Individual Coverage Health Reimbursement Arrangements (ICHRAs) are a relatively new approach for employers to reimburse workers to buy their own health insurance instead of offering a traditional group health plan. This brief explains how ICHRAs work and explores some of the factors driving adoption and limiting their growth.

For the past several years, KFF has included questions about ICHRAs and similar arrangements in its annual Employer Health Benefits Survey (EHBS). This year those questions were supplemented with interviews and round-table discussions with brokers, employers, insurers, firms that provide ICHRA administration and support services to employers, and other experts to gain greater insight into how this relatively new product market is evolving. Information from the EHBS, the discussions with industry participants, as well as KFF review of research literature and industry promotional materials are incorporated into the discussion below.

Industry participants report a rapid increase in the number of employers offering ICHRAs to their employees, although the number of those enrolled remains very small relative the over 150 million people covered in more traditional employer-provided group health plans. Factors encouraging ICHRA growth include increased awareness of ICHRAs, the ease of adoption for employers not currently offering benefits, lower prices for individual insurance market plans relative to group market premiums in some places, as well as the opportunity for employers with high-risk employees to escape health status rating in the group market. Factors that could hinder their expansion include the scarcity of broader network options, including PPO options, in individual health insurance markets, the inconsistency of individual insurance market options across markets in different states and areas in states, as well as the potential for conflict between traditional health benefit brokers and new ICHRA vendors over roles and compensation. Overall, this is a new approach for employers to provide comprehensive health coverage for their employees, and it will take some time before we know how attractive it might in different market segments.

How are ICHRAs different from typical employer-sponsored health plans?

Most people under age 65 with private health insurance get their coverage through a job. In a typical employer-sponsored arrangement, an employer establishes a group benefit plan to provide medical benefits to its employees and their dependents. The employer may choose to fund the promised medical benefits either directly from its own funds (self-funding) or by purchasing a group health insurance policy from an insurer (insured plan). Any contributions that employees are required to make toward the cost of coverage are typically collected through payroll deduction. This type of arrangement covers over 154 million people under the age of 65.

An ICHRA is a different approach employers can use to fund health benefits for employees and their dependents. With an ICHRA, an employer promises to reimburse employees, up to specified limits, for the costs of enrolling in individual health insurance policies providing major medical coverage (or Medicare). Rather than promise to cover a defined set of medical benefits, an ICHRA is a promise to provide a defined level of funding that the employee can use towards the purchase of any qualifying product available in the individual market, either plans in the Affordable Care Act (ACA) Marketplaces or plans that follow similar rules available off exchange. As discussed below, current rules make it more attractive for employees to choose off-exchange plans in most circumstances.

Whether offered through an ICHRA or as a traditional group plan, amounts provided by the employer to employees through the group health plan are not considered to be taxable income to employees. Employers can establish plans so that amounts contributed by employees towards the cost of the plan are also provided on a tax-advantaged basis, meaning employees do not pay taxes on the funds deducted from payroll to pay for their share of premiums.

How does an ICHRA differ from other health reimbursement arrangements (HRA)

A Health Reimbursement Arrangement (HRA) is a group health plan where an employer makes funds available to reimburse employees for qualified medical expenses. There are several types of HRAs, and employers may include multiple arrangements within their benefits package to cover different services. Many employers use HRAs to make funds available to employees for specific purposes, such as to reimburse employees for cost sharing or services not covered under the main medical plan. The amounts reimbursed to employees through an HRA for medical expenses are not taxed as income to workers receiving them.

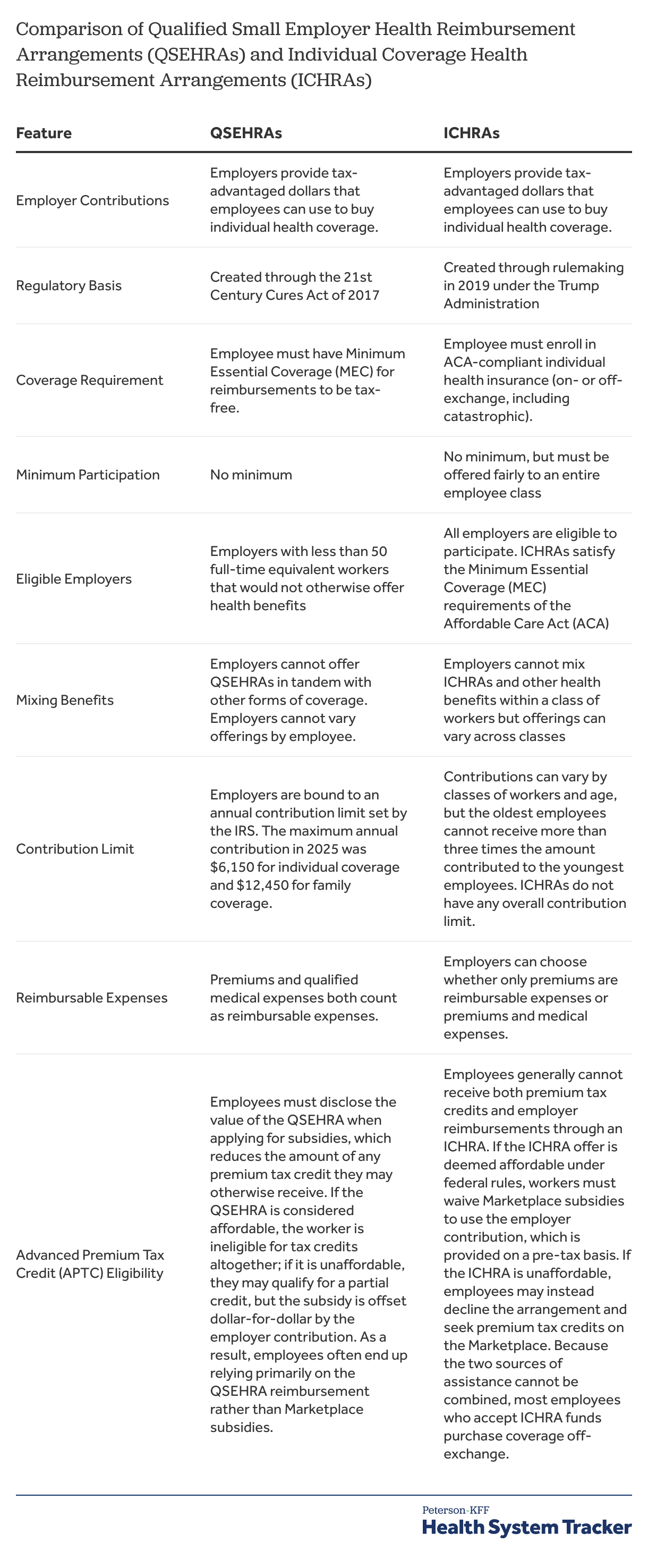

An ICHRA is one of two types of HRAs that can be used to reimburse employees with tax-advantaged dollars for the cost of premiums for individual health insurance coverage. It is the more flexible option and is available to any employer. A second option, called a “Qualified Small Employer HRA” or QSEHRA, is available only to small employers with fewer than 50 full-time equivalent employees that do not offer group health coverage to any employees.

An employer may offer an ICHRA to all its employees or to just employees in one or more of ten classes defined by regulation. This allows employers to distinguish between groups such as salaried and hourly workers, part-time and full-time workers, workers in different geographic locations, and workers under age 25 and older workers. An employer cannot offer both an ICHRA and a major medical group health plan to workers in any of the defined classes, but can offer different options for different classes. For example, an employer could offer a traditional group health plan only to full-time workers and an ICHRA only to part-time workers.

An employer can, however, offer a limited benefit option along with an ICHRA; for example, an employer could offer employees in a class an ICHRA and a direct primary care benefit. There is no limit on the amounts that an employer can make available to employees through an ICHRA, but there are restrictions as to how the amounts can vary across eligible employees, generally reflecting the ways that premiums may vary in the individual market; employers can vary the amounts available by class, by family structure (i.e., number and type of dependents), age (within a 1:3 ratio), and geographic location (ACA rating areas).

For an employer with 50 or more full-time equivalent employees, offering an ICHRA to employees will meet its ACA shared-responsibility requirements provided that the amounts available to employees satisfy affordability requirements. For an ICHRA offer to be affordable to an employee, the amount available must be enough such that the employee’s out-of-pocket cost for the lowest-cost silver plan does not exceed the ACA affordability threshold amount for single coverage, which is 9.02 percent of income in 2025. Offering affordable coverage for each employee often requires employers to vary the available amounts in the ICHRA by age and the other factors discussed above. Employees offered an ICHRA that is affordable to them are considered to have an affordable offer of employer coverage and are therefore not eligible for premium tax credits under the ACA. One difference to note about ICHRAs is that the “family glitch” fix does not apply to an ICHRA offer: the affordability of coverage offered to family members of a worker offered an ICHRA is based on the out-of-pocket cost for single coverage rather than for family coverage.

Employees offered an ICHRA can use the funds to select any ACA-compliant individual market insurance plan available to them, whether sold through a Marketplace or off-exchange. Current tax rules, however, encourage employees to choose off-exchange plans: Employer plans that allow for employee premium contributions to be made with tax-advantaged dollars (premium only plans) are available only if the employee chooses an off-exchange plan. On- and off-exchange plans are part of a single risk pool, but insurers may offer somewhat different products, for example varying networks across on- and off-exchange.

As noted, QSEHRAs are a more limited option, and the rules around them are somewhat complex. Only smaller employers (fewer than 50 full-time equivalent employees) can offer a QSEHRA, though most employers are small enough to do so. Therefore, there is no interaction with the ACA employer shared-responsibility requirements, which only apply to larger firms. Employers offering a QSEHRA must offer it to all full-time employees and cannot offer any other group medical plan to their employees. The amounts that employers can offer employees in a QSEHRA is capped; the limits in 2025 are $6,150 for individual coverage and $12,450 for family coverage. An employee offered a QSEHRA generally remains eligible for ACA premium tax credits, although their tax credit amount is reduced dollar-for-dollar by the amount received through the QSEHRA. Funds received from a QSEHRA by an employee are tax-advantaged provided the employee maintains Minimum Essential Coverage (MEC).

How many employers offer funds for workers to purchase individual market coverage?

While ICHRAs have received a great deal of recent attention in the media and in the political arena, they remain a quite small share of the overall employer health benefits landscape. Among firms with 10 or more workers in 2025, nine percent of firms not otherwise offering health benefits and four percent of firms offering health benefits provided funds to at least some employees for the purchase of individual market coverage, similar to the shares in 2024. The HRA Council, which is a non-partisan advocacy organization, estimates that at least 500,000 to 1 million people are enrolled in ICHRAs and QSEHRAs in 2025.

The shares of employers offering an ICHRA or a QSEHRA, as well as the shares of workers either offered one of these arrangements or receiving reimbursement through one of them, are difficult to measure for several reasons. One is that many of the employers offering these arrangements are quite small, and with millions of small employers located throughout the US, survey estimates can vary quite a bit. Further, adoption appears to vary considerably across states, adding to the difficulty of arriving at national estimates for employer or worker adoption (discussed below).

Another reason the size of the ICHRA and QSEHRA market is hard to measure is that small employers sometimes have difficulty understanding these types of arrangements. For example, consistent shares of small employers reported offering funds to help employees purchase individual health insurance for many years before QSEHRAs and ICHRAs were established and when the legal bases for providing these funds were less clear. Finally, insurers may not always know when their enrollees are being funded through one of these arrangements, which means that offer and take-up cannot be fully measured by looking at plan enrollments.

What are ICHRA vendors and what services do they offer for employers and employees?

Employer and employee roles are different with an ICHRA than with a traditional group health plan. ICHRAs place more responsibilities on employees, who must select and enroll in an individual insurance policy and are responsible for paying its premium. Employers continue to be a primary source of funds for coverage, but their responsibility shifts to reimbursing employees in accordance with the ICHRA, including verifying enrollment and the premium payments by employees. Many employers offering an ICHRA use an ICHRA vendor to assist them and their employees with these new roles. These vendors differ in the manner, types, and levels of services they offer, and in the market segments they target. Some of these vendors primarily perform other administrative tasks and have extended their services to support ICHRAs, while others have a sole or primary focus on ICHRAs.

Vendors can assist employers and employees with a number of tasks. Employers considering an ICHRA may want advice and assistance with setting up the plan, establishing classes, setting contribution amounts for different classes of employees, as well as with verifying employee enrollment in qualified individual market plans and their premium payments. Larger employers, in particular, may want assistance in setting and varying contribution amounts so that they are sufficient to meet the employer’s ACA shared-responsibility requirement to offer affordable coverage to each of their full-time employees. In addition, employers and employees may both want supports, such as online tools or direct personal assistance, to help employees select and enroll in a qualifying individual market plan: employees need to choose from among the sometimes dozens of individual market plans available to them, and then need to be able to document that they have enrolled in a qualified plan and have paid the premium for it.

At a somewhat more sophisticated level, some employers will want an option that allows their contribution amounts to be combined with whatever additional amount each employee owes (collected through payroll deduction) and then be sent directly to each of the individual market insurers covering employees of the firm. This type of arrangement more closely resembles how payments work in a more traditional group health plan and requires additional integration with the employer’s payroll system. It also makes it easier for an employer to implement a premium-only plan, which allows employee premium contribution amounts in excess of the employer contributions to be made on a pre-tax basis. Payments then are directly made to individual market insurers on behalf of the employees, with the paid amounts documented.

Different employers will want and need different levels of support. Small employers new to benefits may be well served by the current broker and an enrollment platform, while larger employers considering an ICHRA may want to create an arrangement that resembles their current group health plan in terms of service and tax treatment of employee contributions.

Which factors make ICHRAs more or less attractive for employers or employees?

Discussions with industry participants and reviews of marketing and other literature highlighted factors encouraging or discouraging ICHRA adoption.

Factors encouraging consideration of ICHRAs

Desire for More Control and Predictability of Benefit Costs. Moving from offering a defined set of benefits to offering a defined level of funding can provide an employer with more control over its overall level of spending as well as better predictability of its benefit costs year over year. Employers that offer one or more traditional benefit plans to their employees face the risk that claims costs will be higher than expected, which can lead to unexpected costs during the year (e.g., for self-funded plans) and to higher-than-expected premiums for the next year (for experience-rated insured plans). (For small employers buying insured plans, premiums cannot vary by the health status of employees.) Controlling cost growth can involve complex choices of balancing changes to benefits, cost sharing, and contributions, any of which may upset employee expectations.

Offering an ICHRA can reduce the risks facing employers and simplify its benefit decisions. Once ICHRA funding levels are established, employers are insulated from higher-than-expected medical costs during the plan year. Renewal decisions also are less complex because the employer is managing only a level of funding rather than balancing all the factors involved with offering one or more complete benefit plans. Because an employer’s costs are not tied to a specific set of benefits or to the medical conditions of its workforce, it has more freedom to decide how much, if at all, it wants to increase benefit costs each year, provided that, for larger employers, the level of ICHRA funding is sufficient to assures that employees can find an affordable plan in the individual market.

These advantages for the employer are accomplished by shifting some risks and responsibilities to different parties. With an ICHRA, all the risks around annual medical claims are shifted to individual market plans. Employees assume the task of choosing a benefit plan and, if their employer’s ICHRA contributions do not keep up with premium costs, of increasing their contributions, finding less expensive plans, or some combination of both.

Escaping Experience Rating and High Renewals. Employers generally view having more control over their health plan as a good thing, and large shares of mid-sized and larger employers self fund their benefit plans in part to take more control over their benefit offerings. What may be seen as an advantage by many employers can be a disadvantage to employers with relatively costly workforces (e.g., older, in higher-cost industries) or can become a disadvantage if one or more workers develop a costly and persistent medical condition.

Employers outside of the small group market generally cannot escape at least some of the higher costs from these situations: Those with self-funded plans assume these costs directly while those that purchase insurance face premiums based on the demographics and health status of their workers. And while insurance and stoploss coverage can insulate employers from catastrophic costs during a year (or sometimes for some guaranteed period), the expenses for workers with persistent high costs eventually will become the responsibility of the employer because no insurer or stoploss carrier will accept the risk for a premium below the expected cost.

“We had two years of renewals with our carrier that were between 25 and 30%…The other insurance companies that we asked to bid would not even bid at all. The third year, our insurer, came back with a 47% renewal, which they said was the maximum allowed increase for policy renewals. They said that even with the 47% renewal they were shouldering some losses on our behalf and because of that, we could expect to see at least a 40% increase in our renewal for as far as they could project out into the future…The reason we’re in this situation is because we have a number of employees with high-cost chronic conditions.” – Chief Financial Officer, medical services non-profit

Offering an ICHRA largely divorces an employer’s costs for medical benefits from the health issues and claims experience of its workforce. This is because individual market premiums do not vary with health risk factors (other than age, where variation is limited to 1:3). ICHRAs essentially have become the only effective way that employers with over 50 employees can transfer the medical risks of their workforce to a larger risk pool without paying a premium that is based on their expected costs. This opportunity can be particularly attractive for mid-sized employers (e.g., 50 to a few hundred employees) where one or two enrollees with persistent high costs can potentially affect the viability of the whole benefit plan.

Flexibility to Address Complicated Workforce Situations. ICHRAs can help employers offer benefits in situations where traditional benefit offerings may be limited, difficult to construct, or costly to administer. Examples might include employers with remote employees, those with seasonal or part-time workers, or those with low take-up of existing benefits or high turnover of workers. Each of these situations can complicate offering a traditional group health plan: covering remote workers in multiple locations may limit carrier choice; including seasonal or part-time employees in a plan can be administratively complex and costly; low participation rates can run afoul of minimum participation rates in group health plans; and high employee turnover can lead to unstable claims costs for a plan as well as making it more costly to administer.

Employers may consider an ICHRA, either offered to particular classes of employees (e.g., remote or seasonal workers) or as a replacement for the current group health plan (e.g., to address low participation or high turnover) as a way to reduce the complexity of their offerings or achieve more stable costs.

“We have two provider-carriers in our area that sort of have a monopoly. Most of the plans have really narrow networks because of this. Employees can now choose which health system they want to be in, rather than just being placed into one. New employees or those outside our area really like this because they don’t have to switch providers.” – Chief Financial Officer, medical services non-profit

Plan Choice for Employees. An ICHRA can help employers that want to offer more plan options to their employees to do so without incurring greater administrative burden. This may occur, for example, for a smaller employer with employees that want quite different levels of benefits and cost-sharing or have quite different preferences over things like network size or inclusion of local health systems. Offering an ICHRA can allow employees to choose very different health plans in the individual market, potentially allowing them to better match their preferences.

“Employees are having at least the same level of coverage [as with our old group plan], but now they have more flexibility and can choose plans that are right for them.” – Chief Financial Officer, medical services non-profit

A potential issue for employees, however, is that understanding the differences across dozens of plan options can be daunting, particularly if they have no experience comparing different aspects of plan design. Employers offering ICHRAs typically use ICHRA platform vendors with tools to assist employees with plan selection, which may help mitigate this problem. As discussed below, employees may not always be satisfied with the network and provider choices in individual market plans.

“Employees want a plan that has a doctor in-network that they want to see, not the doctor our old group plan wanted them to see. They like being able to choose that.” – Associate Executive Director, home health care non-profit

“Talking to a lot of employees, they hate that with the traditional group offerings they only get two or three plans to choose from one insurance carrier. For many employees who might be sick and have established relationships with doctors, their doctors may not even be in network with the one carrier that the group is offering coverage through.” – Broker

Expansion of the Infrastructure to Support ICHRAs. As discussed above, employers considering ICHRAs often use specialized vendors to help them design and implement the arrangement. Growth in the number of vendors, as well as in the scope and sophistication of the services they offer, may help the market to grow as more employers, and particularly larger employers, are presented with ICHRA options.

Policy Changes. Some state governments have created financial incentives designed to encourage small businesses to adopt ICHRAs or QSEHRAs. Indiana, for example, enacted legislation in 2023 offering tax credits to firms with fewer than 50 workers who provide coverage through these arrangements, and similar measures have been introduced in Georgia, Texas, and Ohio.

Factors discouraging consideration of ICHRAs

Limited Awareness and Understanding. Awareness of ICHRAs remains limited among both employers and employees, in part because it is relatively new and operates under a different set of compliance standards than traditional group coverage. Employers without dedicated benefits staff may also be unfamiliar with how ICHRA works or what administrative responsibilities it entails. Limited awareness can slow adoption, as both employers and employees may be hesitant to participate.

“While we haven’t really encountered surprises in the process of beginning to offer ICHRAs, the surprise was that this existed. I just had no idea until our broker brought it to our attention.” – Chief Financial Officer, medical services non-profit

“The hardest part is educating the staff because this is a complicated financial insurance product.” – Chief Financial Officer, medical services non-profit

“It is a huge challenge to explain to incoming staff who you are recruiting what an ICHRA or QSEHRA is because virtually no one knows what they are.” * – Executive Director, youth development organization

Limited Network Options in the Individual Market. Market participants frequently mention limited provider networks in the individual market, particularly the lack of PPO options with out-of-network coverage, as an impediment to ICHRA adoption. There is a general perception that employees covered in the group market expect to be offered PPO coverage, which can be difficult to achieve in some places in the individual market. Similar concerns also exist around access to major hospitals and health systems in individual market provider networks. Individual market plans quite often have closed networks and a rather narrower selection of providers in order to better control costs and keep premiums low.

“Many facilities in our general area that do not take many individual market plans. The networks can be a little narrow. There are also no PPOs available in our area. It’s something that our employees really want, but we just don’t have at the moment.” – Associate Vice President, College

To address these issues, some insurers focusing on the ICHRA market have begun to create off-exchange individual market plan options with PPO networks that more closely resemble group market plans. These options may address employer and employee concerns, but they may not be available in all markets, and it remains to be seen whether more individual market insurers will follow this path.

“I find the plans on the Marketplace incredibly difficult to understand. Personally, I chose a plan that I thought was great, and over the course of the year I found out the networks sucked.” – Vice President, small consulting firm

Inconsistent Individual Market Options Across Geographic Areas. The number, types, and relative affordability of individual market plans vary across states, which can be an impediment for employers that want to provide coverage options in multiple locations. For example, ICHRAs can be more cost effective for employers and employees in areas where individual insurance market premiums are lower than small group premiums, but this can vary state to state (this is discussed more below). There also may be differences across states or even across rating areas in access to individual market plans with broader networks or access to major health systems.

“There are only two insurers in our area that are attached to health systems. Our employees are really limited on who they can see because of this.” – Associate Vice President, college

Concerns about the Ability of Employees to Navigate the Individual Market. Some employers have concerns about how their employees would view switching from a traditional group health plan to an ICHRA, as well as whether employees would be able to make good plan choices. Some employers worry that employees who make the wrong plan choices may be dissatisfied with the arrangement and may not get the care they need.

“I would say that for our employees, we’re an employee-owned company and I think it sounds like, you know, people that are owners in a company expect a company to take care of them. And this [ICHRA] sounds like a kind of kicking them to the curb, if you will, like they’re sheep. That’s the impression I would have. So, you won’t see me proposing that at my company.” – Vice President, manufacturer

“Our first year, 95% of workers were satisfied with their plans. That dropped to 89% last year because some people did not know how to effectively shop for their health plan.” – Associate Executive Director, home health care non-profit

Employers with this concern may look closely at the ICHRA platform vendors to determine whether they offer a sufficient level of support for employees weighing plan choices, particularly for the first time.

“It was a priority for us that we had a full-service vendor that could deal with the financial pass through but also provide hands on service like a broker and help get people enrolled and provide advice.” – Associate Vice President, college

Broker Concerns About Their Roles in ICHRAs. Some brokers may be reluctant to suggest ICHRAs to their employer clients because it can result in a loss of business and income.

Many small and mid-sized employers use a broker to help them select an insurer and benefit options for their group health plans. The broker generally receives a commission from the insurer in these cases, both when the business is placed with the insurer and when it is renewed each year. The broker may also sell other coverages, such as life or disability insurance, alongside the health insurance plan, and will also receive a commission for these products. Employers will often stay with the same broker even when they shop for new coverage or consider other plan changes, and these relationships help supply a steady and predictable level of income to the broker.

The broker role changes when one of its client-employers replaces a traditional group health plan with an ICHRA. Employers offering an ICHRA generally will contract with an ICHRA administrator that can help manage the arrangement and assist employees with individual market plan selection. While some ICHRA administrators facilitate the original broker placing the new individual policies and retaining the commission income, others assume that role, either immediately or at renewal. Some ICHRA administrators also have appointments to offer ancillary insurance products to employees, which is a further threat to the relationship between the existing broker and the employer.

To offset some of these concerns and to encourage brokers to consider ICHRA as an option for their clients, some ICHRA administrators are developing new ways to compensate them, such as splitting the commissions received from the individual market policies or building a fee for original broker into the administrator’s contract with the employer.

“I’ve worked with two vendors. I switched early on to [my now preferred vendor] because my previous vendor did not allow us to be the broker on record. In that case, we don’t get to receive commissions or speak on our clients’ behalf with the carriers.” – Broker

“The main point of dissatisfaction is that for a couple years in a row now, what our employees can afford is actually declining. Many people who could originally afford a $0 deductible plan can no longer do that with our stipend.” – Associate Vice President, college

What types of employers are more likely candidates for ICHRAs?

Any employer can offer an ICHRA, but discussions with industry participants and reviews of marketing and other literature suggest that certain types of employers are more likely to offer ICHRAs to some or all of their workers.

Small Firms New to Offering Benefits. Newly offering employers are good candidates for ICHRAs for several reasons. One is that employees not currently receiving a benefit offer may have fewer expectations about the benefits that are available through individual market plans; for example, the lack of PPO options may be less of a concern for them than it is for employers and employees switching from an existing small group plan. Similarly, there are no existing broker relationships to disrupt when a newly offering firm adopts an ICHRA; in fact, brokers may see these firms as an opportunity to offer their services to firms that they have been unable to interest in the past, although ICHRA administrators also market service directly to these firms. A third reason is that ICHRAs are a flexible way to begin offering benefits to employees. Unlike small group insurance plans, ICHRAs do not have minimum participation or contribution requirements. Also, as noted above, ICHRAs allow employers to aid workers without taking on some of the costs and risks of sponsoring a group plan. This allows employers to set predictable budgets, which may be a particularly important factor for new businesses with changing or uncertain finances.

“For the first several years [of our business], we did not offer any sort of health benefits to our employees…But I thought it would hurt us in the long run from a talent acquisition standpoint if we do not offer some sort of benefits plan.” – Vice President, small consulting firm

“Up until a year and a half ago, we did not offer any health coverage. Obviously, that was limiting our ability to recruit competitive candidates and our future growth.” – Executive Director, youth development organization

Employers with Large Renewal Increases or High-Cost Employees. Receiving a large increase at plan renewal is a frequently cited reason for employers to switch from a traditional group health plan to an ICHRA. This can happen, for example, when one or more plan enrollees develop a costly and persistent condition. As discussed above, offering an ICHRA is the only way employers that are too large for the fully-insured small group market can join a community-rated risk pool where the cost to cover their workers is not based on the workers’ health status. It is therefore sometimes an option of last resort for mid-sized employers that have been priced out of fully-insured and level-funded plans.

“We had two years of renewals with our carrier that were between 25 and 30%…The other insurance companies that we asked to bid would not even bid at all. The third year, our insurer, came back with a 47% renewal, which they said was the maximum allowed increase for policy renewals. They said that even with the 47% renewal they were shouldering some losses on our behalf and because of that, we could expect to see at least a 40% increase in our renewal for as far as they could project out into the future.” – Chief Financial Officer, medical services non-profit

“About three years ago, we had a 30% increase in our group health plan, which was unaffordable. We were looking at bumping everyone down to below 30 hours and not offering insurance or even going out of business.” – Associate Executive Director, home health care non-profit

Small Firms in States where Premiums are Lower in the Individual Market than in the Small Group Market. Industry participants point out that interest and growth in ICHRAs is higher in states, or sometimes in rating areas within states, where premiums for comparable groups of people are lower in the individual market than in small group market. Because the product levels and rating factors for the two markets are the same, this means small employers can achieve sometimes significant savings by choosing an ICHRA rather than a small group market plan.

There are several reasons why it may be more expensive to cover the same group of people in the small group market than in the individual market. One is state policies that reduce individual market costs; for example, a number of states have used Section 1332 waivers to develop reinsurance programs that offset insurer costs for high claims in the individual market, thus lowering individual market premiums overall. Indiana takes a different approach and directly subsidizes ICHRA adoption by small employers with tax credits.

A second reason the small group market may be more expensive than the individual market is that the average health of people insured in the small group market in some states or areas may be poorer than those covered in the individual market. This may reflect different mixes of people across the two markets (e.g., differences in occupations), or it may result from the growth of health status underwriting in products available to small employers. In recent years, a meaningful share of small employers has switched to a nominally self-funded option often called a “level-funded” plan. In these arrangements, small employers create a self-funded plan but also purchase a combination of stoploss policies that virtually eliminate any risk that their costs will be higher than projected for the year. Employers can qualify for lower premiums for these stoploss policies only if their workforce can meet medical underwriting standards (i.e., they are relatively healthy). These policies draw relatively healthy people out of the insured small group market, which will cause premiums to increase in that market. This impact is likely more subtle than the direct state policies discussed above but could be meaningful over time.

State and local insurance markets are complicated, so other factors, such as differing numbers of insurers in the two markets, the influence of associations, or differences in regulation, may also be at play. Whatever the causes may be, premium differences across markets can produce almost built-in savings for employers willing to consider an ICHRA.

What might the future of ICHRA be?

The future of ICHRA may depend on many factors, for example: how easy it is for employers and employees to use, the quality and affordability of available plans, the regulatory environment, and the stability of the individual health insurance market. Many small firms do not offer funds for employees to purchase non-group coverage indicate they are not likely to do so over the next two years. The individual market has been relatively stable in recent years—premiums have held mostly flat and insurer participation has reached record levels—but with 2026 premiums expected to rise sharply and the expiration of enhanced premium tax credits likely leading to millions of enrollees losing coverage, the individual market could become less attractive to employers and insurers. Even so, some insurers—particularly those that focus on the individual and Medicaid markets—may view ICHRA as an opportunity to recoup enrollment losses they might otherwise experience.

Acknowledgments

The authors would like to thank Medicarians for their assistance in organizing a focus group at the 2025 Medicarians Conference in Las Vegas, as well as Take Command Health for their help in organizing interviews with employers.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.