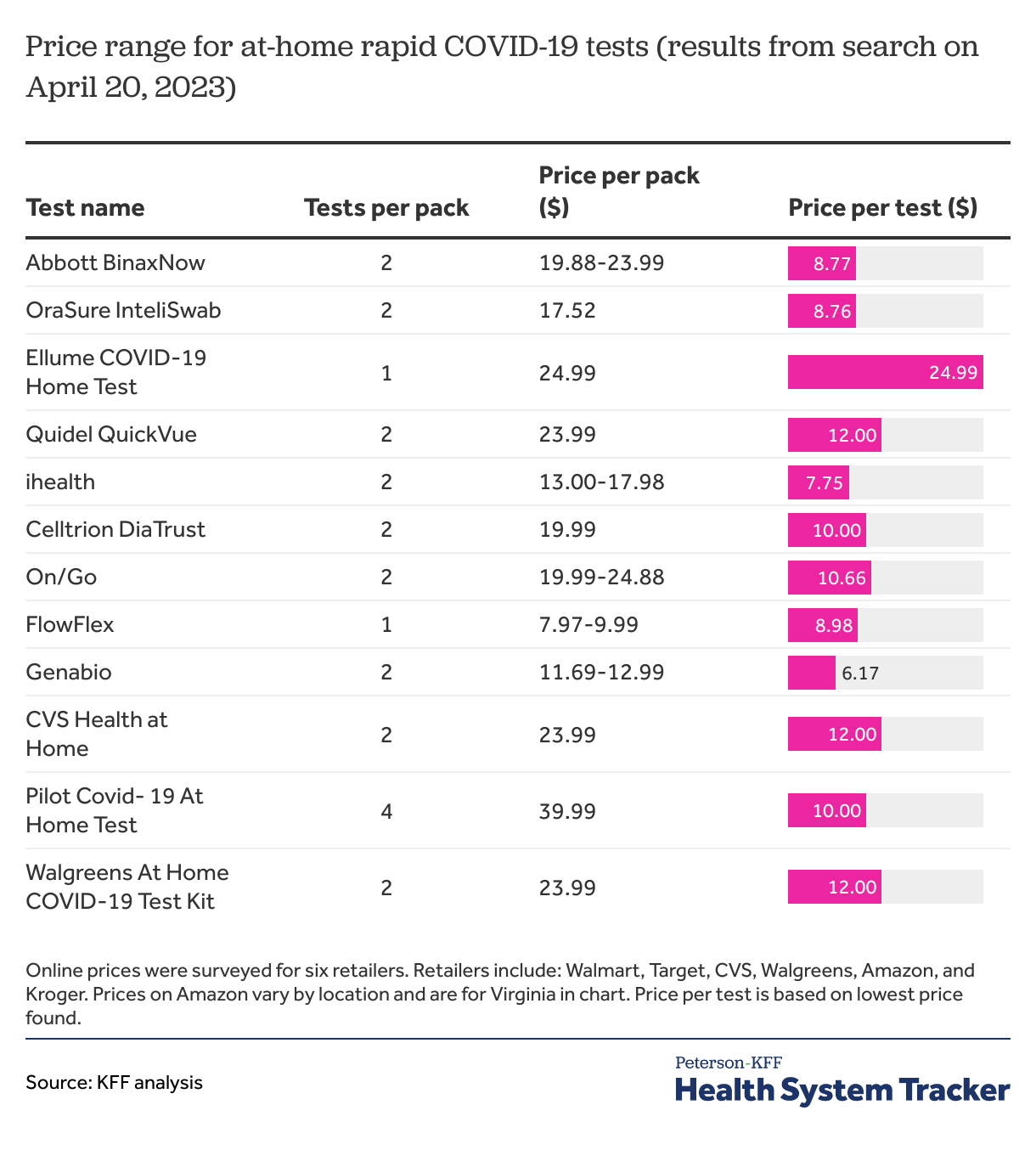

At-home COVID-19 tests typically cost about $11 per test

We scanned websites for 6 major retailers to examine variations in prices for at-home COVID-19 rapid tests. We find the average price for rapid at-home COVID-19 tests was $11 per test across retailers. Most at-home rapid COVID tests cost between $12-$24 per pack and contain two tests per pack. The total cost for a pack of COVID-19 tests ranged from $8 (1-test pack) to $40 (4-test pack). Costs were similar compared to those found in the 2022 searches.

Discussion

COVID-19 tests, performed in a clinical setting or at home, became more accessible during the pandemic and are now a mainstay of preventing the spread of COVID-19 and identifying those who may need access to treatment. Early in the pandemic, test availability and accessibility was challenging, including for at-home testing. While much testing has moved to at-home rapid COVID-19 tests, many people continue to seek COVID-19 testing in clinical settings, either for confirmation of at-home results or as part of a diagnostic workup. After the PHE ends on May 11, 2023, federal law no longer protects insurance enrollees from cost sharing, prior authorization, or other forms of medical management in coverage of COVID-19 tests, either at home or in a clinical setting. Loss of coverage for millions of people with the ending of continuous enrollment for Medicaid enrollees, coupled with lapsing coverage of COVID-19 testing for people without insurance in states that had temporarily extended coverage, means many more people may bear the entire cost of COVID-19 testing.

This analysis finds typical private insurance payment for diagnostic laboratory COVID-19 tests is about $45 and typical self-pay cash price at hospitals is $51 for an antigen test and $91 for a PCR test. Prices for at-home COVID-19 testing average $11 per test, though consumers typically purchase a set including multiple tests which increases this cost. Moving ahead, enrollee cost sharing for COVID-19 tests in a clinical setting will depend on their health plan and where they receive a test. In instances where the health plan applies a deductible or if the test is performed out-of-network, the enrollee could face the full costs.

People receiving a test in a clinical setting will likely be subject to additional charges, such as physician visit costs (which, in an earlier analysis we found averaged $93 for an office visit) and/or specimen collection fees. Cost sharing for a visit solely for COVID-19 testing was prohibited in the past but may now apply after the end of the PHE. A person either privately insured within their deductible or uninsured seeking an outpatient office visit for a COVID-19 test could see a cost of approximately $130-150, including office visit fees and COVID-19 testing. People without health insurance would be liable for the entire cost of the COVID-19 test and associated visit in most circumstances.

While tests ordered within a clinical setting will generally be covered, albeit potentially with cost-sharing, this is not the case for at-home tests. Consumers will likely have to pay the full cost of at-home tests, as with other types of at-home testing. Although there have been federally purchased tests available for free, the supply has dwindled. Prices identified in this analysis were in the context of federal policy that provides these tests free to the consumer; it is unclear if prices will change once coverage of these tests concludes with the PHE.

Out-of-pocket costs can accumulate over the course of multiple tests needed for multiple family members. Even nominal cost sharing and out-of-pocket expenses for at-home tests may add up to prohibitive sums, alter testing behavior, or result in delayed or forgone care.

Methods

Merative MarketScan outpatient claims data for 2021 were used to analyze commercial health plan payments for outpatient COVID-19 tests in this analysis. To make MarketScan data representative of large group health plans, weights were applied to match counts in the Current Population Survey for enrollees at firms of a thousand or more workers by sex, age, state, and whether the enrollee was a policy holder or dependent. Weights were trimmed at eight times the interquartile range. CPT codes corresponding with COVID-19 tests were classified by methodology: antigen (CPT 87426, 87428, 87811) and PCR (87635, 87636, 87637, 0202U, 0241U); as well as whether the code was solely for SARS-CoV-2 (87811, 87426, 87635, 0202U) or included other pathogens in a panel (87428, 87636, 87637, 0241U). Other CPT codes were examined but not included in the analysis due to low volumes. For distribution of commercial insurance prices, negative values and the top percentile were trimmed.

To look at self-pay cash price rates for hospitals, Turquoise Health price transparency data were used. Turquoise Health updates hospital price transparency data on a rolling basis to contain the most recent data possible. Rates used in this analysis ranged were aggregated by Turquoise Health between April 2021 and April 2023. Antigen and PCR testing refer to CPT codes 87426 and 87635, the most common codes for COVID-19 testing found in 2021 MarketScan outpatient claims for each test methodology respectively. Rates in the top and bottom percentile were trimmed. One of the challenges with hospital price transparency data is that the number of rates for a given rate type and code can vary. To prevent overweighting hospitals with more rates listed, the median self-pay rate for the hospital was first calculated to represent the hospital. Then, the median hospital rate in each state was calculated to represent the typical rate for the state.

To estimate the price for at-home testing, we scanned websites for 6 major retailers (Walmart, Target, CVS, Walgreens, Amazon, and Kroger) on April 20, 2023 with methodology similar to a previous KFF analysis. For each retailer, all brands of available rapid antigen tests were included in the analysis except Amazon, where prices were recorded for brands that were available at the 5 other retailers.