Whether public and private insurance plans should cover GLP-1 agonists when prescribed primarily for weight loss has been a significant topic of interest and debate. GLP-1 agonists are a class of prescription medications that were developed to help people with type 2 diabetes manage blood sugar levels. Common brand names include Ozempic, Wegovy, Mounjaro, Saxenda, and Victoza. The effects of these medications – reducing appetite by decreasing hunger signals, slowing digestion, and helping people feel fuller for longer – also makes them effective in reducing weight. There has been a marked increase in the use of these medications since they were first approved for weight loss in 2014, particularly following the approval of Wegovy in 2021 and Zepbound in 2022. This has led to a substantial rise in prescriptions for weight loss among patients without diabetes.

The large and growing share of people of all ages are obese. Obesity is one of the most serious health issues facing the nation and is associated with many health conditions, ranging from cardiovascular diseases to cancers, so effective medications to help people control their weight could have substantial health benefits. These potential benefits, however, come with high costs that raise concerns about the impacts on public and private payers. These medications are relatively expensive and patients may need to use them continuously to maintain weight loss. In total, 34% of non-elderly people with employer-sponsored health insurance (36.2 million people) have a body mass index that would medically qualify them for a GLP-1 drug. Given the large number of people who might benefit from these medications for weight loss, they could have a meaningful and long-term impact on the costs of health benefits.

The discussion below combines findings from the 2025 KFF Employer Health Benefits Survey with insights gained from interviews and group discussions with employers from five focus groups across the United States covering over one hundred companies employing over a quarter of a million. These conversations with employers were held throughout the summer and fall of 2025.

While the 2025 Employer Health Benefit Survey finds there was a notable increase in the share of the largest firms (5,000+) that cover GLP-1 medications for weight loss, the conversations with employers highlight their concerns about the cost of these medications. Many employers reported that use was higher than expected and covering them significantly increased prescription drug cost. While recognizing their effectiveness in addressing obesity, many employers indicated they were considering scaling back coverage. In some cases, employers reported adding or strengthening case management programs or changing utilization management requirements. Several firms that initially covered GLP-1 drugs for weight loss have since restricted coverage to only cover GLP-1 agonists for employees with specific medical indications, like diabetes. These firms face the challenge of removing benefits from employees who may like and value the coverage.

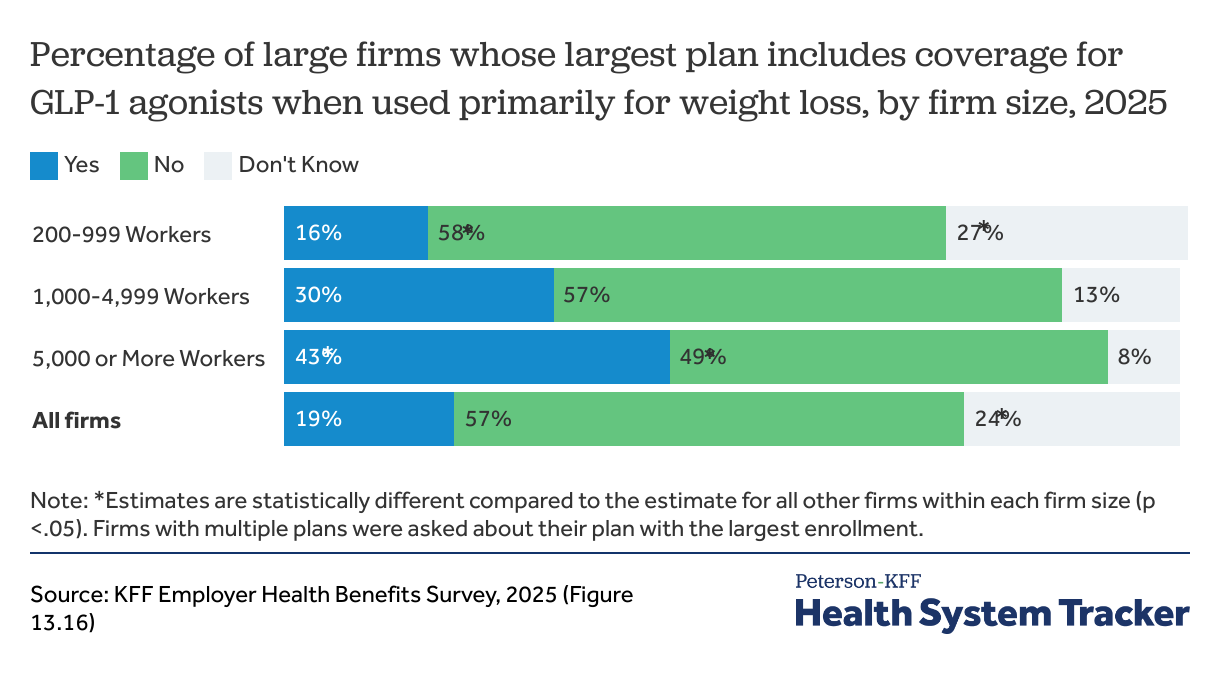

One in five (19%) firms over 200 workers covers GLP-1 agonists for weight loss with more coverage among larger firms

One-in-five (19%) firms with 200 or more workers, including 43% of firms with 5,000 or more workers, cover GLP-1 drugs for weight loss in their largest health plan in 2025. Importantly for the availability of coverage across the workforce, the share of firms with 5,000 or more workers covering these medications for weight loss increased significantly over the last year (from 28% in 2024 to 43% in 2025).

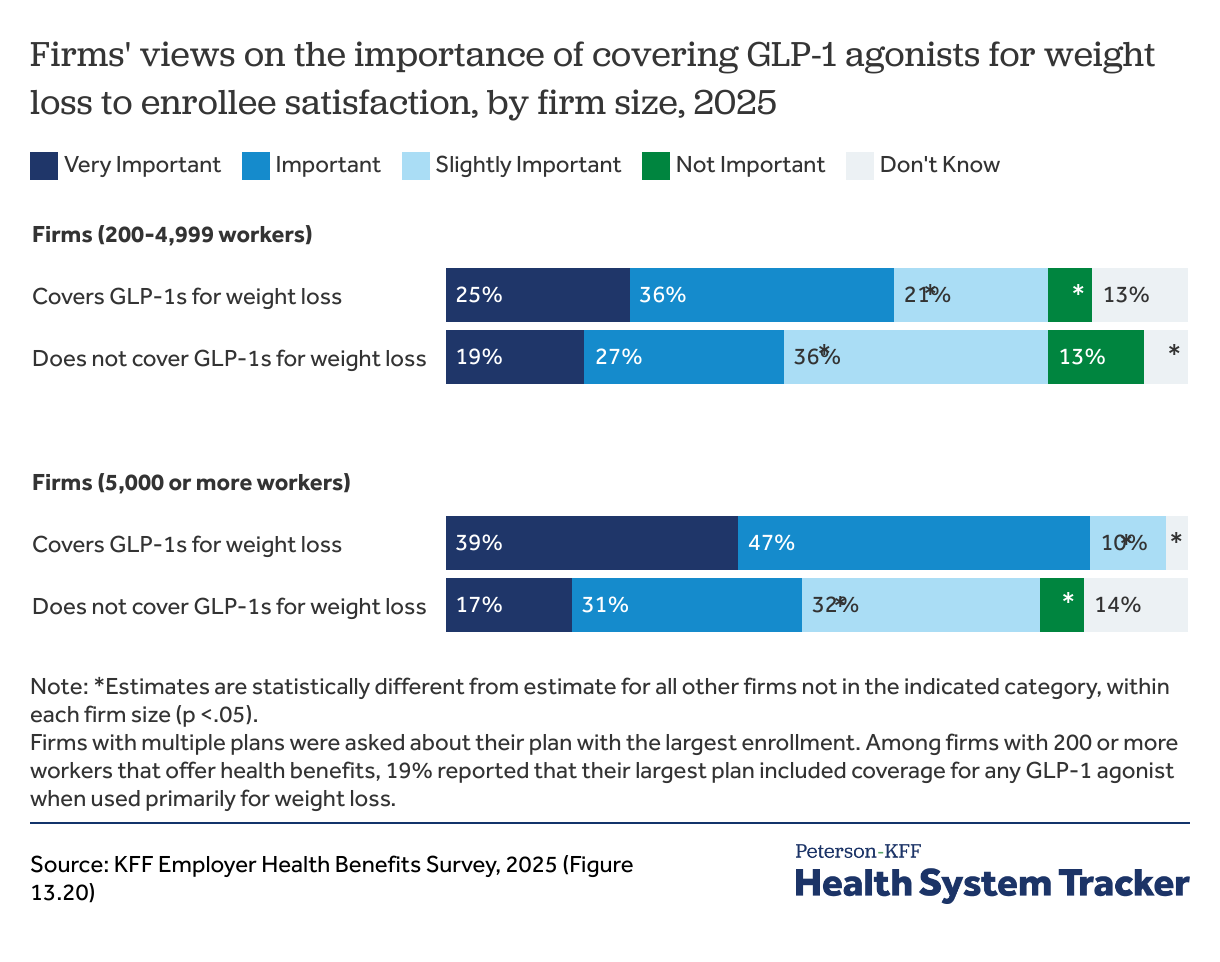

Among employers covering GLP-1 agonist drugs for weight loss, most firms view it as important or very important for employee satisfaction

The meaningful shares of larger employers covering these medications for weight loss, notwithstanding their relatively high cost, underscores the importance many employers place on covering these medications for employees. Many employers recognized that these drugs could have beneficial health impacts for their workforce, although they disagreed about the extent to which these drugs would reduce other healthcare use or provide a return on their investment. Many employers believed that coverage was an important benefit that was valued by employees.

“We have 165 employees, but we have about 40 of them that are on GLP-1 agonists for weight loss. And these employees … a lot of them have issues with high blood pressure. It’s not just because you know, they want to be skinny, but they’re doing it to help with their health.” – Human Resource Representative, large manufacturer

“You know, when you bring the weight down, the blood pressure comes down, the cholesterol comes down, …. there are a lot of really good benefits to [other conditions] that that could be expensive, that are more expensive than the drug, especially with the drug cost coming down.” – SVP Human Resources, large non-profit

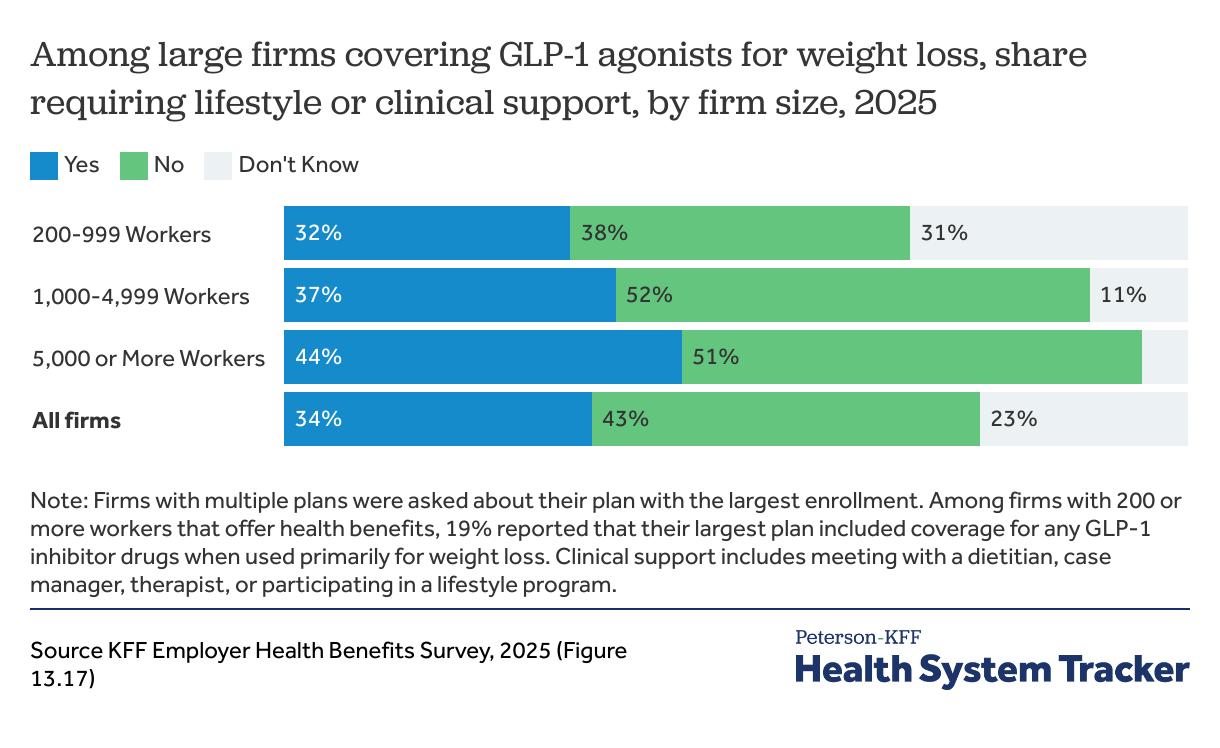

One in three (34%) firms require lifestyle or clinical support programs before allowing employees to receive GLP-1 agonists for weight loss

About a third (34%) of firms covering GLP-1 agonists for weight loss require enrollees to meet with a dietitian, case manager, therapist, or participate in a lifestyle program in order to have the medications covered, up from 10% of firms last year. These differences in whether to mandate steps before enrollees received GLP-1 drugs were reflected in the focus group discussions. Employers took a range of approaches, with some using specialized vendors to provide case management and in other cases, organizing the requirement through the health plan. Some employers expressed hope that life-style coaching would allow employees to “have an off ramp” and stop using GLP-1 drugs after some period of time.

“You have to do weight management if you want [GLP-1 drugs] for weight loss. You have to have a coach and then you can only stay on it for a certain amount of time before you have to get reevaluated.” – Occupational Health Manager, large manufacturer

“You have to go through this app and make sure you’re making some lifestyle changes and every quarter you check in and they’ll have meetings with [case managers].” – HR consultant

Some employers expressed skepticism about mandating case management, suggesting that such programs would be unpopular with employees. In some cases, firms contracted with vendors to provide resources that plan enrollees could choose to participate in voluntarily.

“We chose to keep GLP-1s certainly for diabetes, and we also have it for weight loss as well. We saw about a 30% increase in GLP-1 cost, and so we have direct contracted with an [online weight-loss program] to help us manage that program. We have not made it a mandatory program. It’s still a voluntary program. That’s just our culture, to not force people to do things.” – HR Director, large manufacturer

“We’re certainly keeping an eye on our cost and then we’ll reevaluate every year. And I think we’ll get to a point where we do maybe grandfather people that are on them now. But anybody new wanting to come into the program or anybody new wanting a GLP1 would have to participate in the program.” – HR Director, large manufacturer

Employers also configured a range of utilization management tools to manage spending, including step therapy programs, or mandating coverage based on participating in a program.

“[We dropped GLP-1 coverage] because of the spend, and it was too easy to get. So even though there were steps that employees had to take, it was usually denied the first time and they had to go through an appeal process. But in the beginning of last year, we, we said, no, it has to be for a diabetes prescription.” -Senior Human Resources Leader, large services organization

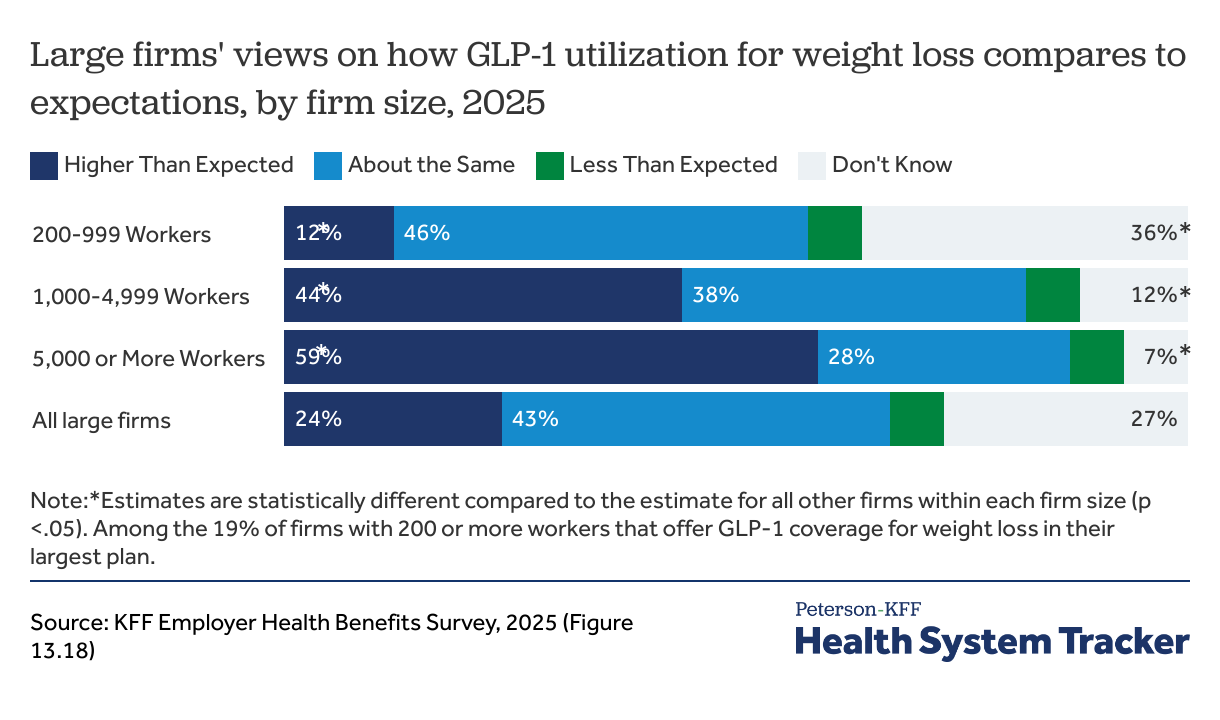

The use of GLP-1 agonists was higher than expected for many large employers including for over half (59%) of employers over 5,000 workers

Since then, many larger employers covering GLP-1 agonists for weight loss reported higher than expected use of the medications and significant impacts on their prescription spending. Forty-four percent of firms with 1,000 to 4,999 workers, and 59% of firms with 5,000 or more workers, say that the use of these medications for weight loss was higher than expected.

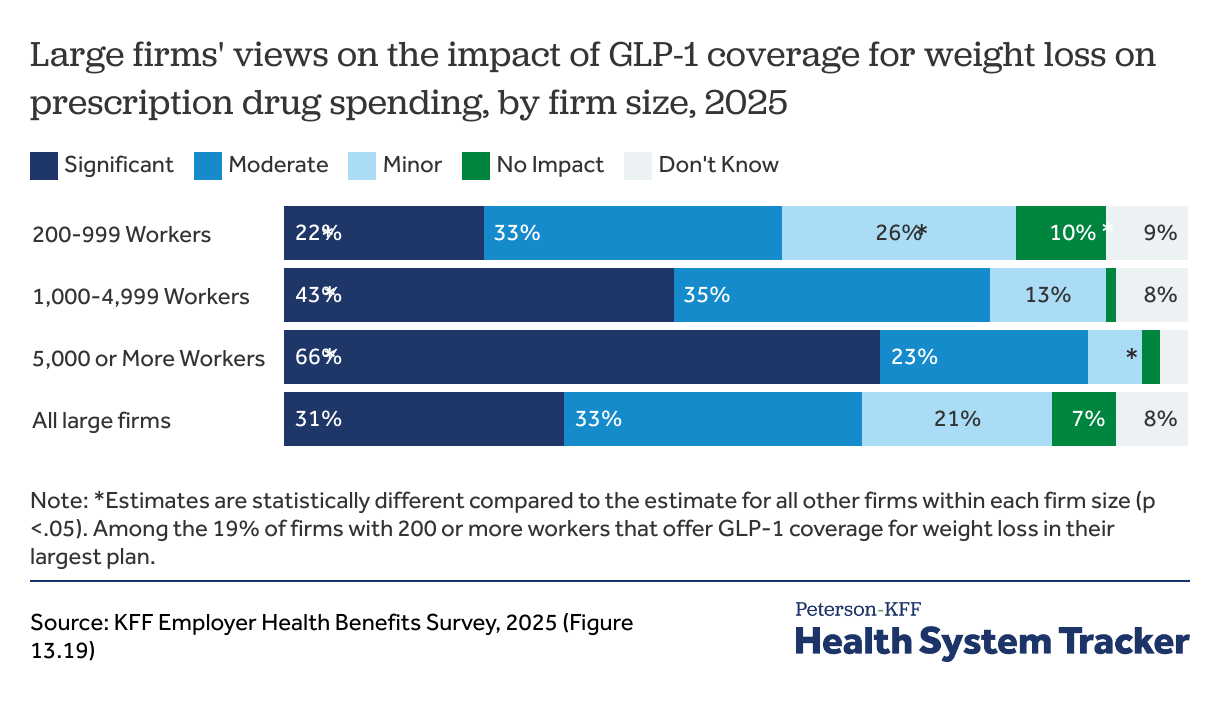

64% of large firms say GLP-1 drug coverage moderately or significantly impacted their prescription drug spending

Similar to the findings on use, 43% of firms with 1,000 to 4,999 workers, and 66% of firms with 5,000 or more workers, say that covering GLP-1 agonists for weight loss had a “significant” impact on the health plan’s prescription drug spending. Additionally, meaningful shares of these employers reported a “moderate” impact on prescription drug spending. Based on the budgetary impact of GLP-1 agonist spending, some employers considered changing their eligibility thresholds to reduce the number of enrollees who were potentially eligible.

“We are looking at covering it for weight loss at a certain BMI. Trying to ease it in and not blow up our budget.” – Senior Benefits Manager, large manufacturer

“We are trying to decide how to manage this crazy cost of the GLP-1s. We made changes and grandfathered in a whole host of individuals. In January of 2024 we put in the requirement that you have type 2 diabetes for certain GLP-1s, and then we put in a BMI of 35 or higher for the weight loss GLP-1s. We don’t require coaching.” –HR leader at large manufacturer

What might the future hold for obesity drug coverage?

In interviews and focus groups with employers, virtually every participant that covered these drugs for weight loss purposes highlighted the cost challenges.

“For us, GLP-1s, last year, were number 32, and this year they’re number one [in pharmacy spending].” – Human Resources Director, health benefits administrator

“Before we knew it, we spent half a million dollars and were projected to go up to $1.2 million the following year.” – Manager of Compensation and Benefits Administration, large retail firm

“I’ll just say our GLP-1 agonist spending year over year was increasing 50% for weight loss. So for 2026, we decided to increase to co-pays, which they hadn’t increased in forever.” – Director of Total Rewards, large manufacturer

“We chose to keep GLP-1s certainly for diabetes, and we also have it for weight loss as well. We saw about a 30% increase in GLP-1 cost.” – HR Director, large manufacturer

Many focus group participants reported that their firms will no longer cover GLP-1 agonists for weight loss due to the increases in use and costs.

“We exclude weight loss, the entire anti-obesity category. We wanted to leave some, but rebates got dramatically worse. We made the business decision to pull the whole category. We had to educate the employees using the others that they were very cheap and should just go buy them. People weren’t getting off the drugs and the costs were skyrocketing.” – Benefits manager, large retailer

“We cover for Wegovy, but the health insurance has notified us that they will no longer be doing that. So we had to send out notices to all of our employees…But the benefits are what pull people into your company and what you can offer, and [covering GLP-1s for weight-loss] is a big one right now. So you know, our powers that be are working to try to see what they can do to help cover some of that cost [of GLP1s], which is something that our employees liked.” – Human Resource Representative, large manufacturer

“We were covering [GLP-1 agonists for weight loss] and they tripled our cost. I mean, the cost just kept going up. So [now], we cover it for prescribed conditions. We reached out to all those that were on it and we gave them a period of time when we offered coaching and other programs to them. But it’s purely how can we manage that cost right now. We know it’s coming down the pipeline. It’s getting approved for so many other conditions, but how do we wrap our hands around it [GLP1’s] and make sure everything is affordable for our whole population?” – Manager of Compensation and Benefits Administration, large retail firm

“We kept trying all the different processes to slow the growth and it was still doubling every year. Our leadership team proposed gatekeeping with [an online weight-loss management program.] And they’re like, no, we can’t afford this at all, so we’re cutting off [coverage for GLP-1 agonists for weight loss]. The letters are going out this week to tell people.” – Director of Benefits Strategy, large manufacturer

Some focus group participants also said that GLP-1 agonist prescriptions for diabetics in their plans were increasing or were higher than they should be and suggested that enrollees who want the medication for weight loss were being diagnosed with diabetes even if they did not meet the criteria. One participant reported tightening up the process for diabetics to receive these medications.

“It was very loosey goosy as to how you get the drug. We had GLP-1s in our preventive care, our expenses went up 20% and pharmacy provider says 20% probably don’t have diabetes. We changed pharmacy vendor, now you can’t get it unless you have had a history of diabetes.”– Senior Benefits Manager, large manufacturer

“We’ve never offered it for weight loss, and it is still one of our top three prescriptions spends every year.” – HR Professional, large manufacturer

“We don’t allow GLP-1s for weight loss… In our type 2 diabetes population, 50% are utilizing the GLP-1s, so we are now excluding them for anything except type 2 diabetes [to manage costs].” – Director of Benefits, large manufacturer

The future of GLP-1 drug prices

Employers are also recognizing that the price paid by employers for GLP-1 drugs are sometimes higher than online direct-to-consumer prices reflecting manufacturer discounts. Wegovy, which was initially marketed at more than $1,300 per month, is now offered by Novo Nordisk directly to consumers for about $499 per month.

“Well, both Eli Lilly and Novo Nordisk have direct-to-consumer programs at around $500 per month, and they’re being utilized. So we’re trying to figure out how employers can get something along those lines.” – CEO, health benefits organization

“We were talking to a Canadian advisor. Canada doesn’t cover it yet, but it is $200, very inexpensive, that’s all about the rebates.” -Senior Benefits Manager, large manufacturer

“I think in between that period of that happening, you’re finding it available other ways. And so when employees realize you’re not going to cover that, they will find other alternatives and places to get [GLP-1 agonists] which are a 1/4 of the cost or less.” -Human Resource Representative, large manufacturer

A GLP-1 agonist has recently been approved for additional diagnoses such as certain cardiovascular risks and liver diseases, which will further increase the number of eligible individuals. HR representatives from several of the large firms also discussed why use of GLP-1 agonists may increase, despite the large cost burden that they have placed on benefit spending.

“So now they’re saying there’s going to be a huge increase in the utilization of GLP-1s, not just for weight loss, but you may go to a physician that may diagnose you with this condition when really you want the GLP-1s for weight loss. Across the board these are going to be more utilized and more readily available.” – Occupational Health Manager, large manufacturer

“Next year, there will be GLP-1s that you take orally. You won’t have to take a shot anymore. So I mean, it’s just it’s going to explode even more than what it has today. And they’re coming out more and more with different, you know, reasons why it works. And so it’s not going anywhere.” – HR Director, Large manufacturer

While there was a great deal of concern expressed about the ability of employers to afford the potential costs for covering these drugs more broadly, many also acknowledged that the pressure to cover them was likely to continue. In one of the focus groups, there was no disagreement when one participant asked, “[d]oes it feel almost inevitable that those drugs are going to become part of our formulary?”

“Our insurance provider, Cigna told us that within the next 9 to 12 months, there’s really not going to be a choice, that all insurance companies are probably going to be covering GLP-1s for weight loss.” – Occupational health manager, large manufacturer

The use of GLP-1 drugs for weight loss is still new for many employers, and many are not sure how or whether they can manage the benefit. Looking ahead, employers may continue to face the competing pressures of employee demand for GLP-1 drugs and concerns about costs. As evidence grows on the drugs’ effectiveness for a broader range of conditions, employers may face increased pressure to cover them, but these drugs’ impact on costs and premiums will remain a concern at the current prices and utilization levels.

Acknowledgments

The authors would like to thank SHRM, and particularly SHRM Tennessee and SHRM Austin, as well as the Midwest Business Group on Health, the NC Business Coalition on Health, and The Alliance for their assistance in organizing the focus groups.

Four focus groups were held in person, conducted at The Alliance 2025 Spring Symposium in Madison, Wisconsin; 2025 TN SHRM Conference in Nashville, Tennessee; NC Business Group on Health’s Fall Forum 2025 in Greensboro, North Carolina, and the Austin SHRM Annual Conference in Austin, Texas. One focus group occurred virtually with the Midwest Business Group on Health.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.