The cost of prescription drugs continues to affect Americans, remaining at the forefront of national politics. Federal and state efforts have aimed at improving prescription drug affordability. Several drug manufacturers have also taken action to limit out-of-pocket prescription drug spending, including three of the four major manufacturers of brand-name inhalers that treat asthma and chronic obstructive pulmonary disease (COPD). In response to pressure from a U.S. Senate investigation in 2024, three companies — AstraZeneca, Boehringer Ingelheim, and GlaxoSmithKline — announced voluntary out-of-pocket spending caps. Included products have an out-of-pocket spending cap of $35 per 30-day supply, with two AstraZeneca products having lower caps at $0 per 30-day supply. The price caps took effect on June 1, 2024, for the applicable AstraZeneca and Boehringer Ingelheim products and January 1, 2025, for the applicable GlaxoSmithKline products. These voluntary caps have the potential to impact many Americans, as asthma and COPD affect an estimated 11% and 3.7% of the U.S. population, respectively.

This analysis uses Merative MarketScan commercial claims data from 2023 to examine out-of-pocket spending on inhalers per 30-day supply for asthma and COPD in the employer-sponsored insurance market and to estimate potential savings under the recent out-of-pocket spending caps. In the employer-sponsored market, 8% of all enrollees filled an inhaler prescription for asthma or COPD. More than one in six (17%) of these enrollees spent over $35 out-of-pocket on at least one inhaler for a 30-day supply during the year. Meanwhile, one in ten prescription inhalers filled in 2023 would have been eligible for the manufacturer savings and would have resulted in savings. Of inhaler users, 8% of enrollees with asthma or COPD inhalers in the employer-sponsored market would spend less out-of-pocket with manufacturer savings programs, saving on average $40 per qualifying inhaler (30-day supply). For 2023, enrollees on a capped inhaler would have had an average annual savings of $170; among all inhaler users, the average savings would have been $13, assuming manufacturer coupons would not have influenced prescribing decisions.

Current policies impacting inhaler costs

The amount that individuals spend on inhalers in the U.S. can be substantial. One study estimated that individuals with asthma spend $3,266 (in 2015 dollars) more out-of-pocket each year on healthcare than individuals without asthma, with $1,830 of that attributable to prescription medication costs. Costs of brand-name inhalers have remained high over time despite little innovation in the medications used, which is largely due to practices like “patent hopping” that have allowed drug manufacturers to prevent entry of generic inhalers into the market. Between 1986 and 2020, 62 inhalers received FDA approval, of which 53 were brand-name products and only 11 were generics. As of 2024, only 5 of the 37 brand-name inhalers on the market had independent generic competition.

Currently, the federal government does not regulate the prices of inhalers or limit out-of-pocket spending. However, five states recently passed laws capping out-of-pocket spending for prescription inhalers covered under plans subject to state regulation. Self-insured employer plans, which cover 63% of covered workers with employer-sponsored insurance, are not subject to state regulation. Illinois, Minnesota, and Massachusetts have a $25 out-of-pocket spending cap on a 30-day supply of prescription inhalers, while Washington and New Jersey have implemented caps of $35 and $50, respectively. New Jersey’s law went into effect March 1, 2024, while the laws in Illinois, Minnesota, and Washington took effect January 1, 2025. Massachusetts’s law went into effect on July 1, 2025.

To benefit from the out-of-pocket spending caps, uninsured and commercially insured patients enroll in a manufacturer copay assistance program. Patients enrolled in health plans with copay adjustment programs or in plans that prohibit enrollees from using manufacturer coupons (such as federal or state health plans or prescription drug plans) are ineligible to participate in these savings programs. Additionally, several of the manufacturers — Boehringer Ingelheim and GlaxoSmithKline — restrict the number of prescriptions qualifying for coupons within a year.

Out-of-Pocket Spending on Inhalers

Approximately 8% of enrollees in the employer-sponsored market filled prescriptions for asthma and COPD inhalers in 2023.

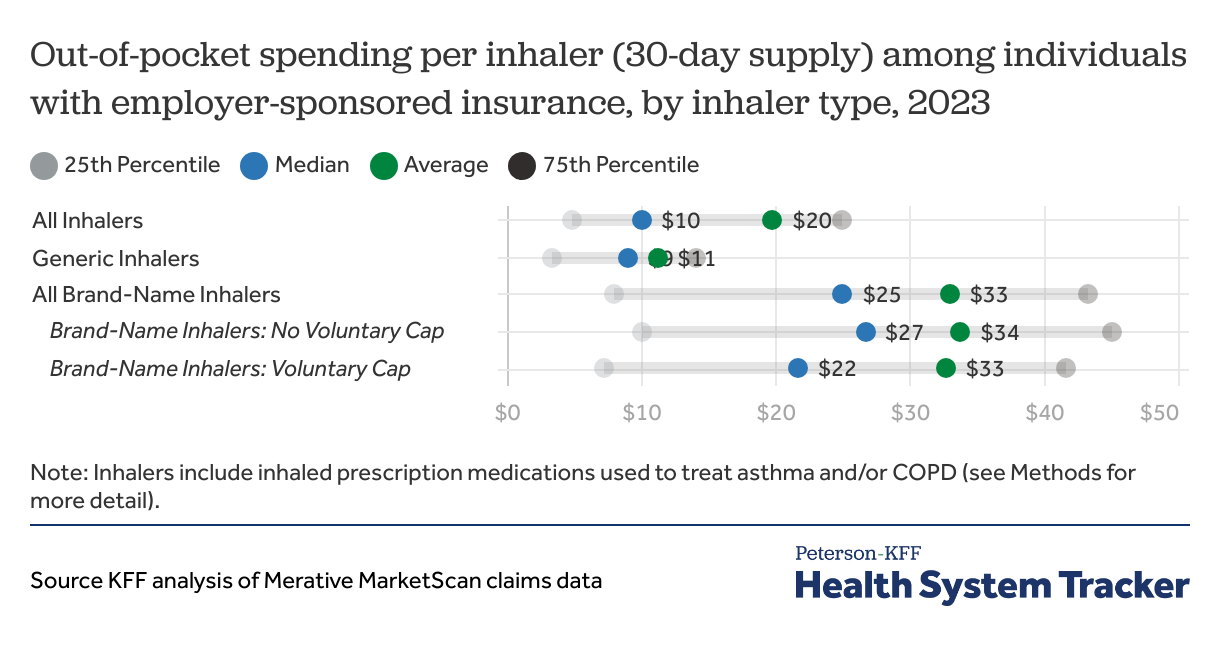

Average out-of-pocket costs for brand-name inhalers are more than double those for generic inhalers

A modest share of inhalers (17%) required $0 in cost sharing per 30-day supply in 2023. For generic inhalers, the average out-of-pocket spending per 30-day supply for an inhaler was $11, with half costing $9 or less; brand-name inhalers cost patients $33 out-of-pocket on average, with half costing $25 or less per 30-day supply. The average out-of-pocket spending for a brand-name inhaler was more than twice that of a generic inhaler, but this varied by drug, ranging from roughly the same price between brand-name and generic to the brand-name being 8 times the price of the generic. A third of brand-name inhaler fills were associated with out-of-pocket spending exceeding $35 per 30-day supply.

Estimated Savings from Manufacturer Copay Assistance Programs

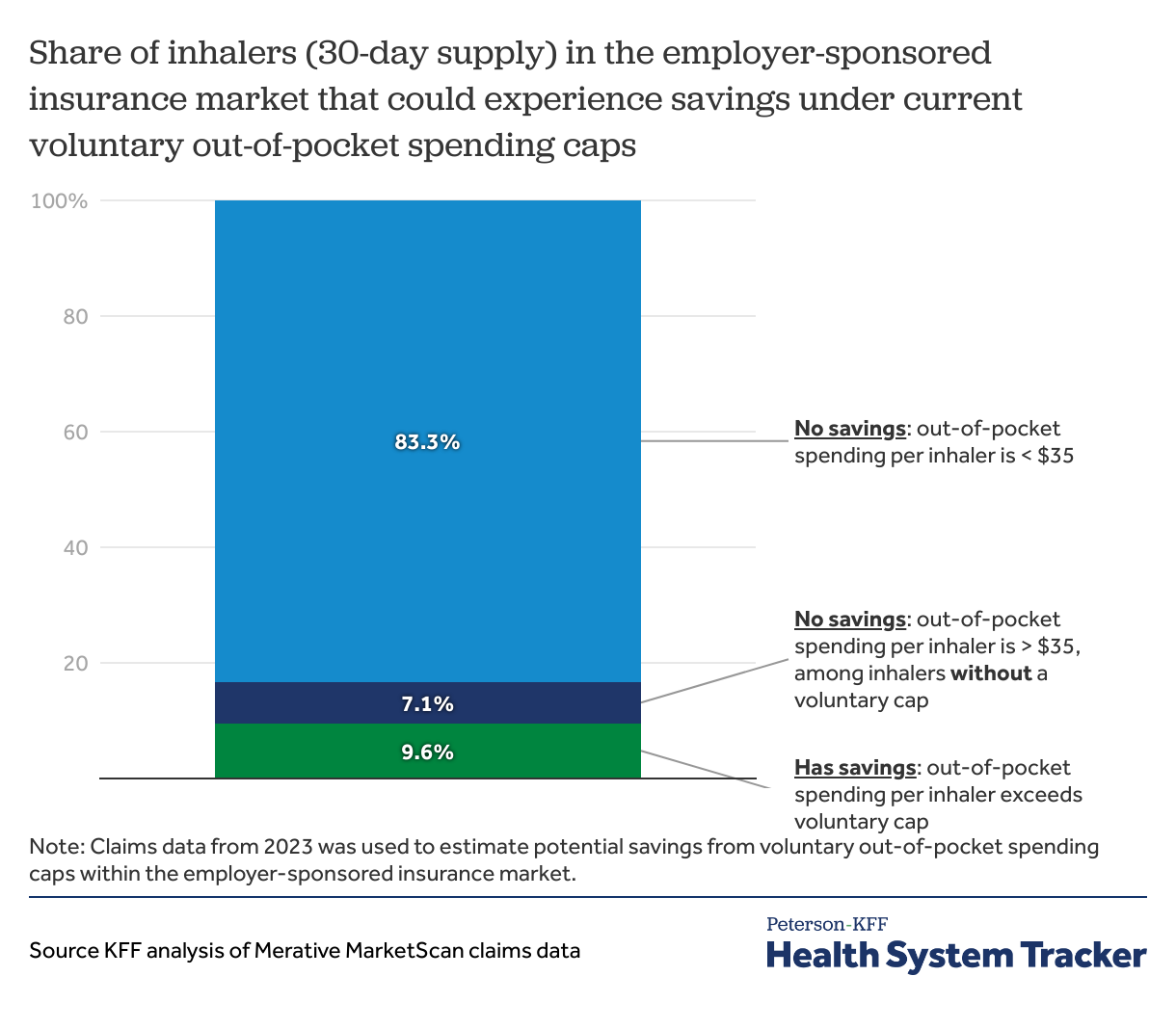

One in ten inhaler fills could experience savings due to the new voluntary out-of-pocket spending caps

An estimated 10% of all inhalers for asthma and COPD could see savings with manufacturer savings programs—this corresponds to 8% of enrollees with inhaler prescriptions filled. An additional 7% of inhalers that had out-of-pocket costs exceeding $35 per 30-day supply would not qualify for savings because the inhalers do not have an associated manufacturer savings program or because the enrollee had reached the maximum savings benefit allowed in the manufacturer savings program. Among patients who use inhalers eligible for their respective manufacturer’s savings programs, not all would see savings. Roughly 1 in 3 inhalers (33%) would have lower out-of-pocket costs for a 30-day supply, benefiting 37% of enrollees using an inhaler covered by the voluntary spending caps.

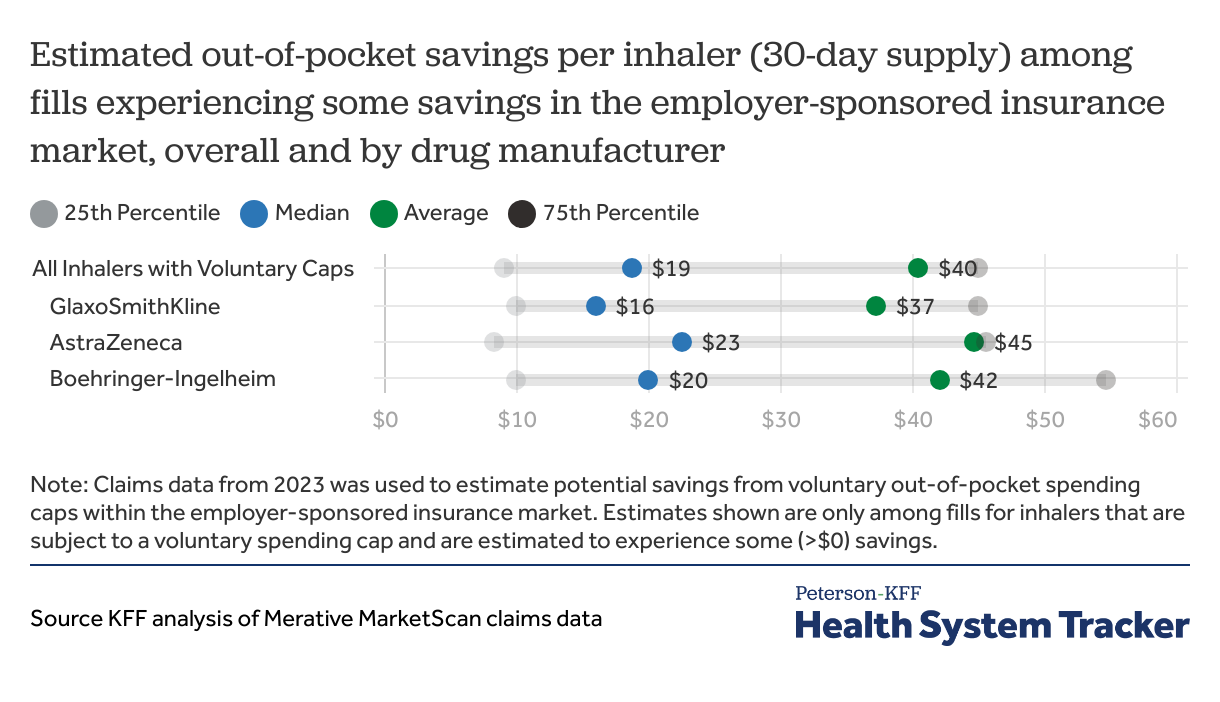

Among inhaler fills covered under the voluntary out-of-pocket spending caps, over half will have savings of $19 or less per 30-day supply

With manufacturer savings programs, the average estimated out-of-pocket savings is $40 per qualifying inhaler (30-day supply). The savings are not distributed evenly: half of inhaler fills would have savings of $19 or less per 30-day supply, whereas 25% of inhalers would cost $45 less out-of-pocket. Overall, individuals with employer-sponsored insurance could save 41% on their out-of-pocket spending on inhalers through manufacturer savings, which constitutes 20% of total out-of-pocket spending on all inhalers.

Methods

Outpatient pharmaceutical claims from the 2023 Merative MarketScan Commercial Database were used to estimate potential out-of-pocket savings for enrollees with claims for inhalers used to treat asthma and/or COPD. Individuals with six or fewer months of enrollment in 2023 were excluded from analyses. To make MarketScan data nationally representative, weights were applied to match counts in the Current Population Survey by sex, age, and state, and included individuals with an employer-sponsored plan as either primary or secondary coverage. Analyses do not account for whether enrollees had a copay adjustment program or were in plans ineligible for participation in the manufacturer copay savings programs.

Claims for prescription asthma/COPD inhalers were identified using three criteria from Micromedex RED BOOK coding: 1) route of administration was “Inhalation,” 2) the product was not available over the counter, and 3) the therapeutic class was one of the following:

- Sympathomimetic Agents, NEC

- Anticholinergic, NEC

- Adrenals and Comb, NEC

- Antichol/Antimuscarin/Antispas

- Antiinflam Agents, EENT, NEC

- Mast cell stabilizer.

Inhalers that are now subject to voluntary out-of-pocket spending caps were further identified using the “product name” field within the RED BOOK. Inhalers from Boehringer Ingelheim (Spiriva Respimat, Stiolto Respimat, Combivent Respimat, Atrovent HFA, Spiriva Handihaler, Striverdi Respimat) and GlaxoSmithKline (Advair Diskus, Advair HFA, Anoro Ellipta, Arnuity Ellipta, Breo Ellipta, Incruse Ellipta, Serevent Diskus, Trelegy Ellipta, Ventolin HFA) are eligible for a $35 spending cap. Two inhalers from AstraZeneca are eligible for a $0 spending cap (Airsupra, Breztri Aerosphere) and two are eligible for a $35 spending cap (Bevespi Aerosphere, Symbicort). Flovent (a popular inhaler made by GSK) was discontinued in early 2024, such that the 2023 claims data used for this analysis are not reflective of any changes in inhaler utilization patterns after Flovent was taken off the market.

All claims for the same enrollee and NDC (national drug code) were aggregated across the entire year. The days’ supply and out-of-pocket cost were then summed across the year to calculate the sum of copays, coinsurance, and deductible per 30-day supply. Aggregated claims that had total out-of-pocket spending less than $0, total payment by the insurer and enrollee as less than or equal to $0, or the number of days supplied as less than or equal to 0 were excluded.

Because the manufacturer savings apply per 30-day supply for an inhaler, out-of-pocket spending per inhaler was estimated by dividing the total out-of-pocket spending by the total days’ supply, rounded to the nearest interval of 30, and multiplying by 30. In this analysis, “one inhaler” refers to a 30-day supply of an asthma/COPD inhaler.

To address outliers, claims were excluded if they had out-of-pocket spending per 30-day supply greater than $700 (representing the upper end of list prices for inhalers). Savings from the spending caps were calculated as the difference between the out-of-pocket spending per 30-day supply and the applicable manufacturer spending cap (either $35 or $0).

The savings represented in this analysis may overestimate actual impact because they assume that patients faithfully utilize the savings card process set by manufacturers. Additionally, prescriptions filled outside of insurance, such as through third-party drug coupon programs like GoodRx, are not included in the claims data and are thus not represented in these estimates. Some enrollees included in this analysis may have already been utilizing manufacturer coupons prior to the implementation of the new voluntary caps. As claims data do not capture this information, savings may be overestimated for these enrollees.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.