One of President Biden’s campaign proposals was to lower the eligibility age for Medicare from 65 to 60, with the goal of offering lower-cost public insurance to a group that often faces high out-of-pocket costs with private coverage. More recently, Democrats in Congress reintroduced a bill that would allow people ages 50 to 64 to buy into Medicare. A policy that moves older adults from private insurance to Medicare could also affect younger adults who remain enrolled in private insurance.

In this brief, we explore the effect that moving older adults onto Medicare might have on employer-sponsored insurance costs. To do so, we evaluate spending by age in large employer plans using IBM MarketScan Commercial Claims and Encounters Database.

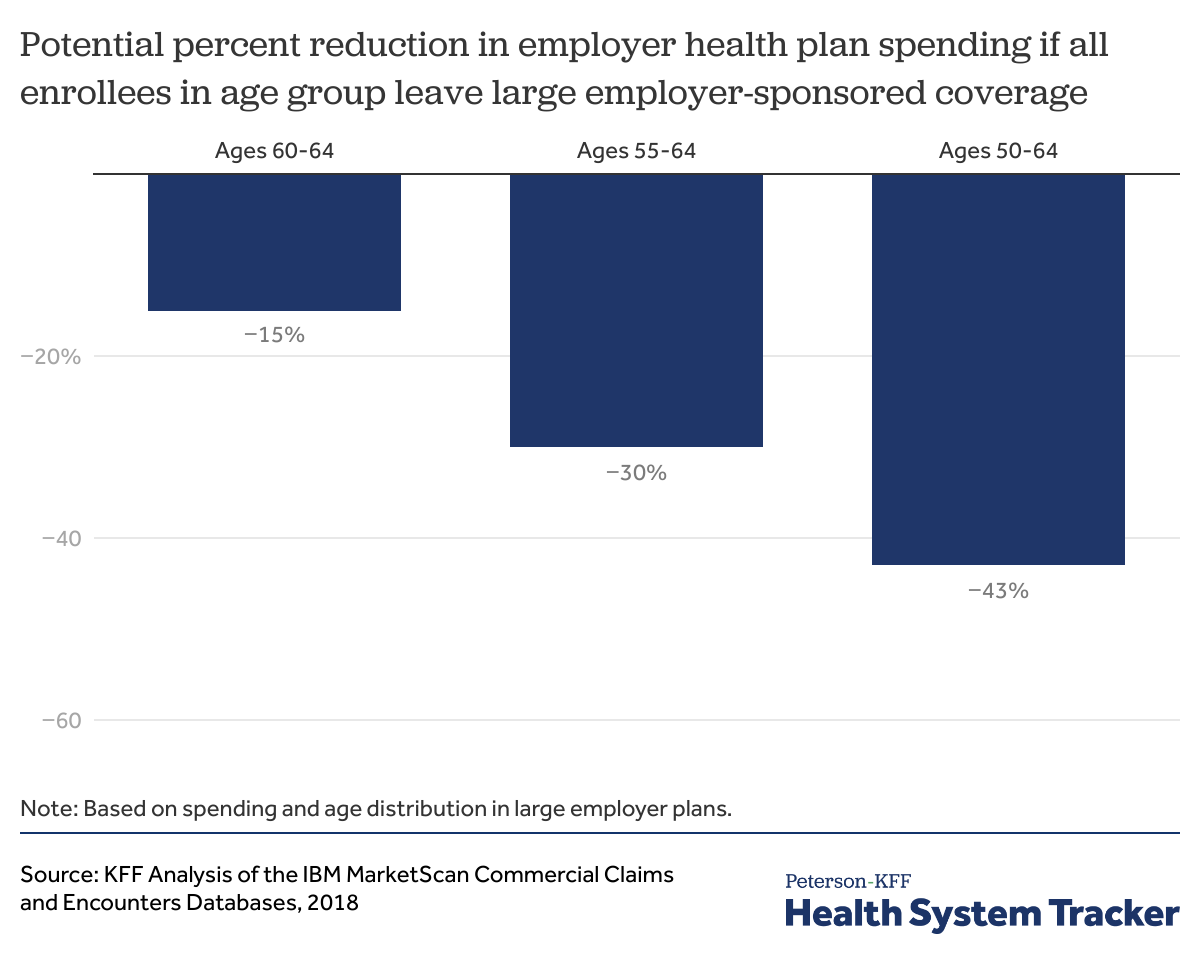

We find that, if people age 60-64 were no longer enrolled in employer-sponsored insurance, costs for employer health plans could drop by up to 15%. Similarly, if all people age 55 and over were no longer enrolled in employer-sponsored insurance, costs for employer plans could drop by as much as 30%. And if all people age 50 and over were no longer enrolled in employer-sponsored insurance, costs for employer plans could drop up to 43%. However, there are reasons to suspect the actual impact on employer-sponsored costs and premiums would be much smaller.

Many working elderly adults choose to continue on employer coverage. If the eligibility age for Medicare is lowered, many working adults may continue enrolling in employer coverage as well. Therefore, the actual effect on employer health plan costs would likely be smaller, depending on how many people ultimately decide to switch to Medicare, if given the option.

These findings suggest that lowering the age of Medicare would have a downward effect on employer health spending and could also have a downward effect on total national health spending due to the lower prices paid in Medicare versus private insurance. The magnitude of any change in health spending would depend on the number of people who choose Medicare instead of an employer plan, the number of uninsured adults who gain coverage, and other factors. However, a large share of health spending for older adults who choose Medicare over employer coverage would be shifted from the private market to taxpayers.

Read more from

Employer-based coverage affordability

Background

Almost six-in-ten (155 million) non-elderly individuals are enrolled in employer-sponsored health plans. The premiums for these plans are typically shared between employers and workers, with workers contributing 27% of the premium cost for a family, on average. Over time, worker premium contributions have grown, raising affordability challenges, particularly for lower income workers.

Generally, people under age 65 currently do not have the option to sign up for Medicare unless they are permanently disabled, so most are enrolled in employer coverage. Currently, people age 65 and older are eligible for Medicare and those who work for a firm with 20 or more employees have the option to choose to be covered under their employer plan or Medicare. If they choose their employer plan, then the employer plan is the primary payer and Medicare is secondary. If the employee instead elects to enroll in Medicare rather than their employer plan, then Medicare is the primary payer. When Medicare-eligible employees elect an employer plan as their primary coverage, they typically defer enrollment in Medicare Part B and D, and are not subject to a penalty for late Medicare enrollment.

In general, healthcare use and spending increases with age because health problems increase with age. However, people in their early sixties (age 60-64) enrolled in large employer coverage actually have somewhat higher per capita health spending than people in their late sixties (age 65-69) enrolled in Medicare. This is in large part because payments to providers are higher from private plans than in Medicare.

One of President Biden’s campaign proposals included lowering the eligibility age of Medicare to 60 years old from the current age of 65. This proposal is aimed at lowering the high premium and out-of-pocket costs older adults often face in the private insurance market. While details of that proposal have yet to be fleshed out, Biden has said that his proposal would allow older adults in their early sixties to have a choice of whether to sign up for Medicare, keep their employer coverage if such coverage is available, or enroll in a new public option.

Under a proposal recently reintroduced by Democrats in the Senate, people ages 50 to 64 would be eligible to buy in to Medicare. This proposal would allow eligible people to buy into Medicare using financial assistance otherwise available to purchase a Marketplace plan. A Medicare buy-in is different from what President Biden proposed during the campaign, which was to lower the age at which people could choose to enroll in Medicare. Under either option, some health spending would shift from the private market to taxpayers.

Age distribution of health spending among enrollees in large employer plans

As is the case with health spending generally, health costs in the employer-sponsored private insurance market are highly concentrated among a relatively small group of people who are in worse health or have more healthcare needs. As health tends to worsen as we age, it is unsurprising that health spending for people with employer coverage is higher among older adults.

We analyzed a sample of medical claims obtained from the 2018 IBM Health Analytics MarketScan Commercial Claims and Encounters Database, which contains claims information provided by large employer plans. We only included claims for employees and/or their dependents under the age of 65.

We find that, while people age 60-64 represent only 7% of enrollees in large employer plans, they account for 15% of health plan spending (not including out-of-pocket costs). Similarly, people ages 55-64 represent 15% of enrollees in large employer plans, but account for 30% of health plan spending. People ages 50 to 64 represent 24% of enrollees in large employer plans but account for 43% of health plan spending.

Employer plan health costs are concentrated among older enrollees

Effect of lowering the Medicare eligibility age on employer-sponsored insurance costs

To understand the maximum potential impact of reducing Medicare’s eligibility age on employer plan spending, we estimated the cost of employer plans, assuming all enrollees ages 60-64 left their employer plans.

This analysis is meant to be illustrative of the maximum potential effect on employer health plan costs. The true effect on employer health plan costs would greatly depend on the Medicare take-up rate. Given a choice, it is unlikely that all people would leave their employer plan. Based on our analysis of the 2019 National Health Interview Survey, roughly two thirds of Medicare-eligible people ages 65 and older who were working and offered coverage from their employer elected to have Medicare as primary payer. The magnitude of the impact on health spending for large employers and workers would depend on how many older workers shifted from employer coverage to Medicare, as well as the details of how a lower eligibility age for Medicare would work. The choice between an employer plan and Medicare may be influenced by a number of factors, including benefits and cost-sharing requirements, premium contributions, network restrictions, and whether they are the policyholder for a plan covering dependents. Medicare does not provide coverage to dependent spouses or children of beneficiaries who are not otherwise eligible for benefits.

If all employees in large employer plans ages 60-64 switched from their employer plans to Medicare, employer health plan costs would decrease by 15%. If all people ages 55-64 were not enrolled in employer plans, employer health plan costs would decrease by 30%. Finally, if all adults ages 50-64 were not enrolled in employer plans, employer health plan costs would decrease by 43%.

Employer-sponsored health plan costs would be lower if older adults moved to Medicare

Health insurance premiums are largely determined by health spending. Therefore, reductions in health spending for people with employer coverage would likely yield savings to employers, which could then also translate to lower employee premiums and/or higher wages. Any reduction in employer health costs could lead to lower premiums paid by employers for health insurance. (Large employers often self-insure, so a reduction in their per-enrollee cost would essentially translate to an similar reduction in “premiums”). Employers would then have discretion of whether and how to pass that savings along to employees, potentially through lower employee premium contributions or higher wages. It is theoretically possible that the savings could be muted if providers increase prices in private insurance plans in response to more people enrolled in Medicare, which pays providers less. Researchers have generally found little evidence to support the notion that providers shift cost on to private payers to compensate for lower public payer payment rates, but we do not know the impacts of a proposal of this magnitude.

Discussion

Like other health reform proposals, lowering the eligibility age of Medicare presents a series of considerations for people who are offered a choice between an employer plan and Medicare. We find that lowering the eligibility age of Medicare could have a downward effect on employer-sponsored insurance costs of up to 15% (if the age is lowered to 60) or 43% (if the age is lowered to 50), assuming all older adults that are given the option choose to shift from their employer plan to Medicare.

However, the true effect on employer health plan costs would greatly depend on the Medicare take-up rate. Currently, many Medicare-eligible adults age 65 and older choose to maintain their employer coverage (making Medicare the secondary payer). If newly eligible older adults choose to remain in their employer plan, any downward effect on employer health plan costs would be smaller. Additionally, if sicker enrollees chose to stay on employer coverage, the cost savings to employers would also be smaller.

Older adults presented with the option of enrolling in Medicare or employer coverage will consider a range of factors, including their own personal out-of-pocket liability and their provider network. People with access to employer-sponsored health coverage would be more likely to switch to Medicare if it would lower their premiums and out-of-pocket costs, which would be true for many people, especially given the lower premiums and additional coverage offered by private Medicare Advantage Plans. However, the more the age of Medicare is reduced, the more likely it is that people given the choice between Medicare and employer coverage will also need to consider health plan options for their spouse or child dependents.

For those who do leave employer coverage under such a proposal, a large share of their health spending would likely shift to the federal budget, in that Medicare is funded in part by general revenues. The shift from employer coverage to Medicare could exacerbate the financial challenges facing Medicare’s Hospital Insurance Trust Fund, without safeguards to prevent this. In his campaign, President Biden proposed to finance the expansion through general revenues, rather than the Trust Fund.

The total costs for people moving to Medicare would likely be lower than their total health costs under employer coverage, in large part because Medicare generally pays hospitals and other health care providers less than private insurers do. In a related study, we find that per capita spending is actually lower for people ages 65-69 on Medicare than it is for slightly younger people ages 60-64 enrolled in large employer plans, which is most likely due to lower payment rates. With younger, healthier, lower cost people shifting into the Medicare risk pool, Medicare premiums for all beneficiaries could also decline.

Taken together, these two findings suggest that lowering the eligibility age of Medicare could have a downward effect on total national health spending, the magnitude of which would depend on the number of people who choose Medicare and how many uninsured people gain coverage, among other factors. While a shift from employer coverage to Medicare would increase costs to the federal government, total health care spending would likely decrease for 60-64 year olds who move from employer coverage (because Medicare pays providers at a lower rate than private insurers) and for others with employer coverage (due to a smaller and healthier group of enrollees).

Methods

We analyzed a sample of medical claims obtained from the 2018 IBM Health Analytics MarketScan Commercial Claims and Encounters Database, which contains claims information provided by large employer plans. We only included claims for people under the age of 65. This analysis used claims for almost 18 million people representing about 22% of the 82 million people in the large group market in 2018. Weights were applied to match counts in the Current Population Survey for enrollees at firms of a thousand or more workers by sex, age and state. Weights were trimmed at eight times the interquartile range. Costs reflect amounts paid under the plan, and do not reflect enrollee out-of-pocket spending, through cost-sharing or non-covered services. In addition, health plan spending includes spending prescription drugs, and is not reduced by the amount of any rebates a plan may receive.

To estimate the share of Medicare-aged enrollees who relied on Medicare as their primary insurer, we used microdata from the CDC’s 2019 National Health Interview Survey Sample Adult Questionnaire to examine working seniors’ access to employment-based coverage coupled with their responses to Medicare enrollment questions focused on Part A and Part B.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.