The COVID-19 pandemic disrupted health spending and utilization trends in the United States, though it is not yet clear how long that disruption will last. In April 2020, health spending dropped precipitously as providers cancelled elective care and patients practicing social distancing avoided health facilities. Utilization of health services has remained somewhat lower than expected based on utilization levels in years before the pandemic. Thus far into the year, we have not seen pent-up demand from delayed or forgone care in the last year. The effects of this delayed and forgone care on health spending and outcomes are yet to be seen. As a result of lagging vaccinations and the more infectious delta variant, COVID-19 hospitalizations and deaths, the overwhelming majority of which are among unvaccinated people, increased over the summer. The continued impact of the COVID-19 pandemic may introduce more uncertainty on future health costs.

Health services spending remained below projected levels through the second quarter of 2021

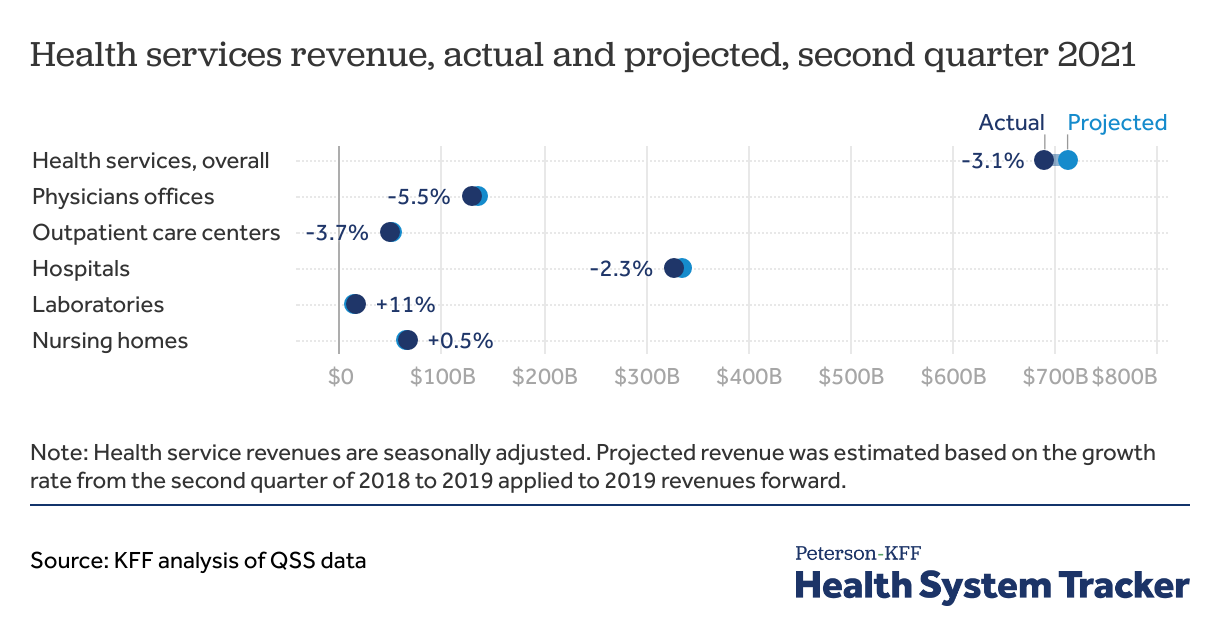

The U.S. Census Bureau’s Quarterly Services Survey (QSS) data show seasonally adjusted health services revenue in the second quarter of 2021 remained below projected levels. Projected revenues were estimated based on 2018 second quarter to 2019 second quarter revenue growth rate applied to the 2019 second quarter forward to 2021. In the second quarter of 2021, actual laboratory services revenue was somewhat above expectations based on pre-pandemic spending, likely due to increased use of COVID-19 testing services. However, for physician services, outpatient care centers, and hospitals, spending in the second quarter of 2021 remained below expected based on pre-pandemic spending.

While uncertainty around the pandemic’s effect on health spending remains, health insurance actuaries have access to the latest health utilization and spending data and can use these data to model future trends. Reviewing health insurer premium calculations for the coming year can give us a glimpse into how the pandemic may or may not affect health spending and utilization in the future.

Insurers planning to offer health plans on the Affordable Care Act (ACA) Marketplaces must submit filings to state or federal regulators detailing their plan offerings and justifying their premiums for the upcoming year. Rates are finalized in early fall (October 15, 2021) ahead of the annual open enrollment period, set to begin on November 1, 2021.

In this brief, we reviewed final 2022 premium rate filings for Marketplace-participating individual market insurers in all 50 states and the District of Columbia. Although the Affordable Care Act (ACA) individual market represents a small share of the privately insured population, the rate filings for this market are detailed and publicly accessible, making them a useful source of information on how health insurers are thinking about their likely costs for the next year. We also reviewed rate filings for the impact of the American Rescue Plan Act (ARPA), which expanded subsidies available in the ACA health insurance Marketplaces, on 2022 average costs in the individual market.

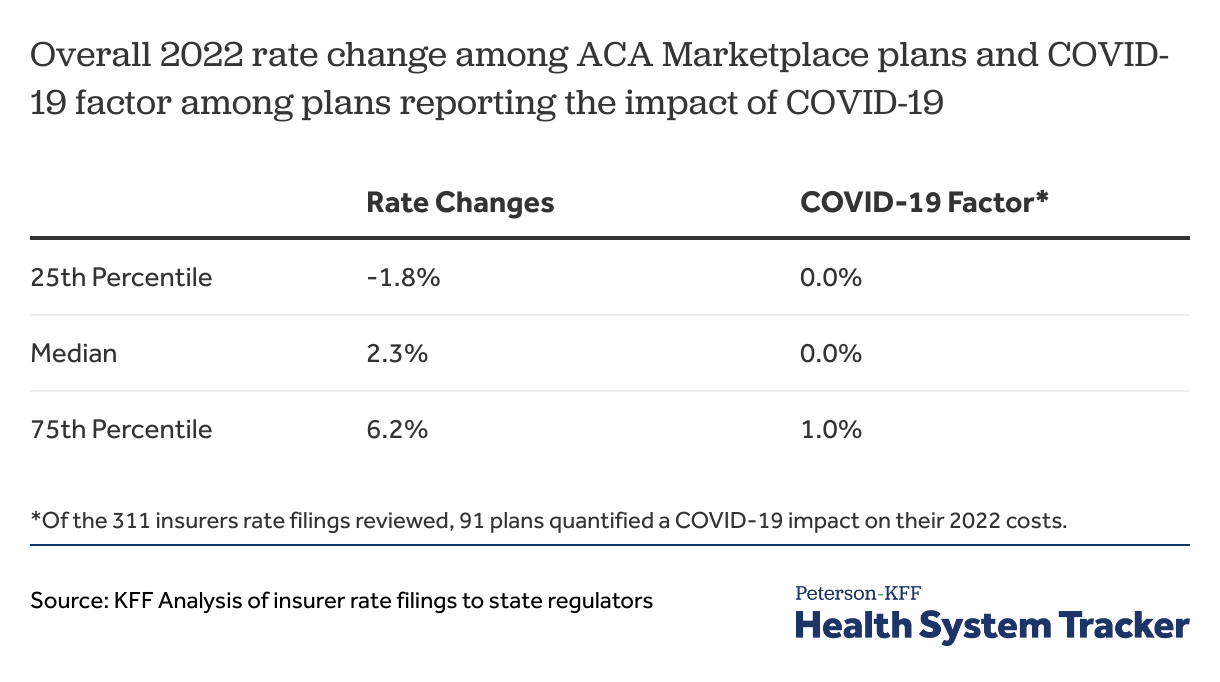

We reviewed rate filings for an overall 2022 average premium increase across Marketplace-participating individual market plans, with a focus on the effect of the pandemic on average rate changes. Of the 311 rate filings reviewed, 272 plans had a publicly available premium change for 2022. A majority of rate changes for 2022 are moderate, with most insurers posting premium increases or decreases of a few percentage points. Rate changes from 2021 to 2022 range from a -28.5% decrease to a 25.6% increase, though half fell between a -1.8% decrease and 6.2% increase. All insurer rates are shown in the Appendix.

Most Marketplace-participating insurers are assuming COVID-19 will have no effect on their 2022 costs

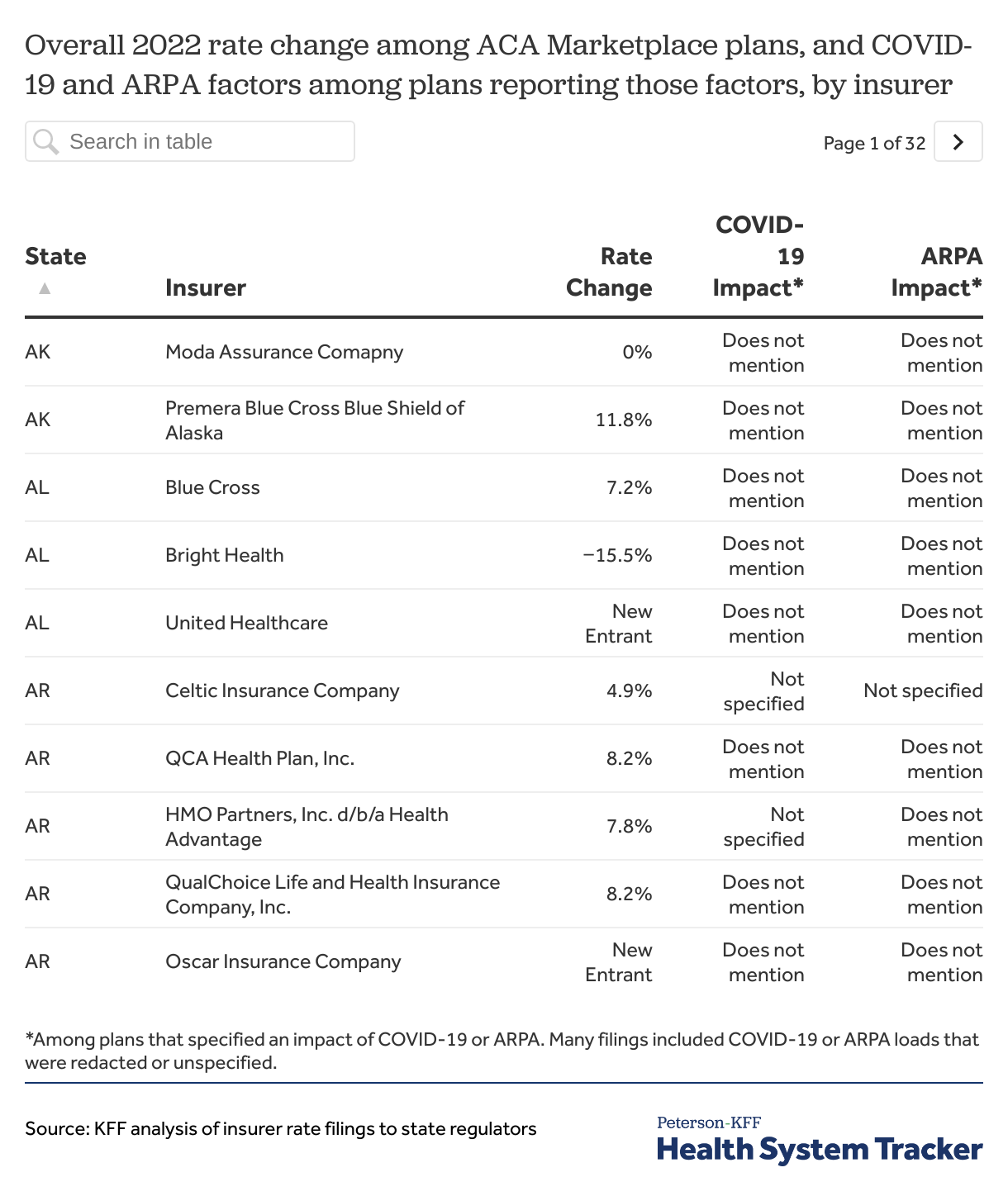

Of the 311 insurer rate filings we reviewed across all states and D.C., 91 (29%) quantified a COVID-19 impact on rates in their filings, and 50 filings (16%) quantified an impact of ARPA expanded subsidies on 2022 rates. Some of the insurers that mentioned an impact of COVID-19 or ARPA on their 2022 costs did not specify the factor or redacted the amount.

Among the 91 insurers that quantified an impact of COVID-19 on their 2022 costs, the impact of COVID-19 on 2022 individual market costs ranged from -2.6% to 8.4% with half of insurers falling between no impact and 1.0% increase.

Of the 50 insurers that quantified an effect of the ARPA on 2022 costs, 29 expect the ARPA to have a downward impact on costs (-5% to -0.2%), one estimated a positive impact (0.6%), and 20 estimated no impact on costs (0.0%). Most insurers do not expect the ARPA to affect their 2022 costs and a few insurers expect ARPA expanded subsidies to decrease the average morbidity of enrollees in the individual market.

Discussion

Most Marketplace-participating insurers expect their costs to return to normal and therefore say the COVID-19 pandemic will not be a factor in their 2022 premiums. Insurers are generally expecting utilization to return to pre-pandemic trends. ACA Marketplace enrollment increased by 15% from 2020 to 2021 following the American Rescue Plan Act, which expanded subsidies in the ACA Marketplaces for 2021 and 2022, and the special enrollment period. A few insurers predict these new enrollees may be healthier and lower risk than current members, though most plans did not quantify the impact of the American Rescue Plan Act on costs in 2022.

While insurers utilize comprehensive data to project future changes in health spending and utilization, their projections remain speculative, especially in the context of the pandemic. Uncertainties remain on how new COVID-19 variants, the plateauing uptake of vaccinations, and potential pent-up demand from delayed care might affect costs in the future.

Methods

Data were collected from health insurer rate filings submitted to state regulators. Most rate information is available in SERFF filings (System for Election Rate and Form Filing) that includes a base rate and other factors that build up to an individual rate. All other filings were found either on the state insurer’s website or on ratereview.healthcare.gov. This analysis only includes rate filings that were made public on or before October 15, 2021.

The impact of ARPA or COVID-19 factors on 2022 costs was categorized as “does not mention” if the actuarial memorandum was heavily redacted, if COVID-19 was mentioned in the context of cost normalizations to pre-pandemic levels, or if those factors were not referenced. The impact of ARPA or COVID-19 factors on 2022 costs was categorized as “not specified” if the insurer made reference to an impact but did not specify the amount.

Appendix

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.