Telemedicine – the delivery of health services by providers at remote locations, such as through video conferencing or remote monitoring – has been seen as a way to possibly improve access to care while lowering costs. There is also potential for telemedicine, often referred to as telehealth, to expand access to care for people in rural areas or other places with limited provider availably. While utilization of telemedicine remains low, employers are increasingly likely to cover these services and express continued interest in refining their approach.

In this brief, we combine data from our employer survey with employer claims data to examine the offering and uptake of telemedicine services by large group enrollees. We analyzed a sample of health benefit claims from the IBM MarketScan Commercial Claims and Encounters Database to calculate the number of outpatient telemedicine appointments among people with large employer coverage. Physician office visits conducted over the telephone or online are only captured as a telemedicine appointment if the physician’s office documents this in the billing code, or in the location of the service (see methods).

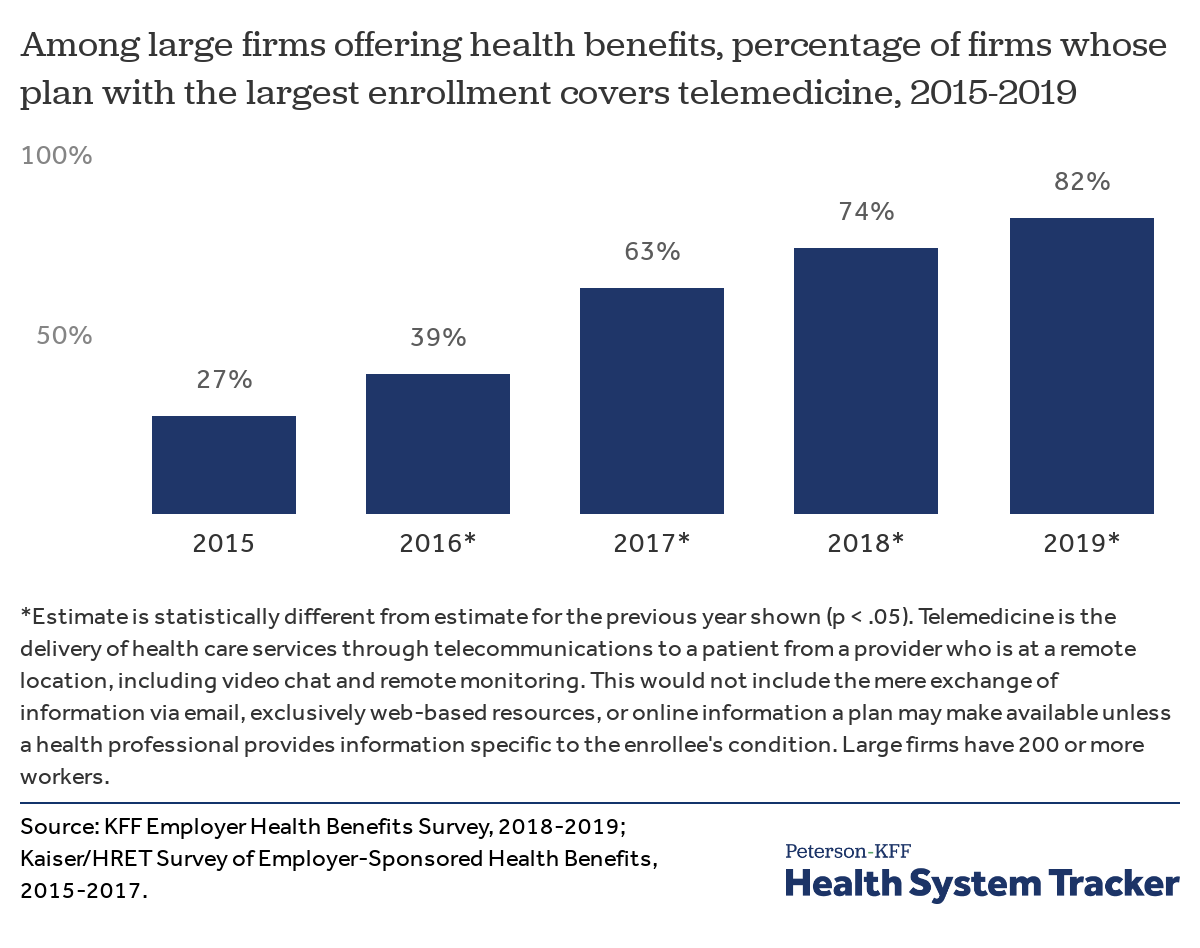

In our 2019 Employer Health Benefit Survey (EHBS), we see that the vast majority of large employers offering health benefits cover telemedicine; over time the share of firms has increased from 27% in 2015, to 63% in 2017, to 82% in 2019. The largest employers – those with 5,000 or more workers — are the most likely to cover telemedicine (90%), while smaller firms – those with 50 to 199 workers – are least likely (65%). Across all firms with at least 50 workers, 69% say their largest plan covers telemedicine.

More employer plans are covering telemedicine than had in recent years

Some employers not only cover telemedicine, but also provide a financial incentive to encourage enrollees to use telemedicine instead of visiting a brick and mortar facility. Among large employers offering telemedicine services in their largest plans, 53% have an incentive, such as lower cost sharing to encourage employees to use these services.

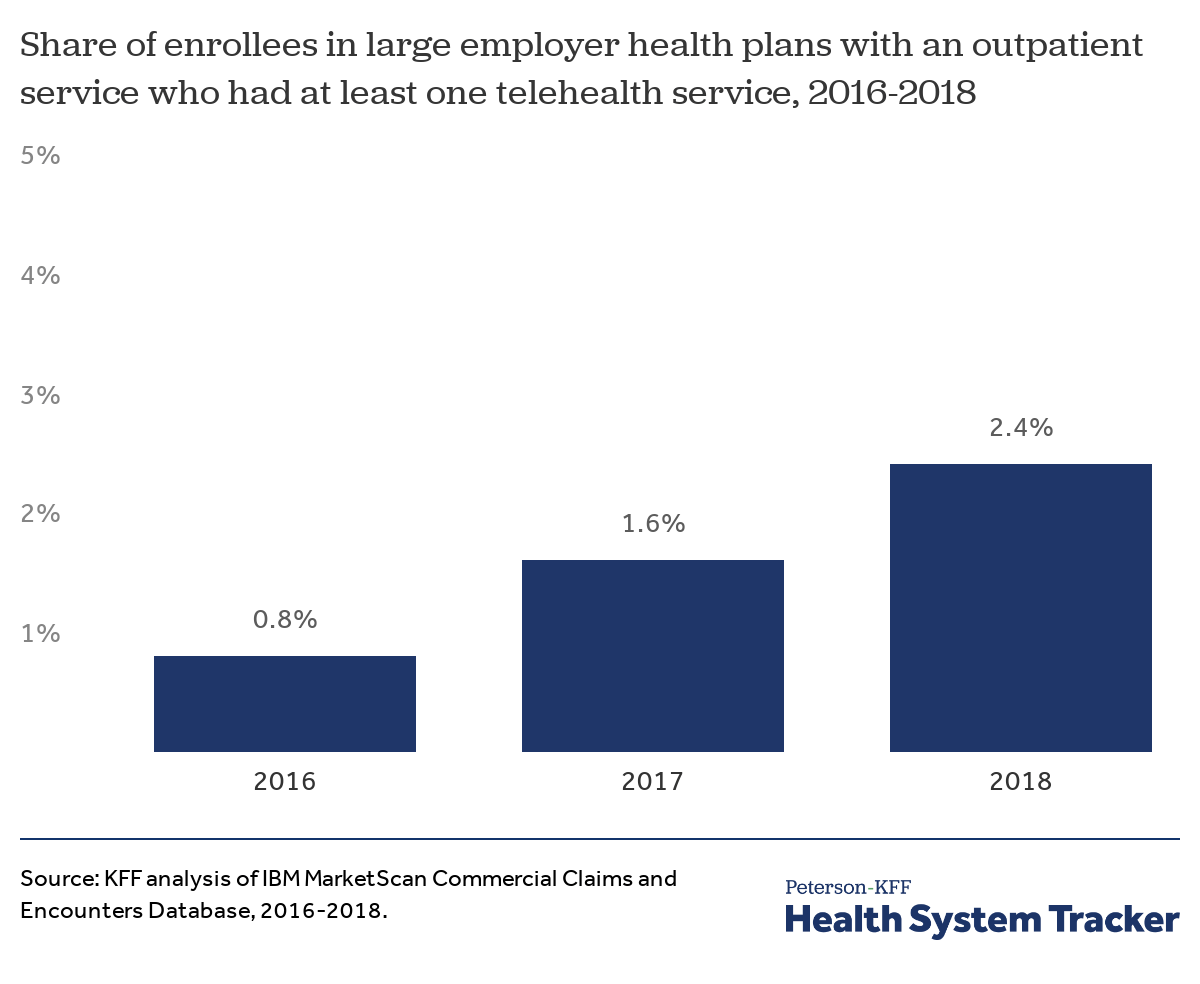

While the vast majority of large group enrollees receive coverage for telemedicine visits, there has been relatively slow adoption by enrollees.

Roughly 1 in 50 large group enrollees with an outpatient service had at least one telehealth service

In 2018, 2.4% of large group enrollees who had an outpatient office visit had at least one telemedicine visit. While still relatively few enrollees see a telemedicine provider, these services are becoming more common, increasing from 1.6% in 2017.

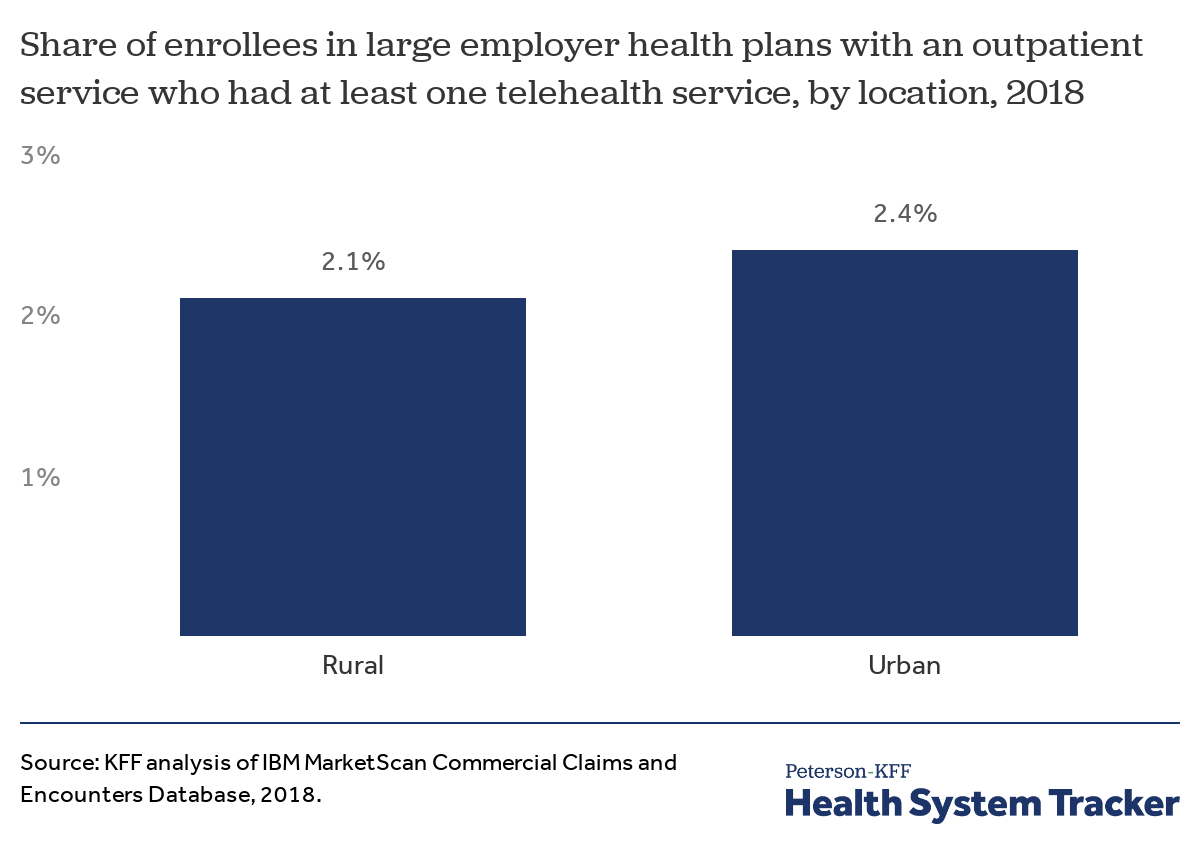

The take-up rate of telemedicine is similarly low among urban and rural enrollees in large employer health plans

Telemedicine has the potential to improve access to care, particularly in rural areas where people may have to travel long distances to see a physician. However, we find the take-up rate of telemedicine is similarly low among both urban and rural enrollees in large employer coverage. In 2018, 2.1% of rural enrollees with at least 6 months of coverage and at least one outpatient claim used telemedicine, compared to 2.4% of urban enrollees.

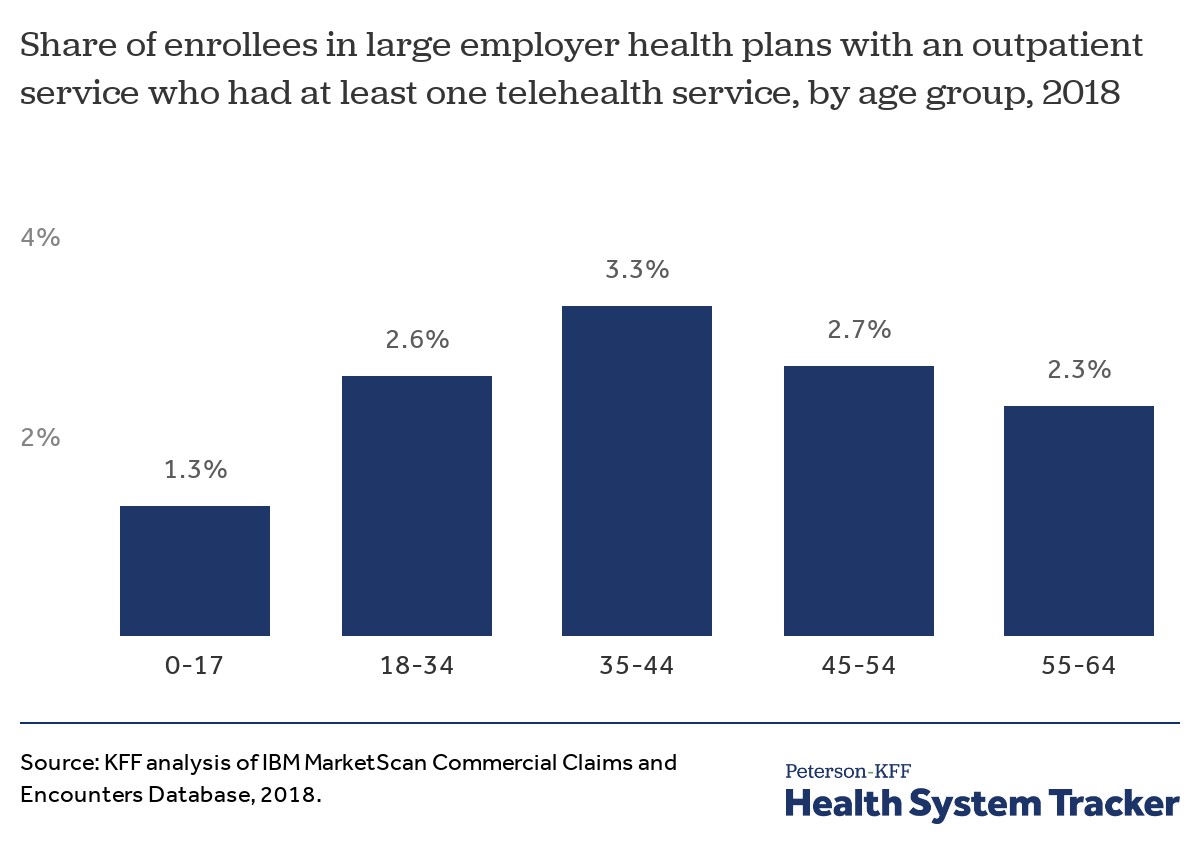

The take-up rate of telemedicine services is highest among adults age 35 to 44

Telemedicine usage was relatively similar among all age groups. While 2.6% of young adults (18-34 year-olds) with an outpatient claim used at least one telemedicine service during the year, 3.3% of 35-44 year-olds and 2.7% of 45-54 year-olds did as well.

Discussion

Employers are increasingly likely to cover telemedicine services, yet while take-up is growing overall use remains low. While just over 2% of large group enrollees with an outpatient visit had a telehealth claim, an even smaller percentage of the total number of visits took places from a provider at a remote location. Because the most recent MarketScan data only extends through 2018, it is yet to be seen whether use of telemedicine has substantially increased over the past year as more employers have started covering these services.

Telehealth can expand the options available to enrollees, including for services such as reproductive health and mental health. While the cost of delivering care through telemedicine is often less expensive than providing care in person, some studies have suggested that the ease of telemedicine may increase the overall use of healthcare services. Our findings mirror the experience of public payers that have made an effort to expand coverage but for whom usage remains relatively low. For telemedicine to be able to move the needle on access to care or overall health spending, more enrollees will need to utilize these services.

Methods

We analyzed a sample of medical claims obtained from the 2018 IBM Health Analytics MarketScan Commercial Claims and Encounters Database, which contains claims information provided by large employer plans. We only included claims for people under the age of 65. This analysis used claims for almost 18 million people representing about 22% of the 82 million people in the large group market in 2018. Weights were applied to match counts in the Current Population Survey for enrollees at firms of a thousand or more workers by sex, age and state. Weights were trimmed at eight times the interquartile range. The sample was limited to people who had an outpatient visit and coverage for more than half of the year (13.1 million observations representing 60 million people).

A telehealth visit is one with a CPT code 99201 to 99205, or 99211 to 99215, or 90832 to 90834, or 90836 to 90839, or 99441 to 99444, or 98966 to 98969, or 99495 to 99496 and either a procedure modifier (procmod) of GT or GQ or 95 or the location of the service was listed as telehealth (stplac equal to 2). In addition, HCPCS codes Q3014 and T1014 were listed as telehealth visits, and any HCHPS code with modifiers procedure modifiers GT or GQ or 95 or the places of service was listed as telehealth. This list is not exhaustive, some telehealth visits happen between providers, as well as some forms of remote monitoring, and inpatient telehealth visits are not included, see Multilayered Analysis of Telehealth: How This Emerging Venue of Care Is Affecting the Healthcare Landscape for an analysis of these types of visits. Please note, we revised the definition of telehealth, from our brief published in October 2018, to utilize the stplac variable which has been added to the Marketscan file.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.